Key highlights:

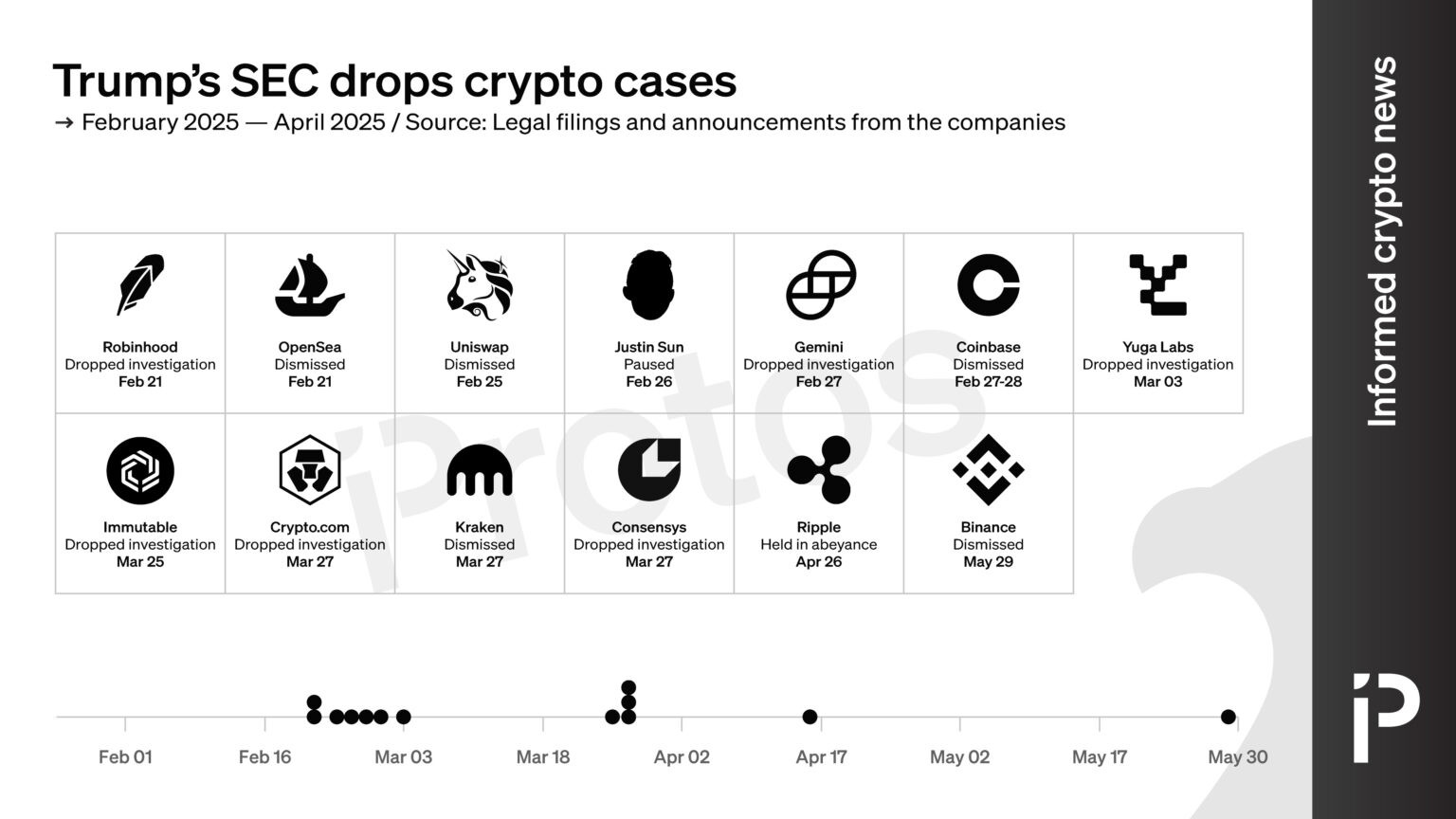

- The SEC has dismissed or suspended roughly 60% of crypto-related cases since Trump took office, far above normal dismissal rates.

- High-profile lawsuits against major crypto firms have been dropped, signaling a clear change in enforcement priorities.

- The shift could bring regulatory clarity but also raises concerns about weaker investor protection.

The U.S. Securities and Exchange Commission (SEC) has dismissed or suspended the majority of its enforcement actions against cryptocurrency companies since President Donald Trump took office. In 2025 alone, the regulator dropped multiple investigations, marking one of the most significant pullbacks in crypto enforcement since the industry emerged.

According to a report by The New York Times, the SEC has suspended, terminated, or dismissed approximately 60% of its crypto-related cases since January. This rate is substantially higher than the agency’s average dismissal rate across other areas of securities regulation.

Several of the cases abandoned by the SEC were among its most visible actions. Lawsuits against Ripple Labs and Binance, which once symbolized the agency’s aggressive stance on crypto oversight, are no longer being actively pursued.

Source: Protos

The regulator has also stepped away from cases involving companies with known links to individuals close to the Trump administration.

The SEC told The New York Times that political favoritism played no role in the change. Officials said the new approach reflects evolving legal interpretations, court setbacks in prior cases, and broader policy considerations. The newspaper reported that it found no evidence that Trump directly pressured the agency to drop specific investigations.

Political changes and growing crypto ties raise questions

At the same time, Trump family-linked entities have expanded their presence in the digital asset sector.

The 81 Executives Who Have Met With President Trump. Source: Skye Gould/Business Insider

In 2025, projects associated with the president or his family included World Liberty Financial, the Official Trump token, and a Bitcoin mining venture operated by Trump’s sons under the name American Bitcoin.

The SEC’s political balance is also shifting

Paul Atkins is expected to continue serving as SEC chair, but the commission is set to lose its last Democratic member when Commissioner Caroline Crenshaw’s term expires in January 2026. Crenshaw has already served 18 months beyond her original term, and as of publication, no replacement nominee has been announced.

The loss of bipartisan representation could further shape the SEC’s approach to crypto oversight, potentially reinforcing the agency’s softer enforcement posture.

What this means for crypto regulation

The SEC’s retreat from aggressive crypto enforcement may provide the industry with a more predictable operating environment in the short term. Fewer lawsuits and investigations could encourage innovation and investment within the U.S. market.

However, the absence of court rulings and legal precedents may also create uncertainty. Without clear boundaries set through litigation, companies may struggle to determine which practices remain acceptable, increasing the risk of future regulatory backlash if market conditions deteriorate.

For now, the SEC’s shift marks a defining moment for crypto regulation in the United States – one that could influence how digital assets are governed for years to come.

Source:: Nearly 60 Percent of Crypto Enforcement Cases Disappear Under the SEC After Trump Takes Office