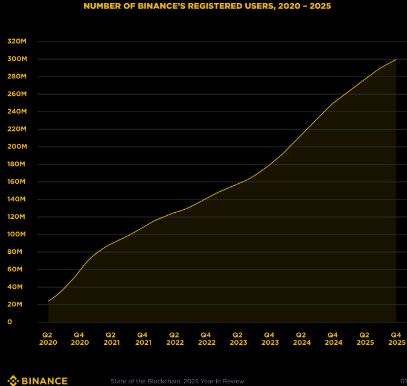

The crypto industry spent ten years wrestling with a difficult question: can you scale rapidly while adhering to strict rules? With the start of 2026, the debate is effectively over. Binance just cleared the 300 million registered user mark worldwide. This proves that massive growth and heavy regulation can coexist.

This number is not just a vanity metric. It confirms that adoption actually accelerates when oversight matures. We have moved past the era of asking investors to “trust us” and entered a phase where frameworks like ADGM allow the market to “verify us.”

As digital assets integrate deeper with global finance, the ability to operate within sophisticated legal structures is no longer optional, it is the prerequisite for the next phase of growth.

Regulation as a new key driver of growth

The shift toward deep regulatory integration took physical form on January 5. This was when Binance officially transitioned its global platform operations to the Abu Dhabi Global Market (ADGM) framework.

Operating under the Financial Services Regulatory Authority (FSRA), this move represents a complete structural overhaul rather than a simple licensing update. The platform has effectively unbundled its services to mirror the architecture of TradFi, a move that directly addresses the structural concerns of institutional capital.

Under this new regime, operations are distinct across three specific entities, each with a defined role. Nest Exchange Limited operates as a multilateral trading facility, handling the matching engine for spot and derivatives markets. Nest Clearing and Custody Limited functions separately as the clearing house and custodian, ensuring that asset segregation is absolute, which is a critical demand from risk managers. Finally, Nest Trading Limited operates as the broker-dealer, managing OTC and conversion services.

Wall Street risk committees have long demanded a specific safety mechanism before deploying capital: segregation. By splitting the exchange, the custodian, and the broker into separate entities, the new structure removes inherent conflicts of interest. It is a setup that traditional finance recognizes and trusts. This architecture does more than just meet a legal requirement; it builds a structural pathway for institutional funds to enter the digital asset market safely.

Discussing this milestone, Binance Co-CEO Richard Teng noted that “The ADGM license crowns years of work to meet some of the world’s most demanding regulatory standards, and arriving within days of the moment we crossed 300 million registered users shows that scale and trust need not be in tension.” Teng’s perspective highlights that regulatory rigor acts as an accelerant for user confidence rather than a brake on expansion.

The market’s response to this regulatory clarity has been tangible. The $2 billion investment from Abu Dhabi-based technology investor MGX stands as proof that sovereign-level capital is prepared to enter the space once the infrastructure meets compliance thresholds. By aligning with the FSRA framework, the exchange has essentially built a bridge for capital that cannot legally or policy-wise enter unregulated environments.

Engineering liquidity through institutional confidence

Regulatory licenses do more than satisfy auditors; they act as a moat that deepens market liquidity. When institutions trust the legal structure, they deploy capital at scale, creating deeper order books and tighter spreads.

The data from Binance’s 2025 Year In Review report confirms that the company’s dominance is now powered by this institutional trust. Total trading volume across all products hit $34 trillion in 2025, with spot trading volume alone exceeding $7.1 trillion. Consequently, the platform’s market share of global spot crypto trading now sits at approximately 41%.

The narrative that crypto is purely retail is becoming outdated. Institutional trading volume grew by 21% year-over-year. Even more telling is the surge in OTC fiat trading volume, which spiked by 210%. This indicates that large-scale capital is moving via regulated rails where execution is reliable and pricing is efficient. Institutions are no longer just dipping a toe in; they are integrating digital assets into diverse portfolios, driving volume through compliant market players.

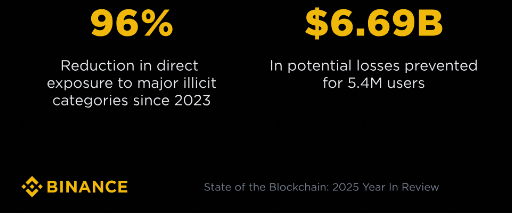

Deep markets require safety to function correctly. Liquidity vanishes if participants fear hacks, scams, and other malicious activity. Binance’s robust controls prevented $6.69 billion in potential fraud losses throughout 2025, and direct exposure to illicit funds dropped by 96% since 2023. These aren’t just compliance metrics; they are liquidity features that determine whether institutional capital stays deployed.

Binance Chief Compliance Officer Noah Perlman commented on this reduction in illicit exposure, “Analysis of independent industry data shows a steep reduction in our direct illicit exposure between early 2023 and mid-2025, even as Binance handled growing volumes comparable to the next six largest exchanges combined.”

Removing bad actors does more than satisfy regulators; it builds a stable floor for high-frequency traders and asset managers. When these participants feel secure, they deploy more capital. This triggers a clear feedback loop: safety deepens liquidity, and deep liquidity draws in more users. Growth, in this context, becomes a direct product of stricter compliance standards.

Operationalising trust in the crypto market

The operational launch of the Nest entities in January 2026 proves that there’s a seamless bridge being built between crypto market players and institutional capital. The ADGM license serves as a blueprint for how exchanges can evolve into mature financial institutions without losing their digital edge.

With the platform now processing 217 million daily trades on average—volumes that rival and often exceed major traditional stock exchanges—the infrastructure is battle-tested.

The structural foundation is now fully deployed. The path is now clear for the next wave of adoption — where the 300 million user milestone is merely the baseline for a fully integrated, transparent, and global financial ecosystem.

Source:: Licenses, Liquidity, and Legitimacy: The New Playbook for Global Crypto Exchanges