Key highlights:

-

Japan enters the stablecoin race with major banks close behind

-

A $308B global market accelerates as JPYC goes live

-

New rules could let Japanese banks invest directly in crypto

Tokyo-based fintech company JPYC has launched Japan’s first yen-pegged stablecoin, marking a milestone for the country’s digital asset landscape and signaling rising competition in the global race for stablecoin dominance.

A new player in a $308 billion market

The JPYC stablecoin is backed 1:1 by bank deposits and government bonds, with a fixed one-to-one exchange rate to the Japanese yen, the company confirmed.

At a press conference in Tokyo, JPYC President Noriyoshi Okabe called the launch “an important milestone in the history of Japanese currency.” He added that seven companies are already preparing to integrate JPYC into their services.

Source: X

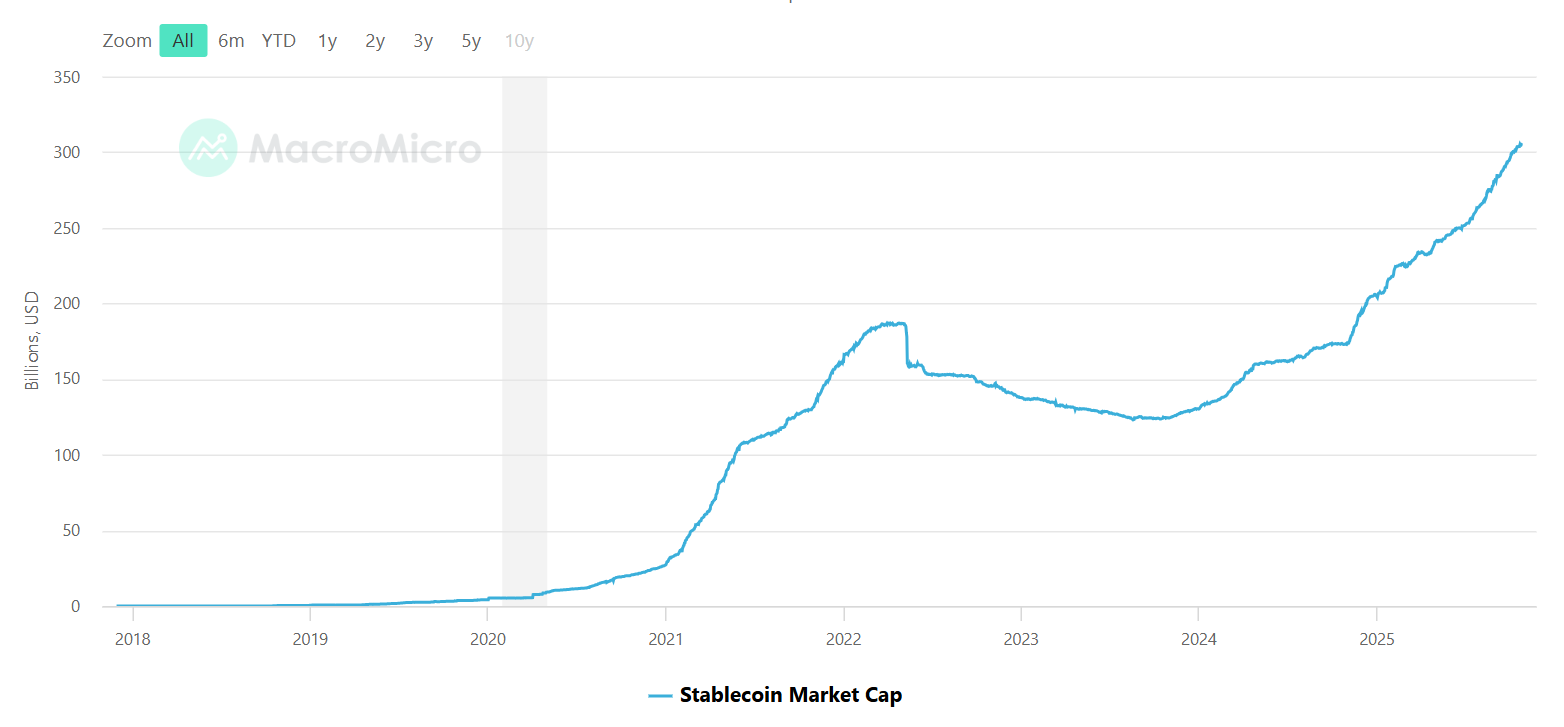

The launch comes during explosive global growth in stablecoins, led by USDT and USDC. Market capitalization now exceeds $308 billion, and dollar-backed stablecoins are already gaining traction in Japan — Circle launched USDC in the country on March 26.

World – Stablecoin Market Cap. Source: MacroMicro

To support adoption, JPYC also unveiled JPYC EX, a platform for issuing and redeeming the token. The service complies with Japan’s strict identity and transaction verification rules under the Proceeds of Crime Act, ensuring transparent and regulated circulation.

Users can deposit yen via bank transfer to receive JPYC in their registered wallet — with yen withdrawals available as well.

Ambitions, competition, and regulatory shifts

JPYC plans to reach ¥10 trillion in circulation within three years and help build new financial infrastructure through stablecoins.

However, rivals are already on the way. Tokyo-based Monex Group plans to launch its own yen-backed stablecoin in August. Meanwhile, Japan’s three largest banks — MUFG, SMBC, and Mizuho — are preparing to issue a joint stablecoin on MUFG’s Progmat platform.

Japan’s Financial Services Agency is also drafting regulatory updates that would allow domestic banks to hold cryptocurrencies such as Bitcoin, signaling a broader shift toward blockchain-based financial services in the country.

Source:: Tokyo Fintech Firm Launches Japan’s First Yen-Backed Stablecoin as Global Market Surges