Strengthening of the crypto market

Bitcoin ended last week at a level below $100,000 amid a possible blockage of the Strait of Hormuz by Iran. However, on Monday, the asset began to gradually recover.

On Tuesday, the first cryptocurrency made a sharp jump, returning to levels above $105,000 amid US President Donald Trump’s statement on the prospects of ending the conflict in the Middle East.

By Wednesday, Bitcoin’s price increased to $108,000, but the coin traded in the $106,000–$108,000 range for the rest of the week.

On Sunday, Bitcoin attempted to break the upper boundary but reversed around $108,500. The coin is now trading around $107,900.

CoinDesk analyst Omkar Godbole believes that a rise above resistance at $109,000 will complete the bull flag formation and provide new highs.

In parallel, the first cryptocurrency’s dominance index increased to 62%. This reflects high investor interest in the asset and less involvement in altcoins.

Bitcoin rose 8.4% on a weekly basis, while Ethereum added almost 11%, trading around $2,450 at the time of writing. The slight divergence in asset performance is likely due to the depth of the past drawdown.

XRP added 11.9% in seven days amid the gradual conclusion of legal proceedings with the SEC. Solana rose 16.5%, while Dogecoin gained 10.5%.

Total market capitalization increased to $3.43 trillion. The Cryptocurrency Fear and Greed Index is at 68.

Fear & Greed Index. Source: Alternative

Positive from the Fed

On June 24, the head of the U.S. Federal Reserve, Jerome Powell, during a press conference, supported the development of bills on cryptocurrencies. According to him, the country needs a regulatory framework for stablecoins.

“It’s a good thing that these bills are moving forward. We do need a framework—particularly for stablecoins,'” he noted.

The statement comes amid the recent passage by Congress of the GENIUS Act, a bill that establishes rules for the issuance and circulation of stablecoins.

In addition, the Fed has decided to no longer consider “reputational risk” when examining banks. Before that, regulators used this factor against financial institutions that worked with the crypto industry.

“Banks are free to choose their customers, and they’re free to engage in transactions with cryptocurrencies, provided that they’re doing so in a safe and sound manner and in compliance with applicable laws and regulations,” the Fed chief added.

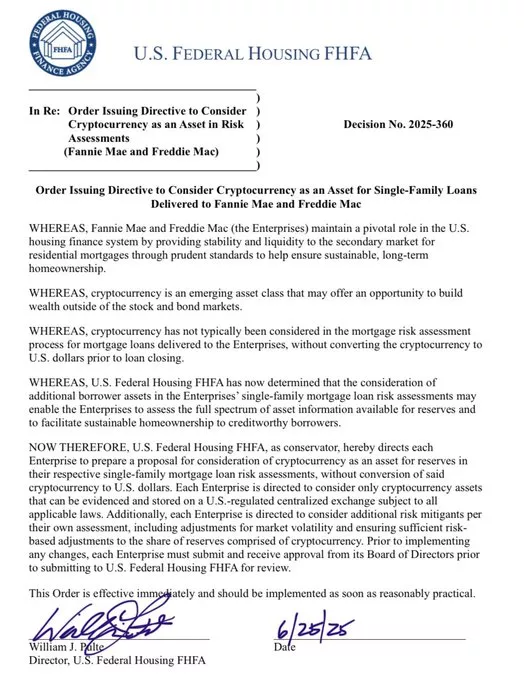

The day after Powell’s speech, on June 25, U.S. Federal Housing Finance Agency Chairman William Pulte asked mortgage giants Fannie Mae and Freddie Mac to explore the use of digital assets.

U.S. Federal Housing FHFA. Source: X

The organizations will prepare a proposal to take cryptocurrencies into account when assessing the risks of mortgage loans for individuals.

“This is in line with President Trump’s vision to make the U.S. the world’s crypto capital,” Pulte emphasized.

Falling complexity of mining

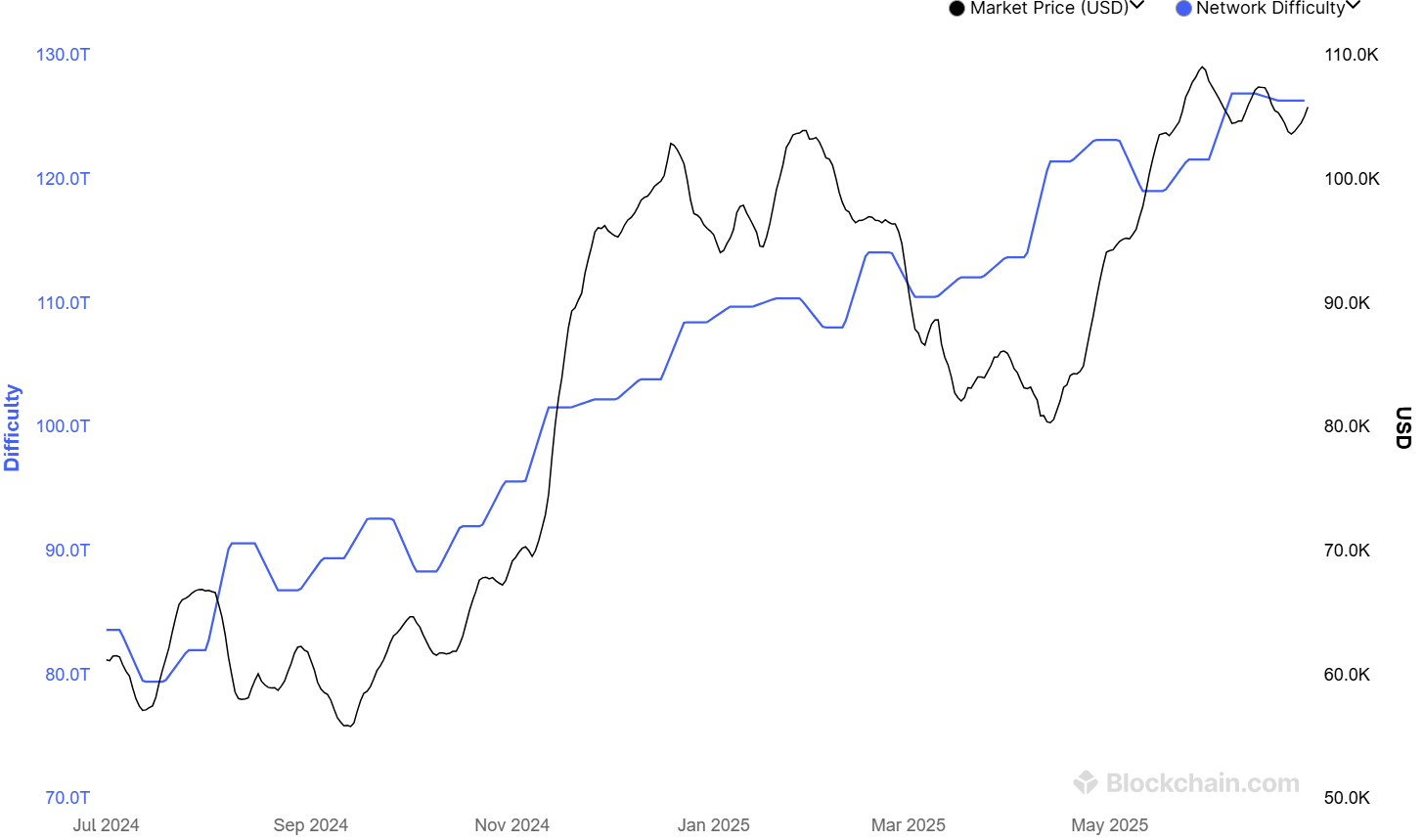

On June 29, the recalculation of Bitcoin’s mining difficulty adjusted it by 7.48% to 116.96T.

Source: Blockchain.com

The index fell for the second time in a row; the drop was the biggest in recent years.

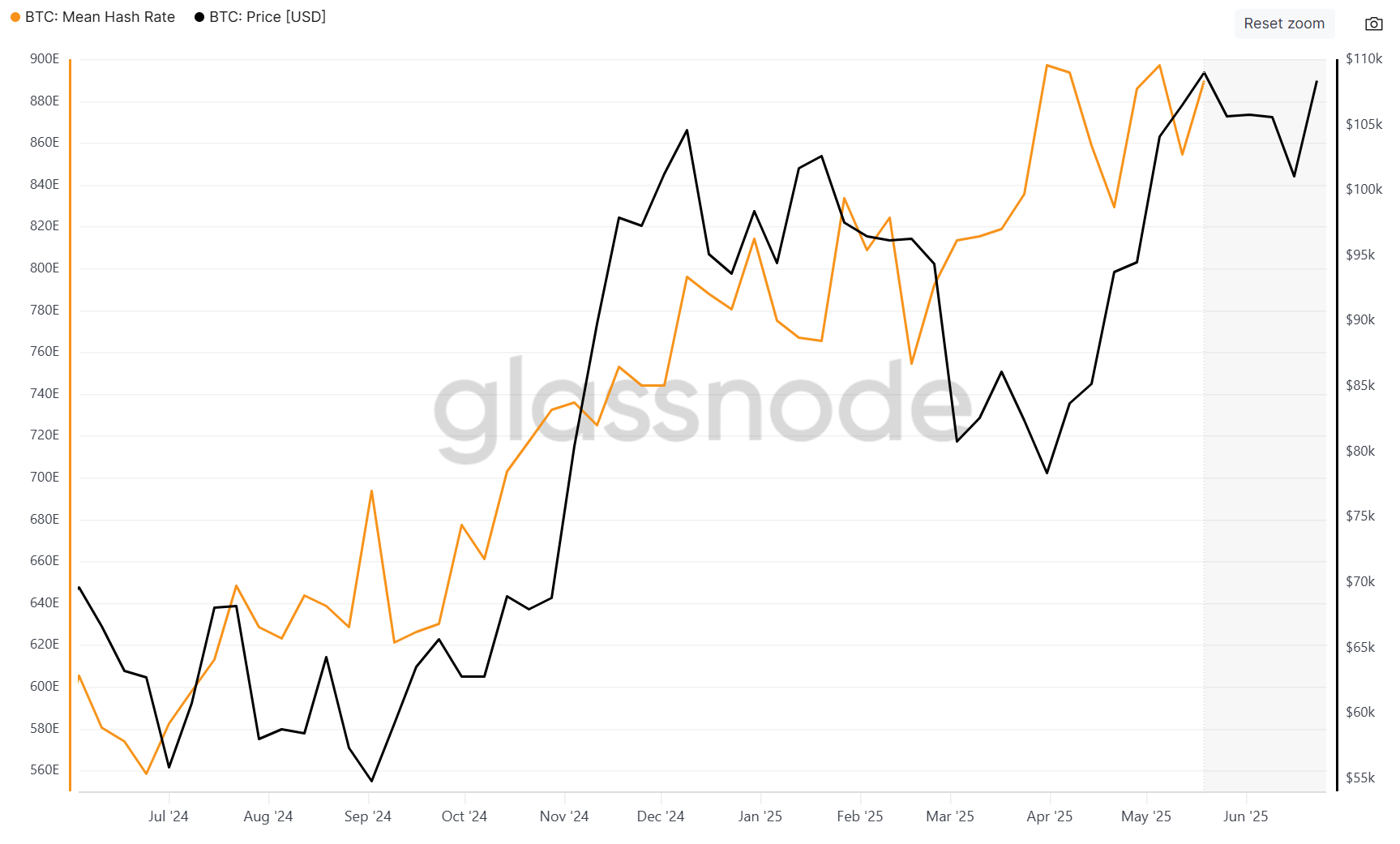

The seven-day moving average of hashrate collapsed to 799 EH/s from near-record highs.

BTC: Mean Hash Rate. Source: Glassnode

The hash price, on the other hand, increased from $53 to $58 per PH/s per day, returning to late May levels. This metric indicates a recovery in mining profitability.

Source: Hashrate Index

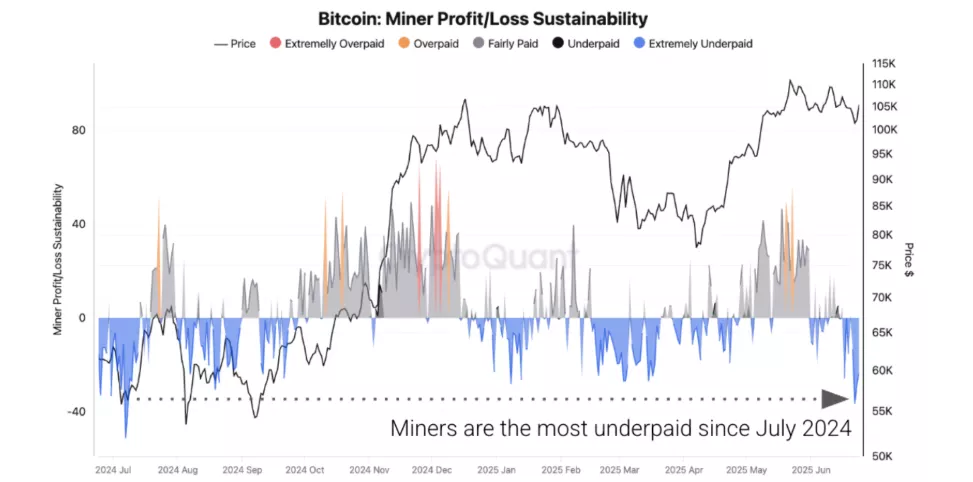

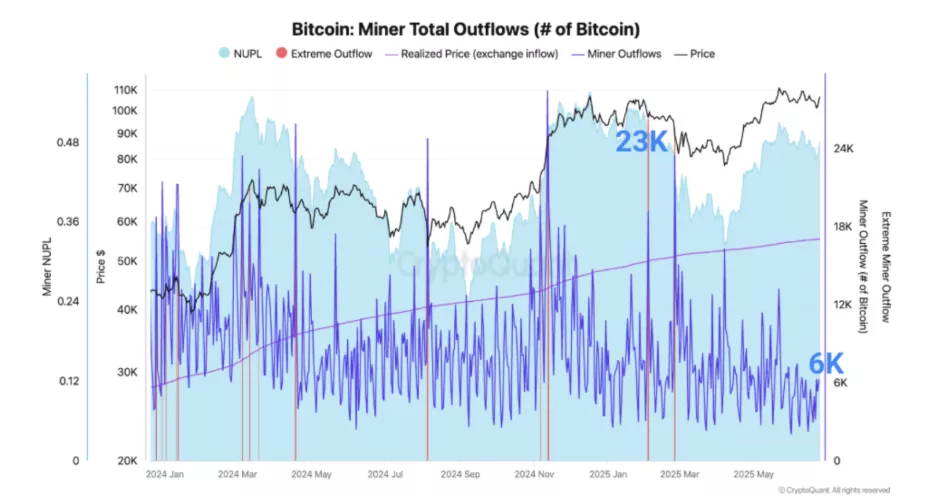

Also during the week, CryptoQuant analysts noted that miners of the first cryptocurrency have increased reserves by 4,000 BTC since April, despite declining revenues. At the same time, participants in the “Satoshi era” segment have shifted to hoarding.

According to their data, the daily revenue of miners fell to the lowest since April 20, 2025 ($34 million). The reason is a decrease in transaction fees and fluctuations in the price of the asset.

Sustainability of Bitcoin miners’ profit/loss. Source: CryptoQuant

Experts also noted that over the past 10 days, the network hashrate has decreased by 3.5%.

Despite the relatively difficult situation, miners are not selling coins. Outflows from their wallets have fallen from a peak of 23,000 BTC per day in February 2025 to around 6,000 BTC. Direct transfers of Bitcoins from miners to exchanges also remain low.

Total outflow of funds. Source: CryptoQuant

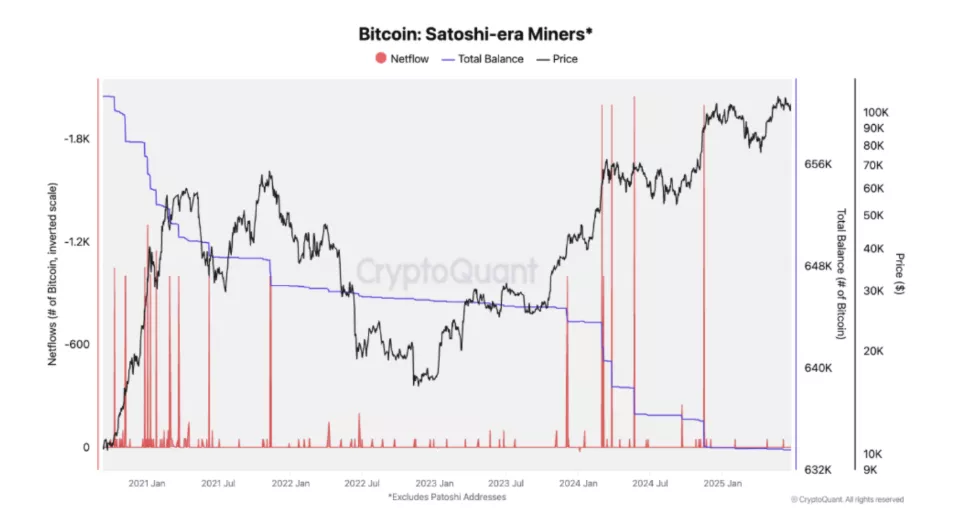

At the same time, players of the “Satoshi era” have minimized their sales. In 2025, they realized only 150 BTC. By comparison, in 2024 the figure was almost 10,000 BTC. Historically, “old” miners sold coins after a strong price increase, indicating a possible market top.

Net flows of “Satoshi era” miners. Source: CryptoQuant

However, not all participants are willing to put up with low returns. Nasdaq-listed miner Bit Digital intends to shift its focus from digital gold to staking and storing Ethereum.

The company is considering various options to change its strategy, up to completely stopping Bitcoin mining and selling assets. The proceeds are planned to be used for projects related to the second-largest cryptocurrency in terms of market capitalization.

Frontend hacking

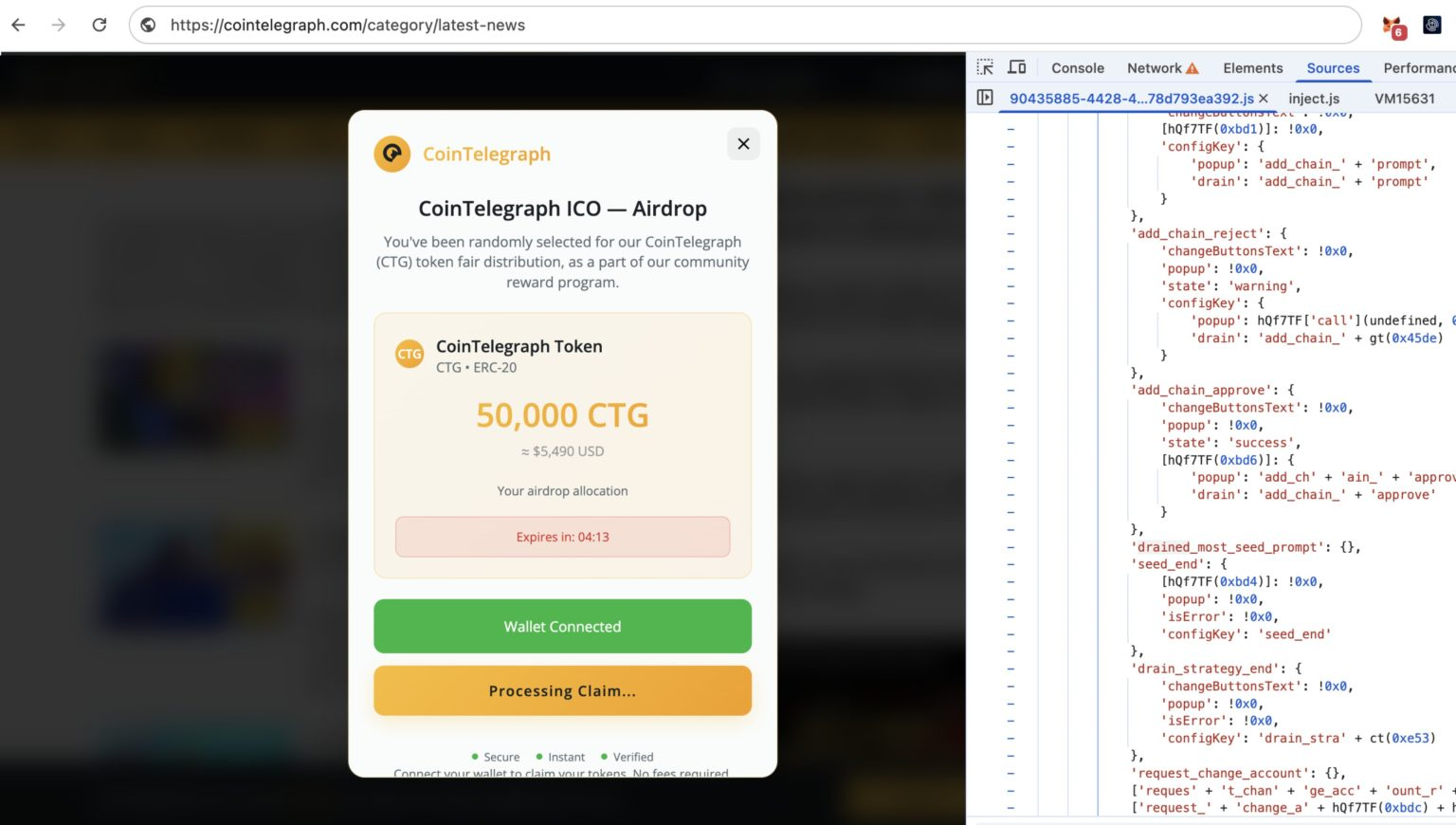

On June 23, the frontend of crypto publication Cointelegraph’s website came under attack. Attackers injected malicious code that displayed a phishing window offering a fake airdrop.

The hackers tried to convince users to connect crypto wallets to receive $5,500 worth of CTG tokens. To be convincing, the scammers mentioned “fair launch” and “audit from CertiK”.

🚨 ALERT: We are aware of a fraudulent pop-up falsely claiming to offer “CoinTelegraph ICO Airdrops” or “CTG tokens” that are appearing on our site.

DO NOT:

– Click on these pop-ups

– Connect your wallets

– Enter any personal informationWe are actively working on a fix.

— Cointelegraph (@Cointelegraph) June 23, 2025

Cointelegraph representatives confirmed the incident, urging people not to click on pop-ups or enter personal information.

The attack is similar to a recent incident on aggregator site CoinMarketCap. On June 20, criminals used a similar phishing scheme.

During the week, it also became known that hackers attacked Trezor customers via the contact support form on the official website.

The attackers sent requests to tech support on behalf of users. This triggered an automated response from Trezor to the customers’ email. The scammers would then send a phishing email that looked like a continuation of the correspondence.

The hardware wallet maker’s team reminded that the seed phrase should not be shared with anyone, and employees never ask for personal data.

According to a report by TRM Labs, the crypto industry’s losses due to hackers for the first half of 2025 totaled $2.1 billion.

Attacks on infrastructure (over 80% of losses) included theft of private keys, seed phrases, and frontend spoofing. Often, attackers used social engineering or insiders.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: This Week in Crypto: Bitcoin Recovers to $108,000 as Fed Chair Backs Crypto Regulation