Key highlights:

- Bitcoin trades near $111,600 while bulls struggle to surpass $114,000 resistance.

- Analyst warnings highlight the risk of a 19% correction to $102,000 support.

- Gold rises above $4,200 an ounce as Bitcoin lags despite favorable macro conditions.

Bitcoin is showing weakness amid gold’s record high. Bitcoin is trading near $111,600, down nearly 2% at the open of U.S. trading yesterday.

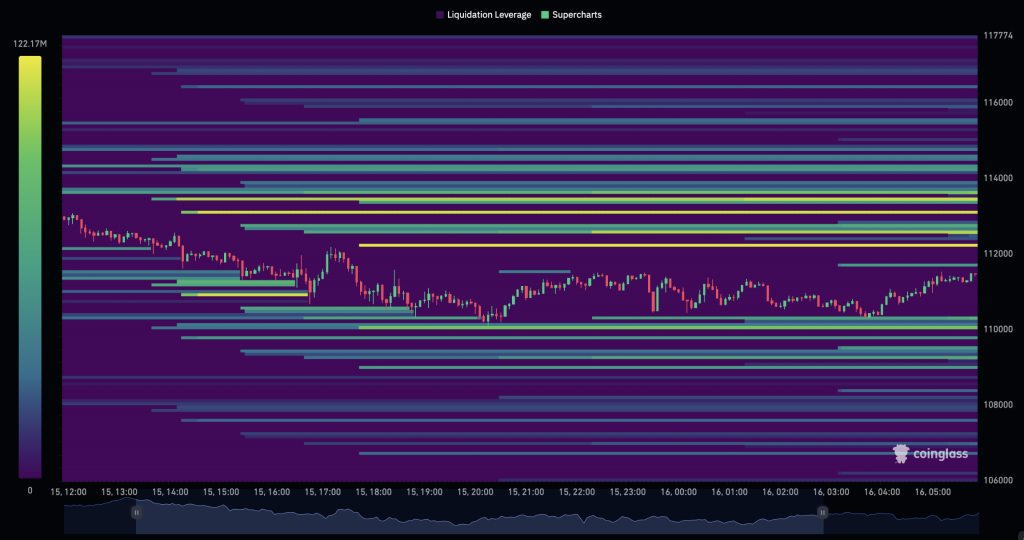

Bulls are struggling to break through resistance just below $114,000, according to CoinGlass data.

Bitcoin liquidity map on the Binance exchange. Source: Coinglass

Trader Roman warns of a possible return to the $102,000 level — the minimum recorded on Binance last week.

“Now it’s starting to look like a failed reversal setup,” he noted while analyzing a four-hour chart, suggesting the market could fill the wick to that level.

BTC/USD 4-hour chart. Source: Roman

Such a drop would represent a 19% decline from Bitcoin’s recent all-time high. Corrections of this size are commonplace in the current bull market, which began in early 2023.

Key support level and analyst insights

Cryptanalyst Ted Pillows considers $102,000 a critical support level:

“$BTC long-term structure is still looking good. As long as the $102,000 level holds, Bitcoin will be in a bull run.”

BTC/USD 1-Month Chart. Source: Ted Pillows

He added that a monthly candle closing below this support would serve as a warning sign for investors.

Gold breaks records while Bitcoin lags

Gold has surged past $4,200 an ounce, reaching a new all-time high. Federal Reserve Chairman Jerome Powell strengthened expectations of interest rate cuts in October, fueling gold’s rally.

Trading firm QCP Capital noted an interesting detail: the correlation between Bitcoin and gold has risen above 0.85, indicating synchronized capital flows between traditional and digital safe-haven assets.

“The setup for a renewed rally may already be forming,” QCP Capital said, though it questions Bitcoin’s long-term ability to maintain its “digital gold” status.

The paradox is clear: traditional gold is confidently rising, while Bitcoin is under selling pressure, putting the market at a critical decision point — bulls must defend key support levels or the correction could deepen.

Easily invest in gold with Tether Gold (XAUT)

- XAUT is a gold-backed token from the world’s biggest stablecoin issuer, Tether

- Each XAUT token is backed by one fine troy ounce of gold

- The gold backing XAUT is securely stored in a Swiss vault

- XAUT can be traded 24/7

- The token is highly divisible, which means you can easily invest smaller amounts

- Instead of worrying about secure physical storage, you can store XAUT in your crypto wallet

Source:: Traders Fear Bitcoin Could Drop to $102,000 as Gold Hits Record High