Key highlights:

Bitcoin drops after $2.7B sell-off, Ethereum takes the lead

QCP Capital analyzed the dramatic shifts in the crypto market following Federal Reserve Chair Jerome Powell’s speech at Jackson Hole. Bitcoin’s short rally quickly reversed, while Ethereum surged to new all-time highs, fueled by growing institutional inflows.

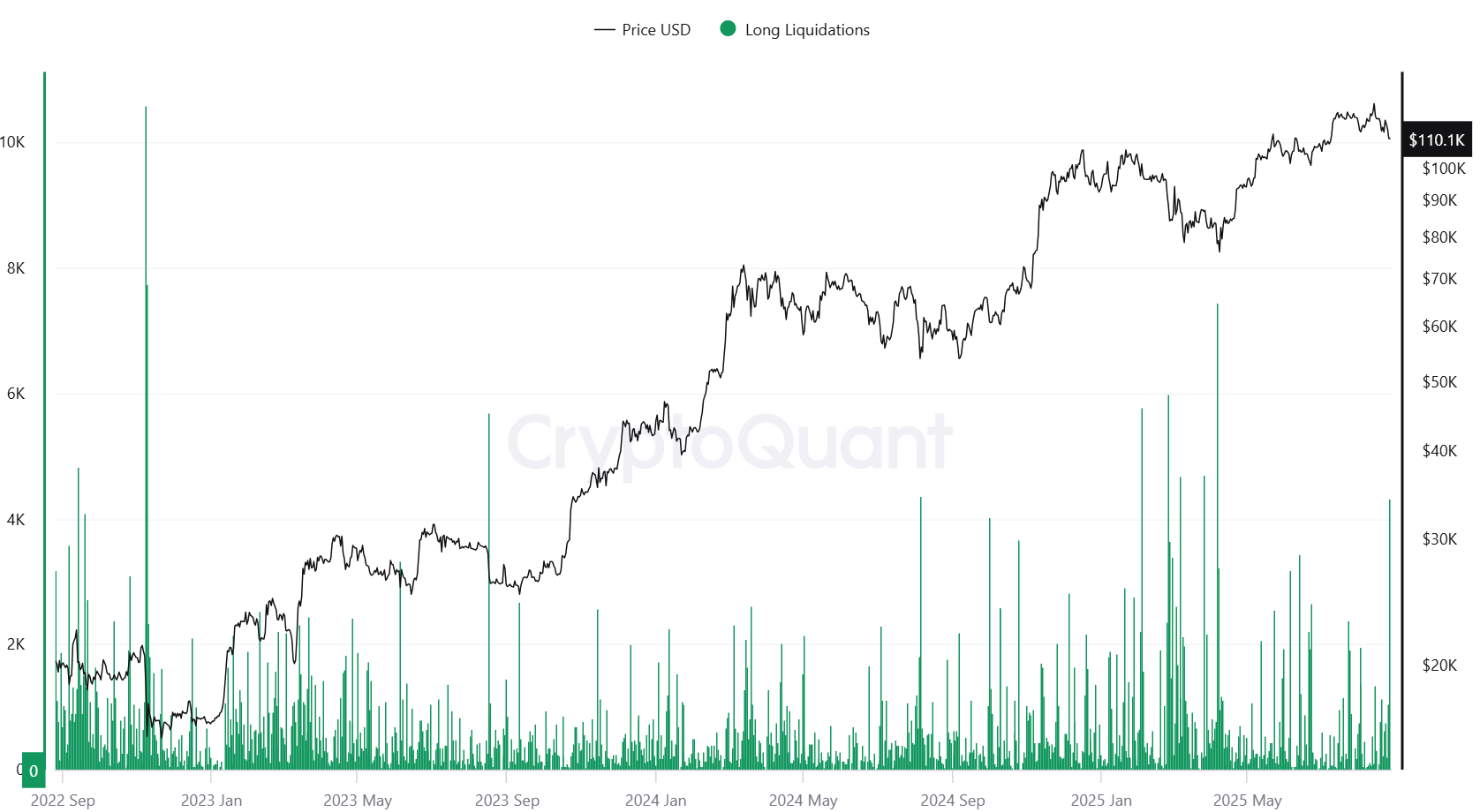

The reversal began when an old-wallet holder sold about 24,000 BTC, worth roughly $2.7 billion during low weekend liquidity, causing a sharp drop in Bitcoin’s price. The event wiped out $500 million in long positions within minutes.

Increase in BTC long liquidations across all crypto exchanges. Source: CryptoQuant

QCP analysts note that the lack of institutional demand leading up to the Jackson Hole summit amplified the impact.

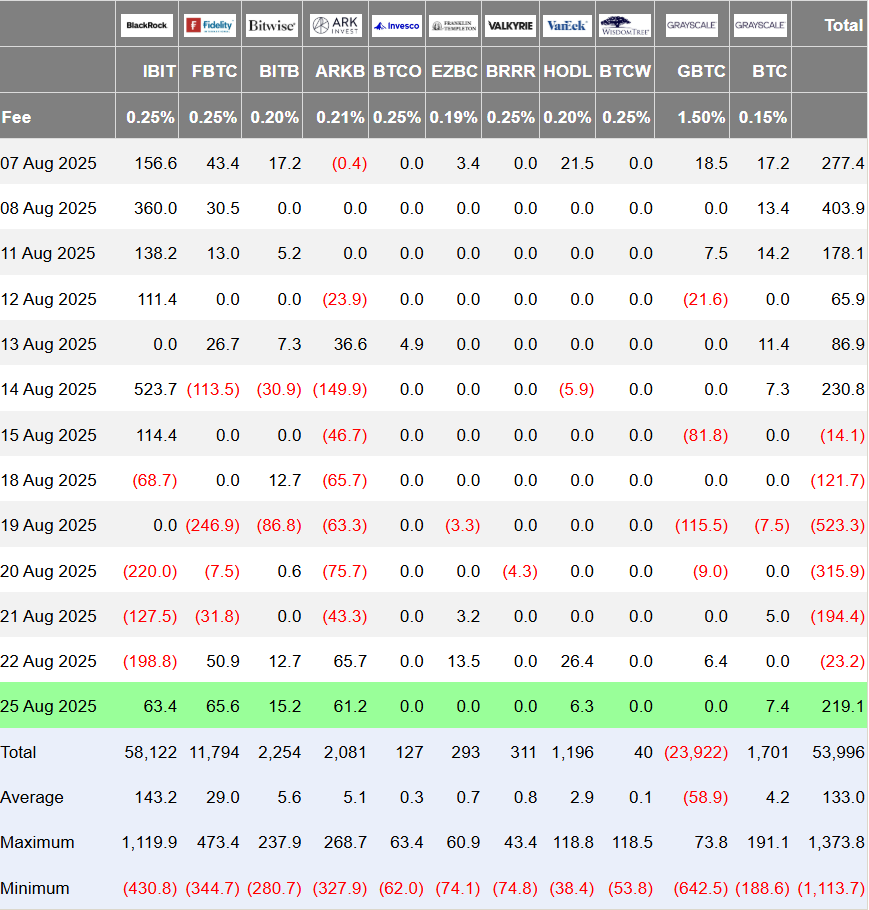

Bitcoin spot ETFs saw six straight days of outflows, totaling $1.2 billion, reflecting waning investor confidence. August activity was weaker than usual, with strategy-based ETF purchases falling short of expected support levels.

US Bitcoin ETF Fund Flows. Source: Farside Investors

Ethereum gains momentum as institutional demand grows

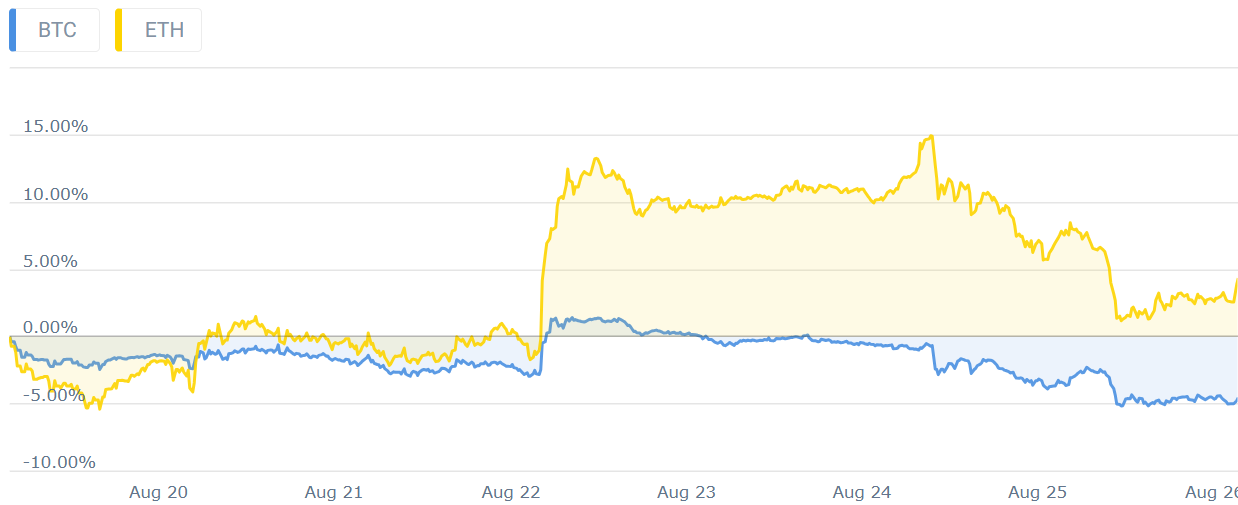

In contrast, Ethereum soared, breaking records and outperforming Bitcoin. According to QCP, the ETH/BTC cross rate rose above 0.04, as funds rotated from Bitcoin into Ethereum. This shift echoes patterns last seen in December, but this time, Ethereum is leading the charge.

BTC compared to ETH 7-day chart. Source: Coincodex

Institutional players like BitMine and SharpLink are accelerating ETH acquisitions. BitMine’s latest $45 million purchase raised its holdings to $7 billion, supporting Ethereum’s price momentum.

Meanwhile, Bitcoin dominance dropped from 60% to 57%, signaling a continued rotation into altcoins, especially ETH. Though still higher than 2021’s sub-50% levels, the drop suggests large players may be betting on Ethereum’s outperformance.

BTC Dominance, 1-month chart. Source: Coincodex

QCP adds that if a staking-based Ethereum ETF is approved this year, it could further solidify ETH’s narrative as a superior reserve asset in the short term.

Despite Bitcoin’s recent weakness, QCP maintains a structurally bullish long-term view. Similar to July’s 80,000 BTC sell-off, they expect institutions to buy on dips.

The current trend signals a possible changing of the guard in crypto: Ethereum is benefiting from institutional accumulation, while Bitcoin consolidates after a major sell-off.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: Old Wallet Sell-Off Crashes Bitcoin — But Ethereum Rises as Institutional Favorite