Key highlights:

- XRP price is trading around $2.94, testing the $2.90–$3.00 support zone after July’s rally to $3.50–$3.60.

- On-chain data shows declining active addresses and transfer volume, signaling short-term cooling in market activity.

- A bounce from $3.00 could spark a move to $3.30–$3.50, while a breakdown may expose $2.70 and $2.45.

| XRP Price | $2.94 |

|---|---|

| XRP Resistance Levels | $3.30, $3.50, $3.60, $4.00 |

| XRP Support Levels | $3.00, $2.90, $2.70, $2.45 |

XRP is trading near $2.94, holding just above the $2.90–$3.00 range that has become the focus for traders.

After a strong rally in July that carried the XRP price to $3.50–$3.60, the market has shifted into a pullback. It’s not a dramatic crash, but more of a controlled cooldown after weeks of upward momentum.

Analyst AltcoinGordon captured the mood perfectly with his tweet: “The $XRP bounce will be studied.” Traders are now watching to see whether this zone will deliver the kind of rebound that gets talked about for months.

XRP on-chain activity shows cooling interest

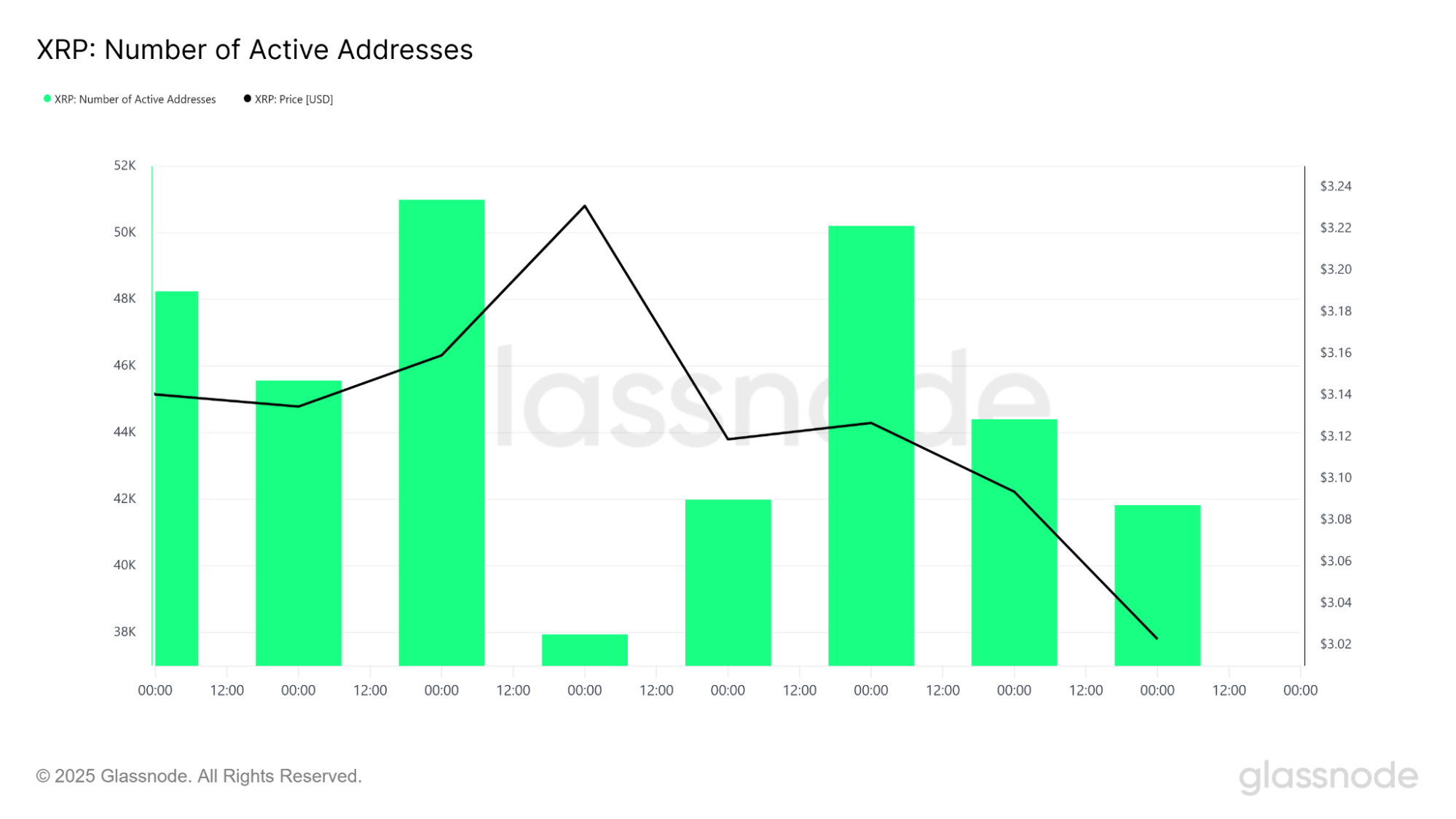

On-chain data from Glassnode provides an extra layer to the story. Active addresses surged past 52,000 as XRP price climbed toward $3.23, showing a burst of user activity during the rally. But as the price began to move downward, active addresses dropped to around 37,000.

A short-term bounce above 50,000 addresses was unable to be maintained, and activity dropped back to around 39,000. This reduction in activity is generally indicative of speculative momentum draining out of the market, at least for the short term.

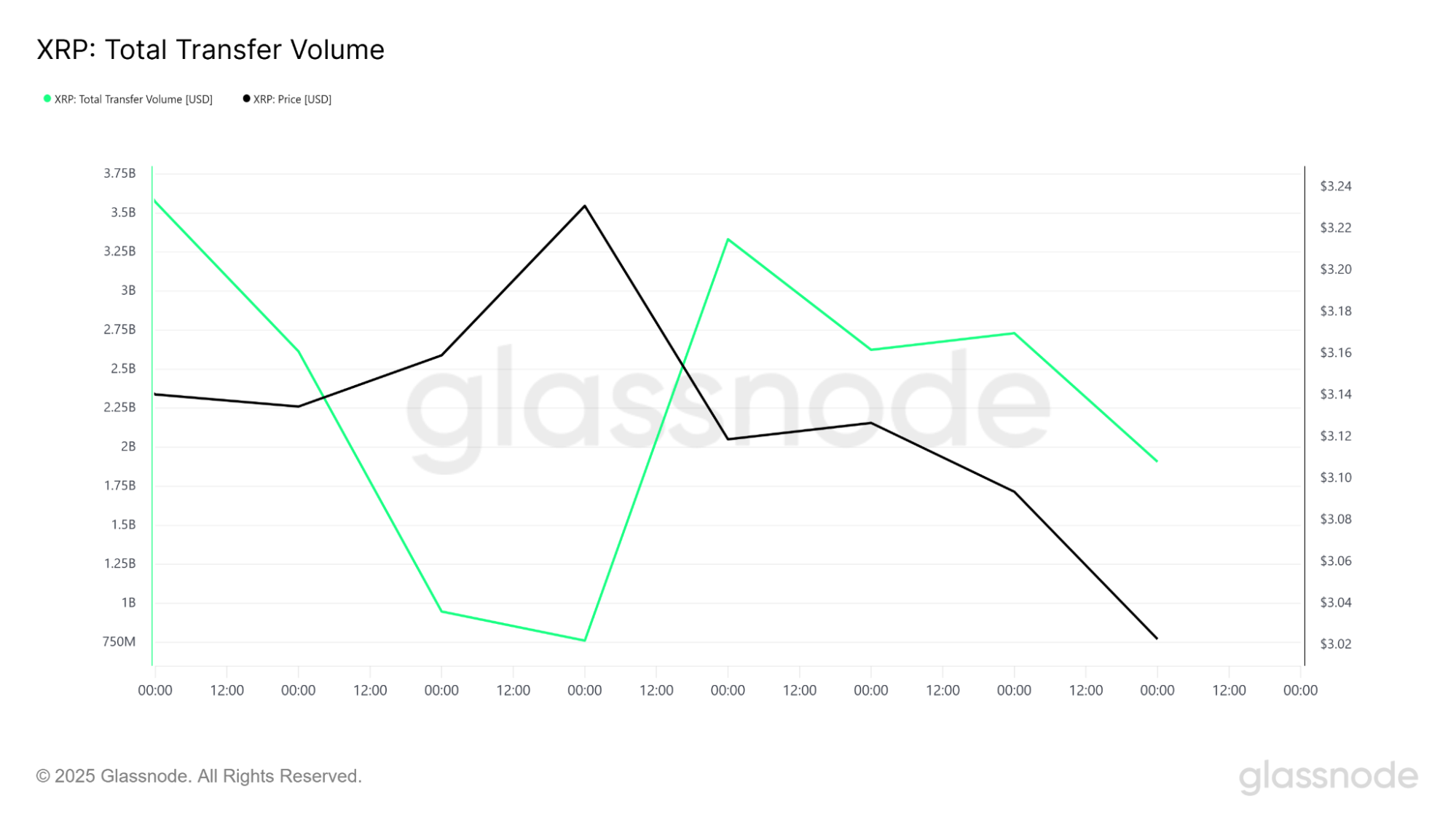

Transfer volume tells a similar story. It started high, near $3.6 billion in USD terms, then fell below $1 billion as the market cooled. A sharp spike to $3.3 billion occurred right as the price was dropping, a classic sign of distribution, where larger holders take profits.

Since then, volume has eased to around $1.9 billion. History shows that XRP tends to perform its best rebound when XRP price recovery is supported by a rise in both active addresses and transfer volume. Without that confirmation, any bounce may remain short-lived.

XRP market structure and technical setup

Despite the weakness since then, XRP medium-term structure is still bullish. The token broke up from $2.00 to $3.50–$3.60 in July, where it formed a series of higher highs and higher lows.

That breakout period has then given way to a short-term downtrend on the 4-hour time frame, where XRP price is below a declining line and below the 100-period moving average at $3.25.

Fibonacci retracement levels provide additional insight. XRP has retraced past the 0.786 level at $3.34, and it is showing that selling pressure exists.

XRP 4h chart. Source: Tradingview

Relative Strength Index (RSI) on the 4-hour chart is around 31, which places it in oversold territory that has a tendency to occur before a relief bounce. On the daily XRP chart, the RSI is neutral at 48, and this means that the market still has room to decide direction.

Long-term support holds intact due to the uptrend line established since April and the 200-day simple moving average at $2.45. These serve as mid-term investors’ levels of comfort that even in case of a breach of this current support, the overall bullish configuration will not be completely violated unless the price goes much lower.

XRP price analysis: Support and resistance levels to watch

Support at $2.90–$3.00 is the line the market is defending right now. A proper bounce here would advance the XRP price to $3.30–$3.50, which has been a recent cap. A close above $3.50 will establish the path to $3.60 and even to $4.00 if volume drives the trend.

If $2.90 breaks, then $2.70–$2.75 and $2.45 are the next levels to watch, incidentally where the 200-day SMA and long-term trendline are. These levels need to see the attention of buying from longer-term investors and swing traders.

XRP daily chart. Source: Tradingview

For resistance, $3.30–$3.50 is where the battle will be fought. Without firm volume and on-chain confirmation, XRP could continue to struggle below this range, which would be a consolidation pattern and not a breakout.

Short-Term outlook and market sentiment

Right now, XRP price is sitting at a decision point. A strong bounce from the $3.00 area could confirm the setup Gordon referenced in his tweet, turning this level into a textbook breakout-retest scenario.

Failure to hold $2.90 could trigger a deeper correction toward $2.70, with $2.45 as the last major defense for medium-term bulls. The market is waiting for confirmation from transfer volume and active addresses, which have historically accompanied XRP’s biggest moves.

What makes this moment so interesting is that XRP has a history of explosive rebounds after periods of low confidence. When network activity and price action align, the token can move fast.

But for now, all eyes remain on the $3.00 support. Whether this level produces the “bounce that will be studied” or gives way to another leg down will likely define XRP’s path for the rest of the month.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: XRP Price Analysis: Why Analysts Are Watching This $3 Bounce Closely