Key highlights:

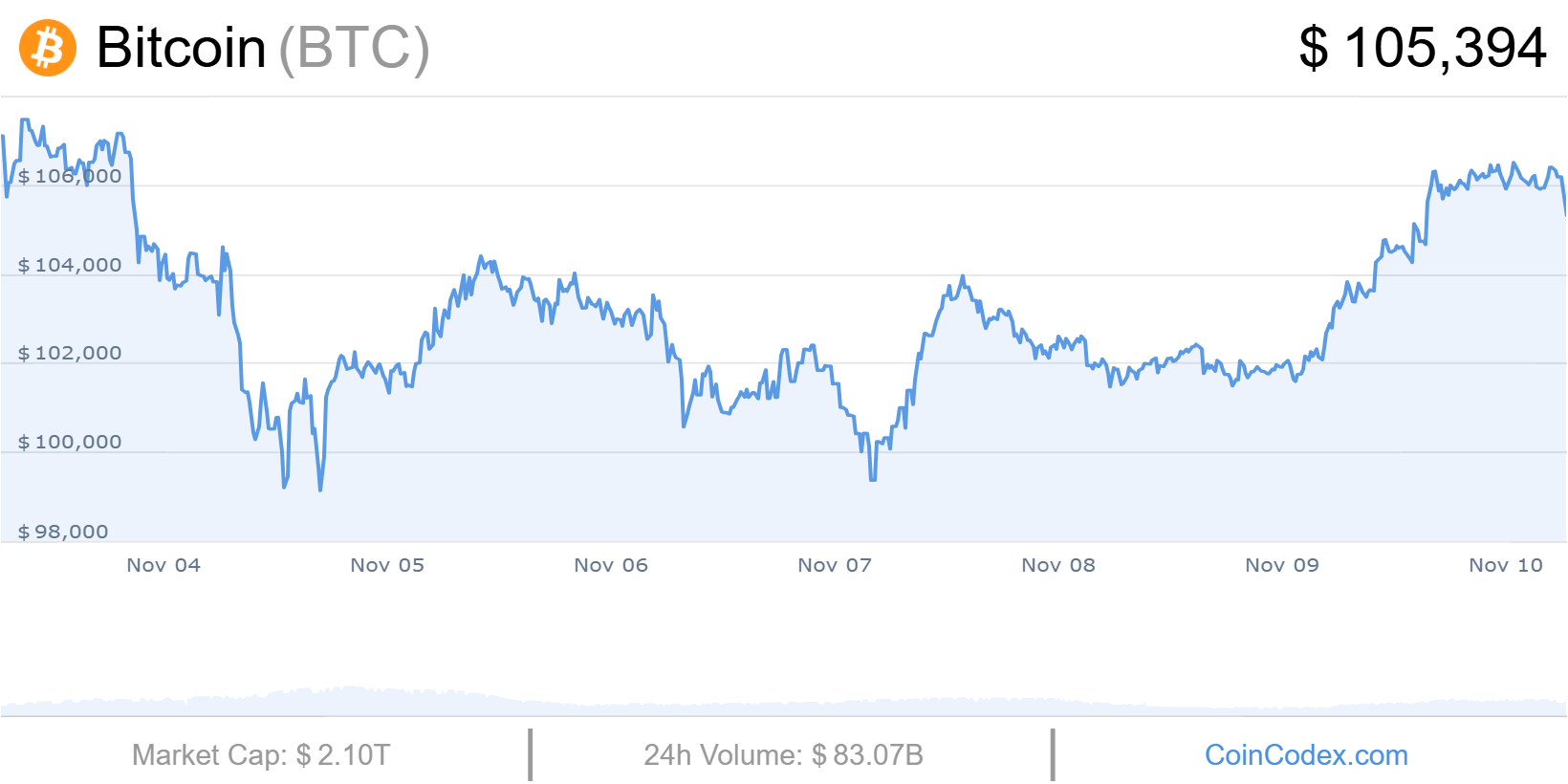

- Bitcoin reclaims $106,500 as traders weigh support near $100,000

- Inflation data, Fed policy, and tariffs add new volatility

- Whales quietly return to accumulation despite recent selling

Bitcoin broke through $106,500, giving bulls a much-needed reason for optimism after weeks of uncertainty. But analysts warn it’s too early to celebrate — many traders still doubt the $100,000 floor will hold.

BTC/USD 1-day chart

The weekly close above $104,500 was the first encouraging sign for Bitcoin holders in nearly a month. According to TradingView, BTC/USD remains above the 50-week exponential moving average (EMA) — a crucial technical support.

“Keep an eye on $GOLD & $BTC 4H trend,” wrote trader Skew on social media platform X, suggesting that both assets may be responding to the same macro forces.

Indeed, the recent U.S. government shutdown marked a turning point for overall market sentiment, influencing both crypto and traditional risk assets.

Trader CrypNuevo mapped out clear support and resistance levels:

- Resistance: around $106,600

- Support: between $101,000–$102,000

- Highs: roughly $114,000–$116,000

The analyst also highlighted a potential “liquidity pool from the liquidation cascade” in the $120,000–$122,000 range — a zone that could attract prices if Bitcoin breaks above current resistance.

BTC/USD 4-hour chart. Source: X

Despite the rebound, caution remains the prevailing mood. Many traders warn the local rally toward $107,000 could quickly reverse amid ongoing macro uncertainty.

Inflation data and tariff drama add to market volatility

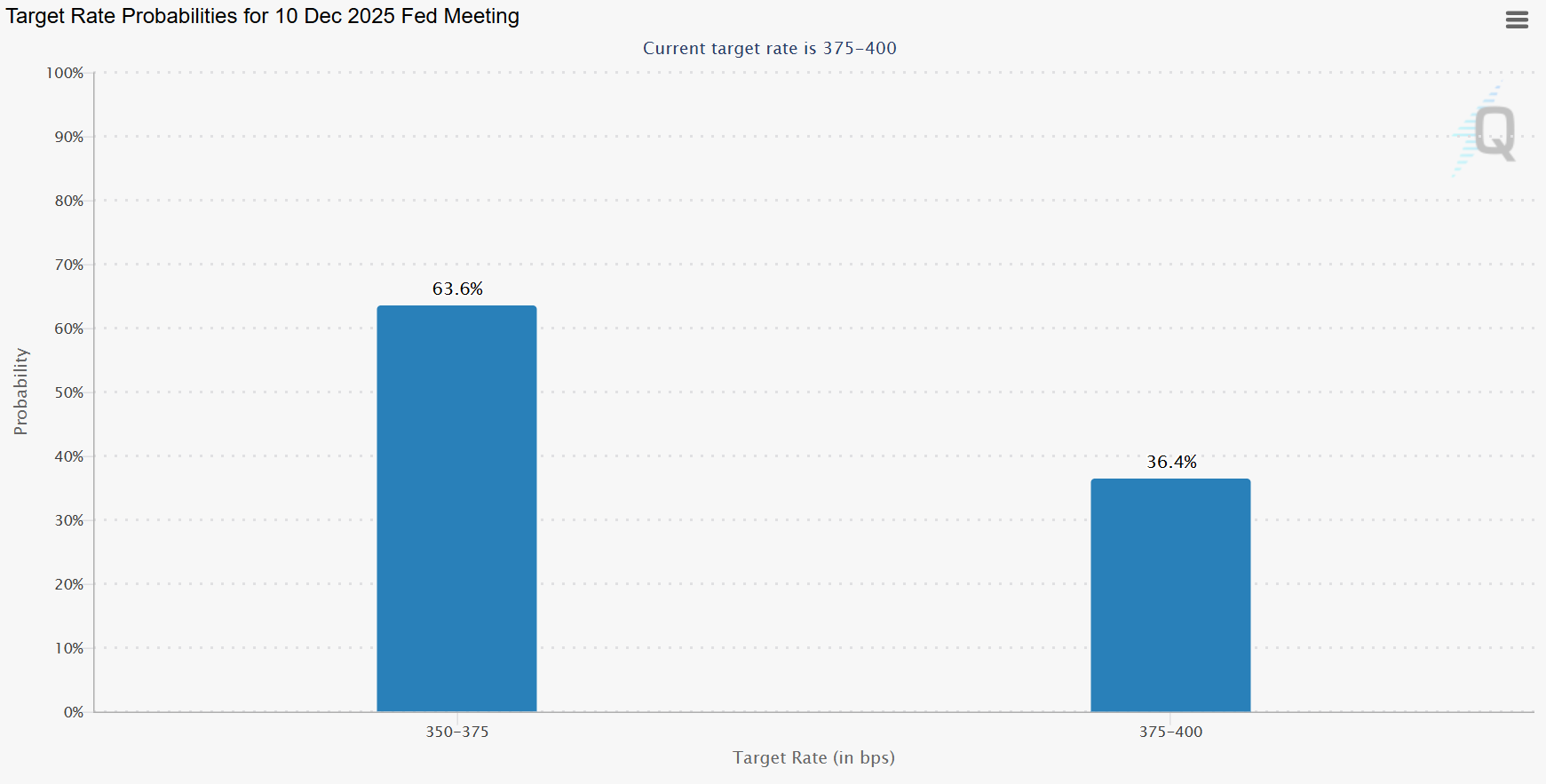

With the potential end of the U.S. government shutdown, attention is shifting back to inflation indicators and the Federal Reserve’s next move.

The Consumer Price Index (CPI) will be released on Thursday, November 13, alongside initial jobless claims, followed by the Producer Price Index (PPI) the next day.

Without the disruption of the shutdown, the data will give traders a clearer view of the economy — including the impact of U.S. trade tariffs. The Supreme Court is currently reviewing these tariffs, and any announcement could bring new volatility to global markets.

“Amid the data blackout, the Fed is cutting rates and market volatility is returning,” summarized trading resource The Kobeissi Letter.

According to CME Group’s FedWatch Tool, markets expect the Fed to cut rates by 0.25% in December, with further reductions likely in 2025.

Source: CME Group

Meanwhile, Mosaic Asset Company described the ongoing uptrend as “the most hated bull market in history.”

“Private-sector data show conditions remain favorable for corporate profits,” the Market Mosaic newsletter noted, despite investor pessimism and record levels of fear.

“Tariff dividends” and stimulus echoes

Markets were also shaken by remarks from President Trump, who promised to send most U.S. citizens a $2,000 “tariff dividend.”

The Kobeissi Letter compared it to the COVID-era stimulus checks, commenting:

“Stimulus checks are officially back.”

“The money supply has jumped 9.1% since the start of the year, driven by both China and the U.S.,” Kobeissi added, calling the plan “outrageous.”

The legality of the proposed tariff payouts now lies in the hands of the Supreme Court, leaving markets on edge for the final ruling.

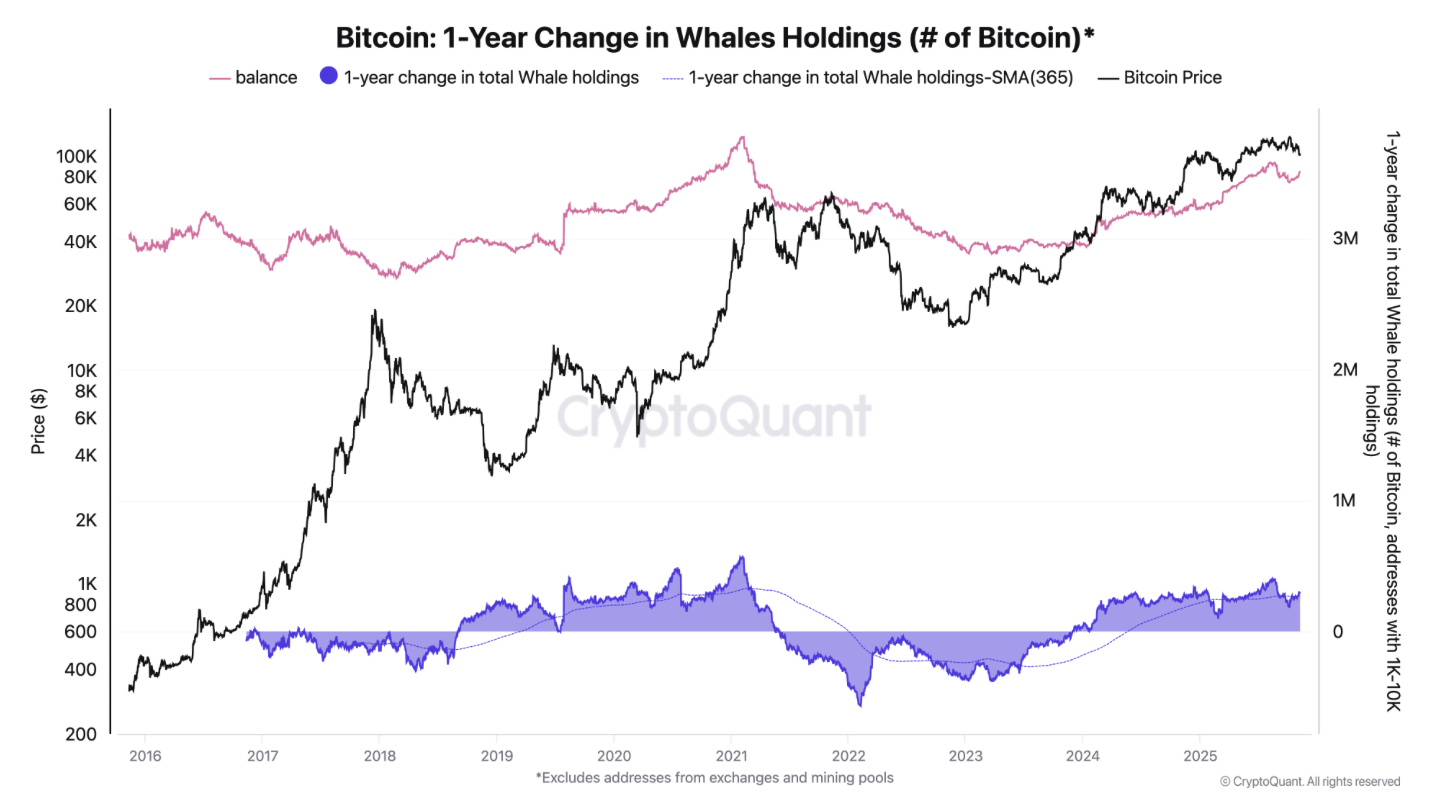

Whales Quietly Accumulate as Market Recovers

Despite short-term selling, on-chain data suggest Bitcoin’s largest holders — known as whales — continue to accumulate coins behind the scenes.

According to CryptoQuant’s Quicktake, the number of BTC held by whales has been rising steadily since 2023.

Annual change in the number of BTC held by Bitcoin whales since 2016. Source: CryptoQuant

Data show whales reduced holdings from 398,000 BTC to 185,000 BTC in October — just before Bitcoin crossed $123,000 — but quickly resumed accumulation, climbing to 294,000 BTC by November 7.

In fact, long-term wallets gained 50,000 BTC in a single day while prices tested below $100,000.

“This cycle looks nothing like the 2021 sell-off,” the analyst concluded.

The ongoing “game of big capital” shows no sign of slowing — and as history suggests, long-term holders often emerge as the real winners.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: Bitcoin Breaks $106,500 but Traders Still Fear the Bottom Could Fail