Key highlights:

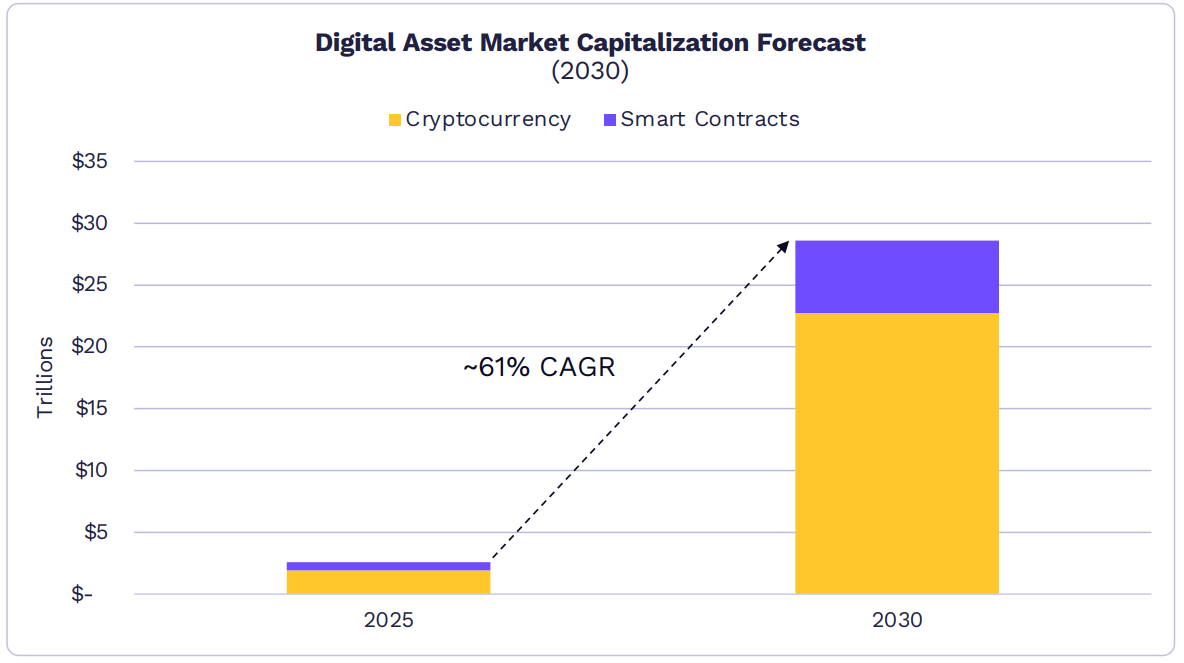

- ARK Invest forecasts the cryptocurrency market could grow to $28 trillion by 2030.

- Bitcoin is expected to account for 70% of the crypto market, potentially reaching $950,000 to $1 million.

- Institutional adoption and DeFi platforms are projected to drive major growth in digital assets.

ARK Invest predicts massive growth for the cryptocurrency market over the next decade, estimating that total market capitalization could reach $28 trillion by 2030.

According to the report, Bitcoin may see its price rise to between $950,000 and $1 million per coin, driven by institutional adoption and the maturation of digital assets as an asset class.

Institutional adoption and Bitcoin’s growth

The firm estimates that digital assets could grow at an annual rate of 61%, with Bitcoin making up roughly 70% of the total market. By 2030, around 20.5 million bitcoins will have been mined, which supports the projected high price levels.

Source: ARK Invest

ARK notes that Bitcoin ETFs and corporate holdings have already increased their share of total Bitcoin supply from 8.7% to 12% by 2025, reflecting growing institutional interest.

Cathie Wood, head of ARK Invest, previously forecast a potential $1.5 million price for Bitcoin by 2030, but the current estimate is more conservative. Despite this adjustment, the report highlights Bitcoin’s increasing role as a leading institutional asset.

DeFi, tokenization, and market expansion

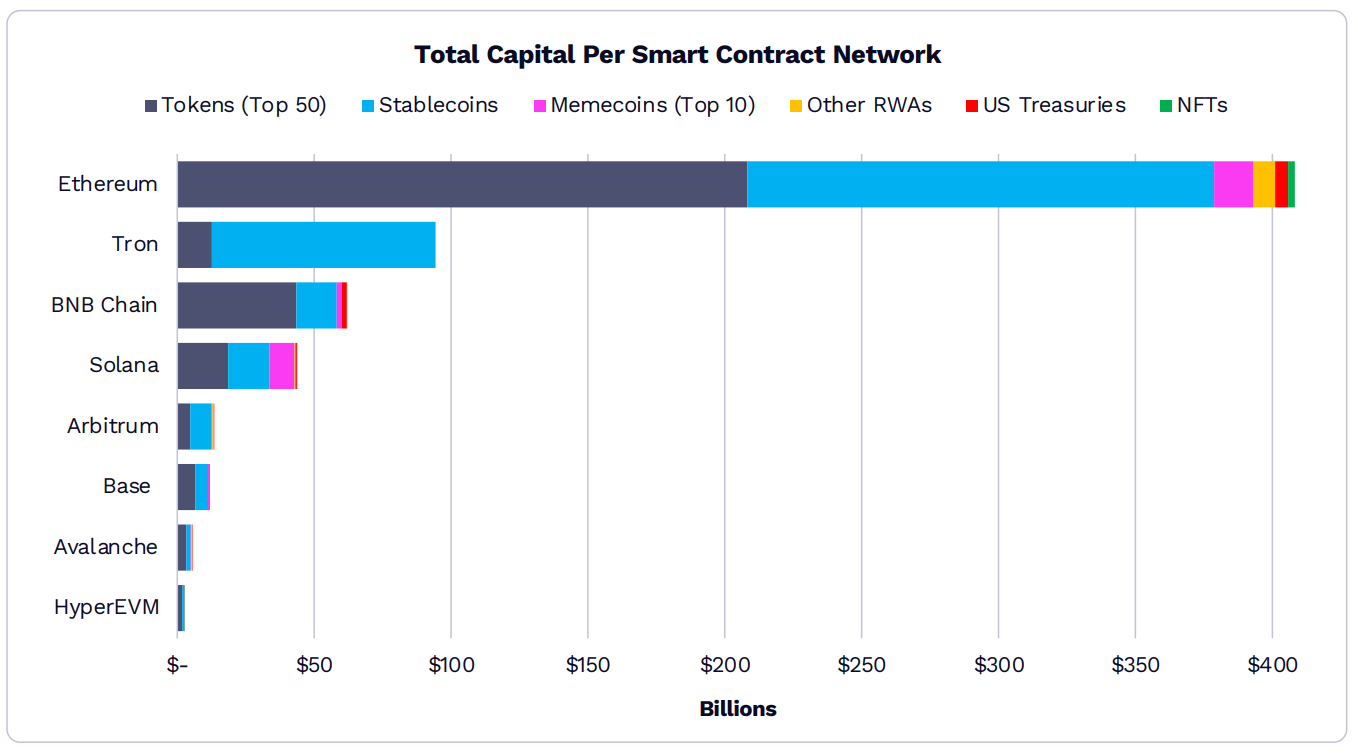

ARK attributes much of the potential market growth to decentralized finance, stablecoins, and tokenized real-world assets. Leading smart contract platforms such as Ethereum and Solana are expected to benefit the most, with projected annual growth of 54%, reaching $6 trillion by 2030.

Source: ARK Invest

The report emphasizes that cryptocurrencies underlying these platforms will derive the majority of their market value from their role as stores of value and reserve assets, rather than from discounted cash flows.

The tokenized real-world asset sector, currently valued at around $22 billion, could expand to $11 trillion by 2030, provided regulatory clarity and institutional infrastructure continue to improve. Achieving this growth will require annual increases of nearly 246%, highlighting both the opportunity and the challenges for the sector.

From a technical perspective, ARK notes that achieving these market levels will require significant scalability improvements. Ethereum, for example, currently processes around 15 transactions per second, insufficient for multi-trillion-dollar markets.

While second-layer solutions are progressing rapidly, traditional financial institutions are also developing digital versions of existing instruments, which could shift some capital away from crypto.

Source:: Bitcoin Could Hit $1 Million as ARK Invest Predicts $28 Trillion Crypto Market by 2030