Key highlights:

- Bitcoin dips to $107K as traders fear a deeper correction below $100K

- ETF outflows and retail withdrawal add pressure on market sentiment

- Analysts warn of a volatile November despite bullish seasonal trends

Bitcoin has once again shown its volatility, slipping 2% in early November and returning to $107,000. On-chain data hints at a possible break below $100,000, pushing traders to reassess strategies as uncertainty deepens.

Analysts expect more downside as liquidity tightens

CrypNuevo Trader voiced his concern, saying:

“In all honesty, it looks like this could be one of the most difficult trading weeks of Q4.”

He highlighted the risk of a correction toward the 50-week exponential moving average (EMA) at $101,150, which coincides with levels reached during the previous decline from the all-time high of $126,200.

Source: X

Meanwhile, Daan Crypto Trades noted liquidity pressure across order books:

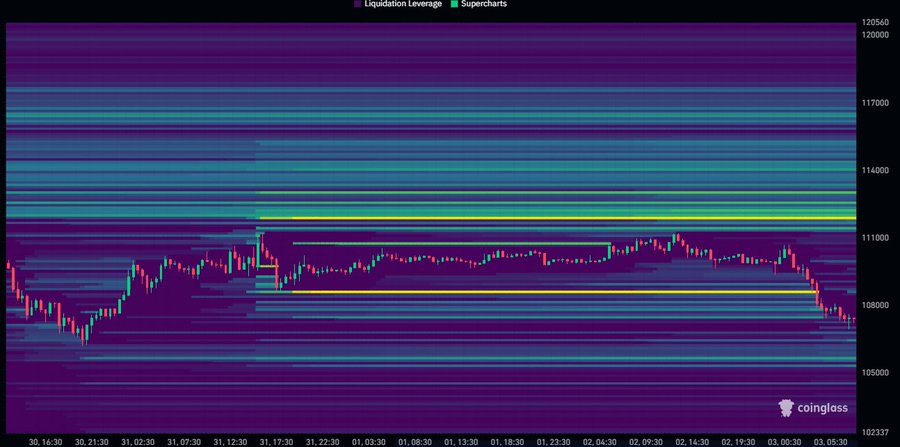

“Price took out the lower bound that was sitting at $108.5K. There’s still a decent cluster around $112K. When zooming out, the $105K-$106K and $117K levels are worth looking at.” (“QUOTE”)

Source: X

This alignment of liquidity zones and weak volume underscores fragile market depth, keeping traders cautious near psychological support levels.

Weak sentiment clouds historically bullish November

November typically marks the start of the strongest half-year for equities, but crypto markets aren’t following suit. Bitcoin’s 2% decline follows its worst October since 2018, dampening the usual bullish seasonal pattern.

Bitcoin Monthly Return. Source: CoinGlass

CoinGlass data shows that Bitcoin’s average November gain since 2013 exceeds 40%, yet Polymarket gives only a 33% chance of BTC closing above $120,000 this month, and 60% for $115,000.

The Fear and Greed Index remains deep in the “fear” zone, showing no signs of relief after the latest price drop to $107,000.

Trade optimism collides with Fed uncertainty

While stock markets saw mild gains from optimism over a U.S.–China trade agreement, crypto assets remain under pressure. Still, geopolitical tension, including U.S. activity in Venezuela and Nigeria weighs on broader sentiment.

Adding to uncertainty, 20% of S&P 500 companies, including AMD and Palantir, are set to report earnings this week. Meanwhile, the U.S. government shutdown has limited access to official inflation data, leaving traders to rely on private reports.

At the same time, the Federal Reserve’s hawkish stance has grown stronger. According to CME Group’s FedWatch Tool, the probability of a rate cut in December stands at 63%, down sharply from earlier forecasts — a sign that monetary easing expectations are fading.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: Bitcoin Drops To $107K As Traders Fear A Fall Below $100K Support