Key highlights:

- The SEC has postponed its ruling on the Truth Social Bitcoin ETF until September 18, also delaying decisions on other crypto ETFs like Grayscale’s Solana Trust and Canary Capital’s Litecoin ETF.

- The ETF, linked to Trump Media, would be the first crypto fund tied to a sitting president’s business interests, prompting scrutiny over potential conflicts of interest and regulatory fairness.

- Trump remains active in the crypto space, recently signing the GENIUS Act into law, which establishes a regulatory framework for stablecoins in the U.S.

The U.S. Securities and Exchange Commission (SEC) has postponed its decision on the Truth Social Bitcoin ETF, extending the review deadline from August 4 to September 18. This Bitcoin ETF, backed by Trump Media and Technology Group, seeks approval to list on the NYSE Arca exchange.

Image source: sec.gov

The SEC has up to 270 days to approve or reject ETF applications and stated the extension allows more time to evaluate the proposal and address any arising issues.

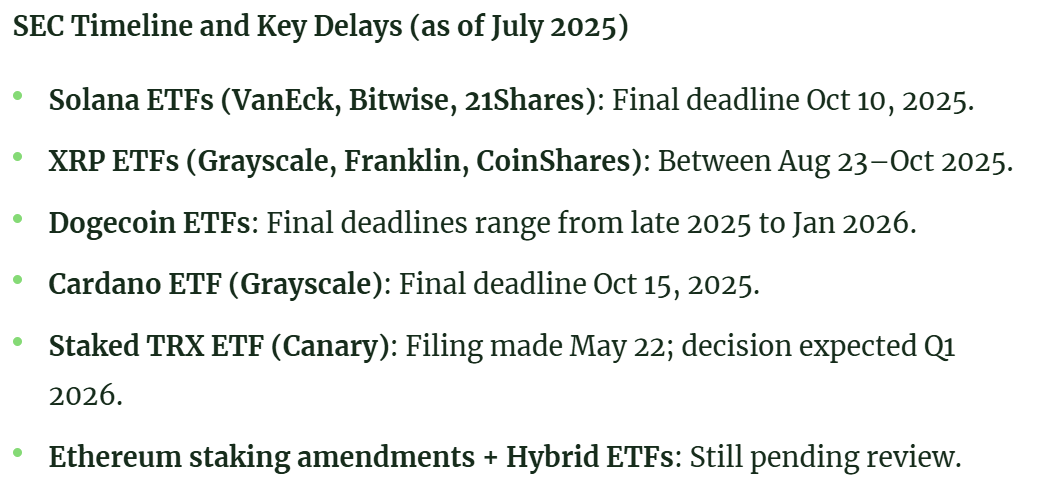

Trump’s Bitcoin ETF is not the only fund facing delays; the SEC has also pushed back decisions on Grayscale’s Solana Trust until October 10, 2025, and Canary Capital’s proposed Litecoin ETF.

SEC Commissioner Hester Peirce, known as “Crypto Mom” for her crypto-friendly stance, recently urged industry stakeholders to remain patient amid ongoing litigation and other regulatory considerations.

SEC Timeline and Key Delays. Source: sec.gov

While today’s delays seem minor compared to the decade-long wait for the first spot Bitcoin ETF—approved in January 2024 after applications starting in 2013—the Truth Social Bitcoin ETF raises unique concerns.

Concerns surrounding the Trump ETF

If approved, it would be the first cryptocurrency ETF linked to the business interests of a sitting U.S. president. Although the ETF itself has not faced formal SEC objections, related Trump-associated cryptocurrency deals have triggered ethical and regulatory fairness questions, notably from Democratic lawmakers.

In May, Senators Elizabeth Warren and Jeff Merkley sent a formal letter to the Office of Government Ethics describing a Trump-linked cryptocurrency deal involving World Liberty Financial, Binance, and a United Arab Emirates firm as a “staggering conflict of interest.” They expressed concerns that the Trump and Witkoff families might use their stablecoin to profit from foreign corruption.

There are also worries that Trump could benefit personally from regulatory decisions affecting crypto markets or firms connected to his business ventures, particularly if a financial product linked to his brand gains approval, increasing its legitimacy and demand.

Trump’s ongoing engagement with the crypto industry

Trump has been engaged with the crypto industry since taking office. On July 18, he signed into law the GENIUS Act, the first major U.S. legislation to establish a clear regulatory framework for stablecoins.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: U.S. SEC Extends Review of Truth Social Bitcoin ETF Amid Regulatory Scrutiny