Key highlights:

- Strategy purchased 1,229 Bitcoin in late December, bringing its total holdings to 672,497 BTC and reinforcing its position as the world’s largest corporate holder.

- The acquisition was funded through a public share offering and reflects the company’s continued long-term Bitcoin accumulation strategy.

- Corporate adoption of Bitcoin continues to grow, with nearly 200 public companies now holding more than 1 million BTC combined.

Strategy has added another major Bitcoin purchase to its balance sheet, continuing its aggressive accumulation strategy as 2025 approaches. Between December 22 and 28, the company acquired 1,229 bitcoins for approximately $108 million, bringing its total holdings to 672,497 BTC.

Strategy has acquired 1,229 BTC for ~$108.8 million at ~$88,568 per bitcoin and has achieved BTC Yield of 23.2% YTD 2025. As of 12/28/2025, we hodl 672,497 $BTC acquired for ~$50.44 billion at ~$74,997 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/UGvjHj5WPg

— Strategy (@Strategy) December 29, 2025

The average purchase price for the transaction was $74,997 per bitcoin, according to regulatory filings submitted Monday to the U.S. Securities and Exchange Commission (SEC). The acquisition was financed through a public offering of company shares, a funding method Strategy has repeatedly used to expand its Bitcoin reserves.

Record-breaking year for Bitcoin accumulation

2025 has been Strategy’s most active year of Bitcoin buying to date. The December transaction, while sizable, was among the company’s smaller purchases this year.

Source: Strategy.com

The firm’s largest acquisition took place on March 31, when it bought 22,049 BTC for $1.92 billion. Additional major purchases followed:

- July 29: 21,021 BTC for $2.46 billion

- February 24: 20,356 BTC for $1.99 billion

In total, Strategy executed 41 Bitcoin purchases in 2025, more than double the number made in 2024 and far above the eight purchases recorded in 2023. The company ended last year holding 447,470 BTC, highlighting the scale of its recent expansion.

A long-term bet on Bitcoin

Under the leadership of co-founder and Executive Chairman Michael Saylor, Strategy began accumulating Bitcoin in 2020 and has since become the largest corporate holder of the digital asset worldwide. The company now holds more Bitcoin than any other publicly traded firm by a wide margin.

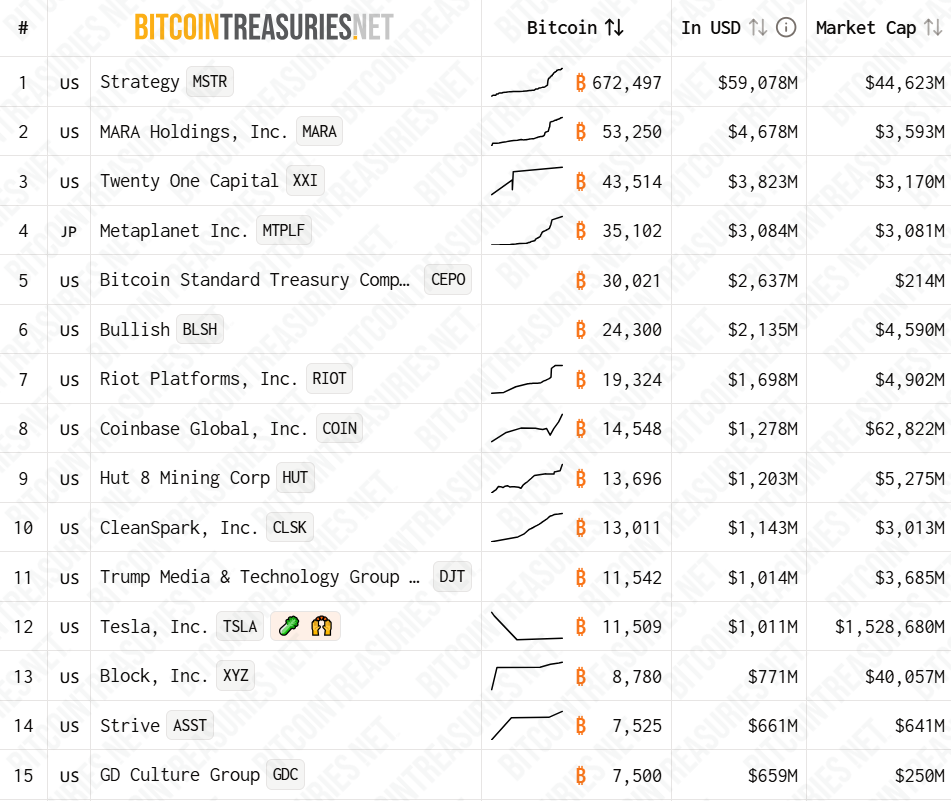

Publicly Traded Bitcoin Treasury Companies. Source: Bitcoin Treasuries

Strategy funds its Bitcoin acquisitions primarily through public equity offerings. Since December 22 alone, it has sold 663,450 Class A shares, generating approximately $108.8 million in net proceeds.

The company reports an annualized Bitcoin yield of 23.2%, a proprietary metric it uses to track growth in Bitcoin per share.

Corporate Bitcoin holdings continue to rise

Strategy’s aggressive strategy reflects a broader trend across public markets. Currently, 192 public companies collectively hold more than 1.08 million bitcoins. The majority are based in the United States, followed by Canada, the United Kingdom, and Japan.

Several firms have followed Strategy’s lead:

- Twenty One Capital: over 43,500 BTC

- Bullish: approximately 24,300 BTC

- Bitcoin Standard Treasury Company: about 30,021 BTC

- Trump Media & Technology Group: 11,542 BTC

- GD Culture Group: roughly 7,500 BTC

As institutional interest grows, corporate Bitcoin holdings now exceed those of governments, private firms, and DeFi protocols combined.

Source:: Strategy Closed Out Its Most Active Bitcoin Buying Year By Adding $108M in Bitcoin to Its Holdings