Elon Musk is best known as the CEO of Tesla, an electric vehicle, technology and clean energy company that has reached a valuation of over $1.5 trillion. However, the billionaire entrepreneur’s massive wealth also comes from other endeavours, perhaps most notably SpaceX.

SpaceX is a private company founded in 2002 that operates in the aerospace sector. The company, which is best known for its innovations in rocket technology and the Starlink satellite internet system, could be preparing for an initial public offering, which would allow everyday investors to purchase SpaceX stock.

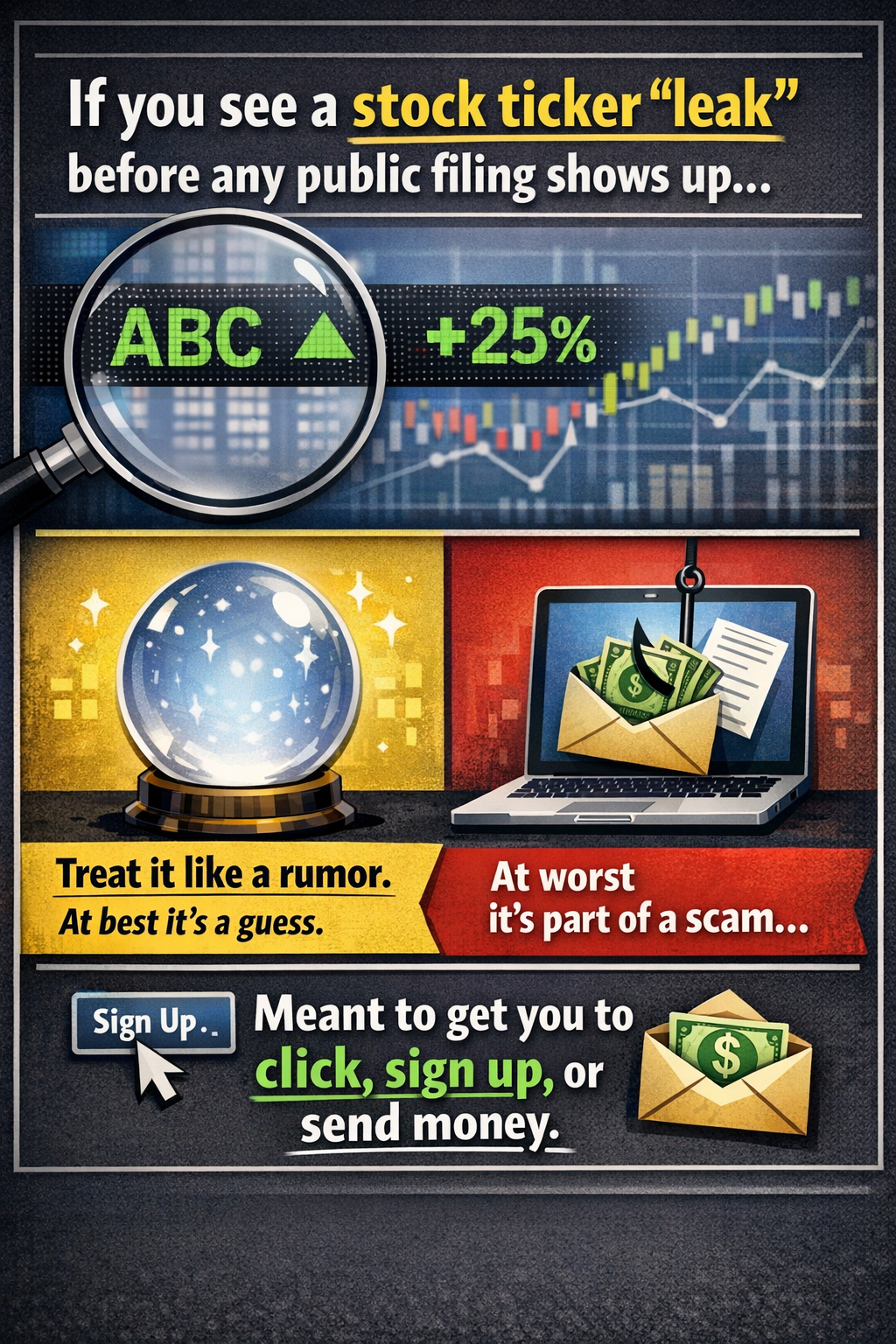

If you’ve searched for the SpaceX IPO date or the SpaceX stock ticker lately, you’ve probably seen everything from confident predictions to sketchy “buy now” ads.

Credible reporting says SpaceX has started more formal IPO planning, with press timelines floating 2026 (or later) as a possible window.

I’ll break down what’s confirmed, what’s still rumor, what would make an IPO “official,” and how you can track real updates (plus safer ways to get space-sector exposure without chasing hype).

Let’s get started!

SpaceX IPO date and stock ticker: What we know right now

I want to make facts clear, because SpaceX going public headlines often skip the boring parts that actually matter.

Here’s what’s confirmed as of December 2025:

- SpaceX has not completed an IPO. It’s still a privately held company.

- SpaceX has not announced an IPO date. There’s no official timeline from the company that locks in a month, quarter, or year.

- SpaceX has not announced a stock ticker. No ticker is “reserved” for you to trade on a normal brokerage app today.

- There is no public SEC registration statement (like an S-1) reported. If it’s not filed and public, it’s not an IPO in motion that regular investors can act on.

What credible reports suggest (but are not official announcements)

- Multiple reports, including Bloomberg, say SpaceX has begun formal IPO preparations, which can include internal planning, advisor conversations, and getting financial materials ready for public markets.

- Press coverage has mentioned a possible 2026 listing window, with some reporting leaving room for later timing if markets or internal priorities shift.

- Reports also discuss recent private share activity and pricing, including a reported $421 per share reference point in a secondary or insider context, and valuation talk near $800 billion, with media scenarios sometimes stretching to $1 trillion to $1.5 trillion in IPO chatter. Treat all valuation numbers as rough scenarios until a prospectus exists.

Bottom line: SpaceX may be preparing for an IPO, but nothing is official until the paperwork and exchange process becomes real and public.

What would make a SpaceX IPO “official”?

You’ll know SpaceX is truly going public when you see several concrete steps, not just “sources say” headlines:

- A public SEC filing (typically an S-1 for a US listing)

- An announced stock exchange (NYSE or Nasdaq are the usual guesses, but it must be stated)

- Named underwriters (the investment banks leading the deal)

- A published prospectus that lays out financials, risks, and share structure

- A stated pricing date and the first day of trading

Until those items exist, “SpaceX IPO confirmed” posts are just speculation, or worse, bait.

Why there is no official SpaceX stock ticker yet

A ticker symbol is not something a company announces years in advance like a movie title. It’s usually finalized much closer to listing, after the company coordinates with the stock exchange and completes key filing steps.

I’ll say it plainly: no SEC filing, no real ticker. You might see people guess “SPACEX” or something cute, but that’s not how exchanges work. Real tickers also have to be available, approved, and tied to a specific listing application.

IPO timeline clues

IPOs are a process. They’re not a single moment.

Here’s the general path most large US listings follow:

- Choosing advisers and banks: Companies line up investment banks, lawyers, and auditors.

- Audited financials get ready: Public markets expect clean, consistent reporting.

- Drafting the S-1: This is the big document that explains the business, the risks, and the numbers.

- SEC review period: The SEC asks questions, the company responds, updates follow.

- Investor marketing (roadshow): Executives pitch big investors, interest gets measured.

- Pricing day: The IPO price gets set, shares get allocated.

- First trade: The stock opens for public trading, often with a lot of volatility.

A “2026 IPO” target, when mentioned in the press, is usually an estimate based on early steps like prep work and advisor talks. Timing can change fast due to market conditions, regulation, or SpaceX deciding it prefers private funding a bit longer.

Why SpaceX may go public: money needs, Starlink growth, and big missions

SpaceX doesn’t need attention. It already has plenty. What it might need, depending on its plans, is scale-level funding and a clean path for early investors and employees to turn paper wealth into real money.

An IPO can do three practical things:

1) Raise a huge amount of capital: Rocket development, manufacturing, launch cadence, satellites, ground stations, and next-gen vehicles are all expensive. Reports in late 2025 framed the move as a sign that private markets may not be enough for the next phase.

2) Create liquidity: Early investors, employees with stock, and long-time backers often want a clear exit path. Secondary sales can help, but public markets are the biggest liquidity engine around.

3) Put a public price tag on the story: Private valuations can drift and differ by deal. A public listing forces one shared scoreboard, updated every day.

SpaceX also isn’t a “one product” company. Launch is one engine, but Starlink changes the narrative because it looks more like a recurring revenue business, which public investors tend to understand more easily.

How Starlink could affect the SpaceX IPO story

For many investors, rockets feel like project-based revenue. Big contracts, big launches, big headlines, then you wait for the next one.

Starlink changes this because it can be framed more like a subscription business, with ongoing service revenue tied to customer growth and network expansion.

That’s a pretty big deal for IPO storytelling. Public market investors often prefer companies with repeatable revenue and a clear way to forecast growth. Starlink can support that narrative, even if SpaceX stays a single combined company.

You’ll also see a lot of talk about a potential Starlink IPO or spin-off. Analysts and commentators bring it up because it’s easier to value a satellite internet business on its own. Still, as of December 2025 reporting, there is no confirmed public announcement of a separate Starlink IPO date or a formal spinoff plan.

What a huge SpaceX valuation could mean for everyday investors

A headline valuation number sounds like bragging rights. For you as an investor, it changes the math.

If a company lists at a very high valuation, the market is already expecting a lot. Growth has to stay strong, execution has to stay sharp, and bad surprises can hit harder because the stock has less room to “grow into” the hype.

Also, valuation chatter varies wildly. You’ll see media scenarios ranging from hundreds of billions to over a trillion. Without an official filing, those are opinions and negotiation anchors, not facts.

Here’s a simple way to think about it. If a company’s market cap is $1 trillion and it grows to $1.1 trillion, that’s a 10 percent gain. If you bought at a $100 share price, a 10 percent gain is about $10 per share. Big numbers can still move, but the upside comes from execution, not wishful thinking.

How to invest before and after a SpaceX IPO

First, the blunt truth: you can’t buy SpaceX shares on a normal brokerage today. If you type “SpaceX” into your trading app, you won’t find a real listing because SpaceX is private.

So what are your options?

Pre-IPO exposure (limited for most people) Pre-IPO shares are typically sold through private transactions and are often restricted to accredited investors through certain platforms or broker channels. Even then, access can be limited, fees can be high, paperwork can be dense, and resale rules can be strict.

Indirect exposure (more realistic for most investors) Some people choose to invest around the theme instead of trying to force SpaceX ownership:

- Space and aerospace ETFs: Broad funds that hold baskets of space, defense, and satellite-related companies.

- Aerospace and defense contractors: Companies that sell engines, avionics, materials, and services across the industry.

- Satellite communications peers: Public companies in adjacent markets (not the same as Starlink, but tied to similar demand drivers).

This isn’t a substitute for owning SpaceX. It’s more like owning the “picks and shovels” around a gold rush. You get exposure to the category without betting everything on one company and one IPO day.

After an IPO is official If SpaceX files and confirms an offering, you’ll have clear sources to rely on, and you can decide if you want to buy at IPO, wait, or skip it entirely. Waiting is often underrated. Many high-profile IPOs swing hard in the first days, and sometimes the calmer entry shows up later.

The bottom line

As of December 2025, there is no confirmed SpaceX IPO date and no official SpaceX stock ticker because the company is still private and there’s no public SEC filing showing an offering in progress.

Some reports do suggest more formal IPO planning is underway, and some press timelines point to 2026 or later, but timing can slip for all sorts of reasons.

If you want to stay ahead of the rumor mill, focus on what counts: real filings, named underwriters, and official prospectus documents. The hype will always be loud. Your best edge is to stay calm and not let emotions (including FOMO) rule your decisions.

Source:: SpaceX Stock Price, IPO Date, Ticker and More: Elon Musk's Space Company Plans to Go Public