Key highlights:

- MicroStrategy claims Bitcoin is now far less volatile than critics suggest

- Saylor says the company can survive even an 80–90% BTC crash

- Veteran traders warn Bitcoin may mirror a historic commodity bubble

Disclaimer: Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Michael Saylor, executive chairman of MicroStrategy, dismissed claims that Wall Street’s growing presence in the Bitcoin market has hurt price performance or fueled instability.

“I think we are getting a lot less volatility,” Saylor told Fox Business. As of Wednesday, Bitcoin had fallen nearly 12% in a week and was trading at $91,616, according to CoinCodex.

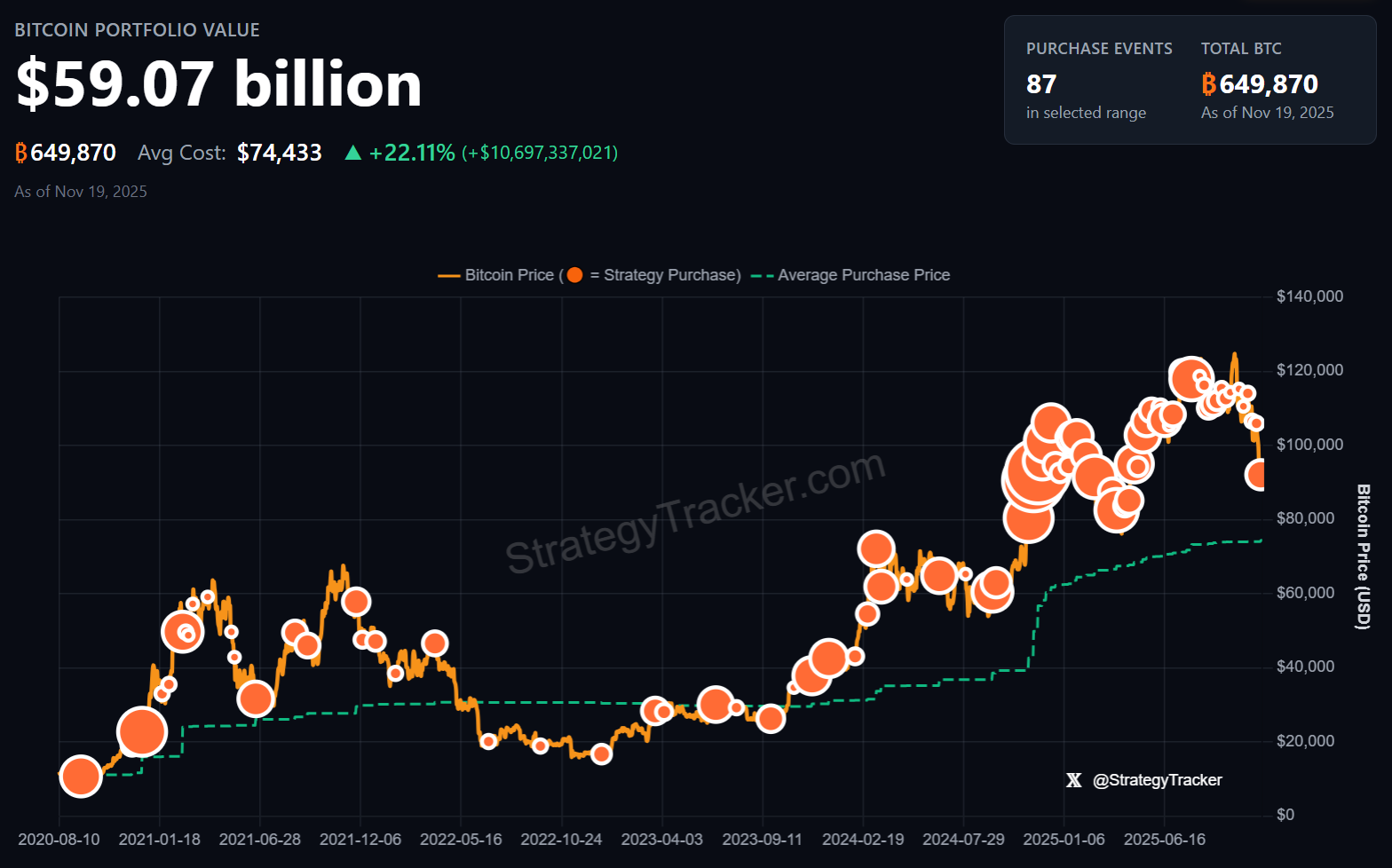

A steady decline in Bitcoin volatility since 2020

Saylor noted that when MicroStrategy began purchasing Bitcoin in 2020, its annual volatility hovered around 80%. Today, he says that figure has eased to about 50%.

₿etter than Ever. Today I was the warm-up act for @natbrunell as we both talked Bitcoin with @cvpayne. You’ll want to hear what she had to say. pic.twitter.com/vDaFceyeza

— Michael Saylor (@saylor) November 18, 2025

According to him, Bitcoin’s volatility is likely to fall by an additional five percentage points every few years as the asset continues to mature. Eventually, he predicts Bitcoin will stabilize at a volatility level about 1.5 times higher than the S&P 500, while offering proportionally stronger returns.

“Bitcoin is stronger than ever,” Saylor said. MicroStrategy currently holds 649,870 bitcoins valued at $59.59 billion, according to SaylorTracker.

Source: SaylorTracker

Strategy’s most recent purchase was announced on November 17, when the company disclosed that it acquired 8,178 BTC for $835.6 million. This was MSTR’s largest Bitcoin purchase since July.

MicroStrategy’s modified net asset value (mNAV) multiple, used to measure how its market valuation compares to the worth of its Bitcoin has slipped to 1.11x, down from roughly 1.52x when Bitcoin hit its October 5 all-time high of $125,100.

With Bitcoin weakening, MicroStrategy’s shares (MSTR) closed at $206.80, down 11.50% over the past five days, according to CoinCodex.

MicroStrategy preparing for deep drawdowns

Despite the recent downturn, Saylor said he remains unconcerned even if Bitcoin faces a far steeper drop.

“The company is designed to withstand a decline of 80–90% and continue to operate,” he stated, and added:

“I think we’re practically invulnerable. Our leverage level is currently around 10–15% and approaching zero, which is extremely reliable.”

However, veteran trader Peter Brandt cautioned that MicroStrategy could find itself “underwater” if Bitcoin repeats the pattern of the 1970s soybean bubble, when prices surged, peaked in 1973–1974, and later collapsed by about 50%.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.