Key highlights:

- Metaplanet’s market-to-Bitcoin net asset value (mNAV) has fallen below 1.0, signaling its stock trades at a discount to its Bitcoin reserves.

- The Japanese company holds 30,823 BTC worth approximately $3.5 billion, yet its share price has declined over 74% from its peak.

- Broader market fears, including escalating U.S.-China trade tensions, may be contributing to investor uncertainty.

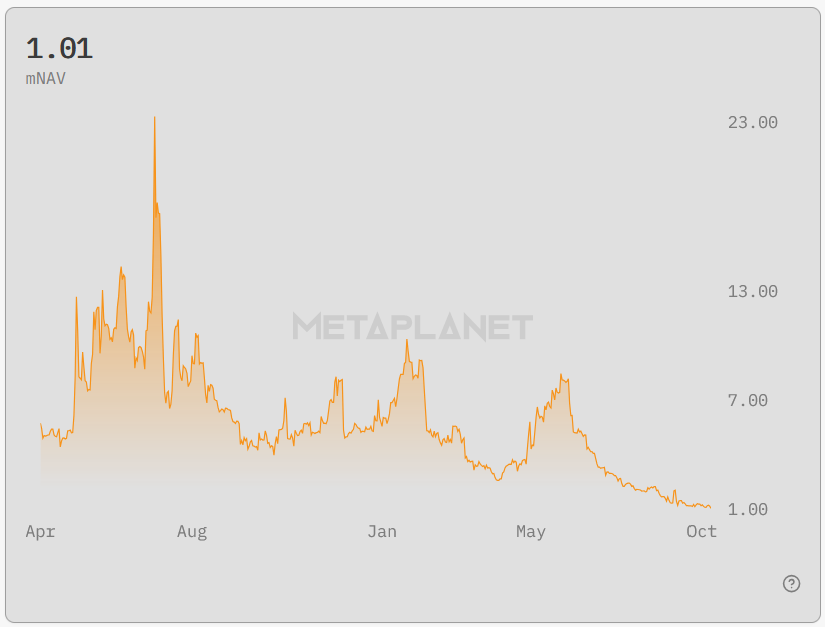

Japanese Bitcoin treasury firm Metaplanet briefly traded at a discount to the value of its crypto holdings, as its market-to-Bitcoin net asset value (mNAV) fell to 0.99 for the first time on record. When a Bitcoin treasury company trades below 1 mNAV, the company’s enterprise value (calculated as market capitalization plus debt) is lower than the net asset value of its Bitcoin reserves. Metaplanet has since recovered to a mNAV of 1.01.

According to Bloomberg, Japan-listed company Metaplanet Inc. has seen its enterprise value fall below the value of its Bitcoin reserves. Metaplanet adopted a Bitcoin accumulation strategy in April 2024 and once traded at a significant premium to its Bitcoin net asset value. After…

— Wu Blockchain (@WuBlockchain) October 14, 2025

This milestone marks a sharp turn for Metaplanet, which pivoted to a Bitcoin-focused treasury strategy in April 2024. The firm currently holds 30,823 BTC, valued at roughly $3.5 billion, positioning it as the fourth-largest public Bitcoin holder globally. However, its stock has fallen steeply, closing at 482 yen on Tuesday after a 12.36% daily drop, an overall decline of 74.5% from its all-time high of 1,895 yen.

mNAV drop signals shifting investor sentiment

The decline in mNAV, down from a peak of 22.59 in July 2024, is a result of shifting market sentiment. The company had seen a surge in valuation after its initial Bitcoin purchase last year, but the enthusiasm has waned amid recent sell-offs and a temporary halt in its BTC acquisitions. Its last recorded purchase was on September 30, when it acquired 5,268 BTC.

The mNAV metric, which includes debt and other liabilities in the enterprise value calculation, is a key indicator for evaluating digital asset treasury firms. A sub-1.0 mNAV suggests the market may have concerns about Metaplanet’s capital structure, operating model, or its ability to continue expanding its Bitcoin holdings without diluting shareholders.

Metaplanet’s mNAV history. Source: metaplanet.jp

Market-wide headwinds add pressure

The drop in Metaplanet’s valuation comes amid broader market turbulence. Fears of a renewed U.S.-China trade war resurfaced after President Donald Trump vowed to impose 100% tariffs on Chinese imports. In response, Beijing has declared it will “fight to the end,” escalating tensions that have rattled both crypto and equities markets.

Other digital asset treasury firms are also experiencing valuation strain. KindlyMD (NAKA), which holds 5,765 BTC, is trading at 0.959x mNAV, while industry leader Strategy (MSTR), despite holding 640,250 BTC valued at $72 billion, is seeing underperformance relative to Bitcoin, with only a 5% year-to-date stock gain versus BTC’s 19%.

Metaplanet’s current mNAV discount may present an opportunity for investors seeking exposure to Bitcoin at a reduced premium, but it also reflects market caution. With its capital raising strategy under review and no recent BTC purchases in two weeks, investors appear to be weighing the risks associated with its debt profile and long-term execution.

Source:: Metaplanet Trades Below Value of Its Bitcoin Holdings for First Time