Key highlights:

- Solana’s price has gone quiet, but the structure looks more like consolidation than panic selling.

- The support and resistance levels are converging, pushing SOL toward a point where a larger price action might be unfolding.

- As the price consolidates, on-chain data shows that Solana’s network activity continues to be healthy.

Solana has been in a strange spot lately. The SOL price isn’t falling apart, but it’s also not doing much to excite anyone. It’s just kind of there, not weak enough to panic over, not strong enough to chase.

Some traders see this stretch as dead money. Others think it looks like the kind of quiet phase that shows up before a bigger move. When you step back and look beyond just the candles, the picture starts to feel a bit more layered than it does at first glance.

Looking at the bigger picture for the SOL price

On the weekly chart shared by Gordon, Solana is still in a large consolidation phase since its strong bounce from its 2023 lows.

That long rounded bottom on higher timeframes indicates SOL already went through its major reset. Since then, price hasn’t trended cleanly in either direction. Instead, it’s been chopping sideways.

Just stack as much $SOL as you can under $200.

The lower the better.

Then sell at $1000.

Easy. pic.twitter.com/GEosCQeM3l

— Gordon 🐂 (@GordonGekko) January 27, 2026

That range is pretty clear. The SOL price has struggled to stay above the $180–$200 range, while it attracts buyers at the $110–$120 range. For quite some time now, the price has been ranging between these two levels.

At the moment, SOL is sitting closer to the middle-to-lower part of that range. That’s not a bullish signal on its own, but it’s also not a breakdown. It looks more like a market waiting for direction, not one reacting emotionally to every move.

What the on-chain data says about Solana

Price only tells part of the story, especially for a network like Solana. When you bring on-chain data into the picture, things look a bit steadier than the charts alone might show.

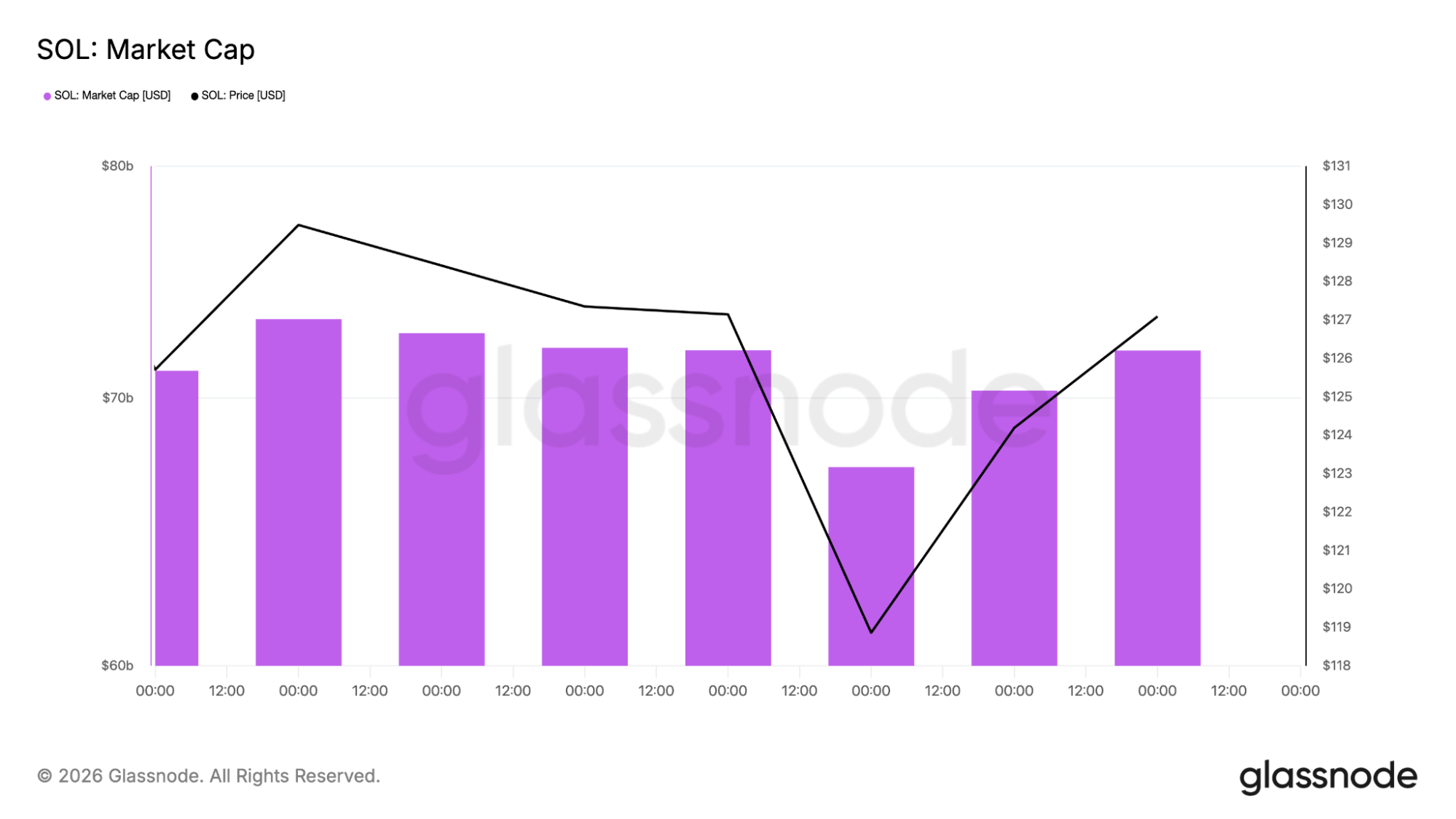

Glassnode data shows Solana’s market cap dipped during the recent pullback but recovered fairly quickly. That matters because it indicates capital didn’t rush for the exits. Instead, it looks like money rotated and settled.

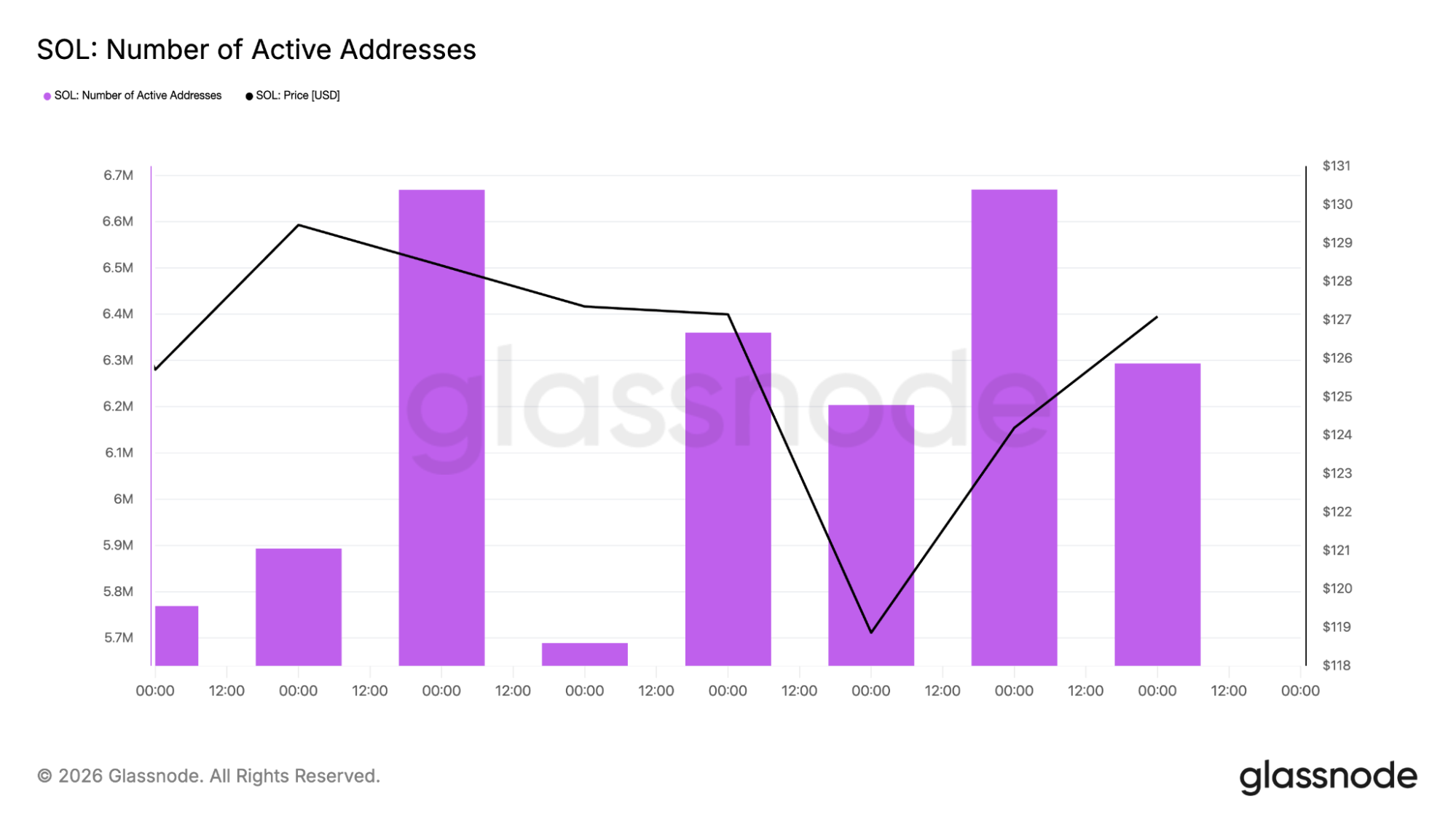

Active address data shows a similar pattern. There was a drop during the correction, but activity picked back up as price stabilized. That’s usually a sign that users are still engaging with the network even when price isn’t trending higher.

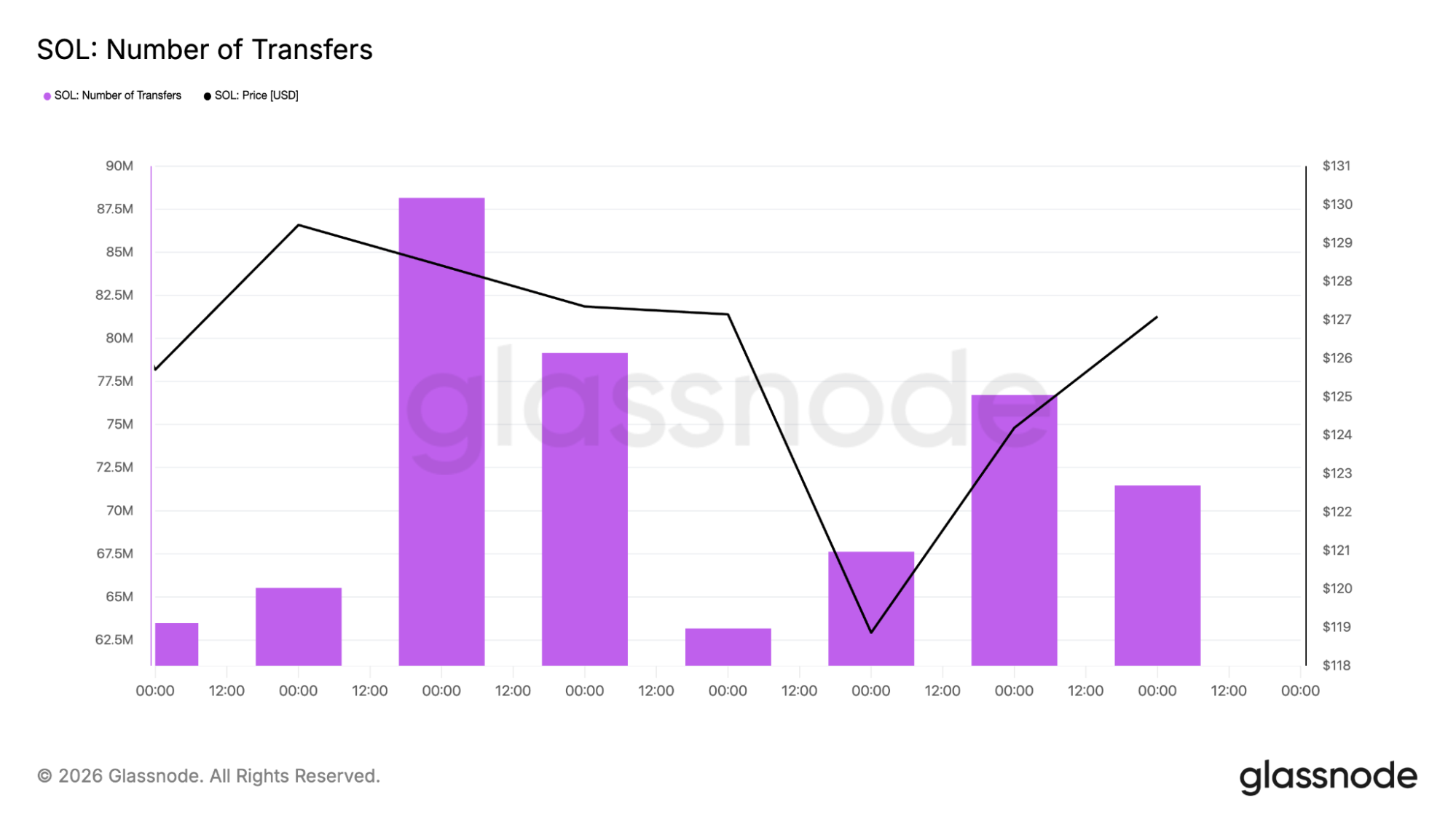

Transfer data also lines up with that view. Transaction counts dipped alongside price but bounced soon after. Taken together, these metrics indicate that Solana isn’t being abandoned. The SOL price might be stuck, but the network itself still looks very much alive.

Short-term Solana price action shows indecision, not panic

When you zoom in on the lower timeframes, especially the 4-hour chart, one thing becomes pretty clear: the SOL price isn’t panicking.

It recently bounced off a support area in the low $120s, a zone that’s already been tested a few times. So far, buyers keep showing up there, which says a lot about how the market views that level.

4-Hour SOL price chart analysis

After that bounce, SOL did try to move higher, but it ran into familiar resistance around the mid-$140s. That part wasn’t surprising. What was interesting was how the price reacted afterward. Instead of rolling over hard, SOL eased lower slowly, with smaller candles and no real burst of selling pressure.

When you look at the daily chart, the picture doesn’t change much. The SOL price is still sitting above its broader support area, and there’s no sign of aggressive breakdown candles. Daily closes have stayed relatively calm, which indicates sellers aren’t fully in control here.

Daily SOL price chart analysis

The signals line up in a comparable way. In the 4-hour chart, the RSI indicator eased its position as the price went back and then settled. On the daily chart, the RSI is sitting in the middle and is neither overbought nor oversold.

It is not screaming bullish, but it is not screaming bearish either. It is more like the market is taking a breather and is trying to decide which way to go.

Making sense of the “buy under $200” narrative

Comments like “just stack SOL under $200 and sell at $1000” sound simple, but markets are rarely that straightforward. What those statements really reflect is long-term confidence rather than a precise trading plan.

From a technical perspective, anything below $200 keeps the SOL price inside its broader range. That doesn’t guarantee upside, but it does explain why some long-term holders see these levels as relatively attractive compared to previous highs.

Still, conviction alone doesn’t move charts. For Solana to actually break out of its range and start a trend, it needs to retake its resistance levels. If that does not happen, it is likely that the bulls will again fail to sustain their rallies, just as they have done in the past.

What comes next for SOL?

In the near term, the zone around $120 is important for Solana. If it remains above this zone, it is good for the overall setup. A clean break below that level would likely change sentiment fast.

On the upside, the $140–$150 area is the first real hurdle. A strong move back above that zone would put $180 and then $200 back into focus. Until that happens, any bounce should be treated with caution.

According to CoinCodex’s 3-month Solana price prediction, the SOL price could drift toward $160.75, which reflects the more bullish view of where the market might head in the near term.

Right now, Solana doesn’t look like a coin ready to surge. It looks like a market building a base and waiting. Whether that base turns into something bullish or breaks down entirely will depend on how price reacts at the edges of this range.

The SOL price isn’t giving clear answers yet, but it’s setting the stage. The next decisive move will likely say a lot about where Solana heads next.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Solana Price Analysis: Crypto Expert Says Stack $SOL Under $200 – Here’s Why