Bitcoin sets a new record as ETFs surge, perp-DEX volume crosses $1 trillion, and Poland advances tighter rules.

Uptober is underway

Bitcoin gathered momentum in October after a late-September lull, briefly trading below $110,000 before accelerating toward new highs as sentiment turned risk-on.

On Oct. 5, a new all-time high was printed at $125,708, followed by a cooldown to $123,300, placing the total market cap near $2.45 trillion and weekly gains at 13%.

Macros and flows helped: the U.S. government shutdown set the tone, while Bitcoin spot ETFs logged $3.24 billion of weekly inflows.

Source: SoSoValue

Ethereum funds added $1.3 billion as ether tested $4,600 and now trades near $4,500, about 8% below its peak.

BNB joined the records above $1,110; total crypto value surpassed $4.3 trillion, with BTC dominance at 57% and ETH at 12.7%, as the Crypto Fear and Greed Index jumped to 74 from 34.

Perp-DEX momentum

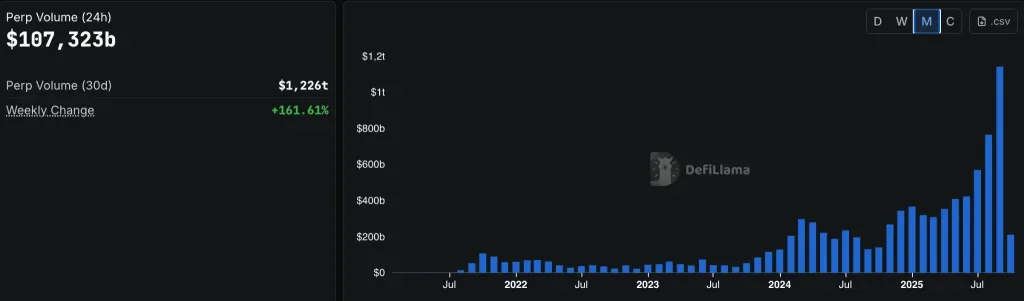

Perpetual-futures DEX volume exceeded $1 trillion in September for the first time, signaling a hotly contested field among leading platforms.

Source: DeFiLlama

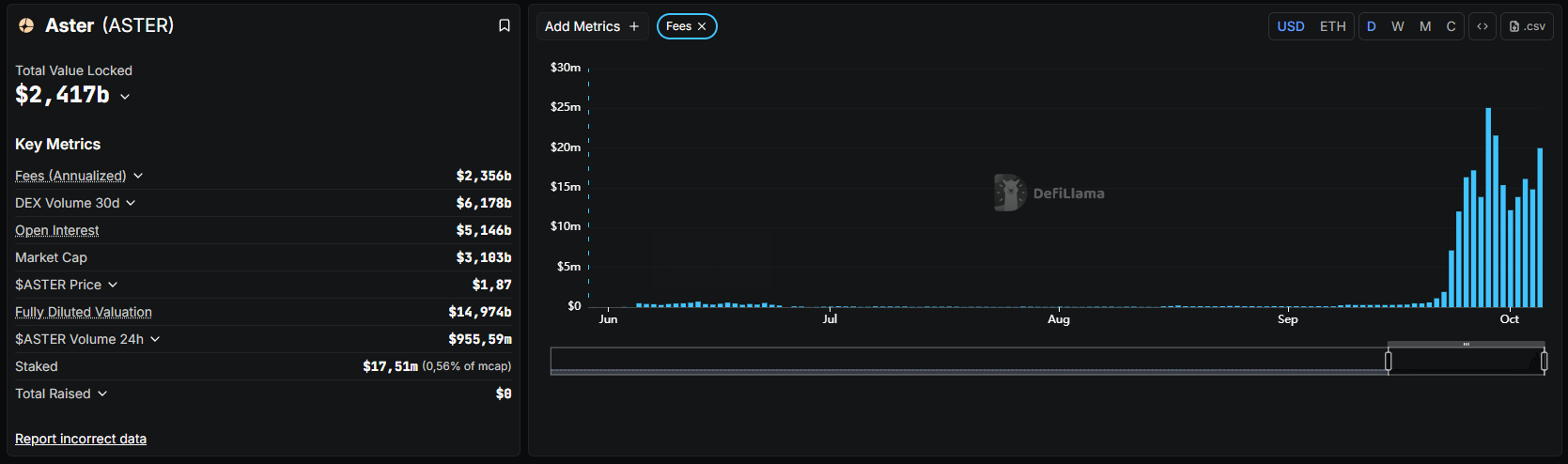

Aster led with $493 billion, followed by Hyperliquid at $280 billion and Lighter at $165 billion, as Aster’s TVL hovered near $2.41 billion.

Source: DeFiLlama

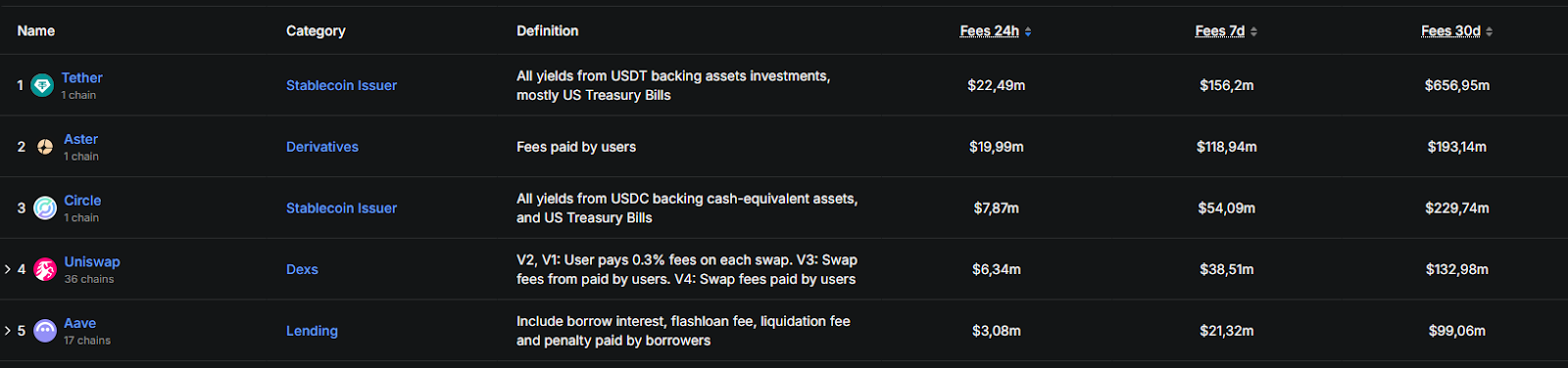

And topped protocol fees at $29 million on Sept. 28 before slipping to second over the last 30 days at $193 million:

Source: DeFiLlama

Lighter announced its full Layer-2 launch after eight months of beta, with a token generation event due by year-end, while analyst Patrick Scott called Hyperliquid the most investable despite share declining from 45% to 8% on the back of a resilient model and a market-cap-to-revenue ratio of 12.6.

SEC priorities

At a joint roundtable, SEC Chair Paul Atkins labeled crypto regulation the agency’s number-one task and stressed seamless coordination with the CFTC on oversight and jurisdiction.

“We must work in unison. The main thing is to create a system where our agencies will seamlessly coordinate their actions,” said Atkins.

The SEC reiterated securities oversight, while the CFTC covers most commodity-like tokens; Atkins highlighted tokenization’s potential and estimated up to two years to finalize rules.

In a letter to DoubleZero, the SEC excluded DePIN tokens from its oversight in this context, indicating the 2Z token would not require securities registration, a move the project framed as evidence of productive regulator–builder dialogue.

Kazakhstan’s AI push

Telegram founder Pavel Durov announced a new AI lab in Kazakhstan at Digital Bridge 2025, aiming to deliver private, transparent, and efficient AI features to over a billion users, beginning with tests in Telegram mini-apps.

Durov and Kazakhstan’s president at the forum. Source: Aqorda

“A year ago, we opened our first regional office in Kazakhstan and are very pleased with the results. I am delighted to announce that today we are launching a dedicated artificial intelligence laboratory in the Alem.ai building,” the entrepreneur said.

President Kassym-Jomart Tokayev discussed collaboration on education, AI, and cybersecurity, later meeting Changpeng Zhao to talk licensing, industry development, and potentially adding BNB to reserves as the KZTx stablecoin was unveiled without details.

Zhao and Tokayev. Source: X

Poland moves on with licensing

Poland’s Sejm approved the Crypto-Asset Market Act and sent it to the Senate, appointing the KNF as primary supervisor and aligning licensing with MiCA for service providers.

Applicants must disclose corporate structure, prove capital adequacy, and detail internal controls, compliance, risk management, and AML; penalties for operating without a license include up to two years in prison and fines up to 10 million zloty, with a six-month transition period after adoption.

Critics called the bill overregulation that threatens 3 million investors and pointed to lengthy KNF processing times as a structural concern.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: This Week in Crypto: Bitcoin Breaks Records As ETFs Surge And Perp-DEX Volume Hits $1 Trillion