Thumzup Media has received approval from its board of directors to create a cryptocurrency reserve of up to $250 million. The firm, which has received investment from Donald Trump Jr., plans to diversify its assets with Bitcoin, Ethereum, Solana, XRP, Dogecoin, Litecoin, and the USDC stablecoin.

Asset diversification strategy

Thumzup CEO Robert Steele attributed the company’s decision to positive changes in U.S. digital asset policy. He stated that diversifying its cryptocurrency portfolio will allow Thumzup to gain broader market exposure.

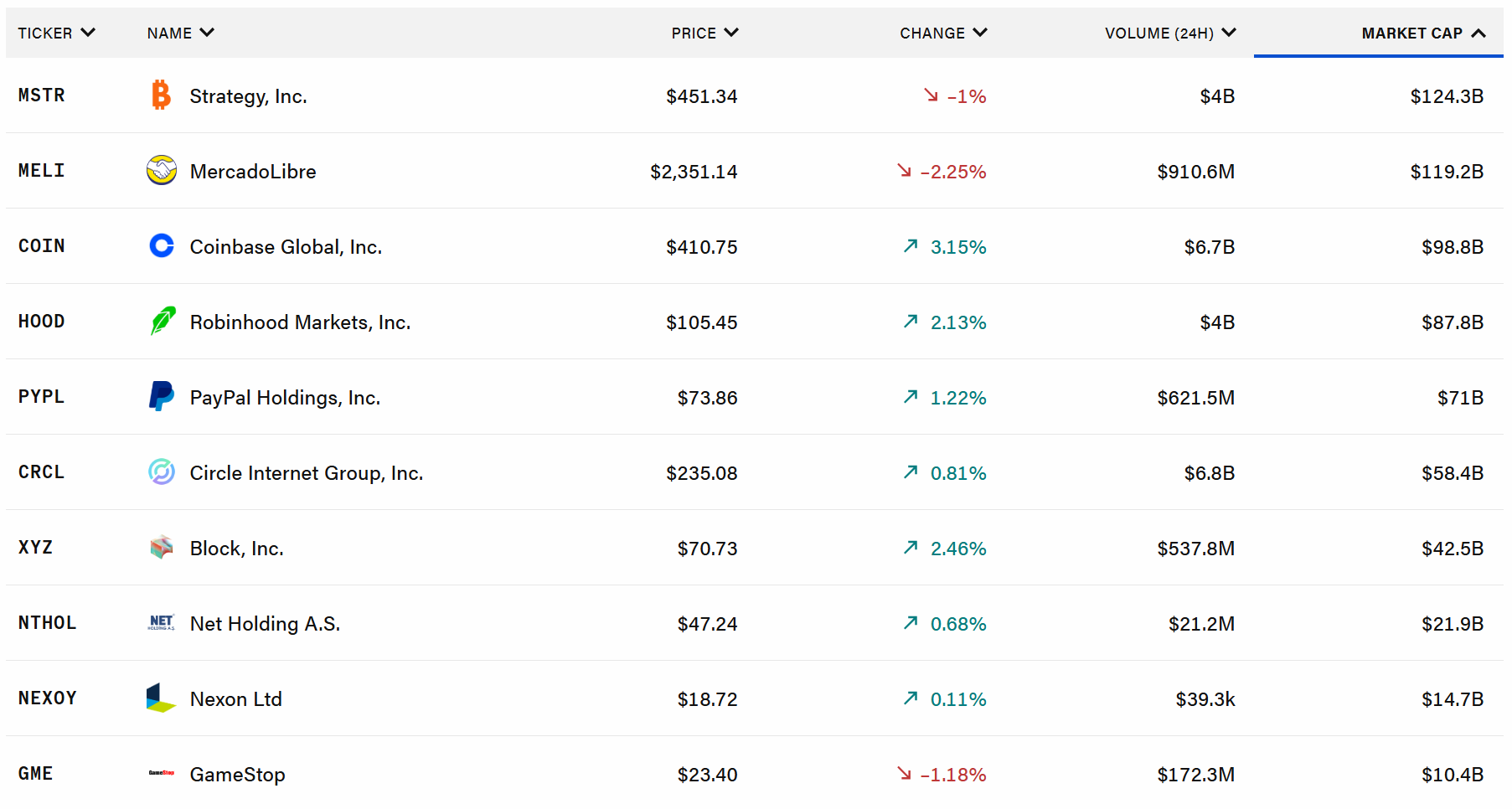

Crypto company stocks. Source: TheBlock

He also noted that as the U.S. federal government moves toward more cryptocurrency-friendly policies and greater regulatory clarity, Thumzup aims to remain at the forefront of this transformative technology.

Trump family connection

The company, founded in 2020 and based in Los Angeles, operates a platform that allows users to earn money by promoting branded content on social media. Last week, it was revealed that Donald Trump Jr., the eldest son of the former U.S. president, owns 350,000 shares of the company, worth approximately $4 million.

This announcement follows Thumzup’s $6 million convertible preferred stock offering, arranged by Dominari Securities last week. Both Donald Trump Jr. and his brother Eric Trump serve as advisors to Dominari, the parent company of Thumzup.

In fact, if you’re watching companies tied to the Trump family, you might want to keep an eye on Thumzup’s stock—especially as a recent forecast from CoinCodex points to potential notable price movements for Thumzup in the near future.

The decision to create a cryptocurrency treasury reflects a growing trend among public companies to incorporate digital assets into their corporate strategies. Thumzup’s move to expand the reserve beyond Bitcoin to include major altcoins demonstrates management’s confidence in the long-term prospects of the cryptocurrency market.

Source:: Trump’s Thumzup Media Approves $250 Million Cryptocurrency Reserve