Artificial intelligence has taken over the global economy, transforming 2025 into an era of unprecedented technological competition and systemic imbalance. What once seemed like a software-driven race has become a hardware and energy war.

OpenAI has entered into agreements with Samsung and SK Hynix to supply up to 900,000 DRAM wafers per month until 2029 – an amount estimated to represent around 40% of global RAM production, with a total contract value between $60–90 billion. This development immediately reshaped the semiconductor market.

The deal instantly raised prices. As a reminder, a 64 GB RAM kit now costs roughly the same as a new MacBook Air, and some memory modules have risen in price by over 156% in a single month.

Latest DDR5 RAM prices are up 120–200%, with 64GB kits topping $600. Source: PCPartPicker

This hardware bottleneck is becoming one of the defining economic constraints of the AI era.

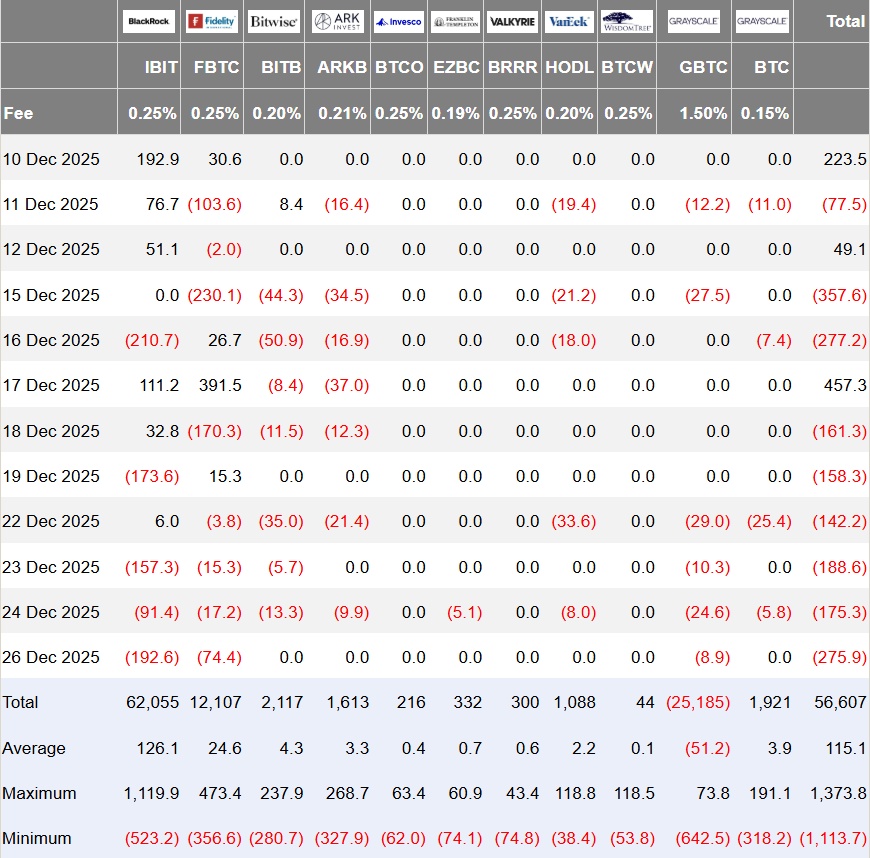

Crypto markets under pressure

Against this backdrop, the cryptocurrency market remains under significant stress.

Bitcoin ended the year down 7%, trading near $87,000 after briefly reaching a historical peak of $126,000 in October. Institutional investors have been steadily exiting the market.

Bitcoin ETFs experienced $782 million in outflows in a single week, largely due to uncertainty surrounding the delayed CLARITY Act in the United States.

Source: Farside Investors

Ethereum alone saw $555 million in outflows, while Bitcoin lost $460 million.

According to the BTC/USD 12-month chart, this correction coincides with weakening institutional conviction and declining trading volumes.

Mining pressure and network stress

The mining sector is feeling the impact directly.

The Bitcoin network hashrate fell 4%, marking the sharpest decline since April 2024. Bitmain responded by sharply reducing ASIC miner prices, offering discounts of up to $7 per terahash. At the same time, hash price fell to $35 per TH/s per day, below the estimated breakeven point of $40.

Bitcoin Hashprice Index. Source: Hashrateindex

Despite this, analyst Samson Mow described 2025 as a bearish year in the short term while predicting a multi-year bull cycle extending toward 2035 – a paradox that reflects broader uncertainty in the market.

AI and the labor market: structural disruption

AI’s influence is no longer theoretical.

In the United States alone, 55,000 workers have already lost their jobs due to automation, averaging 7,000 layoffs per month, out of 1.17 million total layoffs nationwide.

At the same time, OpenAI has reportedly doubled computing margins to nearly 70% and generated $3 billion in revenue through the ChatGPT mobile app in just 31 months. The platform now serves around 900 million users, generating 2.5 billion queries per day.

China’s GigaChat became the first AI system to pass the SFA financial analyst exam, while another AI model surpassed humans in the ARC-AGI-2 abstract reasoning test, scoring 75% versus 60% for humans – a symbolic moment in the AI race.

Energy: the real bottleneck

The AI race is increasingly constrained not by algorithms, but by electricity.

China has reached a record 3.75 terawatts of installed power capacity, nearly three times that of the United States. In 2024 alone, China added 429 GW, with 83% coming from renewable sources. The country is currently building 34 nuclear reactors, more than the next nine countries combined, and plans to add 200 more by 2040.

In parallel, China has launched a national AI network spanning 55,000 km of fiber, connecting 40 cities and supporting over 4,000 parallel computing workloads. In Beijing, a 10,000 m² humanoid robotics training center is already operational, where the robot Kuafu is being trained for industrial and domestic tasks.

Geopolitics and the AI arms race

Russia has entered the race as well. Oleg Deripaska (Russian trader) has called for the creation of an AI “with a Russian character and worldview,” estimating that 40-50 GW of new energy capacity would be required to compete with China and the United States.

Meanwhile, the Pentagon has selected Elon Musk’s xAI, integrating Grok into the GenAI.mil platform, granting access to more than three million military and civilian personnel.

The battle for technological sovereignty is no longer abstract – it is being fought through data centers, power grids, and semiconductor supply chains.

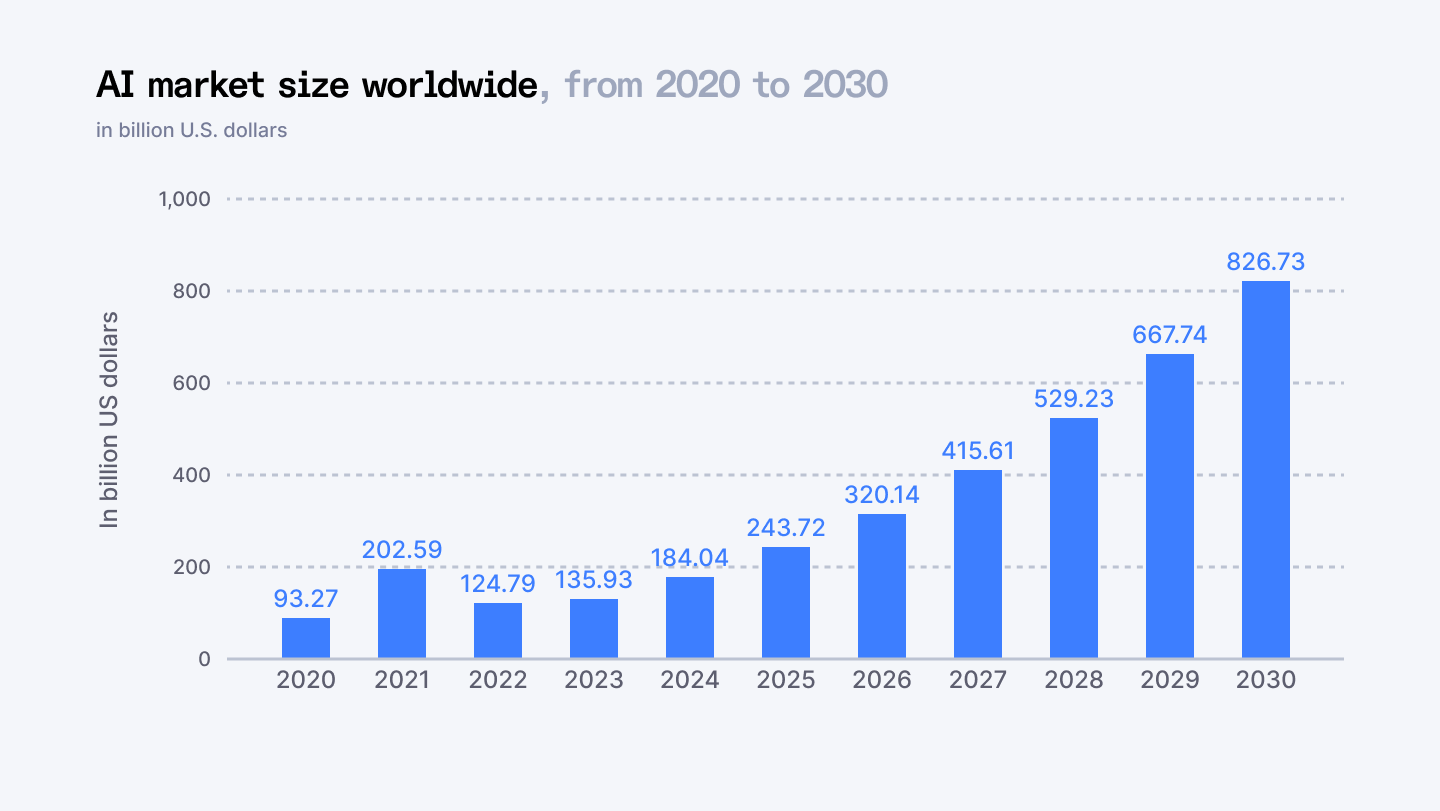

Rapid expansion of the global AI market, reaching hundreds of billions of dollars. Source: Index.dev

Regulation, crypto, and state control

Regulatory pressure continues to mount.

El Salvador is negotiating with the IMF to sell its Chivo wallet as part of a $1.4 billion loan agreement, while retaining 7,509 BTC worth roughly $659 million.

The U.S. national debt has now exceeded $38.5 trillion, increasing at $75,000 per second, prompting economist Peter Schiff to warn of a historic economic reckoning.

King dollar’s reign is coming to an end. Gold will take the throne as the primary central bank reserve asset. That means the U.S. dollar will crash against other fiat currencies, and America’s free ride on the global gravy train will end. Prepare for a historic economic collapse.

— Peter Schiff (@PeterSchiff) December 26, 2025

Final perspective: a new kind of power

The global economy is undergoing a structural shift.

AI companies are becoming the new oil monopolies, controlling computation, energy consumption, and digital infrastructure. At the same time, traditional cryptocurrencies are adapting to a world where algorithms manage capital more efficiently than humans, while retail interest continues to decline.

Search trends confirm this shift: crypto-related queries are falling to yearly lows.

Historically, the situation resembles the oil crises of the 1970s, when control over a critical resource reshaped geopolitics. Today, that resource is not oil, but compute, memory, and energy.

China’s 3.75 terawatts of capacity and OpenAI’s energy demands suggest a future where physics, not finance, becomes the primary limitation.

In the end, the decisive factor may not be algorithms or capital, but access to clean, scalable energy.

Source:: Week in Crypto: Energy, Chips, and Power — Bitcoin Ends the Year in the Red Amid the AI Boom