Rather than responding positively, digital assets triggered a wave of sell-offs, contradicting the usual correlation between political certainty and market stability. This unexpected reaction set the tone for a volatile week ahead.

At the very moment Washington resumed business and broader market optimism spread, Bitcoin plunged to $94,000 — its lowest level since May, marking a loss of nearly 25.5% from its October all-time high. The crypto fear index hit an extreme reading of 16, reflecting heightened anxiety among traders.

Bitcoin Movement From November 10 to 16. Source: CoinCodex

While some, like trader Roman, forecasted a further decline towards $76,000, others, including Crypto Candy, anticipated a rebound in the $93,000–$95,000 range.

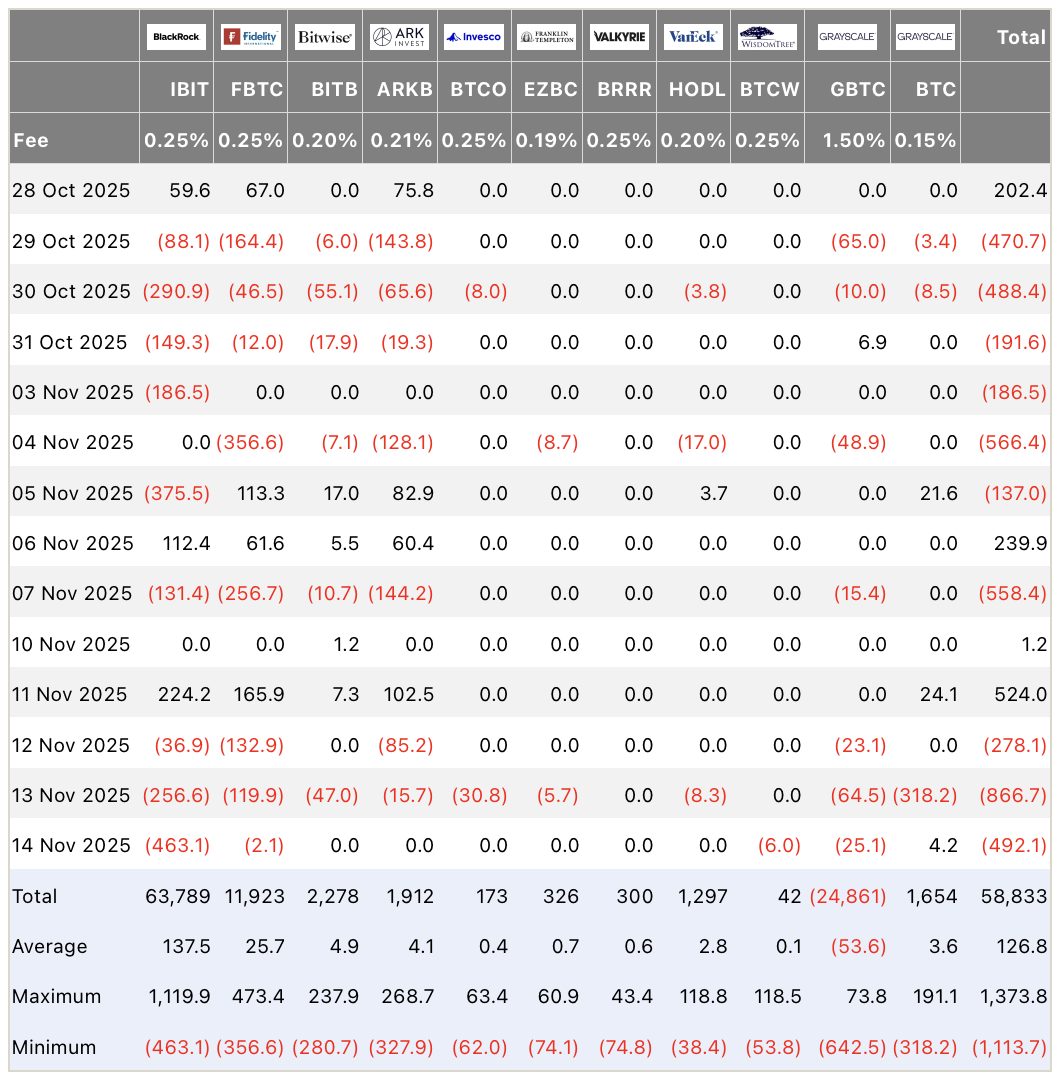

Simultaneously, the ongoing weakness was magnified by an unprecedented outflow from U.S. Bitcoin ETFs. On November 13 alone, $866 million exited these funds, adding significant downward pressure on the market. This marked one of the largest single-day outflows ever recorded and contributed to wiping out all of Bitcoin’s 2025 gains.

Capital flows into US Bitcoin ETFs. Source: Farside Investors

Market data and additional key events midweek

Beyond Bitcoin’s sharp moves, the wider crypto market also faced turbulence. Throughout November 10 to 16, more than $0,5 trillion in market capitalization was erased amid increased volatility.

Crypto Market Cap. Source: CoinCodex

Notably, altcoins demonstrated mixed performance: while some smaller tokens made surprising gains, leading cryptocurrencies like Ethereum experienced continued selling pressure, though it managed modest rebounds at key support levels.

Miners reacted to the challenging environment with divergent strategies. Bitmine capitalized on the market dip by increasing Ethereum purchases by 34%, growing their reserves to 3.5 million tokens valued at $12.5 billion.

On the other hand, Bitfarms revealed plans to transition into AI services, announcing intentions to cease Bitcoin mining by 2027 following an 18% drop in share price. CleanSpark successfully raised $1.15 billion to expand both mining and AI infrastructure, showing confidence in a hybrid future for crypto-related technologies.

Institutional investors adjusted their exposures as well. ARK Invest spent $8.7 million acquiring crypto stocks amid the market decline, signaling a countercyclical investment approach. Meanwhile, Japan’s Financial Services Agency considered new listing restrictions on companies holding Bitcoin reserves, a regulatory development triggered by a severe drop in Metaplanet’s shares, which fell 82% from their yearly high.

The broader macro environment added to market uncertainty. Fed remarks pointing toward a hawkish stance on interest rates, combined with weaker-than-expected inflation and labor data, heightened concerns over liquidity. This convergence of factors intensified selling pressure across risk assets, including crypto.

ETFs and regulation reshape the market landscape

While price action seemed bleak, significant positive developments occurred in the regulatory and ETF arenas. Canary Capital’s XRP ETF debuted with a record $58 million in trading volume, outperforming other ETFs launched in 2025.

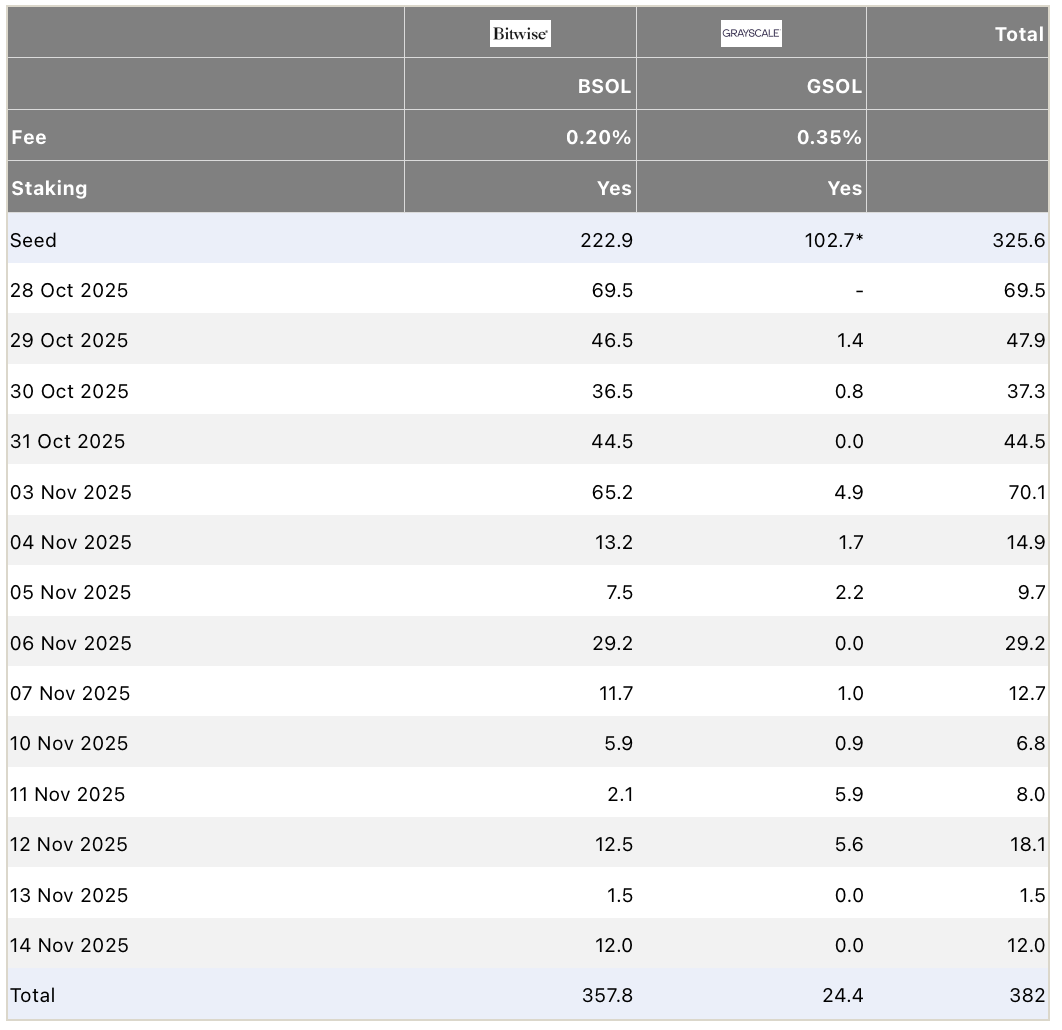

Solana ETF capital inflows also stood out, registering ten consecutive days of inflows totaling $342 million, signaling sustained investor appetite in certain altcoin ETFs despite bearish conditions elsewhere.

Capital flows in the Solana ETF US. Source: Farside Investors

Conversely, Ethereum ETFs faced outflows of $259 million during the same period, reflecting shifting preferences within the institutional investor community.

Meanwhile, experts weighed in on the evolving regulatory landscape. Jeff Park explained the benefits of transferring oversight from the Securities and Exchange Commission (SEC) to the Commodity Futures Trading Commission (CFTC), emphasizing the advantage of aligning commodity regulation with the international nature of cryptocurrencies.

Michael Selig garnered support at a Senate hearing for his nomination as CFTC chairman, a development that could expedite regulatory reforms.

In Russia, the Constitutional Court ruled that USDT is not a digital financial asset, introducing fresh legal uncertainty for stablecoins domestically. This contrasts with U.S. efforts to clarify market rules, including the release of a market structure bill designed to enhance oversight and investor protections.

Technological innovations and payment improvements

Technology developments also made headlines, interwoven with market dynamics. Microsoft publicly disclosed a significant privacy vulnerability — Whisper Leak, which enables AI to analyze encrypted conversations with over 98% accuracy.

This has sparked renewed concerns about privacy in the age of AI. Crypto analysts debated the defensive merits of SegWit wallets against looming quantum computing threats, with Gianluca Di Bella urging an immediate transition to post-quantum encryption standards.

On the payment front, innovations advanced rapidly. Square announced fee-free Bitcoin payments available to four million merchants across eight countries, enhancing real-world crypto utility.

Meanwhile, OKX integrated decentralized exchange (DEX) and centralized exchange (CEX) services into a single mobile app platform, a first-of-its-kind platform designed to unify crypto trading experiences.

Further altcoin highlights included Chainlink’s launch of new reward programs and a 24% surge in Zcash ahead of an impending supply halving, signaling continued diversification and investor interest beyond Bitcoin.

Large “whale” moves involving multimillion-dollar transfers of Bitcoin, Ethereum, and Chainlink pointed toward strategic accumulation, hinting at potential forthcoming market shifts.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: This Week in Crypto: The End of the US Shutdown Did Not Save Bitcoin from a 25% Correction