Trump’s media company has bought $2 billion worth of Bitcoin as part of a new investment strategy.

Trump Media and Technology Group, which owns the social network Truth Social, announced a massive cryptocurrency purchase as part of a plan to diversify its assets and pursue investment opportunities.

Trump team’s cryptocurrency strategy

Trump Media CEO Devin Nunes called the purchase part of the company’s “Bitcoin reserve plan.” In May, the firm announced plans to raise $2.5 billion to build up cryptocurrency reserves. Now those plans are being implemented.

Trump Media CEO Devin Nunes and President Donald Trump at the 2024 Republican National Convention. Source: Alex Wong/Getty Images

“These assets help ensure our company’s financial freedom, protect us against discrimination by financial institutions, and will create synergies with the utility token we’re planning to introduce across the Truth Social ecosphere,” Nunes said.

In addition to the main Bitcoin purchase, Trump Media has set aside $300 million for an options strategy to purchase Bitcoin-related securities. The company intends to continue increasing its position in the cryptocurrency.

Impact on shares and financial performance

Trump Media shares rose $1.04, or 5.6 percent, to $19.71 after the news was announced. However, the company’s shares have fallen 42 percent over the past year.

First-quarter financial results showed revenue of $821,000, up from $770,000 a year earlier. The operating loss narrowed to $39.5 million from $98.3 million in the same period last year.

What is a cryptocurrency reserve strategy?

A cryptocurrency reserve strategy involves purchasing and holding digital assets for the long term, similar to how companies invest in traditional assets like bonds to increase financial flexibility.

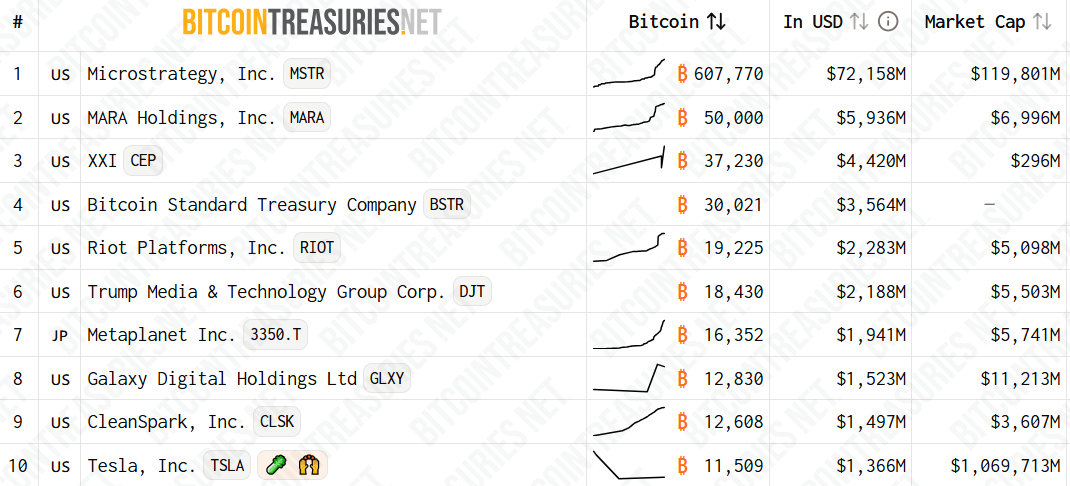

Publicly Traded Bitcoin Treasury Companies. Source: Bitcointreasuries

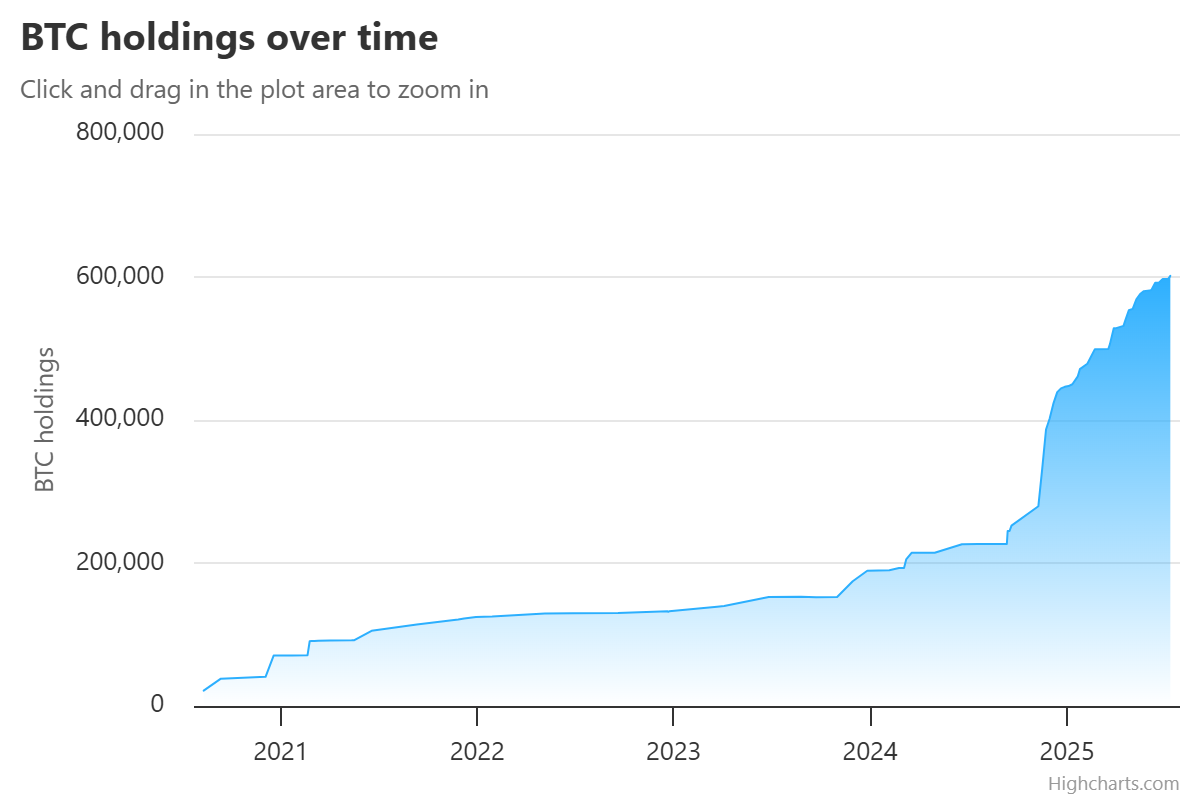

One of the most famous proponents of this approach is billionaire Michael Saylor, who runs Strategy. His firm holds over 200,000 Bitcoins worth tens of billions of dollars at the current exchange rate, making it the largest public company with a substantial Bitcoin treasury, according to data from Bitcointreasuries.net.

Strategy has used a variety of mechanisms, from stock sales to debt issuance, to continually expand its Bitcoin exposure.

As the digital currency’s price has surged toward new highs (up significantly in the past year), Strategy shares have soared thousands of percent since 2020.

Strategy BTC holdings. Source: bitbo

Government support for crypto assets

Saylor’s success has attracted a large following, and the White House invited him to a summit on digital assets this year. The Trump campaign has proposed creating a U.S. “strategic reserve” of crypto assets. Last week, President Trump signed the GENIUS Act, which is the first major law regulating digital currencies.

The company’s strategy reflects a growing belief among its leadership that digital assets are not just a hedge, but a foundational pillar of its future financial infrastructure.

Source:: Trump Media Invests $2 Billion in Bitcoin as Part of New Corporate Strategy