Key highlights:

- $450B erased from markets within minutes after Trump’s post

- Bitcoin and altcoins plunged as traders rushed for safety

- Soybean tensions deepen US-China trade and political rift

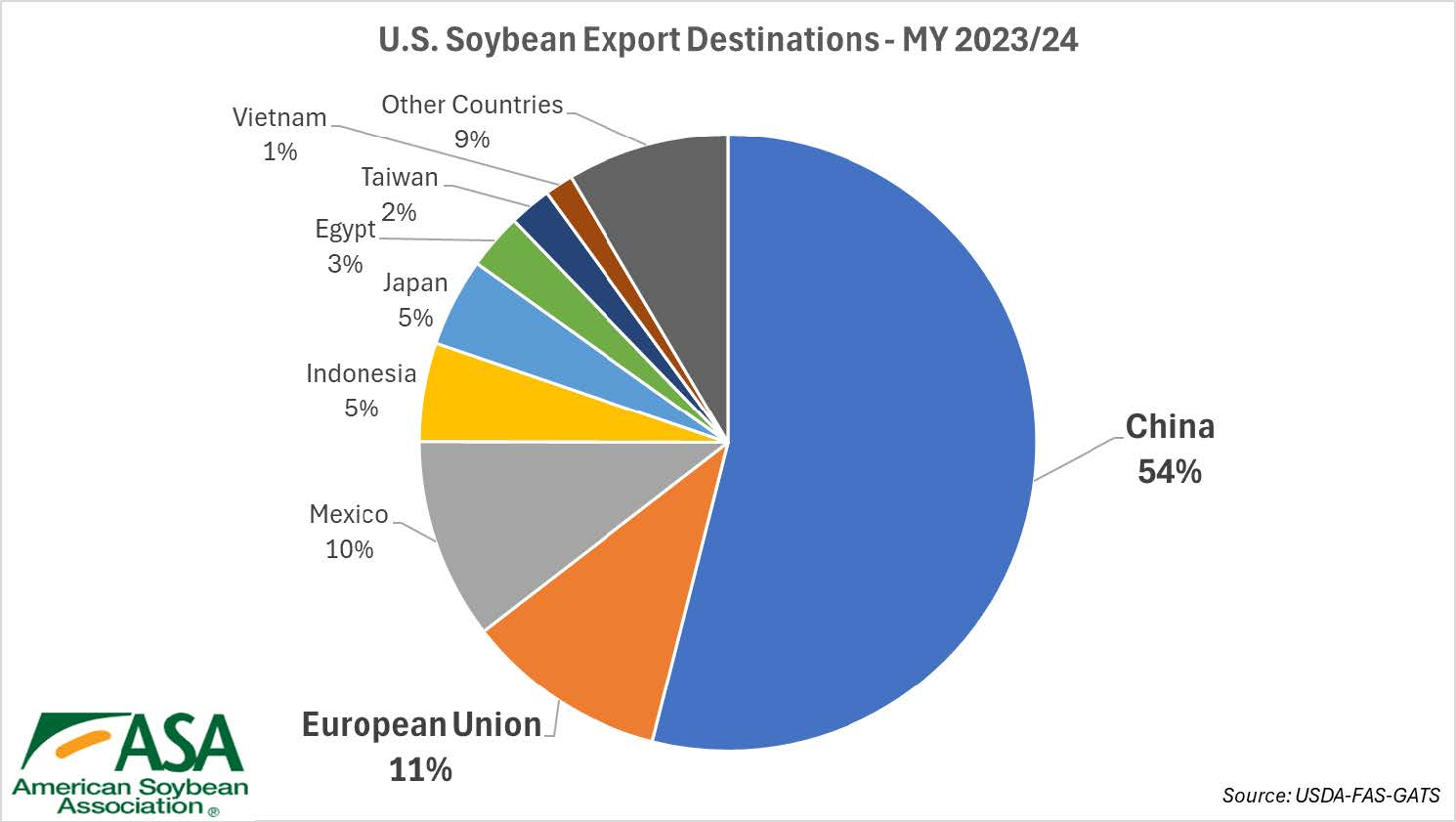

China remains the world’s largest soybean buyer, but in recent years it has sharply reduced imports from the US, turning instead to Brazil and Argentina.

According to the US Department of Agriculture, soybean exports to China have plummeted, leaving massive stockpiles and financial losses for farmers in the Midwest, especially in Iowa and Illinois.

U.S. Soybean Export Destinations. Source: soygrowers.com

Trump’s concerns extend beyond soybeans to cooking oil imports, including used oil for biofuel production. These imports reached record levels in 2024, but Chinese exports fell sharply in 2025 after Beijing revoked several tax breaks.

$450 Billion wiped out in seven minutes

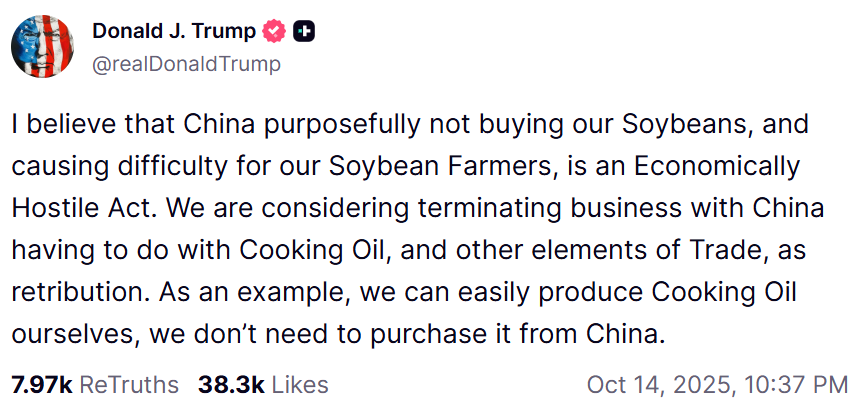

Trump’s post on October 14, 2025, triggered panic in the stock market. Analysts estimate that US market capitalization fell by roughly $450 billion in just seven minutes after his message went live.

Source: Truth Social

The S&P 500 turned negative, while Nasdaq futures dropped 1.1%. Chinese markets also suffered: the Hang Seng China Enterprises Index fell 3.6%, and the CSI 300 slipped 0.5%.

S&P 500 Index Reaction to Trump’s Soybean Announcement. Source: The Kobeissi Letter

Yet not all companies suffered. Shares of agricultural giants Archer-Daniels-Midland Co. and Bunge Global SA rose sharply, reversing earlier declines.

Crypto markets join the sell-off

Cryptocurrencies also plunged amid the broader market panic. Bitcoin dropped around 3–4%, sliding from $116,000 to below $112,000 before stabilizing near $112,000 the following day.

BTC/USD 1-day chart. Source: TradingView

Trading volume surged, up 35% to $90 billion in spot markets and 40% to $144 billion in derivatives, signaling liquidations and opportunistic buying as traders sought to “buy the dip.”

Open interest fell 2% to $72.5 billion, a sign that leverage was being reduced. Total liquidations exceeded $600 million in a single day, mostly long positions.

The global crypto market lost up to $125 billion in capitalization, while altcoins like Ethereum, Solana, and XRP fell between 2–5%. Investors fled to safer assets such as gold and US Treasuries.

The interdependence between the US and Chinese economies remains clear, and each fiery statement from Trump is a reminder that the trade war is far from over.

Source:: Trump’s Soybean War Against China Cost US Markets $450 Billion