Key highlights:

- SUI is sitting at a spot where the market is about to show its hand, either confirming this pullback as just a pause or something more serious.

- The structure on the chart indicates this correction might be running out of steam rather than getting worse.

- All eyes are now on a few key price levels that could give early clues about where SUI goes next.

SUI has been through a pretty rough patch lately. After taking a hit over the past week and slipping again today, the SUI price now sits around $1.49, right in that uncomfortable zone where sentiment turns bearish fast, but the chart itself starts getting interesting again.

That’s exactly where the take from BitcoinSensus comes in. Their post is built around a familiar market rhythm: a five-wave push higher, followed by a three-wave ABC correction, and then potentially a reset into the next move up.

What the bigger SUI picture is hinting at

If you look at the macro chart from BitcoinSensus, SUI’s earlier move looks like a clean impulsive run, followed by a long, drawn-out correction that has flushed out a lot of leverage.

One detail that stands out is the liquidation wick during the selloff, where the SUI price briefly dipped toward the $1.30–$1.35 area before snapping back. That kind of move usually points to forced selling rather than calm profit-taking.

#Sui Macro Uptrend is Still Intact? 📈🧲$SUI has been moving up in 5 wavers followed by a 3 waver ABC correction.

If the pattern repeats, we could now be at the end of the 3 waver and on the verge of reversing. 💥 pic.twitter.com/A9F21PQFaZ

— Bitcoinsensus (@Bitcoinsensus) January 22, 2026

When liquidation wicks appear near the tail end of a decline, they often mark areas where a lot of weak hands were pushed out. In that light, the SUI price hovering around $1.49 starts to feel less random and more like a post-washout zone.

The logic here is simple. If the correction is really maturing, the next thing the market wants to see is a higher low and then a reclaim of the levels that broke earlier, especially the $1.60–$1.65 range.

On-chain data indicates this isn’t falling apart

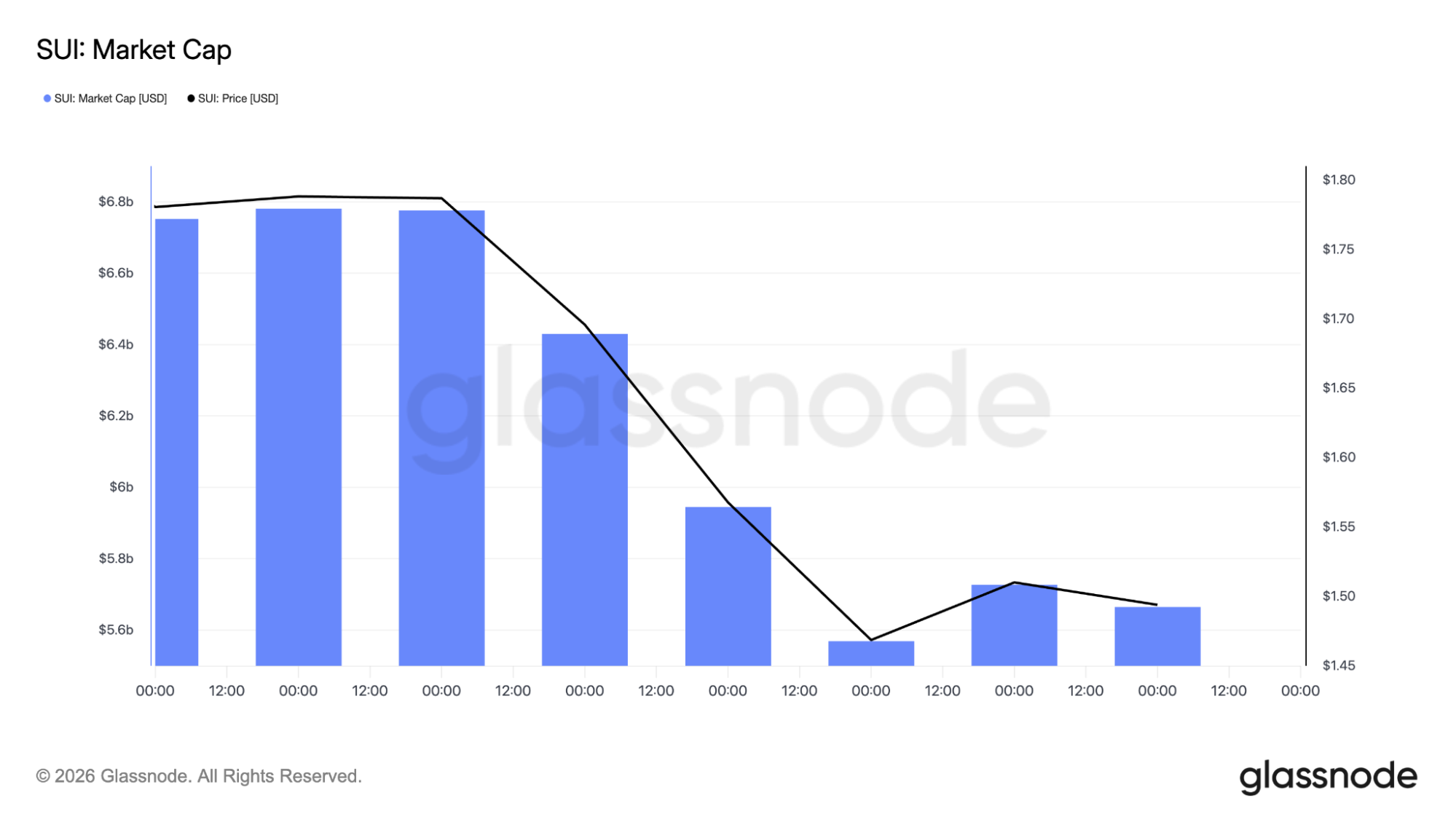

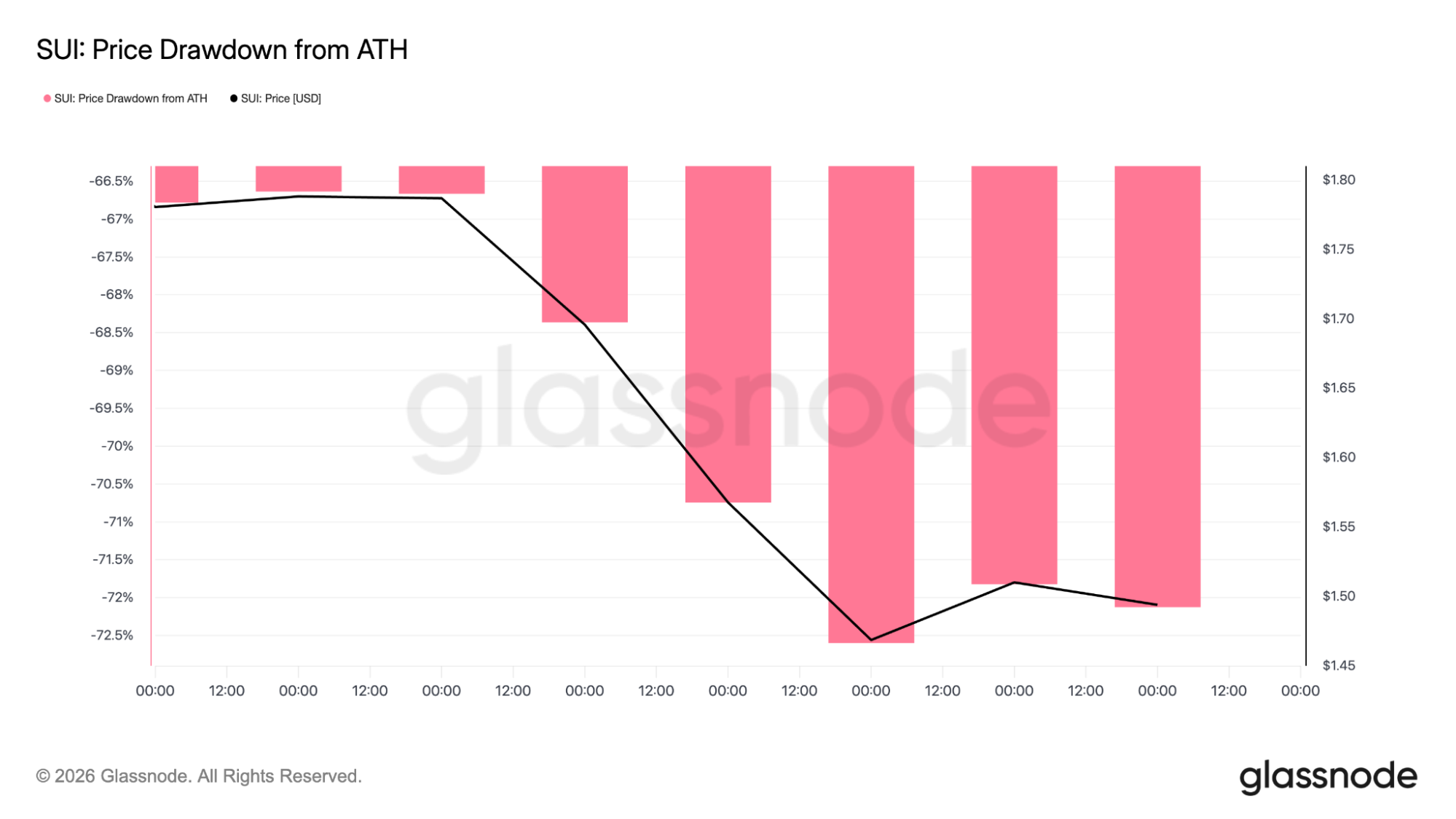

This is where on-chain data adds some really useful context. The Glassnode market cap chart shows a clear drop from around $6.8 billion toward the $5.6 billion region and then something important: that drop slows down.

Market cap stops cascading lower and starts moving sideways. That’s often what it looks like when panic selling ends and the market shifts into a “let’s wait and see” mode.

The drawdown chart tells a similar story. The SUI price drawdown from the all-time high now sits near -72%, and more importantly, it has stopped expanding. That doesn’t guarantee a bottom, but it does suggest that most of the damage has already been done.

Put together, this supports a simple idea: the SUI price has been under real pressure, but the market is not behaving like it’s in full abandonment mode.

The SUI daily chart still feels defensive, not strong

On the daily chart, the SUI price is still stuck inside a broader downtrend from its earlier highs near $2.10–$2.20. You can see the long slide, the sharp breakdown, and then this phase where price stops bleeding and starts trying to stabilize.

That change alone is important. The SUI price is no longer stepping down in a clean staircase. Instead, it’s chopping sideways between roughly $1.40 and $1.60, trying to carve out some kind of floor.

Daily SUI price chart analysis

There’s a wide support area under price that’s already been tested around $1.35–$1.40. The SUI price dipped into it and bounced, which tells you buyers are willing to show up there.

At the same time, there’s heavy resistance above, right around $1.65–$1.70, where previous rebounds have failed. In simple terms, SUI is still under the resistance.

RSI on the daily chart sits on the weak side, which fits the mood perfectly. It’s not overheated, but it’s not showing strength either. It looks like a market that’s still trying to recover after being pushed around.

The SUI 4-hour chart still calls for caution

The 4-hour chart makes the current problem easy to see. The SUI price slipped below a major moving average near $1.60 and has struggled to reclaim it. That’s why the last bounce stalled around $1.58–$1.60 before rolling over again.

4-Hour SUI price chart analysis

There’s a clear decision zone on this timeframe between $1.45 and $1.55. The SUI price is holding just above its recent lows near $1.42, but still below the levels that would confirm momentum is back. RSI here is also weak, sitting in the mid-to-high 30s, which tells the same story as the daily chart.

The clean way to read this is that SUI doesn’t need a miracle candle. It needs a steady reclaim above $1.60, followed by acceptance above $1.65. Grinding back above those levels would do far more for structure than one flashy spike that fades the next day.

The bottom line on the SUI price

Right now, the SUI price around $1.49 looks like it’s trying to decide whether the correction is finishing or just taking a breather.

According to CoinCodex’s SUI price prediction, the token could drift toward $1.12 by February. That’s the cautious view, but for the bullish scenario to stay alive, the SUI price needs to keep defending the $1.40–$1.45 zone.

That means pushing back into the $1.65–$1.70 resistance zone and actually holding there. If the SUI price loses $1.40 and buyers stop stepping in, though, the picture changes quickly. In that case, the market risks sliding back toward the $1.30–$1.25 region and revisiting the lows.

The on-chain data helps explain why this is even a discussion. Market cap compression and a drawdown that stops getting worse often show up around transition phases. That doesn’t mean a rally is guaranteed. It simply means the SUI price is no longer in the same freefall phase.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: SUI Price Analysis: Is SUI’s Macro Uptrend Still Intact?