Key highlights:

- Whale transfers surge as long-term holders double their daily spending

- Analysts reject panic theories and point to classic late-cycle behavior

- New data raises doubts about the four-year cycle and hints at a bottom

Disclaimer: Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Bitcoin whales have intensified their selling activity, with Arkham data showing trader Owen Gunden moving $237 million in Bitcoin to the Kraken exchange. While such transfers often spark fear in the market, analysts urge caution before assuming whales are dumping coins en masse.

OWEN GUNDEN JUST SOLD ANOTHER $290M BTC

Owen Gunden just moved all of the remaining BTC out of his accounts. He deposited over HALF of his holdings directly into Kraken, depositing a total of $290.7M of BTC into Kraken.

He now has only $250M of Bitcoin remaining. pic.twitter.com/ZUB3aToAgH

— Arkham (@arkham) November 13, 2025

Glassnode researchers say they are confident there is no large-scale whale exodus. Instead, the current behavior aligns with patterns seen in the later stages of bull markets, when long-term holders begin to take profits more actively.

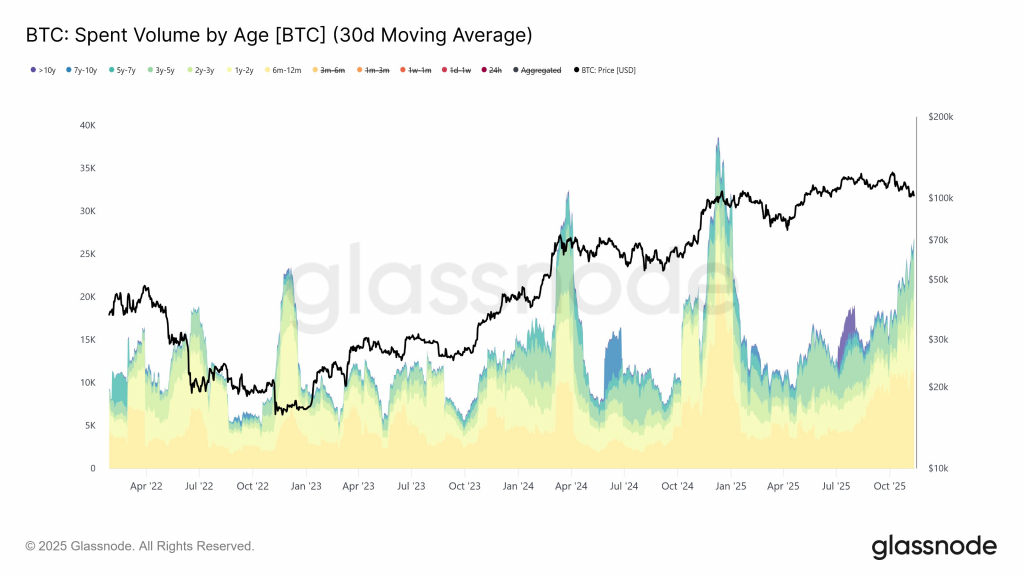

Average monthly spending from long-term holders has doubled, from 12,000 BTC per day in early July to 26,000 BTC per day as of Thursday. Although the increase may appear dramatic, analysts emphasize that this pattern reflects steady, controlled distribution, not fear-driven selling.

Glassnode explains that long-term holders historically take profits throughout every cycle, and the current rise in sell-side pressure from older investor groups fits the late-market environment.

Late-cycle behavior or something more? Analysts question the four-year pattern

Whale selling does not necessarily signal panic. In most cases, it reflects profit rotation, where seasoned investors move gains into safer assets or reallocate positions. Such activity is normal in a late bull market and does not guarantee that Bitcoin has reached its final peak, especially if demand remains strong enough to absorb supply.

Momentum has slowed as macroeconomic conditions shift. Expectations for interest-rate cuts have faded, and liquidity has tightened, creating short-term weakness.

Still, growth has not stopped, and analysts point to several on-chain signals that suggest a market bottom may be forming. Bitcoin’s net unrealized profit ratio currently stands at 0.476, an area historically associated with late-stage corrections.

Is the four-year cycle still reliable?

Traditional market peaks have occurred roughly four years apart.

- December 2017 topped 1,067 days after its bottom

- November 2021 topped about 1,058 days later

- The latest all-time high on October 6, 2025, came 1,050 days after the previous low

From this perspective, the cycle may have already peaked.

But analysts warn that relying on this rhythm may no longer be valid. Demand dynamics have shifted dramatically due to ETFs, corporate treasuries, and new institutional players. These buyers do not operate on a four-year cycle and are more responsive to macroeconomic conditions than historical patterns.

Their activity has slowed recently, but that could change quickly.

As a result, there are compelling reasons Bitcoin could deviate from the traditional four-year model, even if those catalysts are still developing.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Major Investors Are Offloading Bitcoin — Has the Bull Market Peaked?