Key highlights:

- Fundstrat’s Tom Lee predicted an Ethereum bottom amid a $200B market dip, citing strong technical signals and treasury accumulation.

- BitMine Immersion Technologies, Lee’s ETH treasury firm, bought $21.3 million worth of Ether during the downturn.

- Spot Ethereum ETFs recorded over $443 million in net inflows on Monday, outpacing Bitcoin ETF flows more than twofold.

Tom Lee sees ETH bottom forming near $4,300

Tom Lee, Managing Partner at Fundstrat Global Advisors, predicted early Tuesday that Ethereum was bottoming out following a sharp downturn in the broader crypto market. Posting on X at 1 a.m. UTC, Lee stated, “Calling ETH bottom to happen in next few hours,” as the total crypto market saw over $200 billion wiped in liquidations.

Mark @MarkNewtonCMT again at it.

➡️Calling ETH bottom to happen in next few hours

Tickers: $BMNR $GRNY pic.twitter.com/038efU7cZH

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) August 26, 2025

Lee shared insights from Mark Newton, Fundstrat’s Head of Technical Strategy, who described Ethereum as offering “a very good risk/reward here.” Newton projected that ETH would likely bottom around $4,300 and rebound towards new highs, targeting resistance between $5,100 and $5,450.

At the time of Lee’s call, Ethereum had already begun recovering, trading above $4,430 after falling more than 7% in 24 hours. The rebound aligned with Newton’s bullish thesis, which remains valid as long as ETH stays above the $4,067 support level.

BitMine continues aggressive ETH accumulation

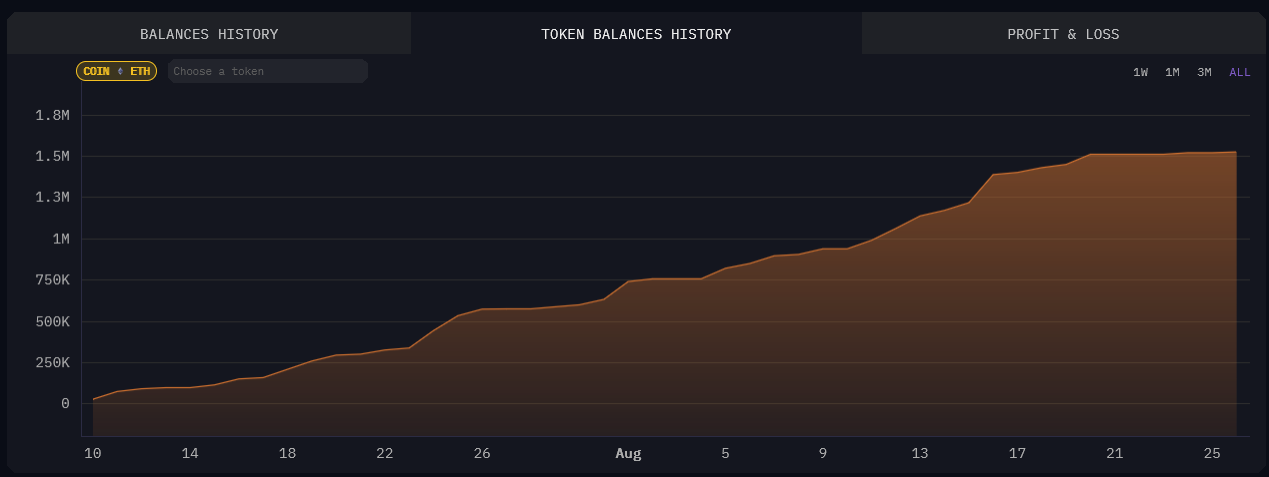

Coinciding with Lee’s bullish call, BitMine Immersion Technologies (an Ethereum treasury chaired by Lee) disclosed the purchase of 4,871 ETH worth $21.3 million on Tuesday. According to Arkham Intelligence, BitMine now holds approximately 1.52 million ETH, valued at around $6.7 billion, making it the largest corporate holder of Ethereum.

Bitmine Immersion (BMNR) ETH balance since July 10, 2025. Image source: Arkham Intelligence

BitMine has significantly expanded its crypto and cash reserves, which rose by $2.2 billion over the past week to reach $8.8 billion. Its net asset value per share surged to $39.84, up from $22.84 in late July, reinforcing its dominant position with 40% of all corporate-held ETH, based on data from StrategyEthReserve.

Ethereum ETFs surpass Bitcoin ETFs in daily inflows

On Monday, spot Ethereum ETFs in the U.S. recorded $443.9 million in net inflows, more than double the daily inflows seen by Bitcoin ETFs.

Investors appear to still be favoring #Ethereum over #Bitcoin at the moment.

Yesterday’s #crypto ETF flows:

💠 $BTC: +$219.1 million

💠 $ETH: +$443.9 millionLarger flows into ETH are especially impressive given that its market cap is over 4x smaller than BTC 👀 pic.twitter.com/oJ9QYgMaOB

— CoinCodex (@CoinCodex) August 26, 2025

BlackRock’s ETHA led the pack with $314.9 million, followed by $87.4 million into Fidelity’s FETH. Other funds from Grayscale, Bitwise, 21Shares, and Invesco also saw positive flows, according to data from SoSoValue.

The spike in ETH ETF inflows signals a notable investor pivot towards Ethereum, driven by its staking rewards, increasing regulatory clarity, and growing adoption by corporate treasuries like BitMine. The trend contrasts with Bitcoin’s recent slide below $110,000, as broader market sentiment turns cautious following the fading impact of dovish signals from the Federal Reserve.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: Tom Lee Calls Ethereum Price Bottom as ETH ETFs Surpass BTC ETFs in Daily Inflows