Key highlights:

- Bitcoin enters a critical week as inflation data and political tension drive market uncertainty.

- Traders expect sharp moves as global risks collide with key technical levels on the charts.

- A single major headline could trigger a breakout or a deep correction.

Bitcoin has seen a fresh surge in volatility amid legal disputes involving the Federal Reserve and rising geopolitical tensions, just as markets head into a critical week for U.S. inflation data.

Traders shrug off fresh weekend gains

Bitcoin opened the week with strong price action during the Asian market open with BTC reaching a local high of $92,392.

However, traders quickly questioned the strength of the news-driven move. Many noted that Bitcoin often reverses gains made before traditional markets open for the new week.

Trader Lennaert Snyder said that, based on recent patterns, he expected a false pump on Sunday that could create opportunities for short positions early in the week. He added that his final downside target remained near the weak $87,600 level from the start of the month.

Trader Skew said that, given the current headlines, the day was likely to be very interesting. He noted that commodities, including Bitcoin, were generally rising, with some spot buying helping to push prices higher.

$BTC

Needless to say with current headlines today is going to be super interestingcommodities as a whole are getting bid here including BTC with some spot buying lifting price here

some hedges closing out here pic.twitter.com/F4r2wuAnK0

— Skew Δ (@52kskew) January 12, 2026

Trader CrypNuevo focused on the 50-week exponential moving average (EMA) near $97,400 as a possible upside target before another decline.

Source: CrypNuevo via X

He said that his main scenario was for price to return to the range lows before moving higher, and that he expected Bitcoin to revisit the low $80,000s. At the same time, CrypNuevo said he remained bullish on 2026, calling $73,000 a worst-case scenario.

Inflation, politics, and the Fed create a volatility cocktail

This could be a highly volatile week as U.S. inflation data meets global political tension and conflict around the Federal Reserve.

Markets are preparing for the release of the Consumer Price Index (CPI) and Producer Price Index (PPI) while also reacting to events in Venezuela and growing fears of conflict involving Iran.

At the same time, the U.S. Supreme Court is expected to rule on the legality of an international trade tariff imposed by President Trump last year.

The Kobeissi Letter said that the volatility of early January had created exceptional conditions for investors and traders.

Early-January volatility has created some exceptional trading conditions for investors.

We just published our trades for premium members.

Since 2020, our calls are up over +516%.

Subscribe below to see how we are positioned into the week:https://t.co/SJRZ4FrNBc

— The Kobeissi Letter (@KobeissiLetter) January 11, 2026

Over the weekend, Federal Reserve Chair Jerome Powell became the subject of a criminal investigation linked to a reconstruction project. Powell suggested that the real motive behind the Department of Justice action was political, pointing to frustration over how slowly interest rates were falling.

Markets reacted quickly. Stock futures dropped, while gold surged to a new all-time high of $4,601 per ounce.

This comes just weeks before the Fed’s January 28 meeting, where officials are expected to decide on their next rate move. The Kobeissi Letter added that the conflict between Trump and Powell would likely lead to even greater volatility.

Is the bear market really over?

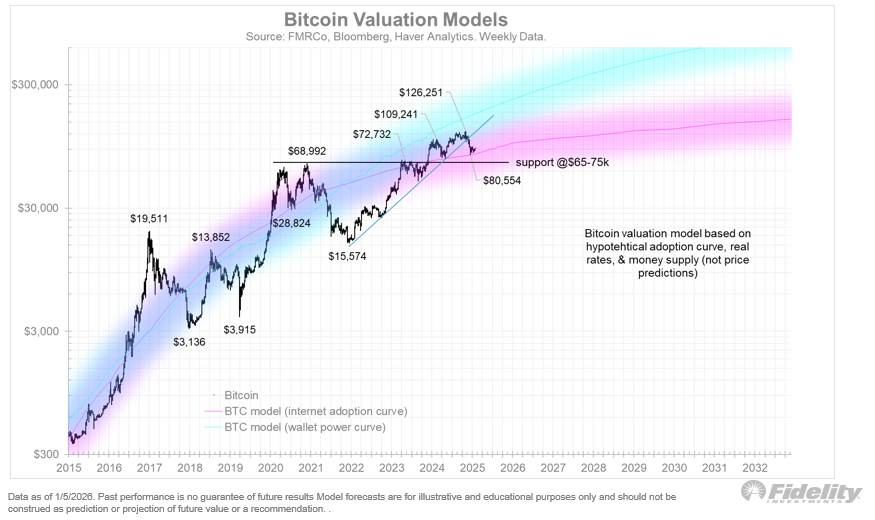

Jurrien Timmer, Director of Global Macroeconomics at Fidelity Investments, warned that Bitcoin could still face a difficult phase.

In an update to his power-law price model, Timmer said that this year could bring consolidation followed by another bearish low.

Source: Timmer via X

He said that many in the Bitcoin community were declaring the end of the four-year cycle and the beginning of a new structural uptrend, but he remained skeptical. While he agreed that the halving cycle was weakening, he did not believe that bear markets would disappear.

According to his model, if prices stall, Bitcoin could face strong resistance and struggle near the $65,000 level.

This week may be decisive. With inflation data, geopolitical risk, legal tension around the Fed, and key technical levels all in play, Bitcoin is entering a period where a single headline could change the entire market’s direction.

Source:: Criminal Case Against Fed Chief And Inflation Data: What’s Next For Bitcoin Next Week