Key highlights:

- Japan’s bond yields hit 16-year highs, threatening a global capital shift.

- The yen carry trade unwinds as trillions may return home.

- Crypto could be the first market hit if global liquidity tightens.

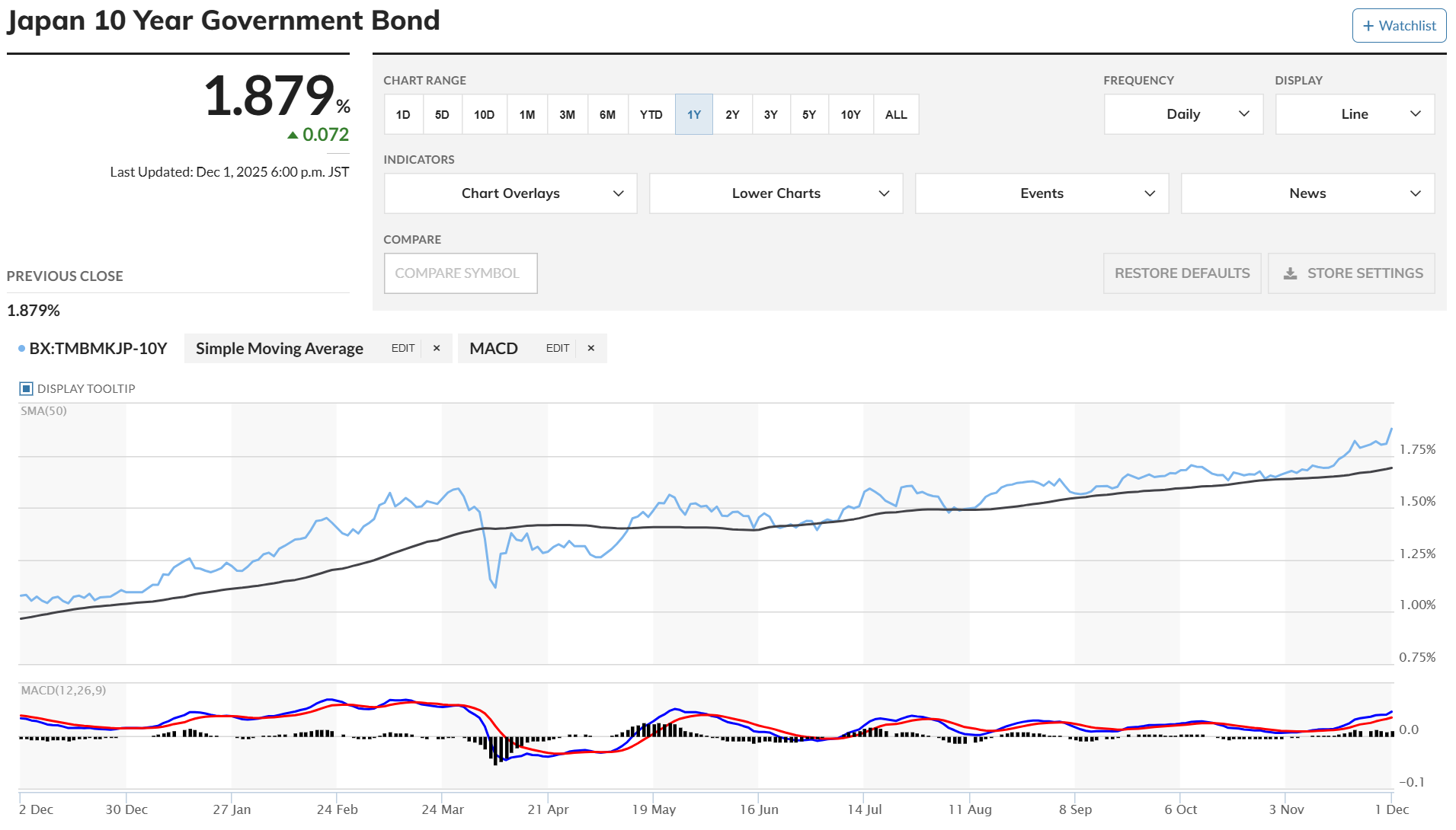

Japanese government bonds have surged to a 1.86% yield, the highest since 2008, and this may become the trigger for a global financial rebalancing. The yield on 10-year Japanese bonds has nearly doubled over the past 12 months, while two-year bonds exceeded 1% for the first time since 2008.

Japan 10-year government bond. Source: MarketWatch

For decades, Japan operated in a world of near-zero and even negative interest rates. That stability allowed one of the most influential global trading strategies to flourish, the yen carry trade, where investors borrowed cheap yen to chase higher yields worldwide.

Trillions at risk as the yen carry trade unwinds

Institutional investors used low-interest yen to buy U.S. Treasuries, European bonds, emerging-market debt, and high-risk assets such as cryptocurrencies. Economist Shanaka Anslem Perera describes the scale:

“Trillions borrowed in yen, deployed into US Treasuries, European bonds, emerging market debt, risk assets everywhere.”

Japanese institutions hold roughly $1.1 trillion in U.S. Treasuries, which is their largest foreign exposure. Perera explains that rising domestic yields fundamentally change investor incentives.

A tough moment for the U.S. and crypto markets

The timing is highly unfavorable for the United States. The Federal Reserve is winding down quantitative easing just as the U.S. Treasury faces record borrowing needs to finance a $1.8 trillion deficit. As Perera warns, the post-crisis financial system may need a profound reassessment.

The crypto market could feel the impact first. Bitcoin and other digital assets perform best in times of abundant liquidity and low interest rates. Japan’s cheap-money environment (and the massive yen carry trade) helped funnel capital into risk assets, from crypto to tech stocks.

DeFi analyst Wukong notes:

“It sits at the highest end of the risk spectrum, so even small shifts in liquidity lead to sharp moves.”

If liquidity drains from global markets back into Japan, speculative capital for crypto could shrink rapidly. At the same time, if global bond markets start aggressively repricing, investors may flee to safety, sparking a broader sell-off in risk assets. The uncertainty has already contributed to a sharp sell-off in the cryptocurrency market that saw the Bitcoin price drop to $85,000 from $91,000 in the space of 24 hours.

Source:: Rising Japanese Bond Yields Put Global Carry Trades at Risk