Bitcoin reached a new all-time high (ATH) near $123,000 this week, while US President Donald Trump signed the country’s first significant stablecoin regulation into law. Here are the week’s major crypto developments:

Bitcoin hits record, altcoins catch up

Bitcoin began the week with rapid growth, breaking through the $120,000 level and reaching a record $122,838 on Monday, July 14.

Analysts attributed the rally to increased institutional demand, macroeconomic factors, and optimism about the United States’ “crypto week.”

However, Bitcoin’s price retreated after US consumer inflation data was released, dropping below $116,000. After recovering and stabilizing, BTC traded sideways to finish the week above $118,000.

On July 17, Ethereum surged nearly 9% overnight to $3,452—its highest since January. The move was driven by record inflows into spot ETFs tracking Ethereum, the world’s second-largest cryptocurrency by market capitalization.

Total Ethereum Spot ETF Net Inflow. Source: CoinGlass

Altcoins generally outperformed Bitcoin this week. Price gains included Dogecoin (+25.8%), XRP (+24.2%), Solana (+11%), and BNB (+7.8%). While Bitcoin’s price was little changed for the period, its market dominance slipped to 59%.

Overall crypto market capitalization approached $4 trillion, prompting some analysts to declare the start of “altcoin season.”

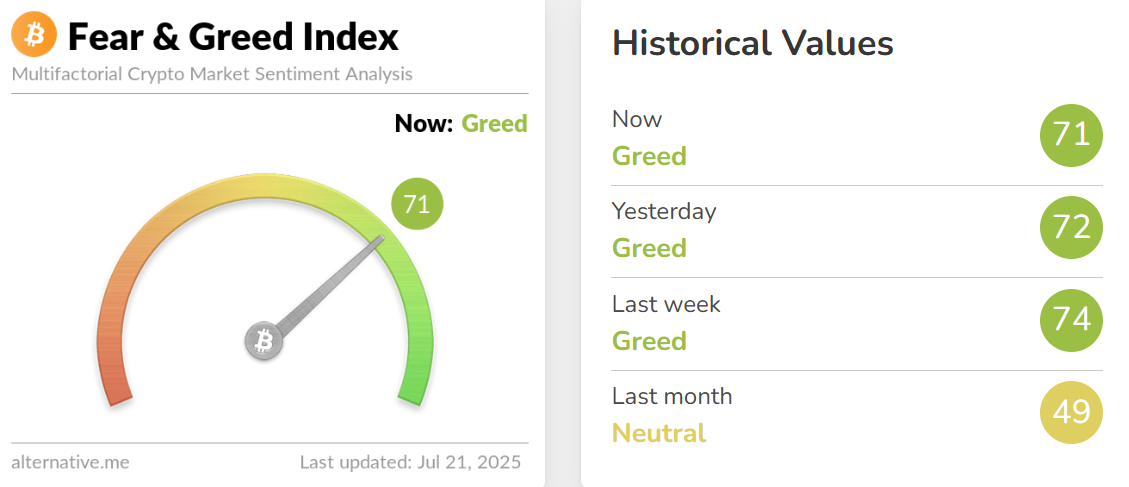

The Cryptocurrency Fear and Greed Index held steady in the “greed” zone at 71.

Fear&Greed index. Source: alternative.me

Trump signs GENIUS Act: First major US Stablecoin law

On July 18, President Donald Trump signed the GENIUS Act, the country’s first major law regulating stablecoins.

“I pledged that we would bring back American liberty and leadership and make the U.S. the crypto capital of the world… The Genius Act creates a clear and simple regulatory framework to establish and unleash the immense promise of dollar-backed stablecoins.” –President Trump pic.twitter.com/F46visJFi8

— The White House (@WhiteHouse) July 18, 2025

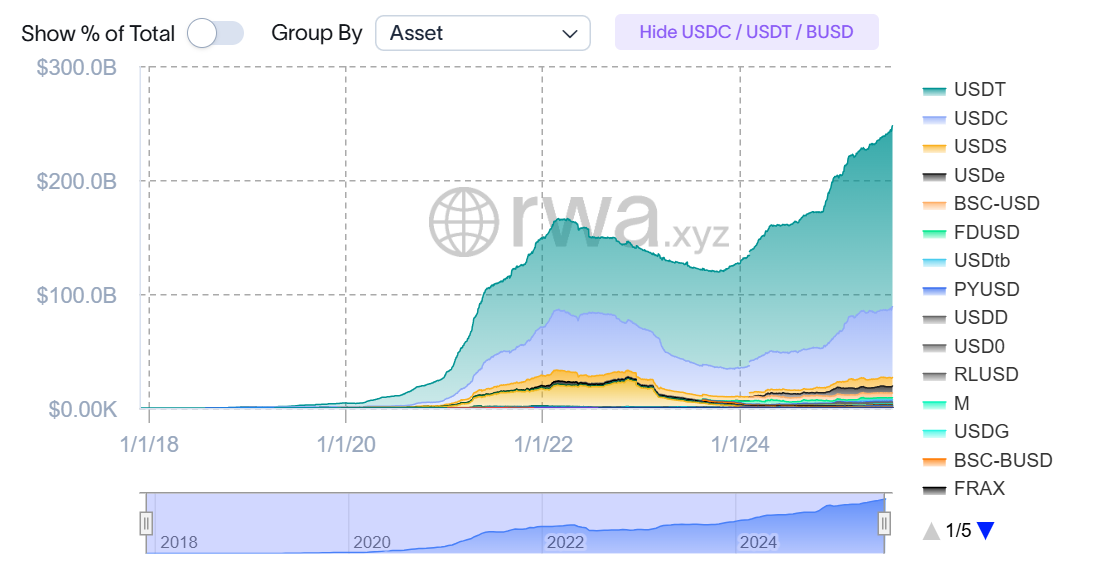

The act sets requirements for fully backing stablecoins with liquid assets and mandates annual audits for issuers with a market capitalization above $50 billion. It prohibits paying interest to stablecoin holders and sets rules for foreign companies entering the US market.

The law goes into effect six months after regulators issue the necessary rules. Trump called it “a clear and simple regulatory framework to unlock the potential of dollar-backed stablecoins.”

Stablecoin Metrics: Market Cap. Source: rwa.xyz

Industry figures attending the signing included Gemini’s Cameron and Tyler Winklevoss, Robinhood CEO Vladimir Tenev, Circle CEO Jeremy Allaire, and Tether head Paolo Ardoino.

President Donald Trump holds up the GENIUS Act. Source: AP Photo/Alex Brandon

Tether intends to comply with the GENIUS Act and bring USDT to the US market within three years, possibly launching a special version of its stablecoin for US and institutional investors. Circle’s CEO noted his company has long operated under similar standards, now formalized by law.

Developers propose quantum resistance plan for Bitcoin network

A group of developers has proposed a way to protect the Bitcoin network from potential quantum computer attacks. Casa Chief Technology Officer (CTO) Jameson Lopp published the proposal on GitHub.

“Quantum attackers could compute the private key for known public keys then transfer all funds weeks or months later, in a covert bleed to not alert chain watchers. Q-Day may be only known much later if the attack withholds broadcasting transactions in order to postpone revealing their capabilities,” Lopp explained.

The core of the proposal is to migrate user funds to quantum-resistant addresses and block the use of older, vulnerable addresses. According to the developers, frozen funds could be recovered. This process would require the creation of a separate Bitcoin Improvement Proposal (BIP).

They referenced BIP 360, developed by Anduro protocol engineer Hunter Beast, which suggests a hard fork to introduce addresses using post-quantum cryptography. Analysts at Deloitte warn that 25% of all Bitcoins, including over a million coins belonging to Satoshi Nakamoto, are at risk from potential quantum attacks.

“Never before has Bitcoin faced an existential threat to its cryptographic primitives. A successful quantum attack on Bitcoin would result in significant economic disruption and damage across the entire ecosystem.”

Previously, Lopp argued that attempts to recover access to lost coins would undermine Bitcoin’s core values, like censorship resistance and transaction immutability. The quantum threat has also been independently studied by researchers at Chaincode Labs.

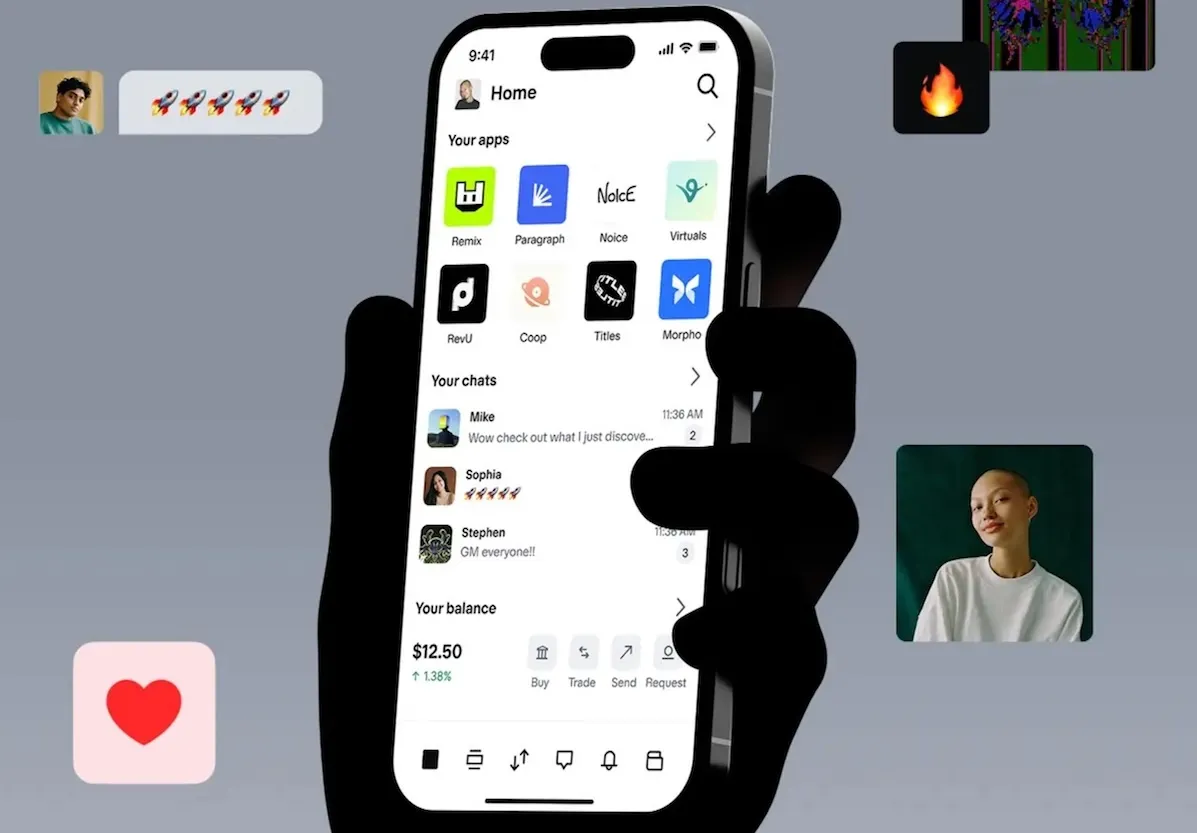

Coinbase launches base app: All-in-One crypto platform

Major US cryptocurrency exchange Coinbase has rebranded its eponymous wallet to Base App. The app combines social networking, mini-apps, chat, payments, and trading.

The next chapter of @base is here.https://t.co/dCnguVlyDr

— Coinbase 🛡️ (@coinbase) July 16, 2025

The company calls this a new chapter for the Base ecosystem. The platform now consists of:

- Base Chain

- Base Build developer toolkit

- Base App consumer application

Coinbase has rebranded its app to “Base App”. Source: Coinbase

The app features a social feed on the Farcaster protocol, allowing users to tokenize posts via Zora, receive tips and weekly rewards for activity, track friends’ trades, and exchange tokens directly within the feed.

Base App has built-in mini-apps, from games to prediction markets. It supports one-tap USDC payments via NFC and encrypted messages with the XMTP protocol.

When registering, users receive a Base Account—a smart wallet that works across different apps and networks.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: This Week in Crypto: Bitcoin Hits New ATH Above $122,000 and Trump Signs Stablecoin Bill into Law