Key highlights:

- Interest payments on US debt exceeded $952 billion in 2025, surpassing defense spending.

- Sustained economic growth of 3% per year for a decade or more is the only path to reducing the debt-to-GDP ratio.

- Artificial intelligence could significantly boost productivity and tax revenues before investor confidence declines.

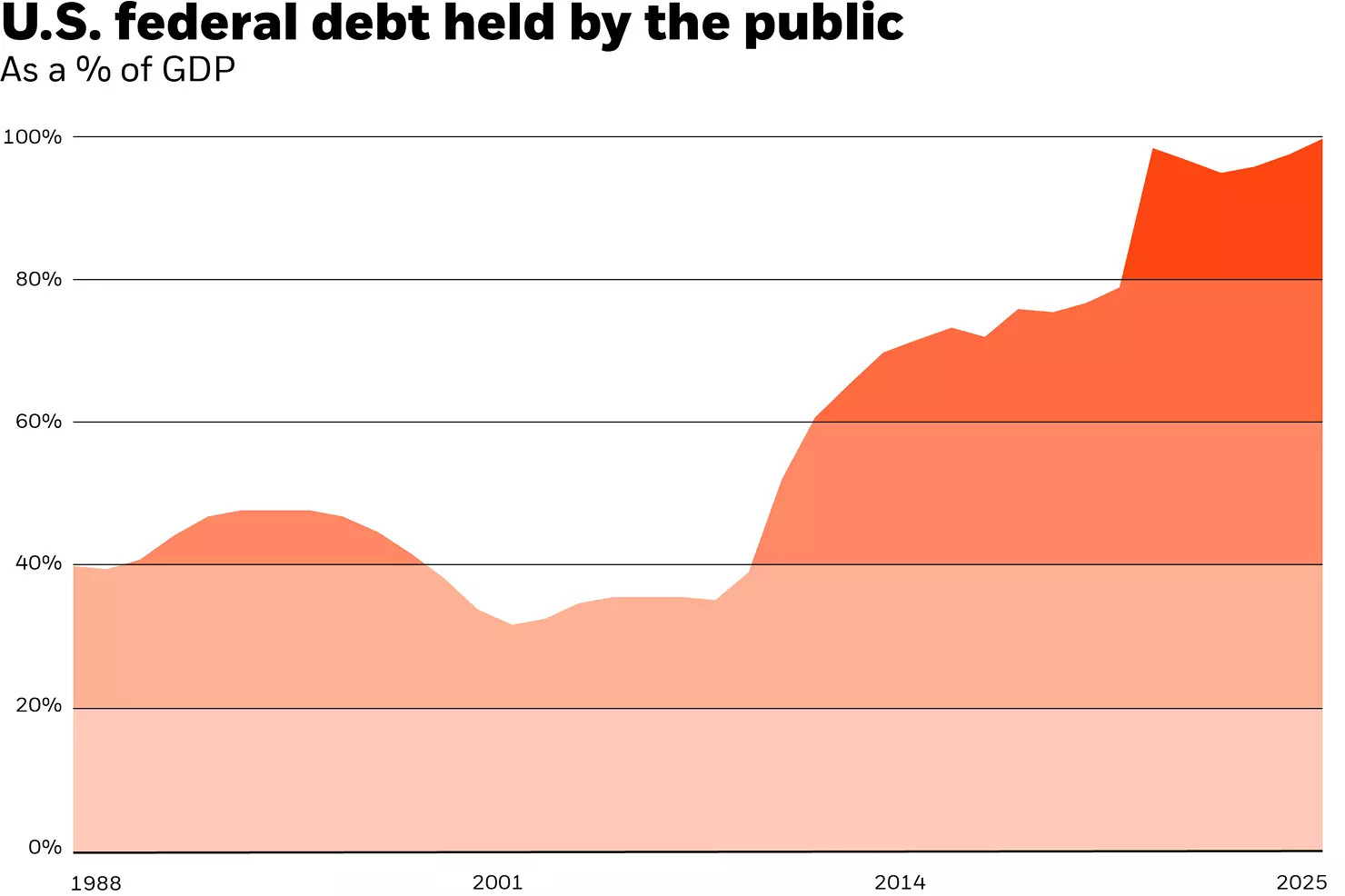

BlackRock CEO Larry Fink recently warned in an interview with CNBC that markets are underestimating the severity of the growing US national debt. With debt exceeding $38 trillion, the United States could face a loss of investor confidence and a sharp rise in borrowing costs, he said.

On January 19, Bridgewater Associates founder Ray Dalio wrote on social media:

“It’s now happening. The existing fiat monetary order, the domestic political order, and the international geopolitical order are all breaking down, so we are at the brink of wars.”

This statement reflects growing concern in the financial community over the US debt burden.

Interest payments are consuming the federal budget

Interest payments on US debt exceeded $952 billion in 2025, surpassing defense spending. According to Fink’s projections, by 2030, mandatory government spending and debt servicing could consume the majority of federal revenue, creating a persistent budget deficit.

The US is entering a debt spiral: rising interest payments require new borrowing, which increases the total debt and further inflates interest costs. Even a small rise in interest rates could trigger a significant surge in debt servicing expenses.

BlackRock (BLK) controls assets worth $14.04 trillion, nearly equivalent to the combined GDP of Germany, Japan, Brazil, and Russia ($14.09 trillion). Fink’s perspective on systemic risks is informed by managing such a large pool of assets.

The critical point is approaching

Fink explained that when interest payments begin to grow faster than the economy, they take up an increasing share of the federal budget. Funds that would otherwise go to infrastructure, education, and defense are diverted to servicing existing debt.

Source: BlackRock

Investor confidence is the key threshold. If investors doubt the US’s ability to service its debt, they will demand higher interest rates, compounding the problem. In extreme scenarios, this could challenge the dollar’s status as the global reserve currency.

Sustained growth offers the only path to stability

Fink sees one clear solution: sustained economic growth of 3% per year for 10–15 years. This rate of growth would help reduce the debt-to-GDP ratio despite a high budget deficit. Without it, interest expenses outpace revenues, turning the budget into a machine for servicing existing debt and worsening the debt spiral.

Last year, the rising debt was overshadowed by AI developments and strong corporate earnings. But after surpassing $38 trillion in October 2025, the debt issue has become impossible for markets to ignore.

Historical context

Historical analysis shows that countries have overcome massive debt crises before. After the Napoleonic Wars, Great Britain’s debt-to-GDP ratio exceeded 200%, yet the technological advances of the 19th century allowed the country to recover.

The US may face a similar opportunity. Artificial intelligence could boost labor productivity, create new industries, and expand the tax base. However, the timing is critical: will AI-driven growth occur before international investors lose confidence in the dollar?

A unique advantage remains: the dollar is the world’s reserve currency, giving the US the ability to issue money to service debt without triggering immediate inflation. Japan’s debt-to-GDP ratio of 260% demonstrates that high debt can coexist with stability when supported by domestic savings and technological leadership.

The key question is whether the combination of productivity growth and fiscal management will prevent a financial crisis in the coming years.

Source:: US Debt Crisis Looms, BlackRock Warns $38 Trillion Could Threaten Markets