Kuadin crypto promotes itself as a mix of AI shopping tools, an e-commerce “digital mall,” and crypto payments. There’s also the Kuadin KDN token at the center.

That pitch sounds convenient, but convenience isn’t the same thing as credibility. This is a risk-focused look at what Kuadin and the KDN token claim to be, and the red flags you should know before putting money in.

You’ll learn how to spot the warning signs that show up again and again in sketchy token sales, like unclear team details, messy token math, huge bonus promos, and big promises with little proof.

Key highlights:

- Kuadin and the KDN token make big claims around AI shopping, crypto payments, and ultra-low fees, but there’s very little independently verifiable proof behind them.

- Basic red flags stand out, including unclear team transparency and token allocation math that adds up to more than 100%.

- Heavy presale pressure, large bonus promotions, and vague exchange listing promises are classic risk signals.

- Audits, partnerships, and working products are either missing or hard to confirm outside Kuadin’s own marketing.

- If you can’t independently verify the team, tokenomics, contract, and listings, the safest move is to stay out and protect your capital.

What is Kuadin Crypto and KDN token?

Kuadin presents itself as a crypto payments and e-commerce project.

Across its marketing and whitepaper-style materials, Kuadin claims it’s building a system where people can shop online and pay with crypto, while merchants get tools to manage payments, trust, and returns.

Here’s what it commonly markets (using “claims” language on purpose):

- Kuadin Pay: a payment gateway that would let merchants accept crypto (and possibly convert between tokens)

- Kuadin Card: a card product concept, usually framed like a crypto debit card for spending

- AI shopping tools: described as AI features that help users find products, reduce or avoid scams, and cut down on bad purchases and returns

- Merchant credibility system: a reputation or trust score concept tied to merchants

- KCLP swapping / conversion mechanics: described as an on-platform swap or reserve-based conversion model

- Very low fees: marketing often claims transaction fees under $0.01

- Supply and burns: materials describe fee burns that reduce supply over time (the total supply is often stated as 400 million KDN in public docs and summaries)

None of those ideas are impossible. The problem is that legitimate projects usually prove the basics early. You can see a working demo, read clear documentation, verify the team, confirm the token contract, and check audits.

With Kuadin, public-facing proof is hard to verify, and the promotion often runs ahead of the evidence.

The basic pitch in simple terms

Translated into everyday language, Kuadin’s pitch looks like this:

You shop online, you pay with crypto, fees are tiny, and “AI” helps filter scams and reduce refunds. The Kuadin coin, a.k.a. KDN is presented as the token that makes it all work, used for payments, fees, rewards, and access to parts of the ecosystem.

That’s the promise. Now we need to ask the boring questions that matter, like: who built it, where it lives, and can you independently confirm the numbers?

Where the promises start to sound too good to be true

Instant settlement, fees under a penny, and big “planned exchange listings” are attention-grabbers. They’re also the kind of claims that require strong proof, not just a slick site or repeated PR articles.

A simple rule helps here: the bigger the promise, the stronger the receipts need to be. If receipts are missing, the promise is just a sales line.

Why you should not invest in KDN Token: The red flags

This section is a checklist style review of the most common scam-like signals that show up around Kuadin and the KDN token, based on publicly visible patterns and what buyers report noticing on the project’s pages.

No real team transparency

If a project wants your money, you should be able to verify who’s behind it.

With Kuadin, it’s difficult to find a clearly presented, independently verifiable team roster (real names, track records, LinkedIn profiles that match, past projects you can confirm, and a verifiable business entity).

- No clear team means no accountability if something breaks or funds vanish.

- It’s harder to assess competence. Payments, cards, and merchant tools are not weekend projects.

- If there’s a dispute, “anonymous team” makes legal options close to zero for most buyers.

A legit team doesn’t have to be famous. But it does have to be checkable.

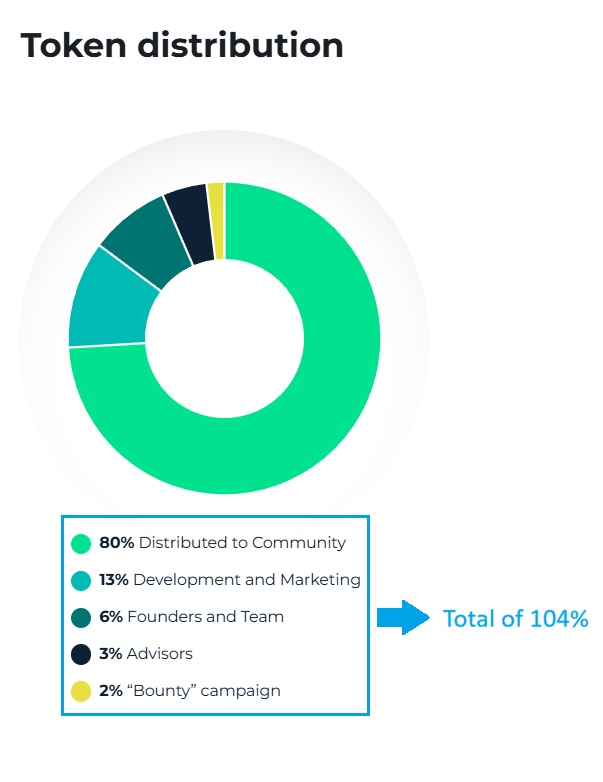

Tokenomics and math errors that break confidence

Tokenomics is just the math of how a token works: supply, allocation, vesting, burns, and who controls what.

One of the biggest practical red flags is as telling as it is funny: the token allocation split on the website adds up to more than 100%.

That’s the kind of mistake that tells you the project didn’t bother to proof basic investor-facing numbers. Perhaps, they even did this on purpose so they don’t have to bother with skeptical investors that are capable of noticing issues with the project.

Immediately, this makes me think:

- If they can’t total allocations correctly, you can’t trust claims about supply control, burn rates, or treasury management.

- Confusing or shifting supply language makes it hard to know what you’re buying, and how diluted you might get later.

- Sloppy token docs are often paired with messy contract setups, or token contracts that differ from marketing claims.

Even if the error is “just” a mistake, it’s a loud signal to stop and verify everything from scratch.

Kuadin presale pressure tactics and bonus promos (classic trap patterns)

Kuadin is heavily promoted through presale messaging. That’s where many bad projects do their best work, not by building, but by pushing urgency.

Watch for patterns like:

- Staged presales with “price increases soon”

- “Limited time” bonuses (some promos claim extremely high bonuses, including figures like 200%)

- Buyer funnels that push you into an “investor panel” or private dashboard to complete payment

Bonuses don’t create value. Liquidity and real demand create value. If there’s no proven market, a huge bonus can be a trap that just gets you to buy faster.

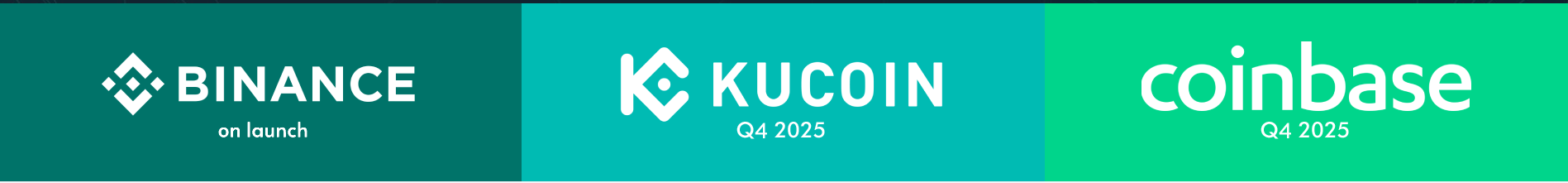

Exchange listing claims that may be hard to verify

Kuadin promotions often mention planned or targeted exchange listings. The issue is not that a listing is impossible, it’s that vague wording can create FOMO without providing proof.

If a token claims a “secured listing,” verification should be easy. Real verification looks like:

- An announcement on the exchange’s official site or official social accounts

- A verified market page that shows trading pairs and volume

- A contract address that matches across the exchange page and the project’s official channels

If you can’t confirm it outside the project’s own marketing, treat it as unconfirmed.

Big claims, thin proof (audits, partnerships, working product)

Kuadin markets a lot: payments, a card, AI, merchant trust, and low fees.

But public materials do not clearly show an independently verifiable smart contract audit from a reputable firm, and third-party coverage often repeats similar PR wording rather than providing hands-on testing.

What solid proof usually includes:

- A real audit report with a known firm’s name, findings, and a link you can verify on the auditor’s site

- Clear technical documentation that matches the deployed contract

- A working product with public users (not just mockups)

- Verifiable partnerships (partners confirm it on their own channels)

“AI plus blockchain” is not proof. It’s a theme. Proof is boring, and that’s (partly) why it’s valuable.

How to protect yourself if you already bought KDN (or Are Thinking About It)

If you’ve already bought, don’t panic-buy more to “average down,” and don’t let anyone rush you. Slow is safe in crypto.

Start with damage control: separate wallets, careful verification, and a hard rule that you won’t send more funds until the basics check out.

A quick verification checklist before you put in another dollar

Save this and run it like a pre-flight check:

- Confirm the official contract address from a trusted source (not a random comment or ad)

- Check token total supply, top holders, and recent transfers on a blockchain explorer

- Look for an audit report link that leads to a real auditor site page (not just a logo)

- Confirm any exchange listing through official exchange announcements

- Test any “product” claims using a fresh wallet with no funds, don’t connect your main wallet to unknown sites

If any one of these steps turns into a maze, that’s your answer.

The bottom line: Kuadin coin is shady at best

Kuadin crypto and the KDN token are trying to sell a big story.

But the public-facing signals raise serious concern, including basic website errors (like allocations over 100%), an unclear team, confusing tokenomics, promo-heavy presale pressure, and exchange or audit claims that are hard to confirm independently.

If you can’t verify the fundamentals, don’t invest. I have been unable to verify Kuadin’s fundamentals. Therefore, if I were giving advice, I would say to stay safe and not invest.

Protect your wallet, verify first, and treat urgency as a warning sign. Your money deserves proof, not promises.

Source:: What Is Kuadin Crypto? Why You Should Not Invest in KDN Token