Key highlights:

- Bitcoin achieved 58.2% annual return over five years, outperforming major assets.

- Target price of $340,000 could surpass previous market cycle gains.

- Potential link seen between Bitcoin and 18-year real estate market cycles.

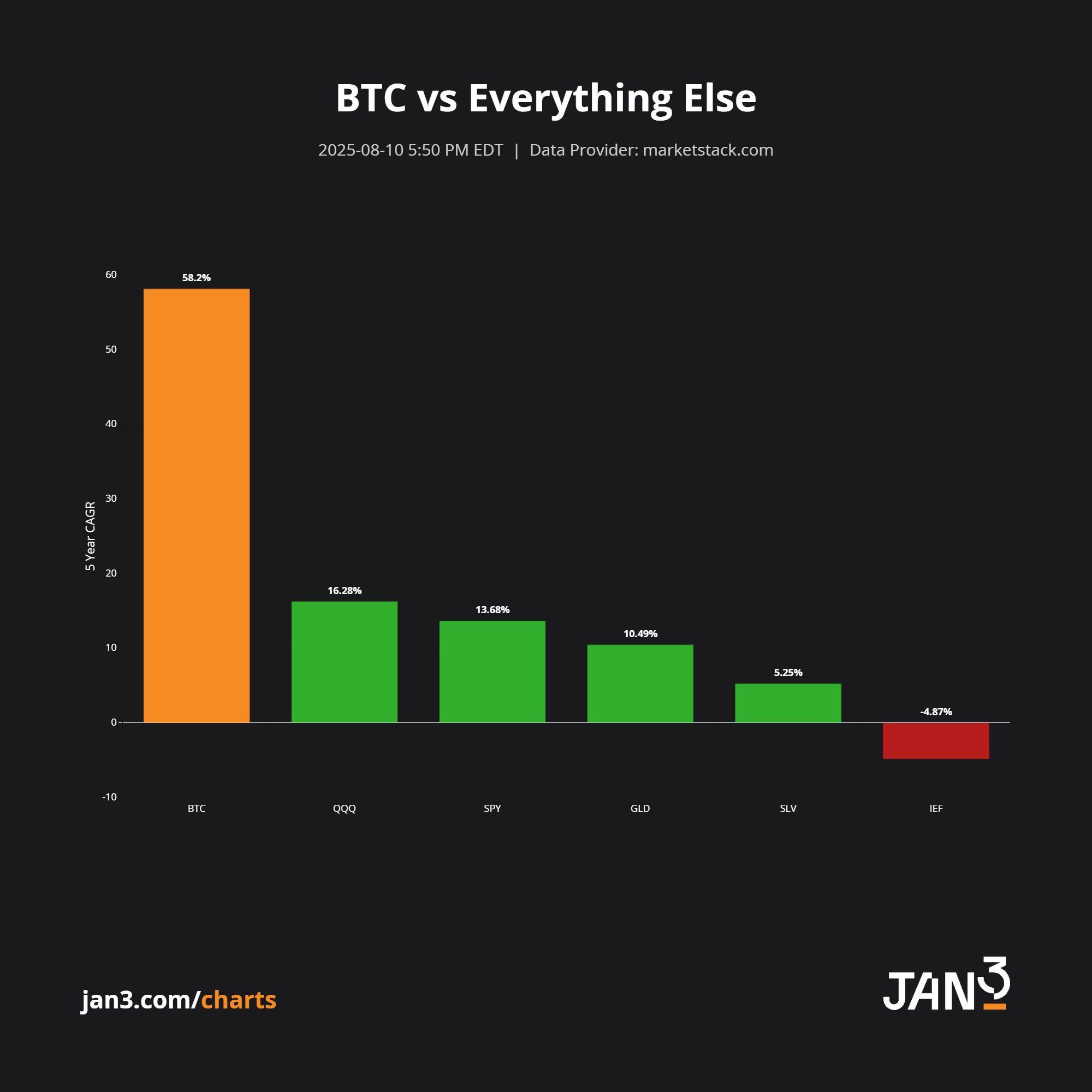

JAN3 Financial Company confirmed Bitcoin’s leadership among global assets over the past five years, highlighting an impressive annual return of 58.2%, far outpacing traditional investments.

Image source: JAN3 Financial

Global Markets Trader Jason Pizzino questioned whether Bitcoin could replicate the record returns of the previous market cycle on social media platform X.

The peak gains during the 2019-2021 cycle reached 2,089%, fueling speculation on whether BTC/USD could surpass this.

Bitcoin bull cycle analysis. Image source: Jason Pizzino

From $15,600 to $340,000: An ambitious price target

Since the 2022 bear market low of $15,600, Bitcoin has surged approximately 700%. However, these gains remain modest compared to historical standards; to match the previous cycle’s record percentage increase, Bitcoin would need to reach $340,000.

Pizzino noted, “If Bitcoin hits $340,000 this cycle, it would be the first time in its 16-year history that it has a greater return than the previous cycle. It is a very big ask, but many are asking if it’s possible.”

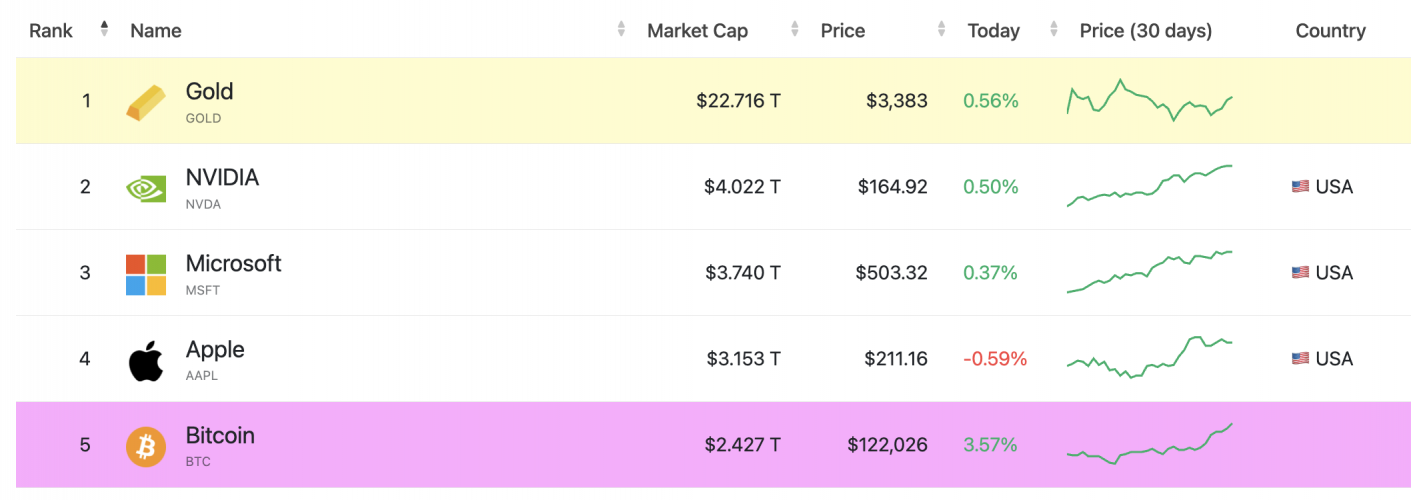

Such a price would imply a market capitalization of $6.7 trillion, still less than a third of gold’s roughly $23 trillion valuation, making Bitcoin the world’s second most valuable asset after gold.

Bitcoin’s position as a leader among assets

As of August 2025, Bitcoin ranks among the top five global assets by market capitalization. Bitcoin reached its all-time high price in gold terms in late 2024.

JAN3 Financial underscores Bitcoin’s long-term outperformance: “Over the past 5 years, Bitcoin has easily outperformed all major asset classes with a staggering 58.2% CAGR.”

Comparatively, the QQQ index returned 16.28%, SPY 13.68%, and gold 10.49% over the same period.

Potential correlation with 18-year real estate cycles

Pizzino also suggested a possible relationship between Bitcoin’s cycles and 18-year real estate cycles, proposing that Bitcoin may be developing a longer-term cycle synchronized with the real estate market.

He summarized, “Bitcoin and the 18-year cycle are going hand in hand in their first full cycle together.”

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.