Key highlights:

- $360M exits crypto funds after Fed signals cautious stance on rate cuts

- Solana attracts $421M inflows — second-largest in its history

- Bitwise’s Solana Staking ETF debuts strong with $222.8M in assets

Hawkish comments from the U.S. Federal Reserve triggered a $360 million outflow from cryptocurrency investment products last week, but Solana stood apart from the broader selloff — drawing record inflows driven by ETF demand.

Investors reduced exposure to Bitcoin funds amid uncertainty over interest rates, while Bitwise’s new Solana Staking ETF (BSOL) attracted strong inflows in its debut week.

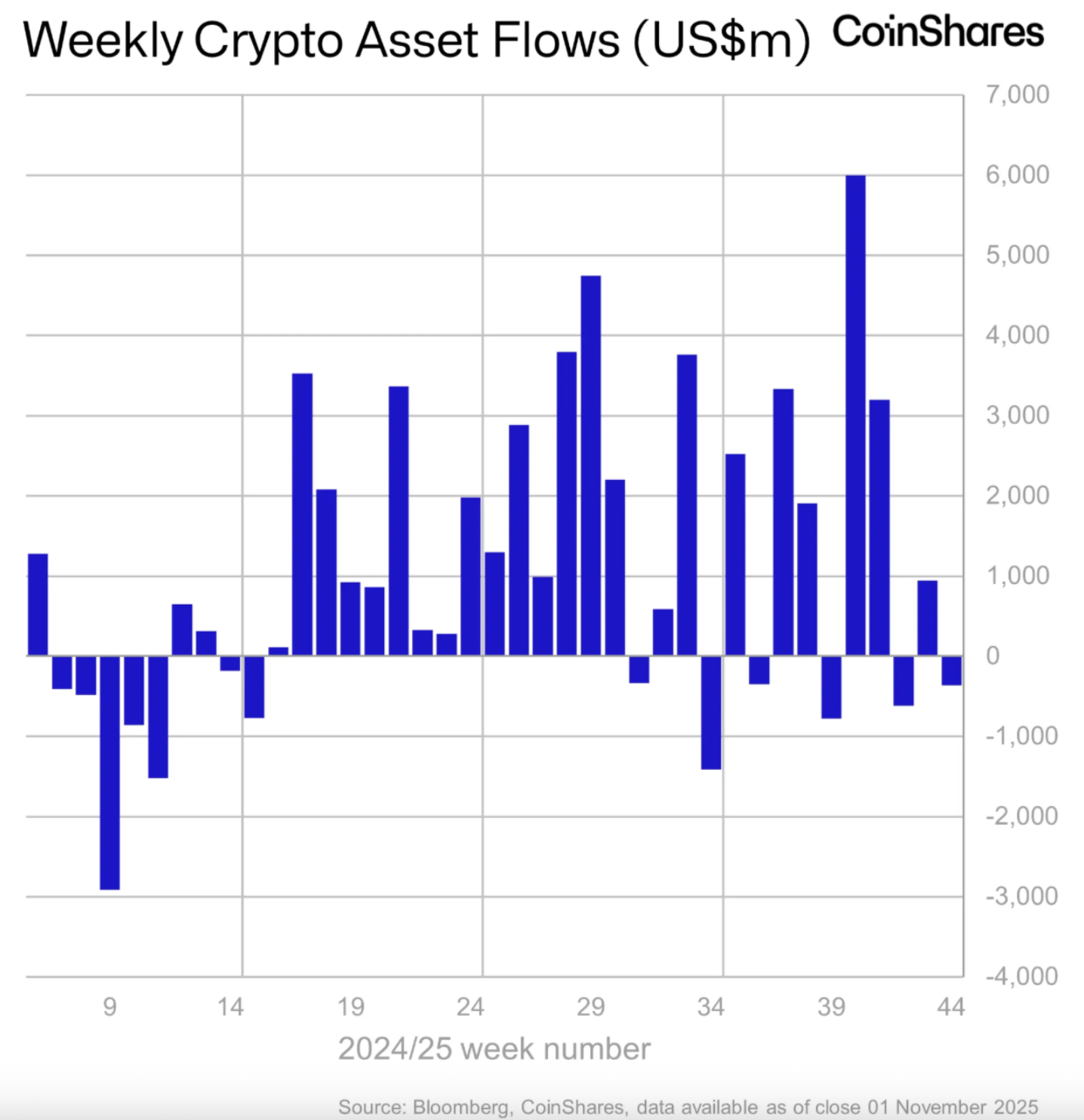

According to CoinShares, digital asset products saw $360 million in outflows following Fed Chair Jerome Powell’s remarks that a December rate cut “is not a foregone conclusion.”

Combined with limited new economic data due to the U.S. government shutdown, markets reacted with heightened caution.

Capital flows in crypto funds. Source: CoinShares

Solana leads inflows as Bitcoin suffers heavy outflows

Most of the selling pressure came from U.S. investors, who withdrew about $439 million, partially offset by modest inflows from Germany and Switzerland.

Bitcoin ETFs were hit hardest, with total outflows of $946 million.

However, Solana defied the trend, attracting $421 million — its second-largest inflow ever, thanks to surging interest in newly launched U.S. ETFs.

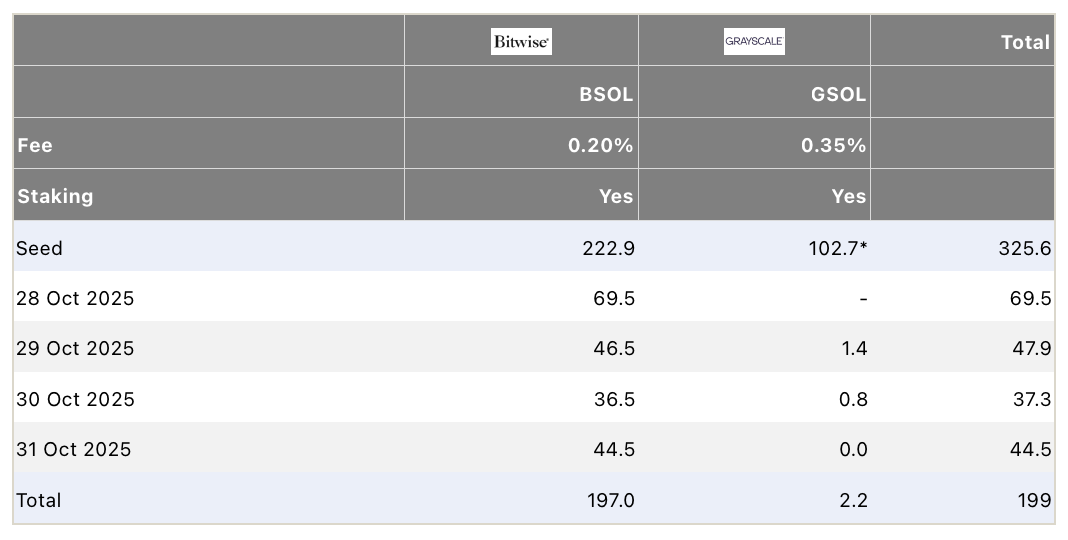

Capital flows in the Solana ETF US. Source: Farside Investors

The move brought Solana’s annual inflows to $3.3 billion, solidifying its reputation as one of 2025’s standout crypto performers.

Ethereum also saw inflows of $57.6 million, although daily flows reflected mixed investor sentiment.

The recent selloff came after a $921 million inflow the previous week, boosted by weaker-than-expected inflation data.

Bitwise’s Solana staking ETF sees strong debut

Bitwise’s Solana Staking ETF (BSOL) launched just a week ago with $222.8 million in starting assets, reflecting strong institutional demand for Solana’s staking products.

BSOL provides investors with direct exposure to Solana and offers an estimated 7% annual yield from on-chain staking rewards.

On October 31, Solana ETFs logged their fourth consecutive day of inflows, adding $44.48 million in a single day.

This momentum underscores how investors are rotating capital toward yield-generating products as they take profits from Bitcoin and Ethereum’s recent rallies.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: Solana Defies the Fed Shock With $421 Million Inflows While Crypto Funds Fall