Key highlights:

NEAR is finally showing signs of life again. After months of slow movement and heavy corrections, some traders now believe the worst might be over. One of them is analyst Lucky, who recently shared on X, “In my opinion, $NEAR bottom is near.”

That tweet was promptly followed by interest from the NEAR community, and when you consider the data, it’s easy to see why. From the neat technical arrangement to the improving on-chain activity, to the seeming shift in sentiment, NEAR might be preparing for its next significant move.

NEAR on-chain data shows signs of recovery

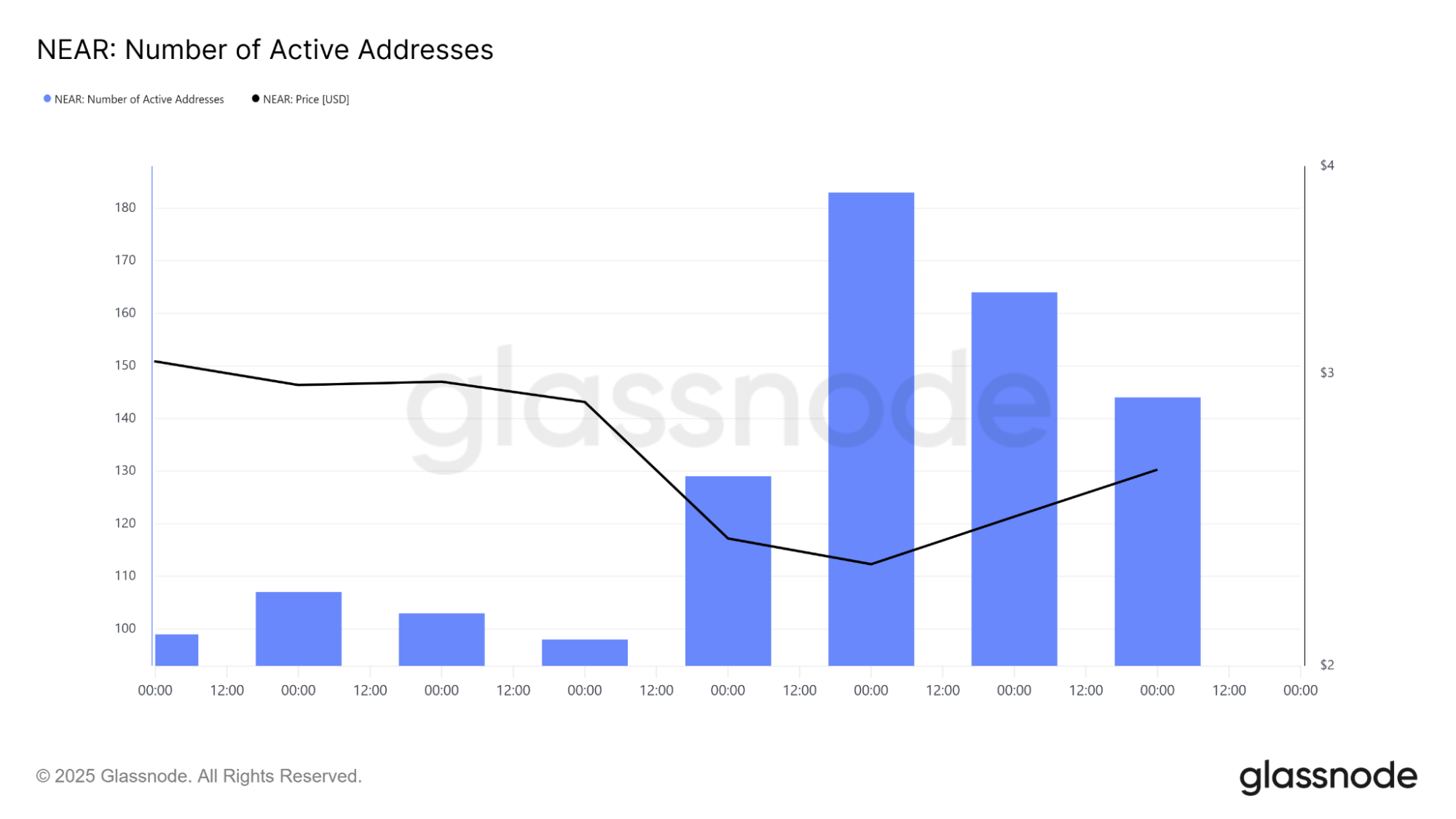

On-chain data from Glassnode adds another bullish layer to the story. The number of active NEAR addresses has been increasing steadily again. Earlier this month, that number dipped below 120, but it is now back to nearly 180 active addresses, which is a sign of resumed activity.

That kind of growth in network activity usually signals that both traders and users are returning, a healthy sign during accumulation phases.

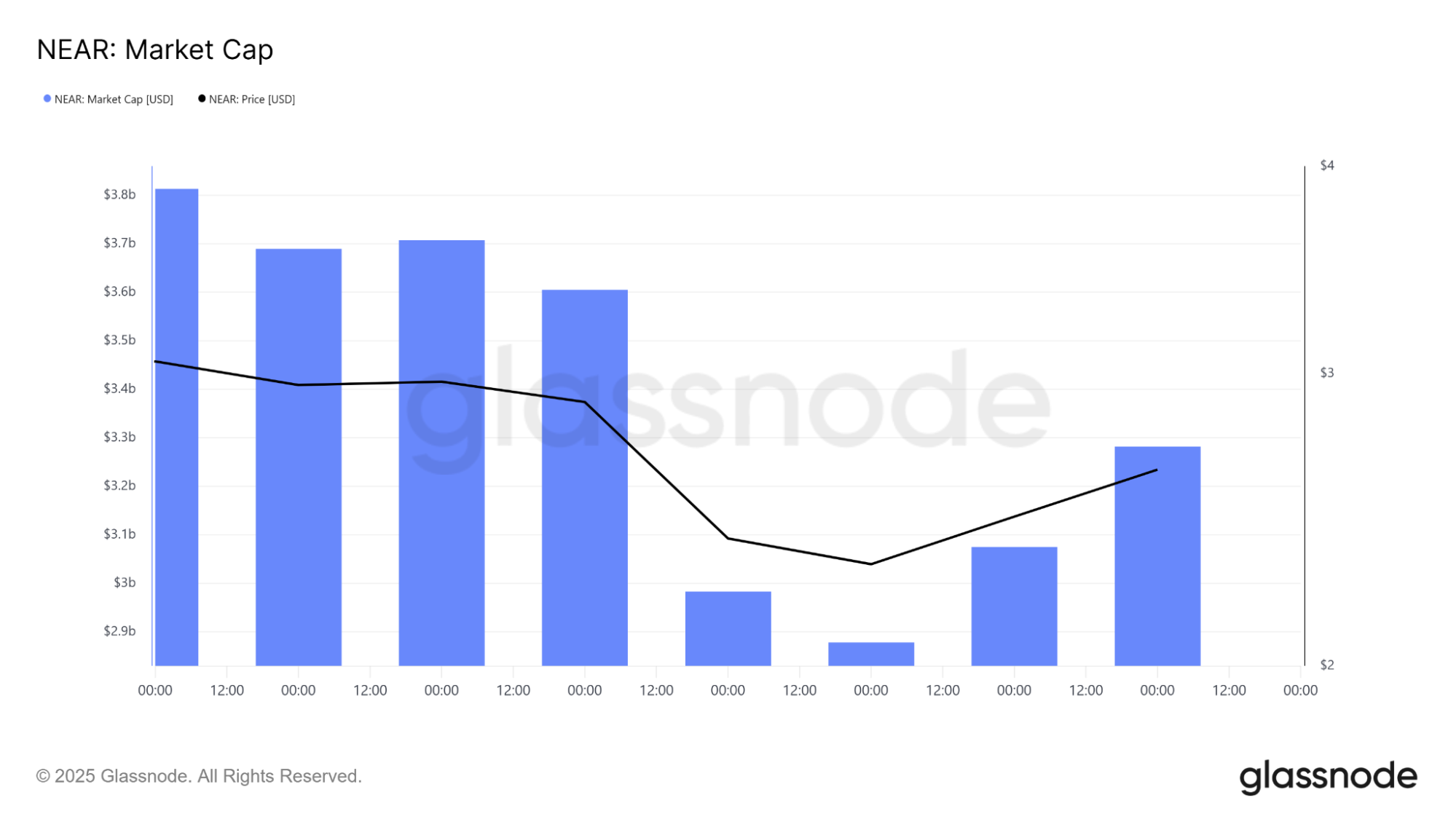

NEAR market cap has also started to rebound, moving from around $3.0 billion at the lows to roughly $3.4 billion. This increase means capital is flowing back into the ecosystem, exactly what you’d expect at the start of a recovery.

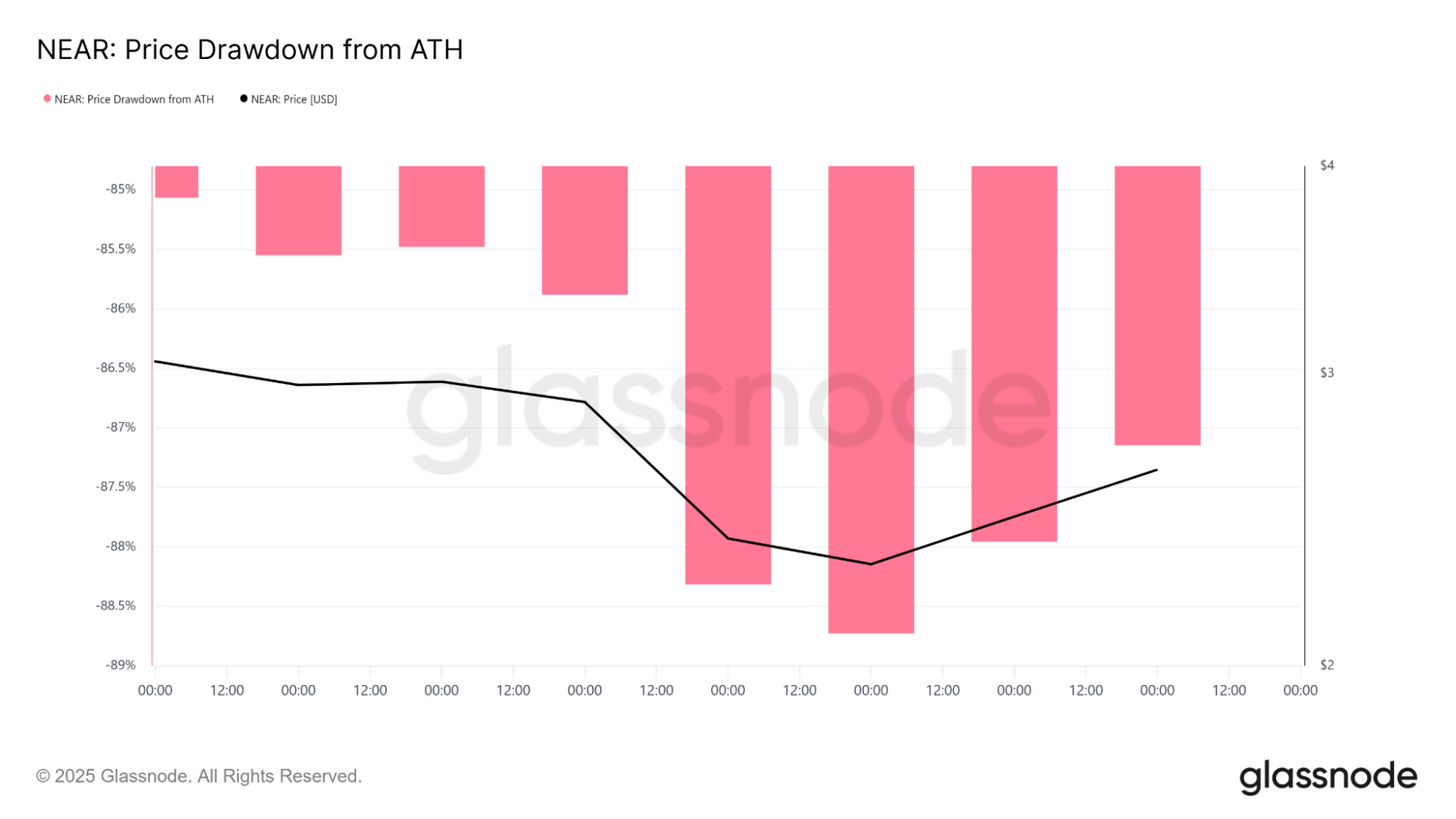

At the same time, NEAR price is still trading about 86% below its all-time high, based on Glassnode’s price drawdown chart. Historically, altcoins tend to bottom out after similar drawdowns. Both Solana and Cardano went through the same kind of declines before reversing during their next bull runs.

If NEAR follows that same pattern, the $2 range might mark its final bottom.

NEAR price analysis: Support and resistance levels to watch

The latest TradingView analysis gives a clearer view of what’s happening in the short term. Support is between $2.00 and $2.20; buyers are clearly defending this range. Resistance is around $3.30 to $3.80; breaking this zone would likely confirm a full reversal.

Next Big Barrier: $4.00 to $4.50, this is where NEAR has been rejected multiple times in the past. The 100-day moving average is near $2.68 and serves as a mid-range pivot. A close above that on the daily time frame would be a nice confirmation of strength.

NEAR 4hr chart. Source: Tradingview

Meanwhile, RSI is 41, which means the token is by no means overbought. Historically, NEAR rallies once RSI breaks out above 50, so that is what traders are watching out for.

Looking at the 4-hour chart, NEAR price has been bouncing between $2.20 and $2.80, forming a tight consolidation range. The Fibonacci retracement levels reveal a few key signals. The price has yet to reclaim the 0.382 level ($3.87); the 0.618 zone ($3.56) remains the main breakout trigger.

The 1.618 extension ($2.24) lines up perfectly with current support, meaning buyers continue to step in there. This compression between resistance and support usually works out into a strong breakout. A close above $3.40-$3.60 would pretty easily propel NEAR price to $4.00 and beyond.

NEAR daily chart. Source: Tradingview

On the daily chart, NEAR price looks like it’s finishing its long correction phase. The token printed a flag to the bull late in 2024 and ran hard, then fell into a falling wedge formation, a shape often found at the end of a downtrend.

That wedge bottomed at around $1.55, and since then, this price level has been a good support level. Each retest of that area has been met with a solid bounce, showing that sellers are slowly running out of steam.

Lucky’s chart sums up the story well: a bullish flag breakout started the previous rally, a falling wedge shaped the corrective pullback, a sideways range between $2 and $3 has now built a foundation for what could be the next uptrend.

As long as NEAR price stays above $2.00, the next logical targets sit around $4.00 to $5.50, and possibly even $8.00 if market conditions keep improving.

Market sentiment is turning positive for NEAR

Lucky’s post also reflects a clear shift in trader psychology. For months, NEAR was ignored while other layer-1 tokens like Solana, Avalanche, and Sui captured interest. But now, that seems to be changing.

In my opinion, $NEAR bottom is near.

What’s your loudest target by the EOY, @NEARProtocol community? pic.twitter.com/jD1QwWhEtl

— Lucky (@LLuciano_BTC) October 13, 2025

Across social platforms, more traders are talking about accumulation rather than capitulation. And the fact that NEAR has held its key support zone even through the latest market crash is giving bulls confidence again.

Most analysts now agree on two things: The downside risk is minimal as long as NEAR price stays above $2.00, and the upside potential is significant, with $4.00 to $8.00 being realistic medium-term targets.

What could happen next to NEAR

- Bullish scenario: If NEAR price breaks above $3.50, momentum could quickly carry it toward $5.00 or higher. That’s where major resistance sits, and a clean breakout could trigger a strong uptrend.

- Neutral scenario: If the price continues to move sideways between $2.20-$2.80, it’s likely just more accumulation before the next big leg up. This would be a healthy structure as the market prepares for a larger recovery.

- Bearish scenario: If NEAR drops below $2.00, that would invalidate the bullish thesis and a retest of $1.55 in the cards. But with the strong support and improving on-chain trends set in place, that does not look like a likely outcome at this point in time.

Is NEAR bottom finally in?

When you combine the technicals, on-chain trends, and improving sentiment, it really does look like NEAR is close to its bottom, if not already there.

The NEAR charts show strong accumulation around $2, the network data is improving, and traders are finally starting to take notice again.

If Lucky’s call turns out right, the $2-$2.50 range could end up being remembered as the best buying zone before NEAR’s next big leg higher. Alternatively, $5.00 would be a conservative initial target, and $8.00 a reasonable one if the market does continue to mend over Q4 2025.

It will be a matter of volume and follow-through from here. If NEAR price can close above $3.50 convincingly, the reversal of the trend will be hard to ignore.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide