With crypto prices surging again in 2025, more traders are turning to margin trading to amplify their gains.

But which exchange should you pick?

Some focus on ultra-high leverage. Others have very low fees, beginner-friendly tools, or offer a massive variety of tradable coins.

That’s why picking the right platform is huge, especially when you’re borrowing funds to trade. The wrong choice can eat into your profits (or worse, wipe out your position).

In this guide, I’ll break down the 10 best crypto exchanges for margin trading in 2025. I’ll compare their features, leverage options, fees, and user experience. Each exchange has strengths and weaknesses, and I’ll tell you exactly what they’re best for.

Let’s get started!

10 Best cryptocurrency exchanges for margin trading in 2025:

- Binance – Overall margin trading

- OKX – High leverage & low fees

- Kraken – Security & U.S. accessibility

- Bybit – Advanced traders & derivatives

- KuCoin – Altcoin margin trading

- Bitfinex – Large traders & flexible funding

- BitMEX – Bitcoin perpetuals

- Bitget – Copy trading & social features

- Crypto.com – Mobile-first trading

- Gate.com – Altcoin variety & margin diversity

The 10 best cryptocurrency exchanges for margin trading (2025)

These are the top crypto exchanges for margin trading, in no particular order.

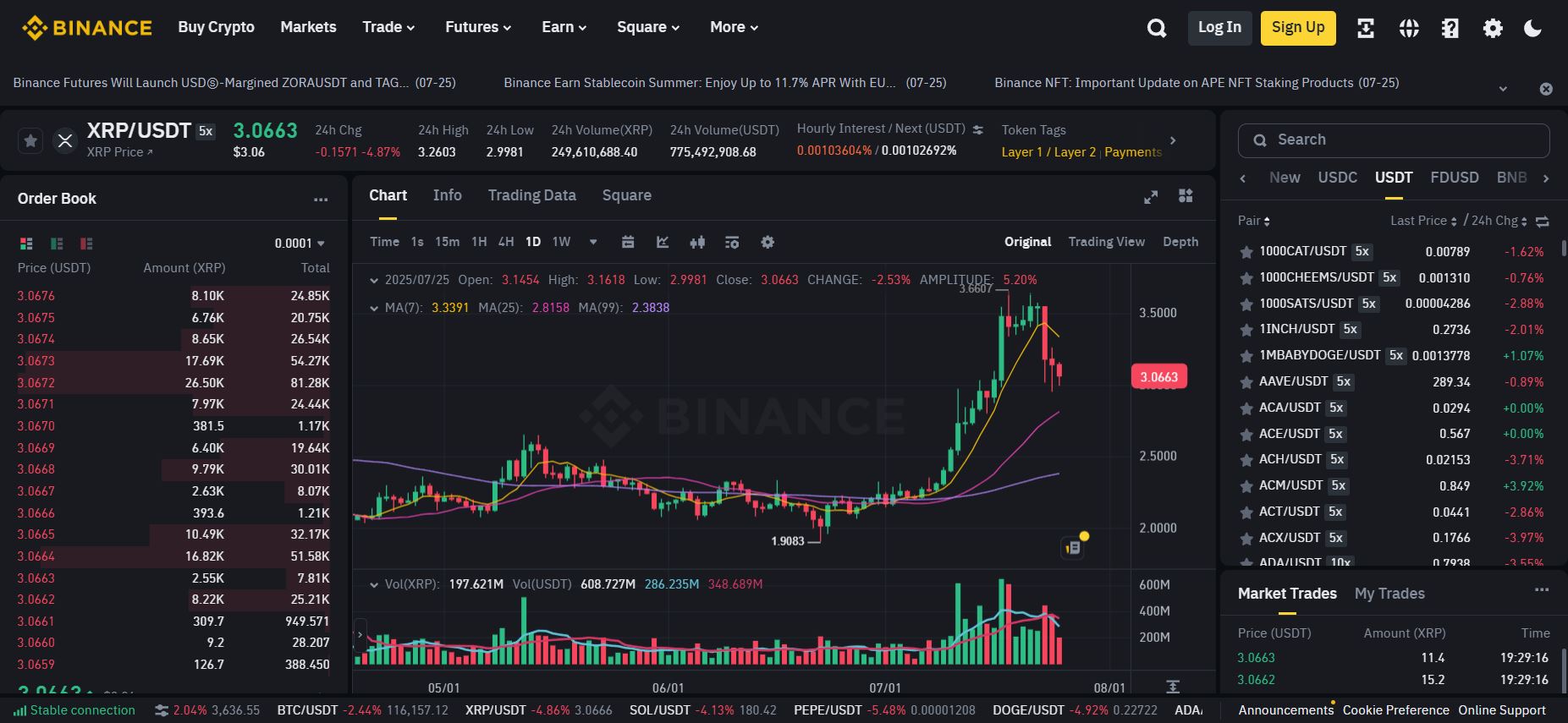

1. Binance – Overall best margin trading experience

Yes, it’s a boring pick. But, Binance is still the king of crypto exchanges in 2025, and its margin trading platform is no exception.

You get up to 10x leverage on spot trades and up to 125x on futures, backed by some of the deepest liquidity in the market. That means fast execution, tight spreads, and very low slippage.

Whether you’re scalping BTC or margin-trading altcoins, Binance has the tools:

- Isolated and cross-margin modes

- Built-in liquidation control

- Hundreds of supported assets

- Pro-grade charting

Trading fees are low too. Spot trades start at just 0.1%, and you can lower them further by using BNB to pay.

Just note: Binance margin is not available to U.S. users (Binance.US doesn’t offer margin trading).

Pros:

- Up to 125x leverage on futures, 10x on spot

- Massive liquidity and super-fast order execution

- Supports 600+ coin pairs for margin trading

- Low trading fees (0.1%, with discounts via BNB)

- Advanced order types and risk tools built-in

Cons:

- Not available to U.S. users

2. OKX – High leverage & low fees

If you want high leverage with tight fees, OKX is your exchange.

It offers up to 10x leverage on spot and up to 100x on futures, with access to 30+ cryptos for margin trading. Its user interface is clean and responsive, and it even includes demo trading.

As for fees, you’re looking at as low as 0.08% maker / 0.1% taker, which makes OKX one of the most cost-effective margin platforms globally.

For automation fans, OKX also supports trading bots and copy trading, so you can set up strategies or follow other pros.

Just like Binance, OKX is not available to U.S. residents. U.S. users are redirected to OKCoin, which doesn’t support margin.

Pros:

- Up to 100x leverage on futures, 10x on spot

- Very low fees and generous volume-based discounts

- Built-in demo mode to practice risk-free

- Trading bots and copy trading included

Cons:

- Not available to U.S. users

- Interface has a learning curve for beginners

- Number of supported cryptocurrencies for margin trading could be higher

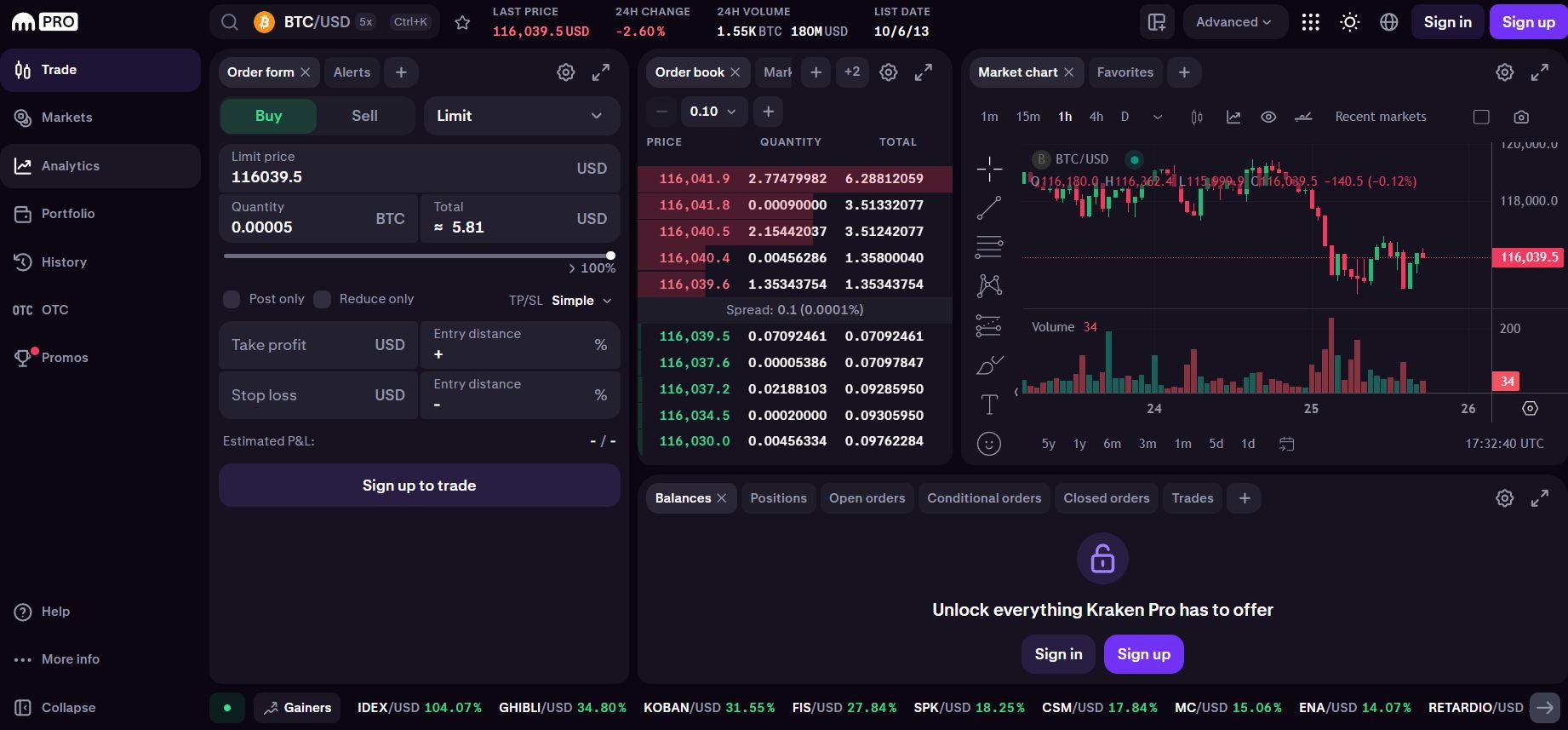

3. Kraken – Security and U.S. accessibility

Kraken is one of the few margin trading exchanges that U.S. users can actually access, so it truly stands out in a market full of geo-blocks.

Max leverage is capped at 5x, which is unremarkable. However, Kraken makes up for it with

- Top-tier security

- Full regulatory compliance

- A clean, professional trading experience

It supports margin trading on 100+ cryptocurrency pairs.

The fees are not the lowest, starting at 0.01%–0.02% rollover per 4 hours. Margin eligibility depends on your account level, and in the U.S., you need to qualify as an Eligible Contract Participant (ECP).

If you want stability, regulation, and transparency, Kraken is the margin exchange for you.

Pros:

- Fully regulated and accessible to U.S. users

- Strong security practices and clean track record

- Simple interface with Kraken Pro for advanced trading

- Offers crypto futures (up to 50×) via Kraken Futures

Cons:

- Max leverage only 5× on margin

- Margin trading restricted in some U.S. states

- Smaller coin selection compared to most other exchanges on the list

Go to Kraken

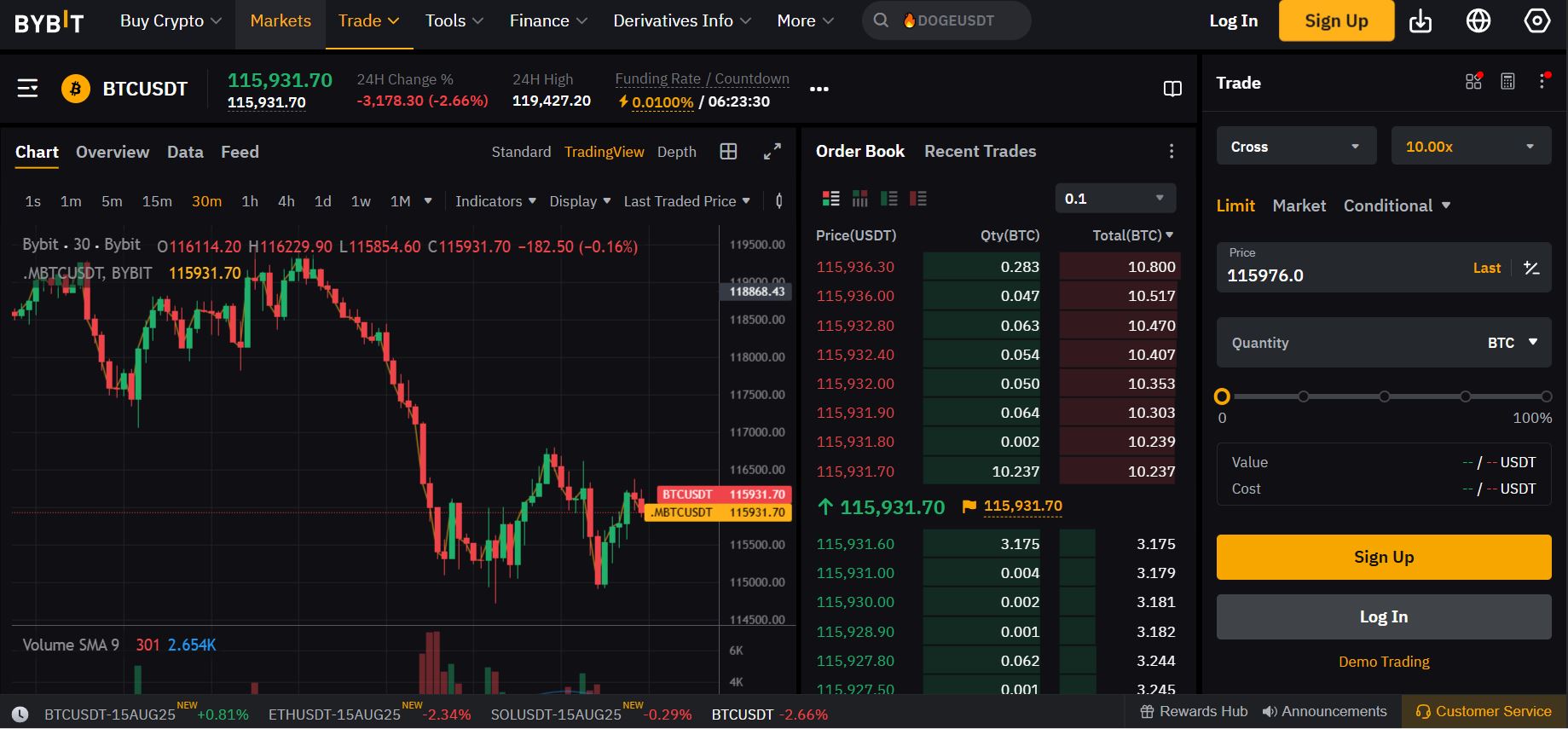

4. Bybit – Advanced traders & derivatives

Bybit is built for serious traders who want high-octane tools and 100x leverage on perpetual futures.

It’s known for deep liquidity, fast execution, and advanced order options. It’s the perfect exchange for scalping, hedging, and complex derivative strategies.

You can trade with cross or isolated margin, and for power users, there’s portfolio margin mode to optimize capital usage across multiple positions.

Bybit also supports over 600 trading pairs and recently expanded into options, copy trading, and even earn products. Plus, it’s got a great launchpad platform.

However, U.S. residents are blocked, and spot margin trading is limited to 5x on select pairs.

Pros:

- Up to 100x leverage on futures with low slippage

- Advanced risk management tools (like portfolio margin)

- High liquidity across BTC, ETH, and altcoin markets

- Great UI for pro traders

- Offers copy trading and bot support

Cons:

- Not available to U.S. users

- Spot margin leverage capped at 5x

- Can be overwhelming for new traders

Go to Bybit

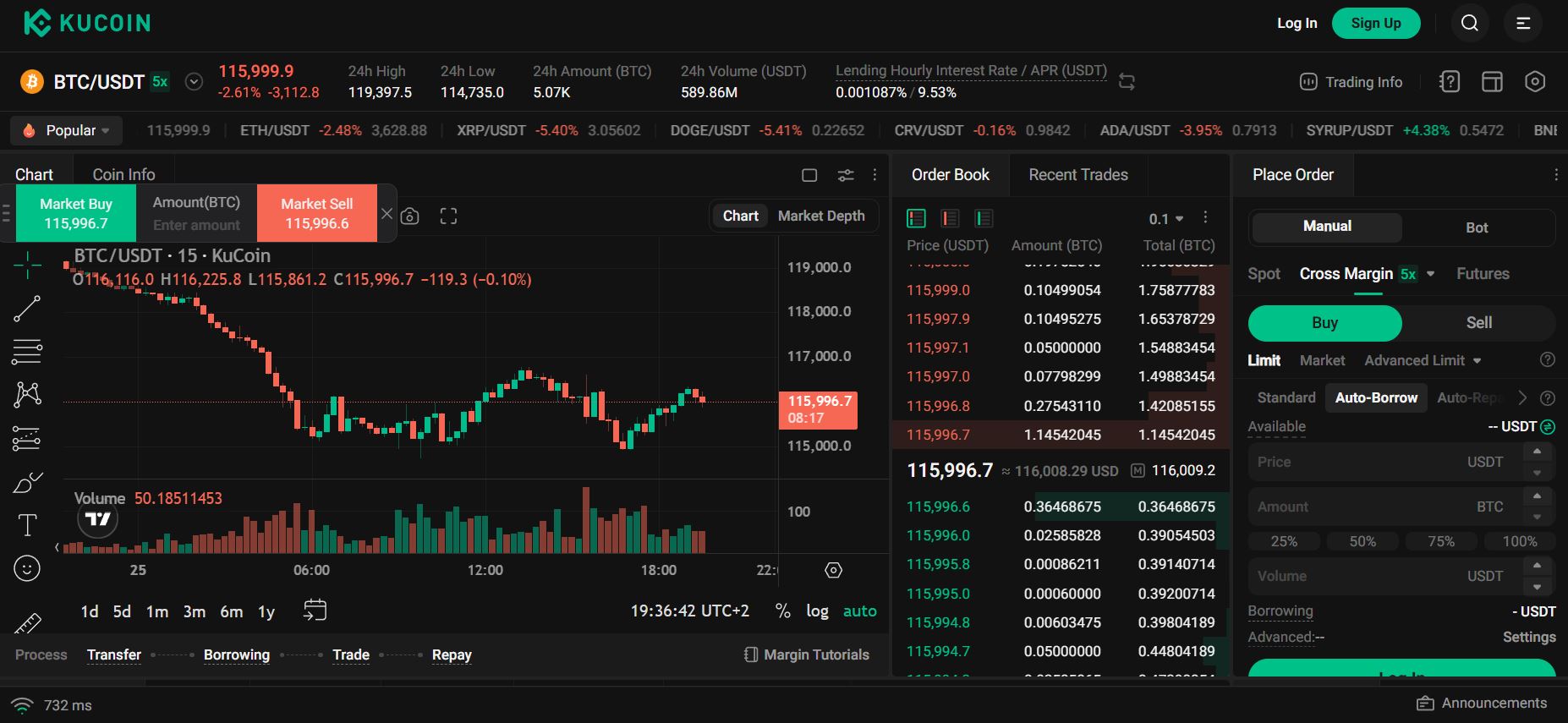

5. KuCoin – Altcoin margin trading

If you want to margin trade small-cap gems that aren’t listed anywhere else, KuCoin is your playground.

It offers up to 10x leverage on a massive selection of 900+ cryptocurrencies, with both cross-margin and isolated margin available.

The fees are competitive, around 0.1%, and you can get discounts using their native KCS token.

KuCoin also has a vibrant community, margin trading tournaments, and a surprisingly intuitive mobile app. Just keep in mind that it’s not licensed for U.S. users, and there are occasional liquidity issues on obscure trading pairs.

Pros:

- Huge selection of margin-enabled altcoins (900+ listed)

- Supports both cross and isolated margin

- Lower fees with KCS token discounts

- Great for experienced traders who like discovering hidden gems

Cons:

- Not licensed in the U.S.

- Liquidity can be low on small-cap pairs

- Platform may be too complex for total beginners

Go to KuCoin

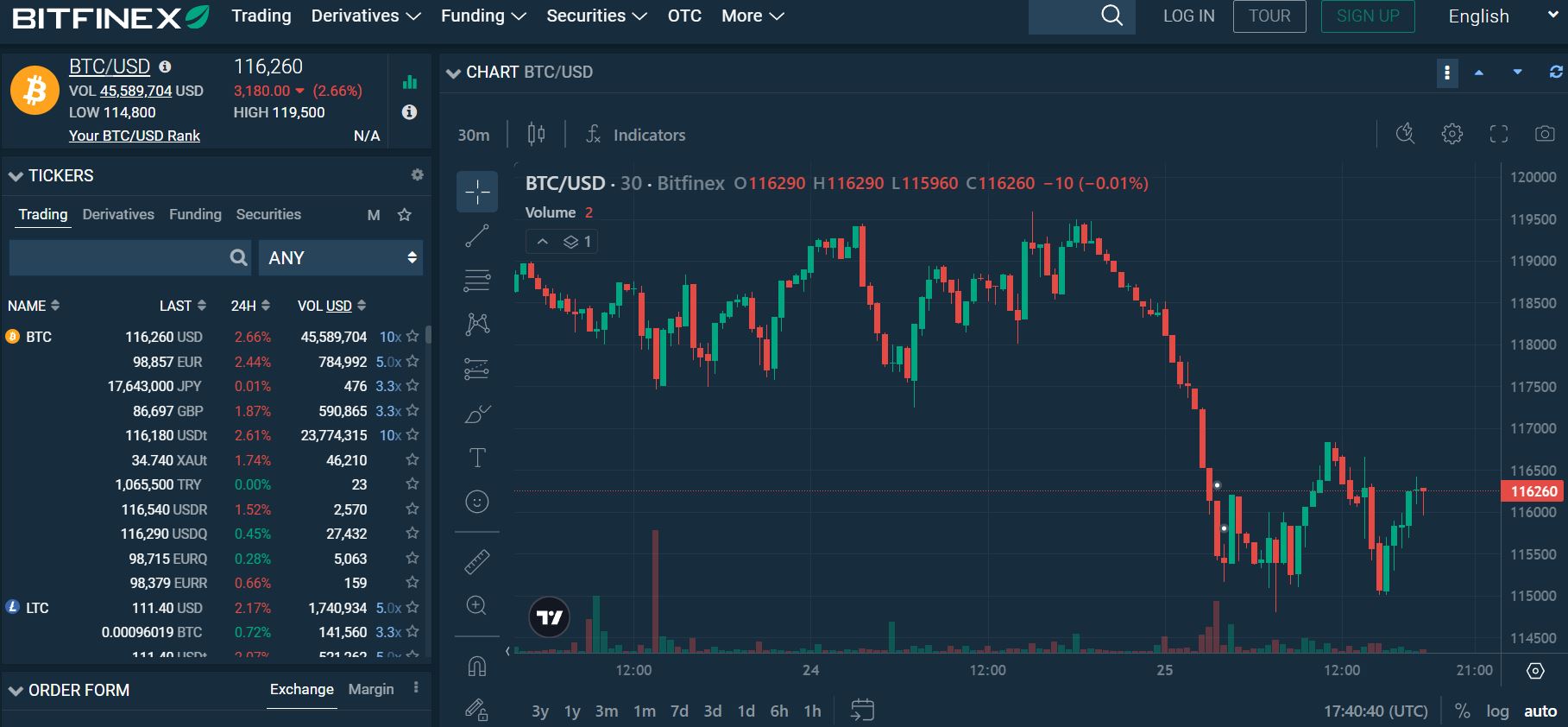

6. Bitfinex – Large traders & flexible funding

Bitfinex is one of the oldest crypto exchanges around. And it’s still when it comes to margin trading.

You get up to 10x leverage on 563 coins, and Bitfinex does something unique: it uses a peer-to-peer funding market. That means you can either borrow funds to trade or lend out your capital and earn passive income from other margin traders.

This gives Bitfinex more flexibility than most platforms, especially for high-volume or institutional traders. Its advanced order types and high liquidity in BTC and ETH markets make it a serious contender for pro users.

That said, U.S. users are not allowed, and the platform has a steeper learning curve if you’re new.

The fees are competitive, though not the lowest, standing at 0.1% for makers and 0.2% for takers.

Pros:

- Peer-to-peer margin funding system

- High liquidity on BTC, ETH, and other major pairs

- Advanced tools for serious traders

- Option to lend capital and earn interest

Cons:

- Not available to U.S. users

- Not beginner-friendly

Go to Bitfinex

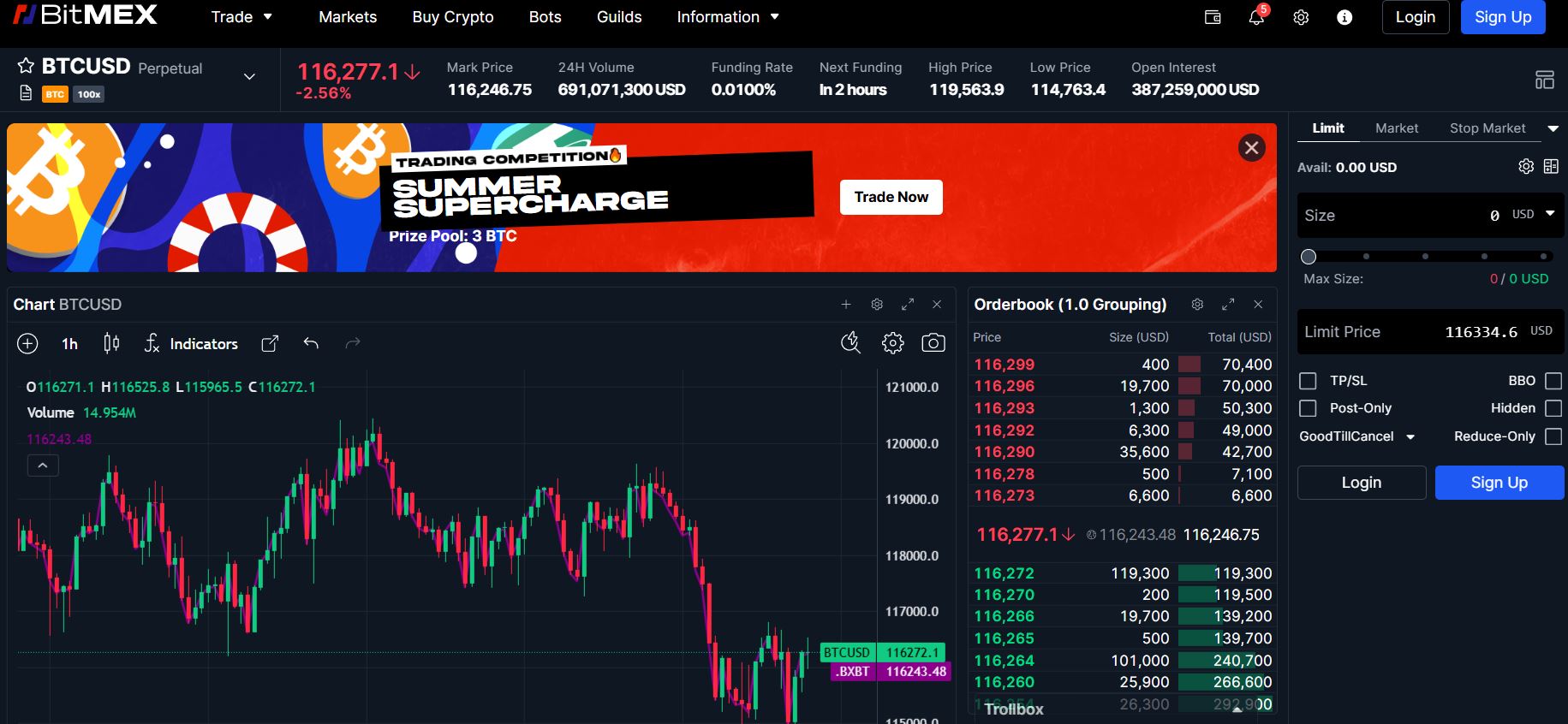

7. BitMEX – Bitcoin perpetuals for experienced traders

BitMEX was one of the first platforms to bring high-leverage crypto derivatives to the market. And many still swear by it for serious Bitcoin traders in 2025.

You can trade perpetual swaps with up to 100x leverage, and BitMEX has maintained strong liquidity in BTC and ETH markets. Its risk engine is strong, and experienced users will appreciate the fine-grained control over position sizing, margin mode, and post-only orders.

All accounts are settled in crypto (primarily BTC and USDT), and the UI is highly focused on performance and reliability, not flashy or “cool” design.

That said, U.S. users are restricted, and the interface is better suited for veteran traders than beginners.

Pros:

- Up to 100x leverage on perpetual contracts

- Extremely low latency and fast execution

- Great liquidity in major markets (especially BTC/ETH)

- Strong risk engine with auto-deleveraging protection

Cons:

- Not available to U.S. users

- Derivatives-only platform, no spot or earn features

- UI feels technical and outdated for casual traders

Go to BitMEX

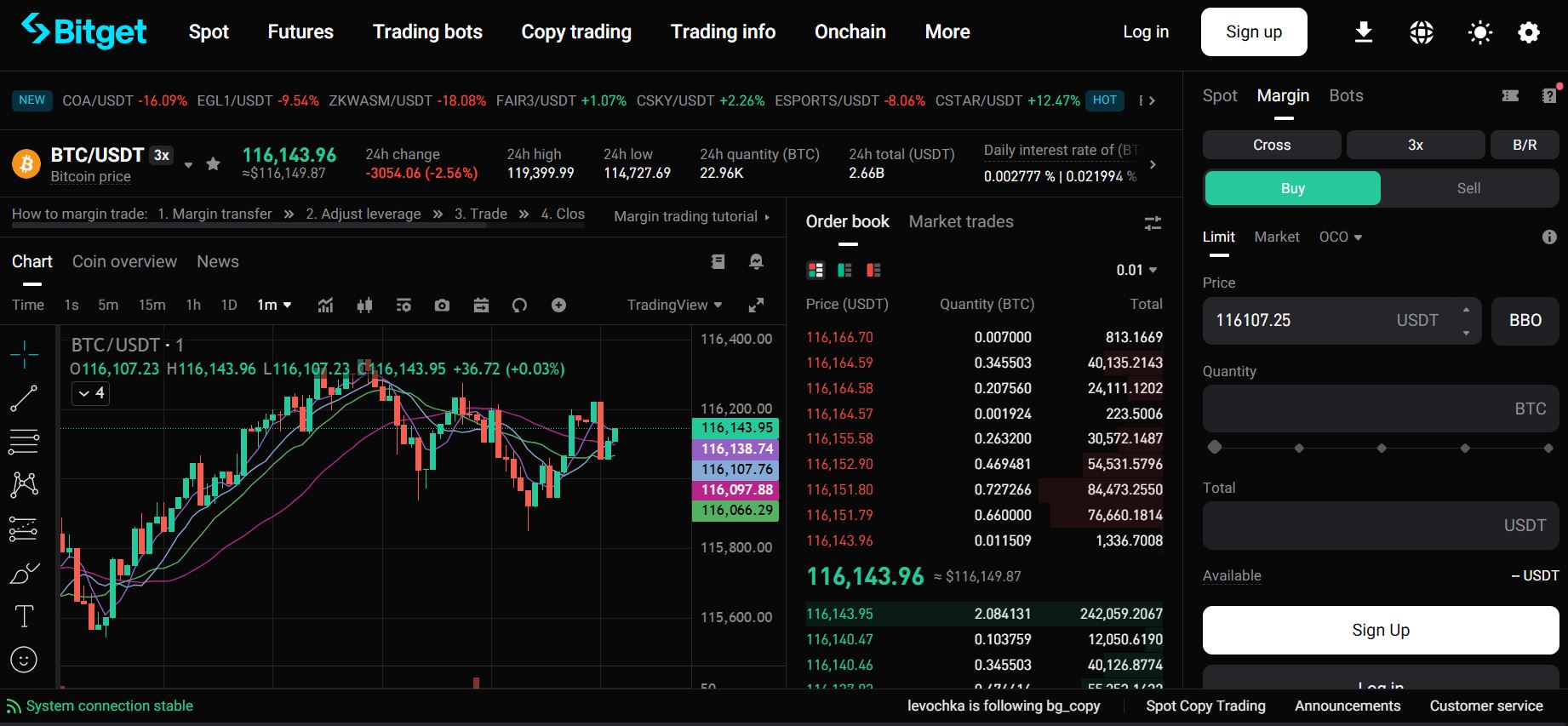

8. Bitget – Copy trading & community features

Bitget is gaining serious traction thanks to its built-in copy trading tools. These let you follow top traders and mirror their moves with one click.

It supports up to 125x leverage on futures and around 10x on spot margin. With over 930 margin trading pairs, it’s great for both mainstream tokens and niche trades.

Beyond margin, Bitget has staking, launchpads, a proof-of-reserves dashboard, and AI-powered tools. It’s (surprisingly) beginner-friendly too, with simple modes for casual traders and pro features for the more advanced.

One downside: it’s geo-restricted in some countries, including the U.S.

Pros:

- Copy trading makes it beginner-friendly

- High leverage (up to 125x on futures)

- 900+ margin trading pairs

- Solid mobile app and clean UI

- Transparent with Proof of Reserves

Cons:

- Not available in the U.S.

- Some assets have thin liquidity

- Fiat on-ramp options can be limited

Go to Bitget

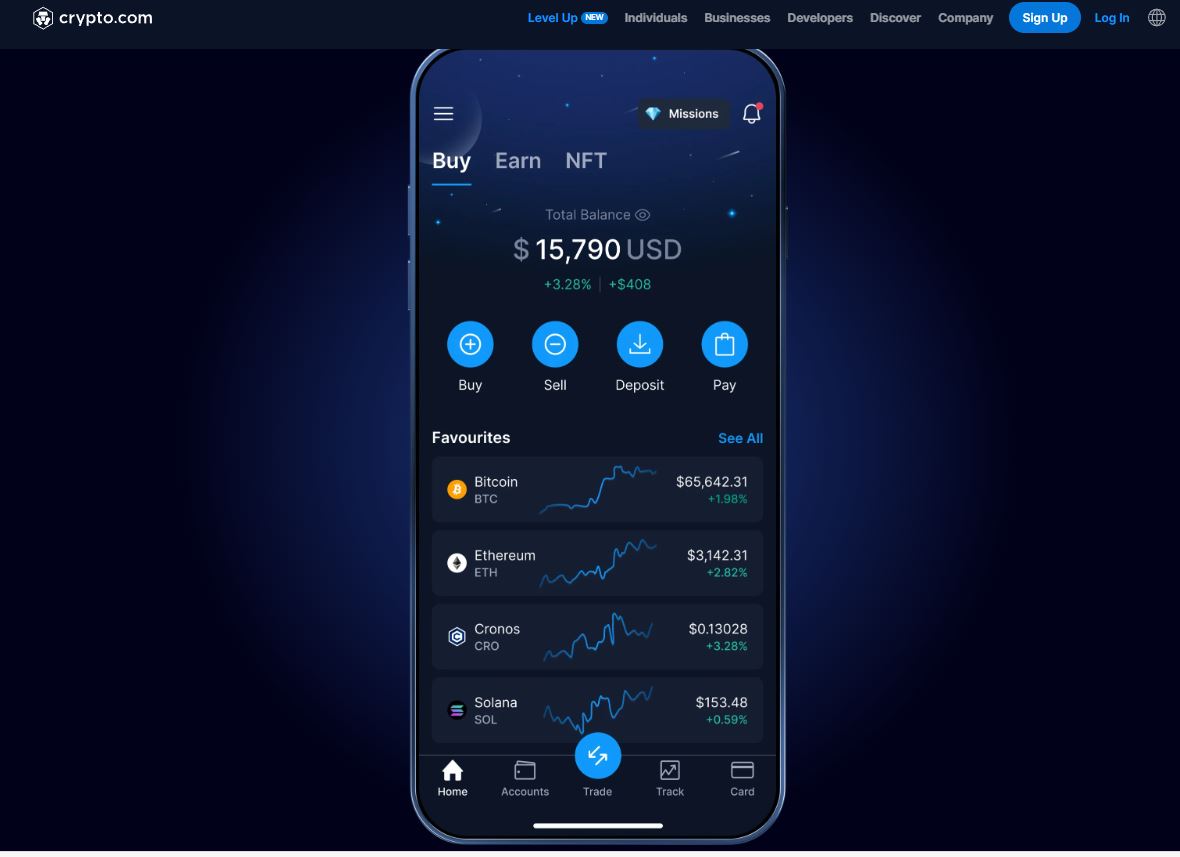

9. Crypto.com – Mobile margin trading

I personally don’t use my phone for trading, but if you do, Crypto.com offers one of the slickest mobile experiences in crypto.

Its exchange supports up to 10x margin trading on 100+ pairs with the Crypto.com app. You can manage trades, check charts, and transfer funds, all from your phone.

The platform also offers a full ecosystem: Visa cards, staking, one of the best crypto wallets, NFT marketplace, and more. For margin trading, you can reduce borrowing costs by staking CRO tokens, making it a solid option for loyal users.

Unfortunately, margin trading is not available to U.S. users.

Pros:

- Excellent mobile trading experience

- Up to 10x leverage on supported assets

- Integrated with Crypto.com’s wider product ecosystem

- CRO staking reduces margin borrowing costs

- Regulated in multiple jurisdictions

Cons:

- Margin trading not available in the U.S.

- Web interface less intuitive than mobile

Go to Crypto.com

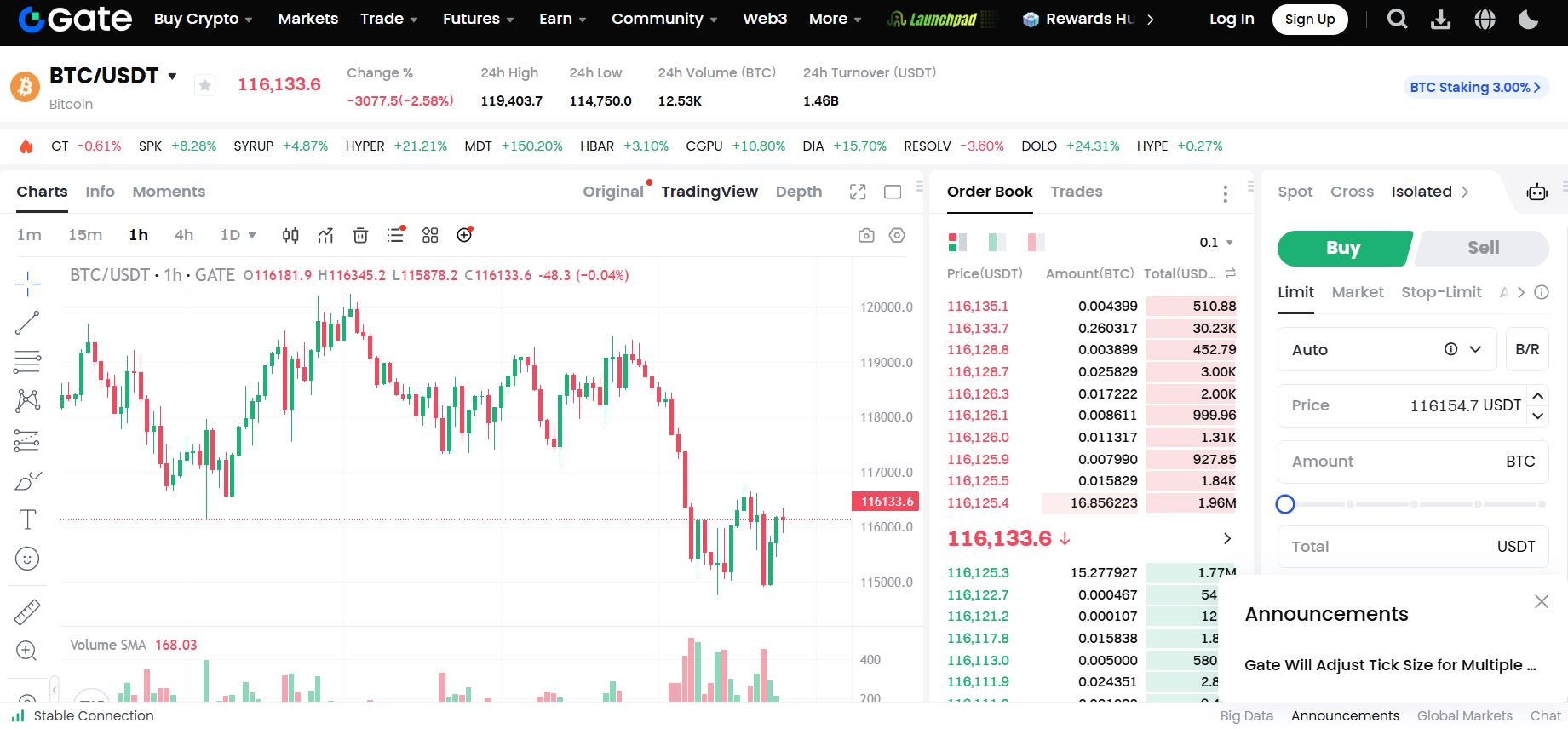

10. Gate.com – Altcoin selection & diverse services

With over 3,800 listed cryptocurrencies, Gate.com is unmatched when it comes to altcoin variety. And yes, that extends to margin trading too.

You can trade with up to 10x leverage on cross margin, or up to 20x with isolated margin on select pairs. If you’re the type of trader who loves finding lesser-known coins and shorting them with leverage, this platform gives you the sandbox.

Gate.io also offers copy trading, futures, structured products, and an NFT marketplace. Security is strong too, with regular proof-of-reserves audits and 2FA by default. Plus, it’s got over $10.8 billion in reserves and a reserve ratio at almost 130%.

Just be aware: U.S. residents are restricted, and with so many low-cap tokens, liquidity on some pairs can be an issue.

Pros:

- Huge selection of coins (3,800+ listed)

- Up to 20× leverage on isolated margin

- Offers copy trading and structured products

- Transparent with regular PoR audits

- Advanced tools and a strong mobile app

Cons:

- Not available in the U.S.

- Low liquidity on obscure altcoins

- Platform can be overwhelming for beginners

Go to Gate.com

The bottom line

Margi trading gives you a powerful way to amplify your crypto profits, but it also increases your risk. That’s why it’s important to pick the right exchange.

If you want the best all-around platform, Binance is still hard to beat (if you’re not in the U.S.). For high-leverage derivatives and pro tools, Bybit and OKX are excellent choices. U.S. traders, on the other hand, will find Kraken the most reliable (and legal) option, even with its lower leverage limits.

Looking to trade niche altcoins on margin? KuCoin and Gate.com give you access to thousands of under-the-radar tokens. And if you want to follow proven strategies, rather than build your own, Bitget‘s copy trading feature makes that easy.

Whichever exchange you choose, start small, manage your risk, and double-check whether the platform is available in your region.

Next up, check out our weekly updated article going over the top cryptos to buy to find what the best cryptocurrency is for margin trading.

Source:: 10 Best Cryptocurrency Exchanges for Margin Trading 2025