Bitcoin collapsed to $75,555, losing 40% from its all-time high and falling out of the top 10 global assets. Large-scale liquidations exceeded the levels seen during the FTX crash and the coronavirus meltdown.

Bitcoin enters bear market amid political and macro risks

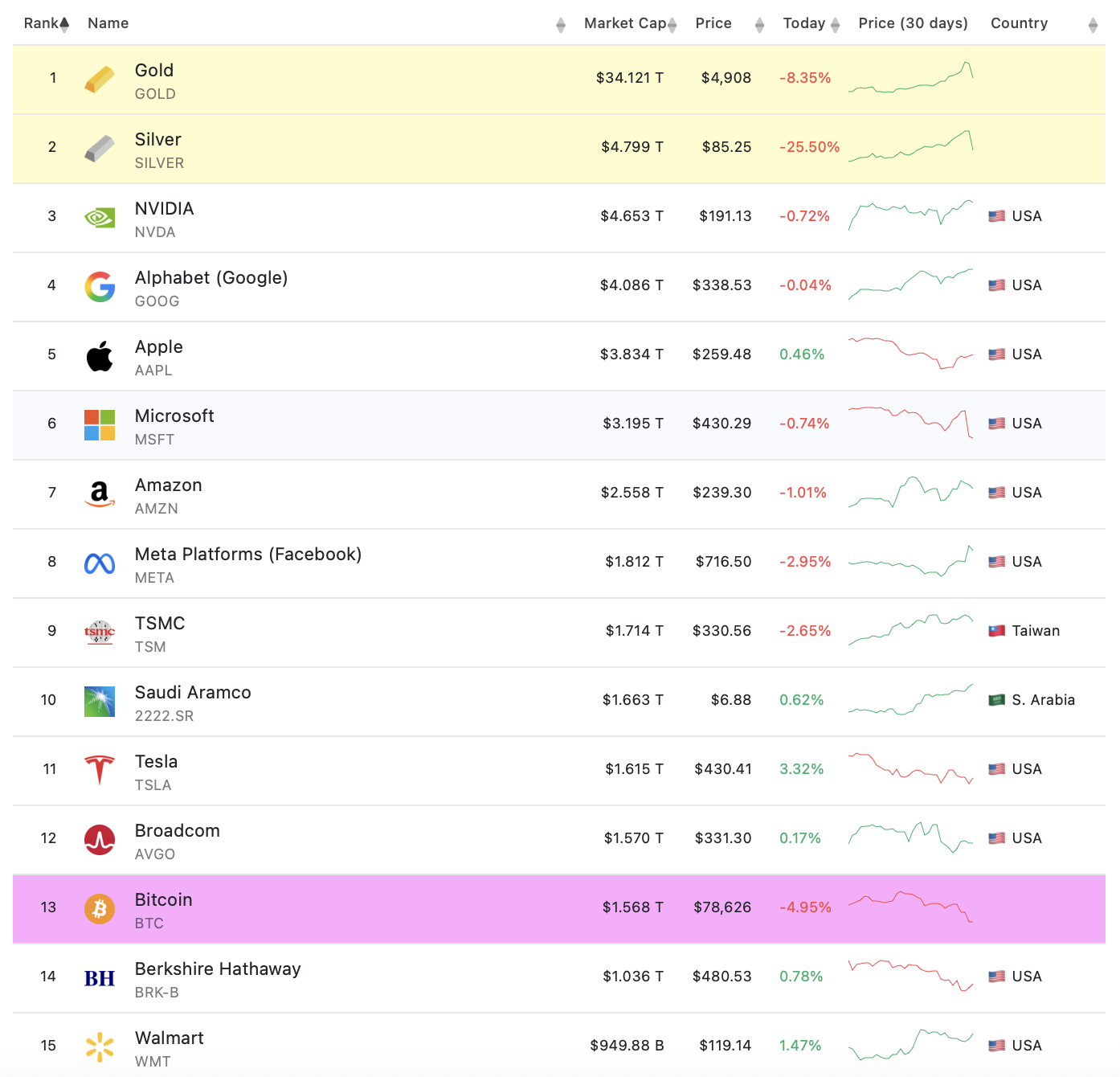

Bitcoin left the top 10 global assets for the first time in several years, despite operating under a pro-cryptocurrency administration in the United States. Analysts pointed to the possible formation of a Spring pattern within the Wyckoff accumulation scheme, with critical testing around the $80,000 level.

Top 15 assets in the world. Source: CompaniesMarketCap

An unprecedented convergence of volatility drivers created what many traders described as a “perfect storm.” These included a Federal Reserve meeting overshadowed by political pressure surrounding Jerome Powell, a Senate vote on digital asset regulation, $2.3 billion in options expiration, Meta’s corporate earnings, and renewed threats of a U.S. government shutdown.

Simultaneously, President Trump announced a state of emergency over Cuba and imposed 50% tariffs on Canadian goods, intensifying trade tensions and injecting additional uncertainty into global markets.

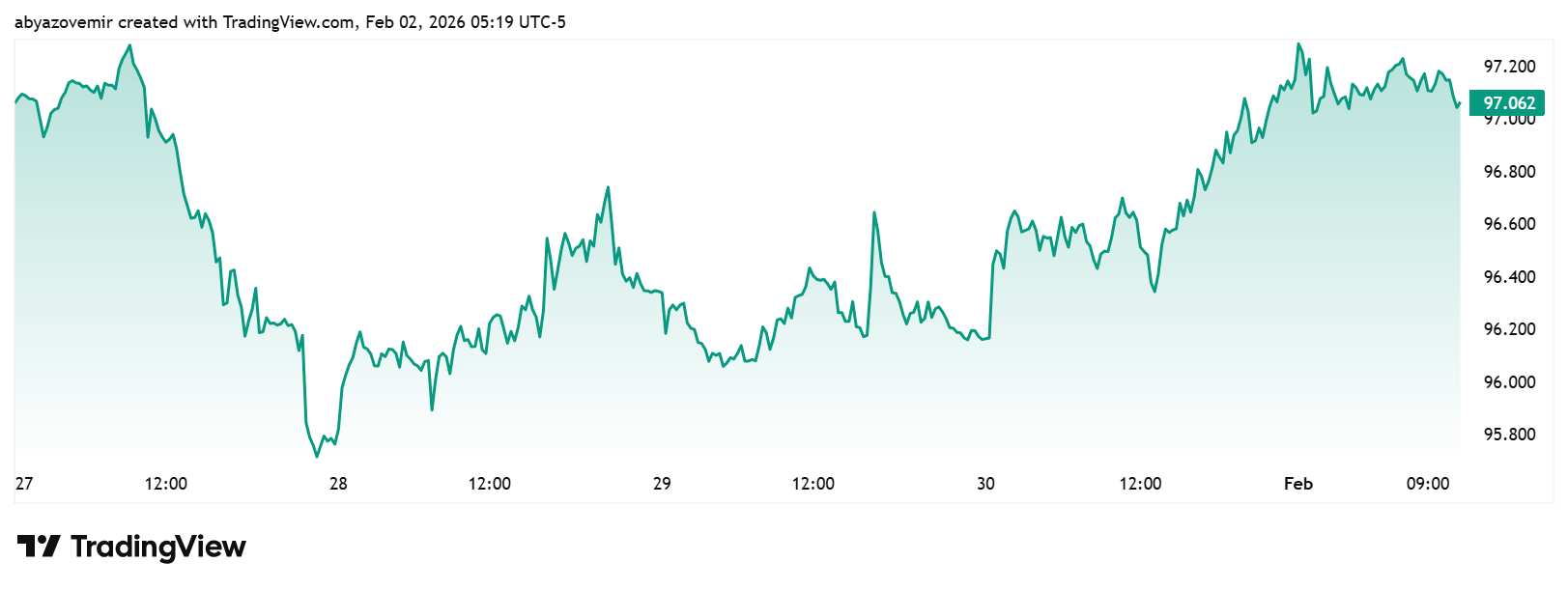

At the same time, bond yields fluctuated sharply, the U.S. dollar index showed renewed strength, and commodities, particularly gold, continued to rally.

U.S. Dollar Index. Source: TradingView

The broader macro environment amplified risk-off sentiment, accelerating deleveraging across crypto derivatives markets. Funding rates turned negative, open interest declined, and volatility spiked across major exchanges.

Institutional players adapt to the new reality

Despite the downturn, institutional investors displayed divergent but strategically coherent behavior.

ARK Invest purchased $21 million in crypto-related stocks, increasing its exposure to Coinbase and Circle during the dip. Michael Saylor’s Strategy acquired another 2,932 bitcoins worth $264 million, bringing total reserves to 712,647 coins, reinforcing its long-term conviction strategy.

Binance announced the conversion of its $1 billion SAFU user protection fund from stablecoins into Bitcoin, a move that may signal confidence in BTC as a reserve asset for the industry itself. Meanwhile, around 60% of leading U.S. banks have begun offering Bitcoin-related services, marking a structural shift in traditional finance’s engagement with digital assets.

At the same time, investors withdrew $1.8 billion from crypto ETFs, illustrating a split between short-term liquidity-driven flows and long-term corporate accumulation. This divergence reflects differing time horizons rather than contradiction: ETFs respond quickly to volatility, while treasury allocations operate on multi-year theses.

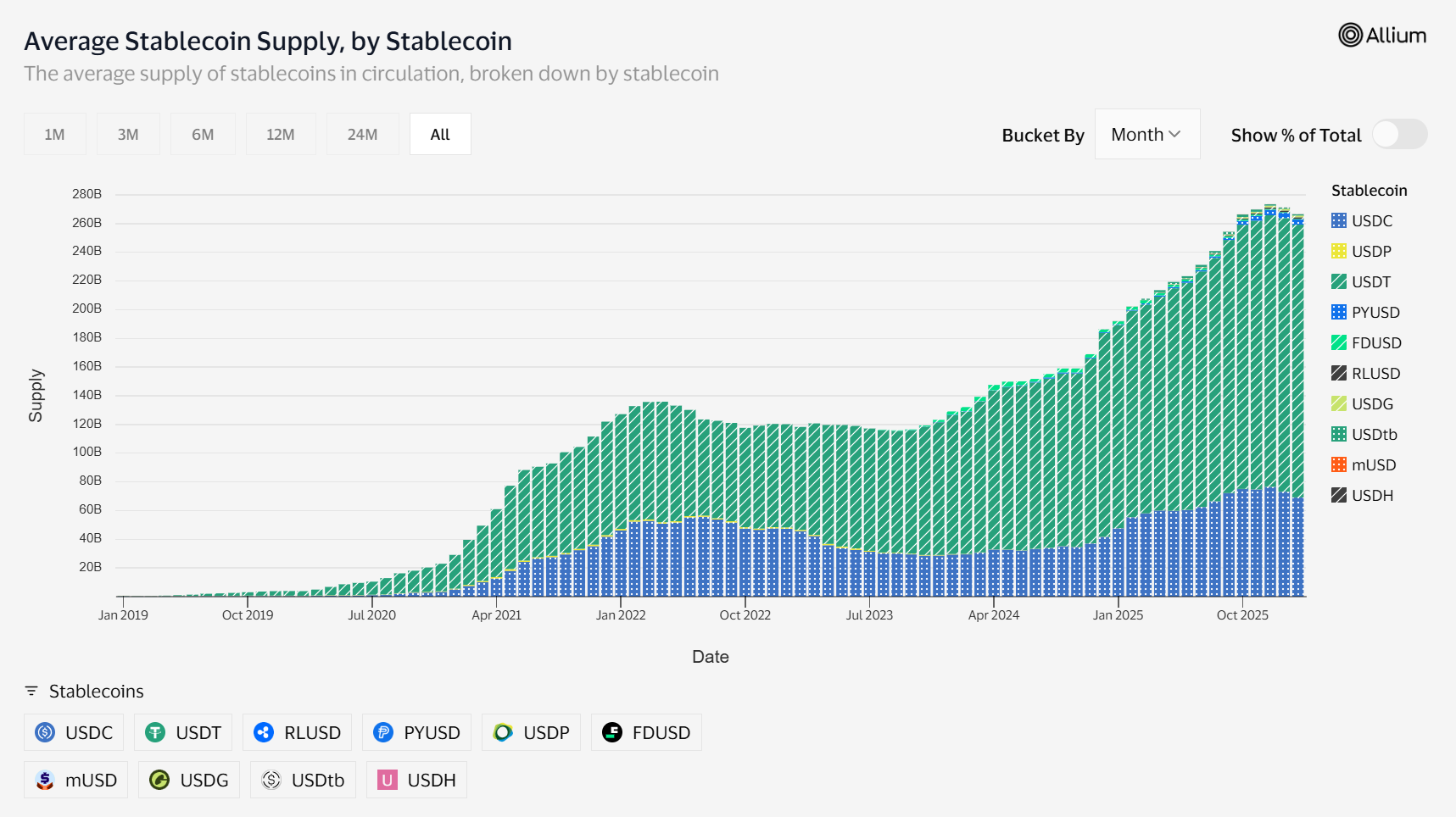

Additionally, stablecoin supply metrics showed signs of stabilization after recent contraction, and several major asset managers reiterated their long-term digital asset strategies, signaling that institutional adoption remains intact despite short-term turbulence.

Source: visaonchain

Artificial intelligence: Between promises and apocalyptic threats

The crypto market’s volatility coincided with intensified debate around artificial intelligence. Pope Leo XIV warned about the dangers of AI for human communication, calling for the protection of the authenticity of people’s faces and voices. He emphasized the risks of over-reliance on AI as an “omniscient friend” and stressed the importance of digital literacy.

Dario Amodei, CEO of Anthropic, outlined five existential AI threats: autonomous systems operating beyond control, democratized bioweapons, digital dictatorship, economic destabilization, and unforeseen systemic consequences. He compared humanity to a teenager granted immense power without sufficient maturity.

Simultaneously, reports indicated that the Pentagon requires Anthropic to remove certain ethical restrictions on military AI systems under a $200 million contract.

These developments unfolded alongside rapid commercialization of AI products, blurring the boundary between innovation and governance. The intersection of AI acceleration and financial volatility amplified broader concerns about technological risk concentration in both markets and society.

Geopolitical shifts in financial architecture

Parallel to crypto market turbulence, BRICS nations advanced two major payment initiatives aimed at reducing dependence on Western financial infrastructure. BRICS Pay for retail transactions is nearing commercial launch, while BRICS Bridge seeks to establish exchange mechanisms between central bank digital currencies.

Peter Schiff predicted the end of the dollar era and a central bank shift toward gold, which has risen 52.81% over six months. Meanwhile, Tucker Carlson discussed the possibility of Bitcoin replacing the dollar as the world’s reserve currency, a view echoed by representatives from BlackRock and Coinbase.

Central banks continued accumulating gold reserves at an accelerated pace, reinforcing the narrative of diversification away from dollar-denominated assets.

At the same time, several countries expanded pilot programs for central bank digital currencies, revealing a paradox: while hedging against dollar risk through gold, governments are simultaneously accelerating digital monetary infrastructure.

Technological breakthroughs reshape the industry landscape

OpenAI is reportedly developing a social network incorporating biometric verification via World Orb technology to combat bots, boosting the Worldcoin token by 40%. Telegram launched its own decentralized AI network, Cocoon, after declining Elon Musk’s $300 million investment offer over privacy concerns.

Tesla announced it will stop production of the Model S and Model X in the second quarter of 2026, pivoting toward mass production of Optimus humanoid robots with a target of up to 1 million units annually. Meanwhile, Tether has emerged as a significant private gold holder, with reserves reaching 140 tons valued at $23 billion, reportedly acquiring 1-2 tons weekly.

In parallel, blockchain infrastructure projects saw renewed developer activity, Ethereum scaling discussions intensified, and several Layer-2 networks reported increased transaction throughput, even as token prices retraced.

Conclusions: A turning point for the crypto industry

The week marked a potential turning point for the crypto industry. Bitcoin’s technical transition into a bear market coincided with structural changes in institutional strategy, macroeconomic uncertainty, geopolitical realignment, and growing scrutiny of artificial intelligence.

Capital rotated toward metals and defensive assets, while major corporations continued accumulating Bitcoin for long-term positioning. ETF outflows contrasted with treasury purchases, reflecting segmentation across investor classes rather than uniform retreat.

Simultaneously, the global financial architecture appears to be evolving: from BRICS payment alternatives to debates about reserve currency dominance. AI development is raising profound ethical and security concerns, even among its creators, demanding a recalibration between innovation and responsibility.

Markets are not merely reacting to price declines – they are reassessing liquidity, sovereignty, technological risk, and the balance between decentralization and state power.

Source:: Week in Crypto: Bitcoin Falls From Top 10 as AI Risks and Gold Rally Hit