Key highlights:

- Nvidia’s data center revenue hits $51 billion.

- Major AI partnerships fuel Nvidia’s biggest growth wave yet.

- New forecasts show Nvidia preparing for massive global demand.

CFDs are complex instruments with a high risk of losing money due to leverage. 82% of retail investors lose money trading CFDs with this provider. Ensure you understand the risks before trading. Past performance is not indicative of future results.

Nvidia has once again proven its dominance in the AI race. The chipmaker reported $57 billion in third-quarter revenue, with an astonishing $51 billion coming from its data center division alone, which is an amount many global corporations don’t make in an entire year.

NVIDIA CEO Jensen Huang on record Q3 FY26 results. pic.twitter.com/aq5ACwLTXQ

— NVIDIA Newsroom (@nvidianewsroom) November 19, 2025

Analysts expected $49.3 billion, but Nvidia surpassed forecasts with ease.

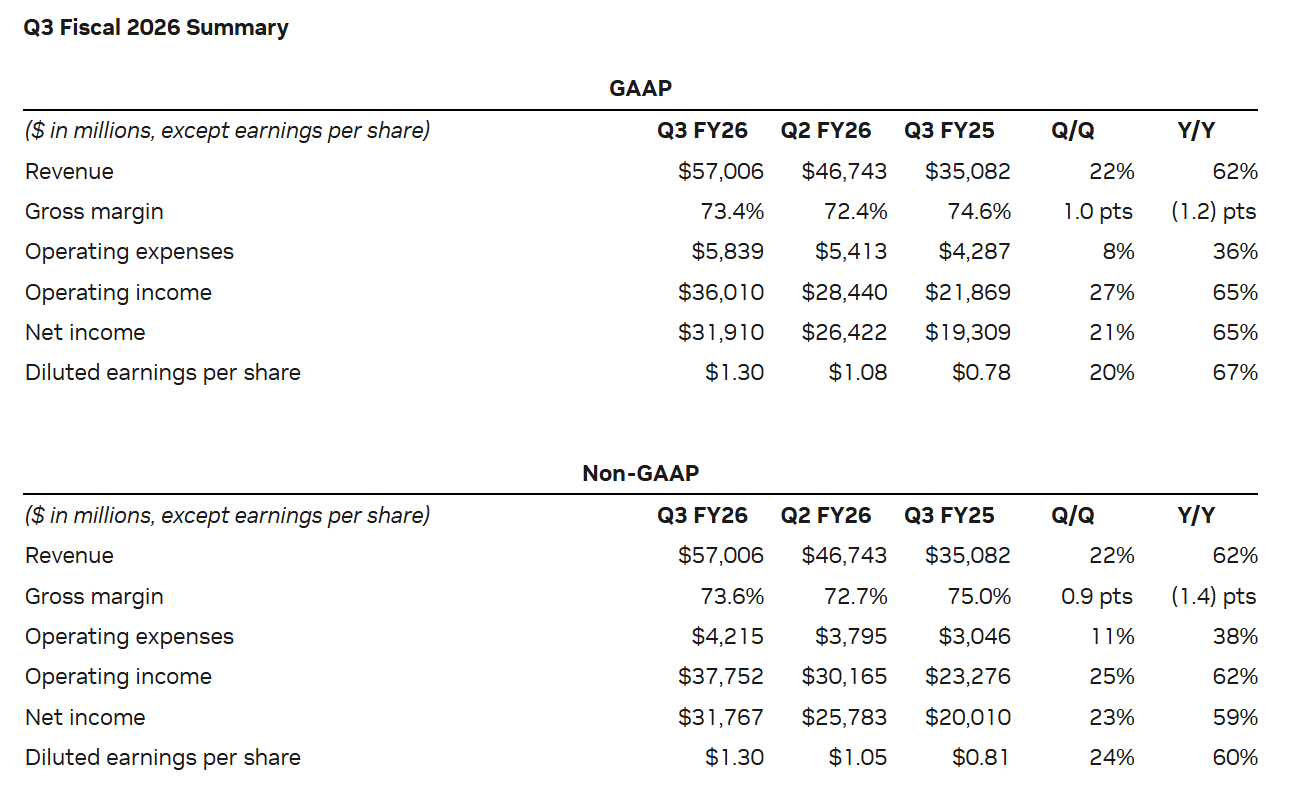

NVDA results for fiscal Q3 2026. Source: Nvidia

The company is so confident in its growth trajectory that it raised its fourth-quarter sales outlook to $65 billion.

Markets reacted instantly: Nvidia (NVDA) shares rose more than 3% in after-hours trading, while other top AI stocks such as AMD, Broadcom, and Taiwan Semiconductor also gained momentum.

Nvidia CEO Jensen Huang directly addressed the ongoing debate about an AI bubble, saying the company sees “a completely different picture.”

He emphasized that the company excels across every phase of AI development, from pre-training to inference, while pointing to the industry-wide shift from CPUs to GPUs, the rise of AI-powered advertising revenue, and the explosive growth of agent-based AI as long-term catalysts.

Billion-dollar alliances fuel Nvidia’s AI expansion

Nvidia also showcased a wave of major partnerships with OpenAI, Anthropic, Uber, and xAI, underscoring its central role in the AI infrastructure boom.

In September, Nvidia and OpenAI announced a strategic initiative to deploy at least 10 gigawatts of Nvidia-powered systems for OpenAI’s next-generation platform. Nvidia plans to invest up to $100 billion in data centers using its own technology, beginning operations in late 2026.

On November 18, Nvidia revealed a “deep technological collaboration” with Anthropic, including a commitment to invest up to $10 billion. Anthropic, on the same day, outlined plans to spend $30 billion on computing infrastructure for its Claude AI model, built on Microsoft Azure and powered by Nvidia hardware. The company also struck a $1 billion deal with Nokia.

Just one day later, Nvidia and xAI confirmed that a massive data center in Saudi Arabia, containing hundreds of thousands of Nvidia chips, would host Elon Musk’s AI venture as its first major customer.

Despite the booming growth, U.S. export restrictions on advanced AI chips continue to hinder Nvidia’s access to the Chinese market.

CFO Colette Kress said the company is “disappointed” by the limits imposed on sales and confirmed that no data center revenue is expected from China in the fourth quarter. Still, Nvidia plans to continue working with regulators on both sides.

Robotics, infrastructure, and a $4 trillion opportunity

Nvidia’s bets extend beyond chips. Automotive revenue hit $592 million in Q3, rising 32% year-over-year.

Kress said Nvidia is poised to capture a major share of the $3 – $4 trillion AI infrastructure market, adding that demand by the end of the decade will exceed earlier forecasts.

Jensen Huang also rejected the idea that only the biggest tech giants benefit from Nvidia’s systems, noting that GPUs improve computing speed and cost efficiency for companies of all sizes.

Nvidia remains firmly in the lead as global demand for AI hardware surges. The company expects to deploy 5 million GPUs in the final quarter alone, solidifying its position at the center of the AI economy.

Plus500: Best CFD trading platform for global investors

- Trade 2,800+ CFDs – stocks, forex, indices, commodities, crypto & more

- 0% commission and competitive spreads with no hidden fees

- Leverage up to 1:30 for retail clients and higher for professionals (professional accounts do not have ICF rights)

- Advanced risk management tools

- Regulated in multiple jurisdictions, ensuring security & compliance

- 26+ million users worldwide

CFDs are complex instruments with a high risk of losing money due to leverage. 82% of retail investors lose money trading CFDs with this provider. Ensure you understand the risks before trading. Past performance is not indicative of future results. Professional accounts do not have ICF rights.

Source:: NVDA Earnings: Nvidia Posts a Massive $57B Quarter and Pushes Back Against AI Bubble Warnings