Bitcoin crash sparks $900B selloff as gold soars past $4,000

The largest cryptocurrency collapse in history

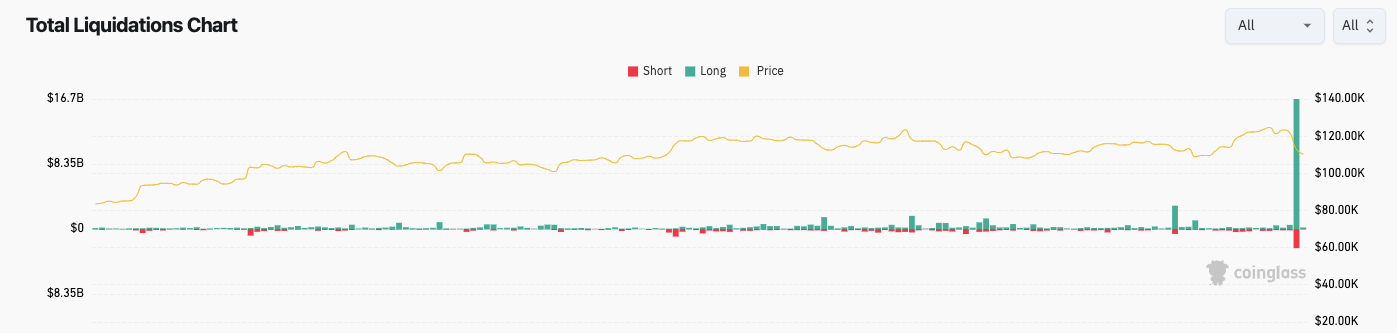

The crypto market has experienced its largest-ever crash, sending shockwaves across global finance. On October 10, forced liquidations reached $19.31 billion — more than ten times the losses seen during the COVID-19 crash and the FTX bankruptcy.

Crypto liquidations (screenshot). Source: CoinGlass

Bitcoin dropped from its all-time high of $126,272 to $102,173 on October 7, a 19% fall. The total crypto market capitalization plunged by $900 billion in a single day, with $500 billion erased in just ten minutes.

Why did the crash happen

The immediate trigger was Donald Trump’s announcement of a 100% tariff on all Chinese goods starting November 1, in retaliation for Beijing’s new export limits on rare earth minerals.

Source: Truth Social

Analysts at Santiment noted that retail investors rushed to blame geopolitics, but the real cause was excessive leverage. According to The Kobeissi Letter, around $16.7 billion in long positions were liquidated against $2.5 billion in shorts — a 7-to-1 imbalance.

Source: Santiment

Technical issues worsened the chaos: exchanges froze, market makers pulled liquidity, and some altcoins briefly hit zero. Binance acknowledged issues with Ethena’s USDe stablecoin, which fell to $0.66 instead of holding its $1 peg.

Co-founder Yi He apologized and pledged user compensation. Meanwhile, Crypto.com CEO Kris Marszalek urged regulators to probe exchanges with the largest liquidations.

Source: X

Despite the bloodbath, some experts see a setup for recovery. Trader Alex Becker called the sell-off “a massive overreaction,” and the Fear & Greed Index dropped to 24 (“Extreme Fear”), a level that often precedes rebounds.

Institutional momentum and ETF inflows continue

Record ETF activity before the crash

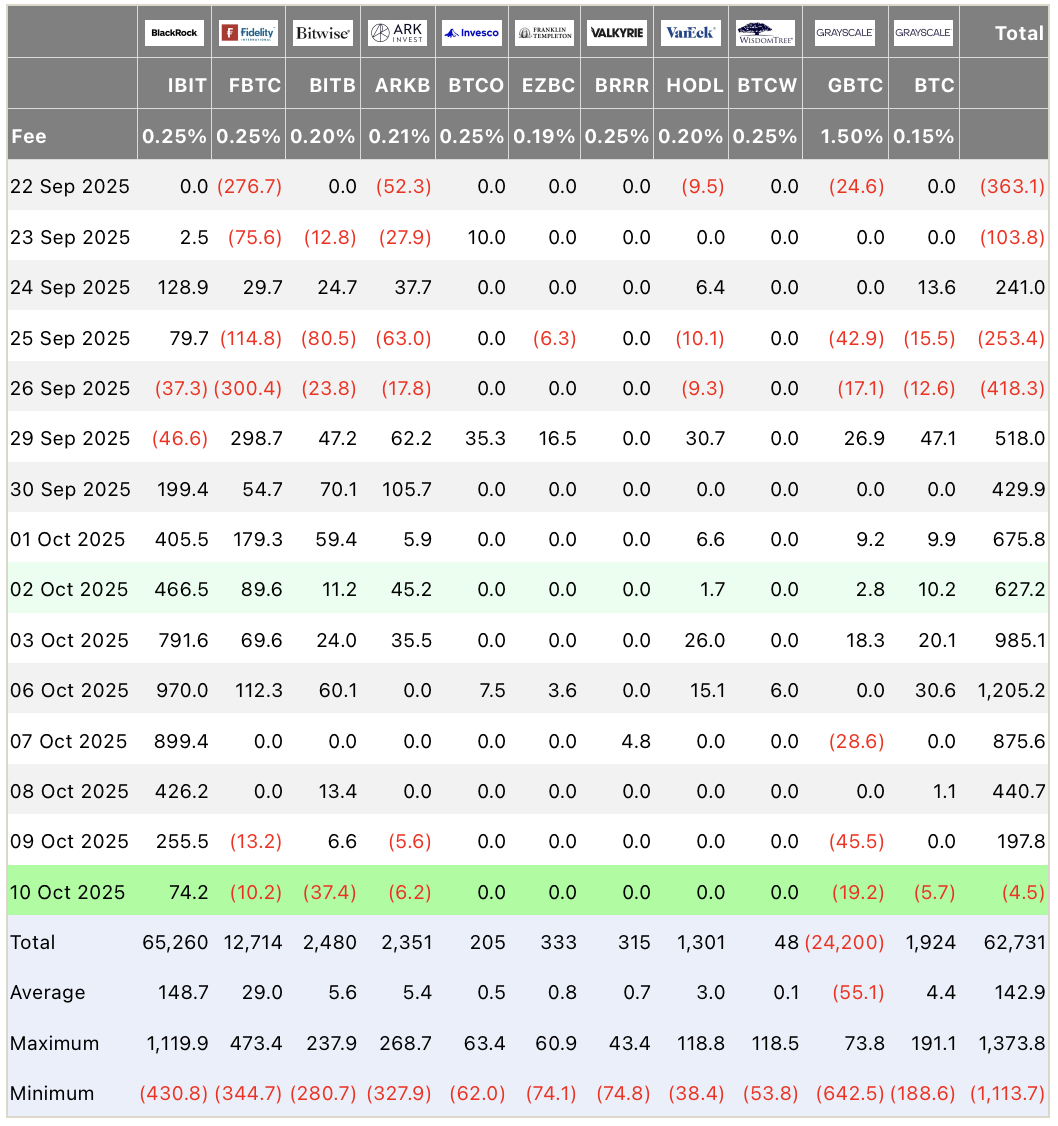

Just days before the collapse, Bitcoin ETFs saw record inflows. Between October 6 and 10, U.S. funds attracted $2.71 billion, including $1.18 billion in a single day — the second-largest daily inflow ever. BlackRock contributed nearly $1 billion of that sum.

Capital flows into US Bitcoin ETFs. Source: Farside Investors

Total assets under management for spot Bitcoin ETFs reached $158.96 billion, about 7% of Bitcoin’s market cap.

Globally, crypto investment products hit a new weekly record with $5.95 billion in inflows, 35% higher than the previous peak. Bitcoin-focused products alone drew $3.6 billion, fueled by optimism around the Fed’s rate cuts and U.S. fiscal concerns.

Ethereum joins the momentum

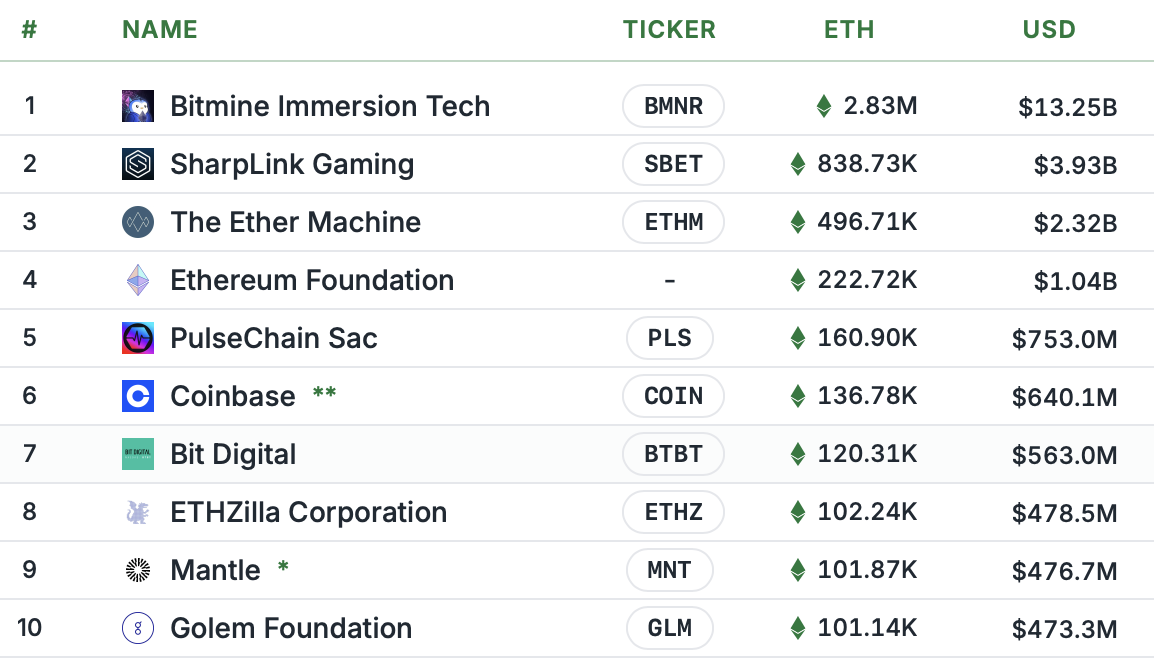

Ethereum products also shone, attracting $1.48 billion and lifting yearly inflows to a record $13.7 billion. Funds and companies now hold over 12.48 million ETH, roughly 10% of Ethereum’s total supply.

Top 10 Corporate Ethereum Holders. Source: Strategic ETH Reserve

Institutional expansion

BlackRock’s IBIT fund is on track to reach $100 billion AUM in less than 450 days — far faster than any previous ETF milestone. Only 18 ETFs worldwide have surpassed that figure.

Gold breaks $4,000 as safe-haven demand soars

For the first time in history, gold surpassed $4,000 per ounce, pushing its market cap to about $27 trillion. Adjusted for inflation, this price finally beats the 1980 record of $850.

Source: TradingView

Deutsche Bank reports that central banks now hold 24% of reserves in gold, the highest since the 1990s.

VanEck analysts estimate that if Bitcoin mirrored gold’s performance, its price would equal $644,000. Research head Matthew Sigel predicts Bitcoin could reach half of gold’s market cap by 2028, as younger investors adopt it as a store of value.

We’ve been saying Bitcoin should reach half of gold’s market cap after the next halving. Roughly half of gold’s value reflects its use as a store of value rather than industrial or jewelry demand, and surveys show younger consumers in emerging markets increasingly prefer Bitcoin…

— matthew sigel, recovering CFA (@matthew_sigel) October 7, 2025

Meanwhile, Peter Schiff noted Bitcoin remains 15% below its all-time high in gold terms, requiring a rise to about $148,000 to match it.

Stablecoins and regulatory shifts

Banks enter the stablecoin arena

Major institutions — Bank of America, Goldman Sachs, Deutsche Bank, and Citi are developing fiat-backed stablecoins pegged to G7 currencies. Fully backed 1:1 by the dollar, euro, or yen, these assets will operate on public blockchains, directly competing with Tether’s $178-billion USDT.

The state of North Dakota plans to launch its own Roughrider Coin in 2026 with payments giant Fiserv.

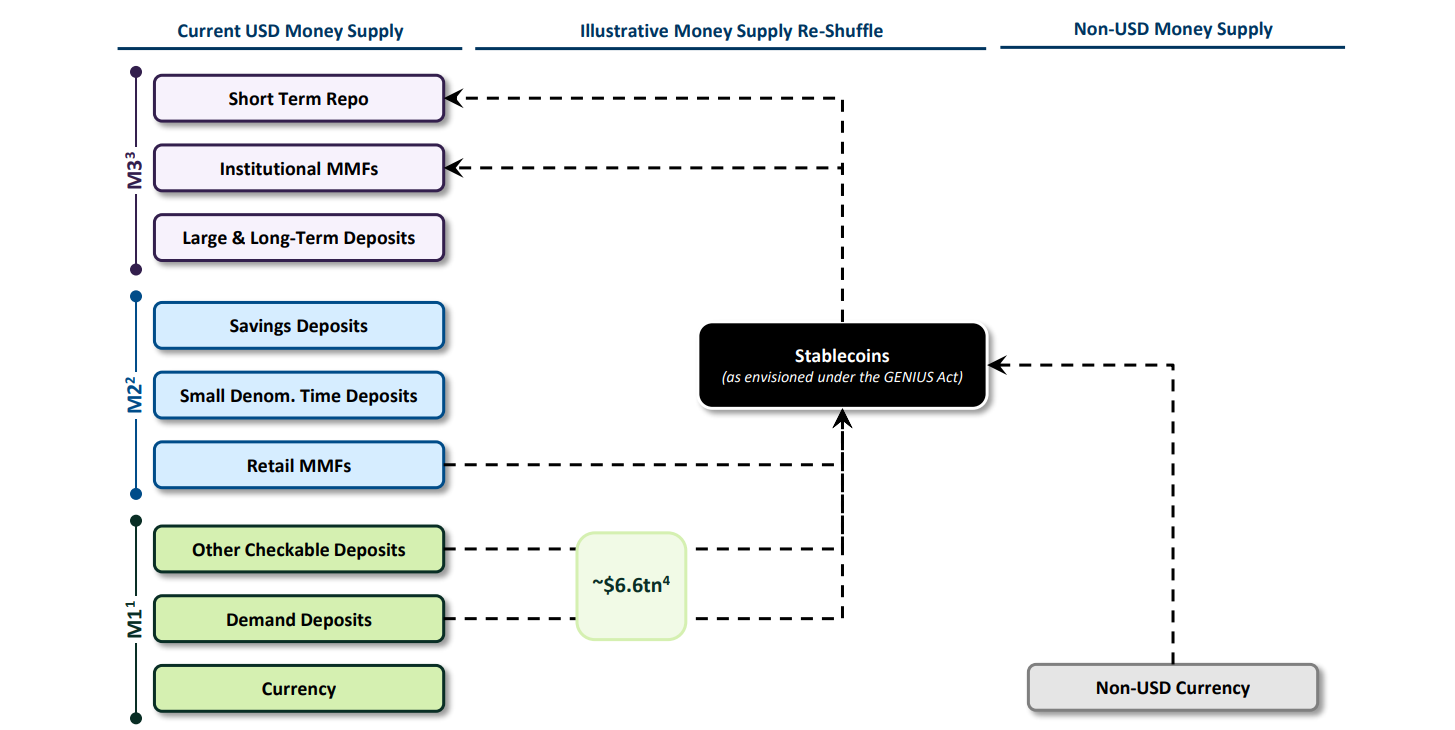

The GENIUS Act, signed by President Trump in July, could trigger a $6.6-trillion deposit outflow from banks into high-yield stablecoins, according to the U.S. Treasury. With savings accounts offering 0.4% interest and Tether or USDC yielding over 3.5% on DeFi platforms, the shift could be seismic.

Source: U.S. Treasury

Global reactions

The EU is preparing to sanction A7A5, a ruble-pegged stablecoin with a $500-million cap — 43% of all non-dollar stablecoins.

Corporate and government crypto strategies

Institutional accumulation

Strategy, which holds 640,031 BTC, now rivals the cash reserves of giants like Amazon and Google. Its Bitcoin holdings briefly exceeded $80 billion in value. CEO Michael Saylor joked, “No new orange dots this week — just a $9 billion reminder of why we HODL.”

Source: X

The Luxembourg Sovereign Wealth Fund allocated 1% of its portfolio ($9 million) to a Bitcoin ETF, calling it “a signal of long-term belief.”

In the U.S., Senator Cynthia Lummis confirmed that the national Bitcoin reserve project is delayed only by legislative hurdles.

Technology and regulation cross paths

Telegram founder Pavel Durov warned that global governments are eroding privacy through digital ID systems and content surveillance. Similarly, Signal president Meredith Whittaker urged resistance to “chat control” laws that threaten free communication.

I’m turning 41, but I don’t feel like celebrating.

Our generation is running out of time to save the free Internet built for us by our fathers.

What was once the promise of the free exchange of information is being turned into the ultimate tool of control.

Once-free countries…

— Pavel Durov (@durov) October 9, 2025

A group of U.S. Democratic senators introduced a controversial bill targeting DeFi protocols, proposing blacklists and KYC for non-custodial wallets. Legal expert Jake Chervinsky called it “an unconstitutional takeover.”

Meanwhile, Elon Musk announced Grokipedia, an AI-powered Wikipedia alternative from xAI, launching in two weeks. Musk claims it will counter “lies and bias” in existing platforms.

Market outlook

The historic crash exposed the dangers of leverage but underscored institutional resilience — ETF inflows continued even amid chaos. Gold’s record high highlights renewed demand for safe havens, while banks and regulators race to define the future of digital finance.

With fear at extreme levels and liquidity reshaping, the next crypto chapter may already be forming beneath the panic.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: This Week in Crypto: Bitcoin Crash Sparks $900B Selloff as Gold Soars Past $4,000