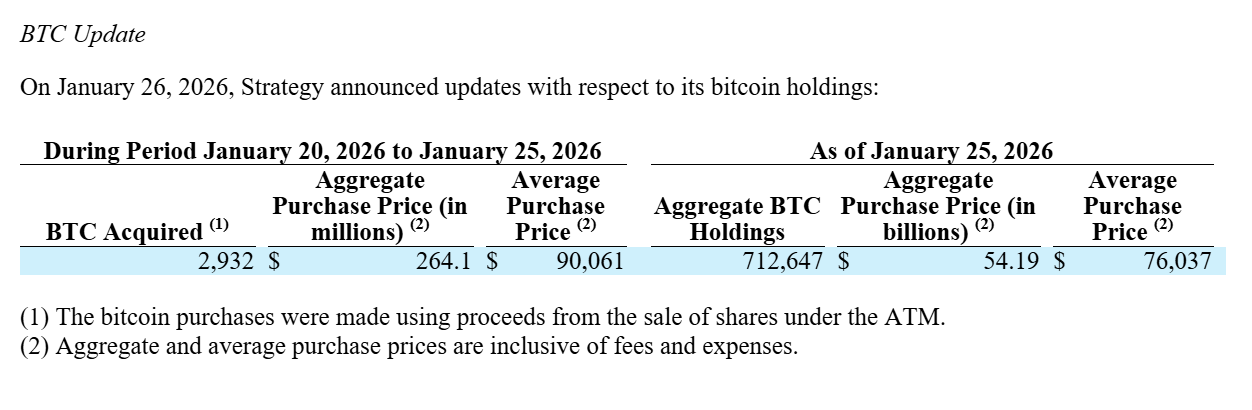

Strategy (MSTR), the enterprise software company led by prominent Bitcoin advocate Michael Saylor, continues its aggressive accumulation strategy. The firm recently acquired an additional 2,932 Bitcoin valued at approximately $264 million during a notable market correction. This purchase was formally disclosed in a regulatory filing submitted to the U.S. Securities and Exchange Commission (SEC) on January 5, 2026.

Strategy has acquired 2,932 BTC for ~$264.1 million at ~$90,061 per bitcoin. As of 1/25/2026, we hodl 712,647 $BTC acquired for ~$54.19 billion at ~$76,037 per bitcoin. $MSTR $STRC https://t.co/QBFRdARwtM

— Strategy (@Strategy) January 26, 2026

Despite Bitcoin’s price volatility, opening above $93,000 one week and briefly dipping below $87,000 the next – the company’s average acquisition cost for this batch stood at $90,061 per coin.

As the world’s largest public holder of Bitcoin, Strategy demonstrates unwavering commitment by expanding its position even amid declining prices. This latest transaction brings the company’s total Bitcoin reserves to 712,647 coins.

These holdings were accumulated at an aggregate cost of roughly $54.19 billion, reflecting an average purchase price of $76,037 per Bitcoin.

The scale of this portfolio underscores Strategy’s transformation into a major institutional player in the cryptocurrency space, positioning it as a benchmark for corporate adoption.

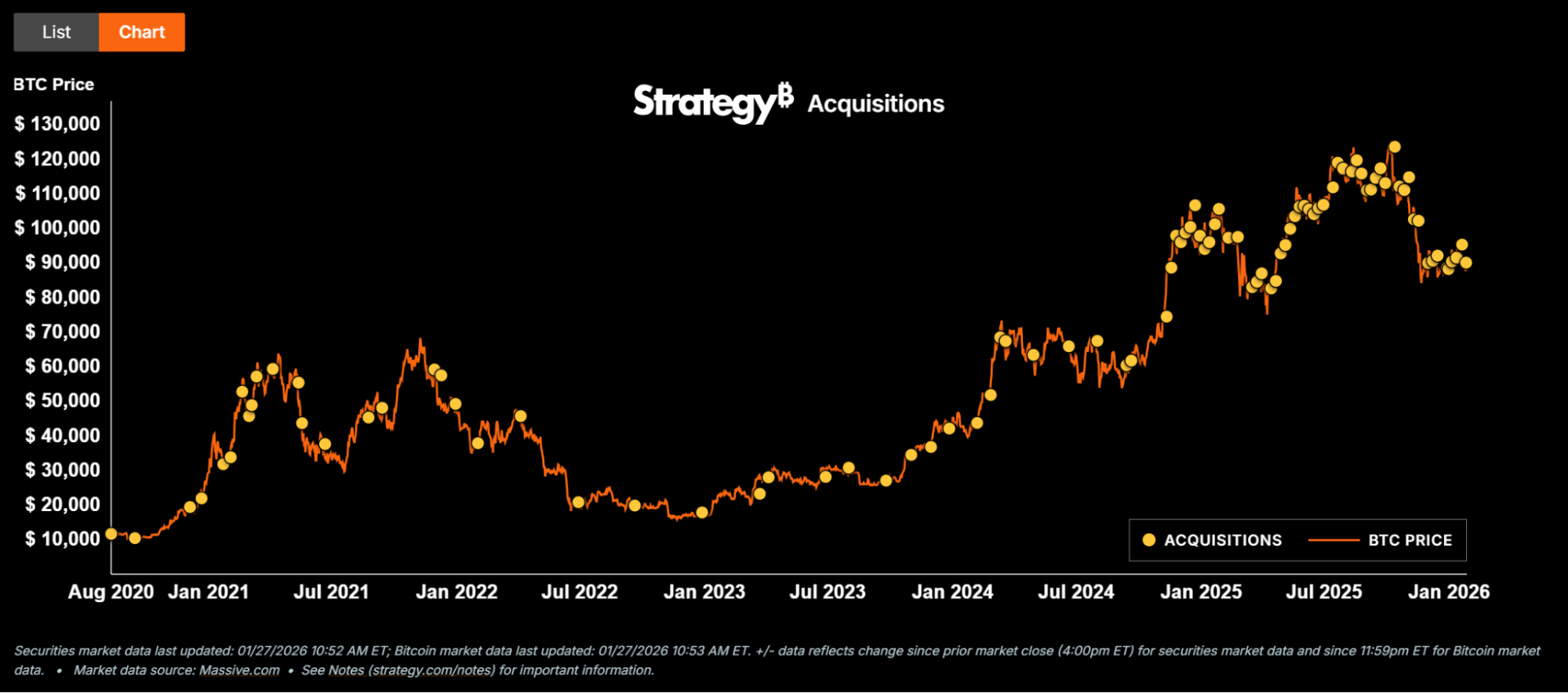

January 2026 marked an exceptionally active period for the company, with purchases totaling approximately 40,100 bitcoins over the course of the month. This volume surpasses the combined acquisitions from the previous five months: August through December 2025, signaling a sharp acceleration in buying activity at the start of the new year.

Source: Strategy

While the most recent purchase of 2,932 Bitcoin was smaller than prior January transactions (22,305 Bitcoin announced last week and 13,627 the week before), the overall pace highlights an aggressive accumulation strategy undeterred by short-term market weakness.

Financing through strategic share sales

To fund these Bitcoin acquisitions, Strategy leveraged equity markets effectively. The company sold about 1.7 million shares of its Class A common stock (MSTR), generating $257 million in proceeds. Additionally, it sold 70,201 shares of preferred stock (STRC), raising another $7 million.

This approach allowed the firm to capitalize on its market valuation while bolstering its cryptocurrency reserves. The timing proved opportunistic, as Bitcoin had declined more than 6% from recent highs, reinforcing MicroStrategy’s philosophy of buying during periods of price dips.

Michael Saylor, the company’s co-founder and executive chairman, had publicly committed in 2024 to continuing Bitcoin purchases even at peak price levels. Recent actions reveal a more tactical evolution: measured transaction sizes amid heightened volatility, yet persistent growth in holdings. This disciplined approach aligns with long-term conviction rather than reactionary trading.

Market implications

Strategy’s systematic accumulation mirrors the gold-reserve strategies employed by central banks throughout the 20th century, consistent buying irrespective of immediate price swings.

The company now controls approximately 3.4% of Bitcoin’s total supply, effectively operating as a private “Bitcoin central bank.” This concentration raises intriguing questions about corporate influence on asset pricing.

The January surge coincided with institutional portfolio reviews following the U.S. presidential election, amplifying its strategic timing. As political and economic uncertainties persist, Strategy’s moves could reshape perceptions of Bitcoin’s decentralization.

Source:: MicroStrategy Adds 2,932 Bitcoins Worth $264M Amid Market Decline