After an explosive 2021, during which Solana skyrocketed to its all-time high of nearly $260 on the heels of +1,120% yearly gains, Solana saw a -94% drop in its value in 2022. After a period of consolidation in 2023, the Solana ecosystem saw a huge revival in 2024, when it became arguably the most exciting blockchain platform in the market.

The Solana bull market peaked in early 2025, when U.S. president elect Donald Trump launched a meme coin on the Solana blockchain. The speculative hype pushed SOL to a new all-time high of roughly $295, but it was followed by a sharp price correction in which SOL tested the $100 price level.

With SOL now trading at much lower prices, it’s natural that many investors are wondering if Solana is still a good investment in 2025. In this article, we’ll explore the main pros and cons of Solana to help you make a more informed decision.

Key highlights:

- SOL is currently trading 55% from its all-time high, which could be a good opportunity for those that believe the project has long-term potential.

- Solana’s on-chain activity is still robust, and multiple promising projects continue building on Solana.

- The Firedancer upgrade is expected to boost the scalability of Solana even further.

- There is a very good chance that we’ll see Solana ETFs launch in the United States this year.

- However, there are also risks to investing in Solana. Demand for meme coins has faded, and Bitcoin has outperformed Solana on multiple key time frames.

Here’s why Solana is considered a good investment

After a stellar 2024, SOL has seen a significant price decline in 2025 so far. To be fair, many other leading altcoins (including Ethereum, Dogecoin, Cardano and Chainlink) have also endured major price crashes this year. Although many crypto investors are shying away from altcoin markets at the moment, there are multiple reasons why now could be a good time to invest in Solana. Here’s a shortlist of the most bullish factors:

- On-chain activity remains strong

- A large number of promising projects is building on Solana

- The Firedancer client will provide an additional boost to Solana’s scalability

- A Solana ETF will likely be approved this year

In the following sections, we’ll explore the reasons why Solana is a good investment in more detail. We’ll also present a case against investing in Solana so that you can get familiar with some of its drawbacks.

On-chain activity remains strong

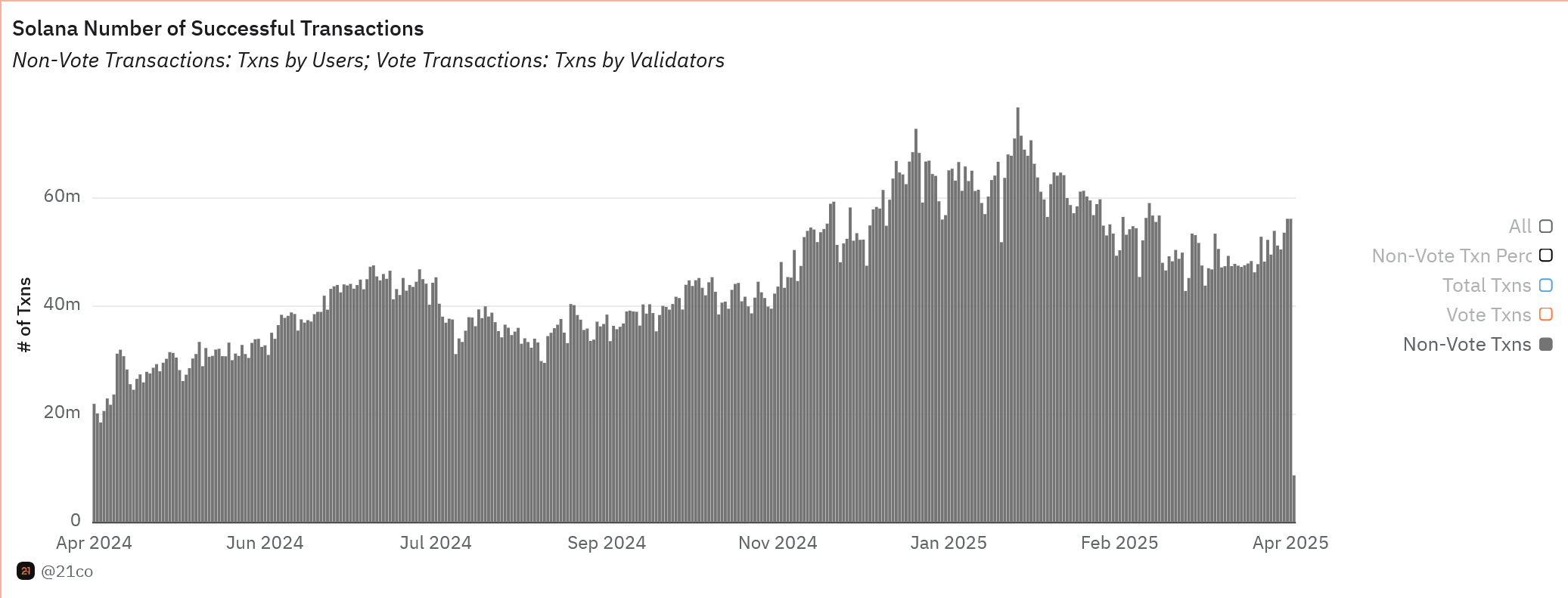

One of the most important metrics for gauging the health of any blockchain ecosystem is on-chain activity. Although the number of transactions processed by Solana has dipped alongside the decrease in the price of SOL, the number of transactions and active addresses on Solana is still very robust. In the past 3 months, Solana has been processing between 40 and 56 million non-vote transactions per day.

Number of daily non-vote Solana transactions. Image source: Dune Analytics (@21co)

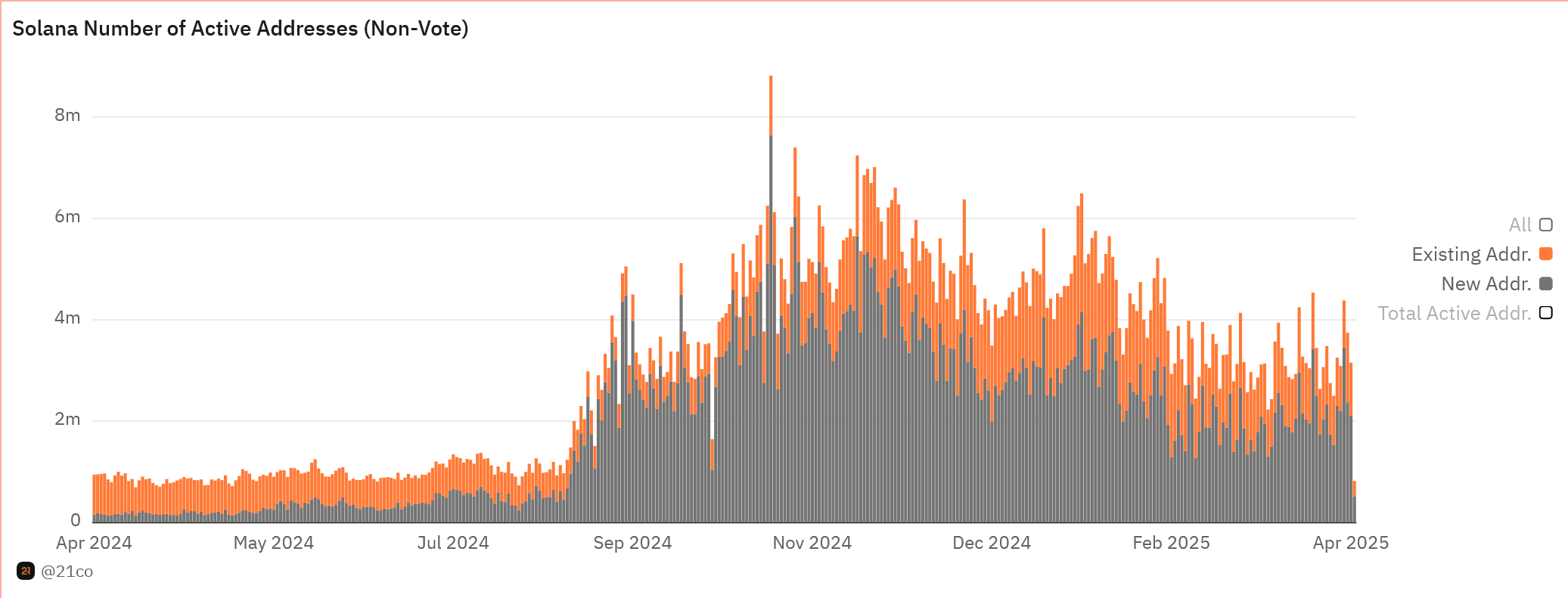

When it comes to the number of active addresses, Solana is still posting much higher numbers than it did in early 2024, despite a noticeable drop-off in January and February. The number of active addresses on Solana is hovering between 2 million and 4.5 million, depending on the day.

Number of daily active addresses on the Solana blockchain. Image source: Dune Analytics (@21co)

A large number of promising projects is building on Solana

Due to its strong scalability, Solana is a natural option for blockchain projects that are targeting a broad userbase. Notably, Solana has established itself as a leading platform for meme coins, as users can create meme coins extremely quickly and with minimal costs. In fact, the speculative mania surrounding meme coins was one of the main catalysts of Solana’s growth in 2024.

However, the Solana ecosystem goes much deeper than meme coins. For example, Solana has established itself as a major hub for DePIN (decentralized physical infrastructure) projects.

Leading DePIN projects building on Solana include Helium, which is creating decentralized wireless networks powered by token incentives, Hivemapper, which rewards users for providing mapping services, and Render Network, which allows users to tap into a decentralized GPU rendering platform.

As blockchain technology and crypto assets become more commonplace, we think DePIN projects could be a major beneficiary as they provide tangible services and not just infrastructure for speculative trading, which is largely what the crypto and blockchain sector has been focused on.

Of course, we also shouldn’t forget Solana’s DeFi ecosystem, which is second only to Ethereum. Projects such as Jupiter, Raydium, Orca and Drift are at the forefront of innovation in decentralized finance at large.

The Firedancer client will provide an additional boost to Solana’s scalability

Firedancer is a new client for the Solana blockchain that’s being developed by the team behind Jump Crypto. The client is designed to overcome the software bottlenecks holding back the full potential of Solana’s scalability. Firedancer achieves this by optimizing networking, consensus rules and runtime processing

A testnet version of the client, along with a prototype mainnet build called Frankendancer, both debuted in September of last year. Although its initial release was scheduled for the second quarter of 2024, full deployment of Firedancer is still anticipated sometime this year.

Mert Memtaz, co-founder of Helius and a prominent voice in the Solana ecosystem, has projected that Firedancer will officially launch by the end of the second quarter of 2025.

The Firedancer upgrade is expected to play a key role in helping Solana move closer to its target of handling 1 million transactions per second.

BREAKING NEWS: Kevin Bowers announces that Frankendancer is now live on Solana mainnet — and the full @jump_firedancer client is on testnet 🔥💃 pic.twitter.com/piZUEuVYnE

— Solana (@solana) September 20, 2024

A Solana ETF will likely be approved this year

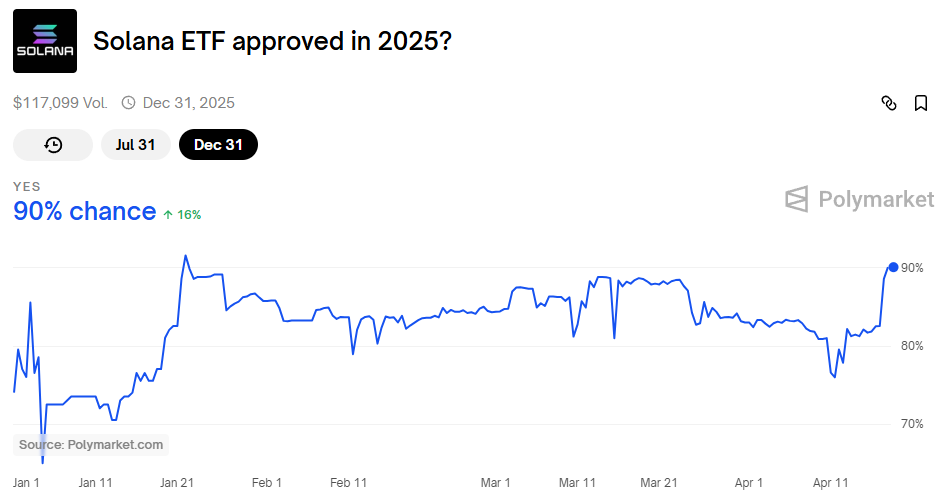

So far, six asset managers have filed to launch a Solana ETF in the United States market. This also includes Franklin Templeton, which has over 1.5 trillion dollars in assets under management.

In the meantime, ETFs that track Solana futures have already been approved, as a pair of such ETFs issued by Volatility Shares started trading last week. The launch of these ETFs comes on the heels of regulated Solana futures debuting on the CME exchange.

According to bettors on Polymarket, there is an 90% chance that the SEC will approve a Solana ETF in 2025.

A Solana ETF could potentially lead to the price appreciation of SOL, as it would allow investors the option to gain exposure to SOL through traditional market infrastructure, without having to concern themselves with using crypto exchanges and securely custodying their SOL coins.

What are the cons of Solana as an investment?

With several bullish factors outlined in the sections above, let’s turn our focus to Solana’s cons as an investment. In our opinion, the main drawbacks for Solana are:

- Demand for meme coins has cooled down

- Long-term demand for altcoins is uncertain as Bitcoin outperforms

Demand for meme coins has cooled down

It is no secret that meme coin trading was one of the main catalysts for Solana’s 2024 bull run. Meme coin trading provided a huge surge of liquidity and activity to the Solana ecosystem, as Solana-based decentralized exchanges saw trading volumes similar to those on Ethereum, despite Solana having a significantly lower market cap. On a few occasions, the trading volume on Solana even surpassed that of Ethereum.

Unfortunately for Solana, the demand for meme coin trading has cooled down significantly after reaching a fever pitch in January 2025 with the launch of the official Trump meme coin. However, speculators eventually became fatigued by the rug pulls, market manipulation and insider trading plaguing the on-chain meme coin markets.

One of the biggest inflection points was the LIBRA meme coin, which was promoted by Argentina’s president Javier Milei. The token, which was supposedly meant to support Argentina-based entrepreneurs, saw a rapid price increase and hit a market capitalization of $4.5 billion within the first hour of launching. However, this increase was quickly followed up by an equally violent price crash that resulted in huge losses for the majority of LIBRA holders.

Pump.fun, the leading platform for launching and trading meme coins on Solana, has seen a clear decline in activity, and its unclear if this is just a temporary downtrend or if the meme coin trend is fading away for good.

Long-term demand for altcoins is uncertain as Bitcoin outperforms

Despite Bitcoin gaining 107% in the last 3 years, many altcoins have been struggling, with 43 out of the top 100 cryptocurrencies losing 40% or more in the same time period. The phenomenon of “alt seasons”, where an increase in the price of Bitcoin would be followed by an even stronger increase in the price of altcoins, could very well be over.

As of April 2025, Bitcoin is outperforming Solana on multiple time frames, including year-to-date, 6 months, 1 year and 3 years. Given that Bitcoin has been delivering better returns and is a much more established asset, it can be difficult to make a case for investing in Solana instead of simply buying Bitcoin, unless you are very optimistic about the potential of Solana’s technology and ecosystem.

The bottom line: Is Solana a good buy in 2025?

Solana is currently in a solid spot for crypto investors looking to make an entry, as the SOL price is down 55% from ATHs while the Solana ecosystem remains very robust.

Whether Solana is a good buy depends mostly on your own risk profile. If you think that Solana is poised for strong growth and you’re willing to take the risk that Solana will continue underperforming Bitcoin, buying Solana could be a promising long-term crypto investment.

If you are looking to diversify your portfolio among different smart contract platforms, check out our Is Ethereum a good investment article.

For more information, check out our ultimate guide on cryptocurrency investing for useful tips and ideas on how to approach investing in crypto.

Source:: Is Solana a Good Investment in 2025?