Key highlights:

- Kraken fires back as banks resist stablecoin yields

- Crypto leaders say banks are defending profits, not users

- A new regulatory fight could reshape digital finance

A new clash has erupted between U.S. banks and the crypto industry after Dave Ripley, CEO of the Kraken exchange, sharply responded to claims that stablecoin yields harm the banking system.

This panel hosted by the American Bankers Association said allowing companies like @krakenfx or @coinbase to pay interest on stablecoins would be “a detriment.”

A detriment to who?

Healthy competition is the bedrock of a free market and free markets benefit actual consumers…

— Dave Ripley (@DavidLRipley) October 21, 2025

The dispute began when Brooke Ybarra, senior vice president at the American Bankers Association (ABA), argued that allowing exchanges to pay interest on stablecoins contradicts their purpose as payment tools rather than savings instruments.

Ybarra suggested that interest-bearing stablecoins could weaken banks’ ability to serve their communities. Ripley rejected that argument outright, questioning who is actually harmed and insisting that consumers deserve the freedom to choose how and where they hold their money.

He accused banks of profiting from customer deposits while providing little in return.

“We are building toward something else — a system where services once reserved for the wealthy are accessible to everyone,” Ripley said.

Crypto industry pushes back as regulation accelerates

Leaders across the crypto sector echoed Ripley’s criticism. Dan Spuller of the Blockchain Association said major banks are simply afraid of competition from platforms like Kraken and Coinbase.

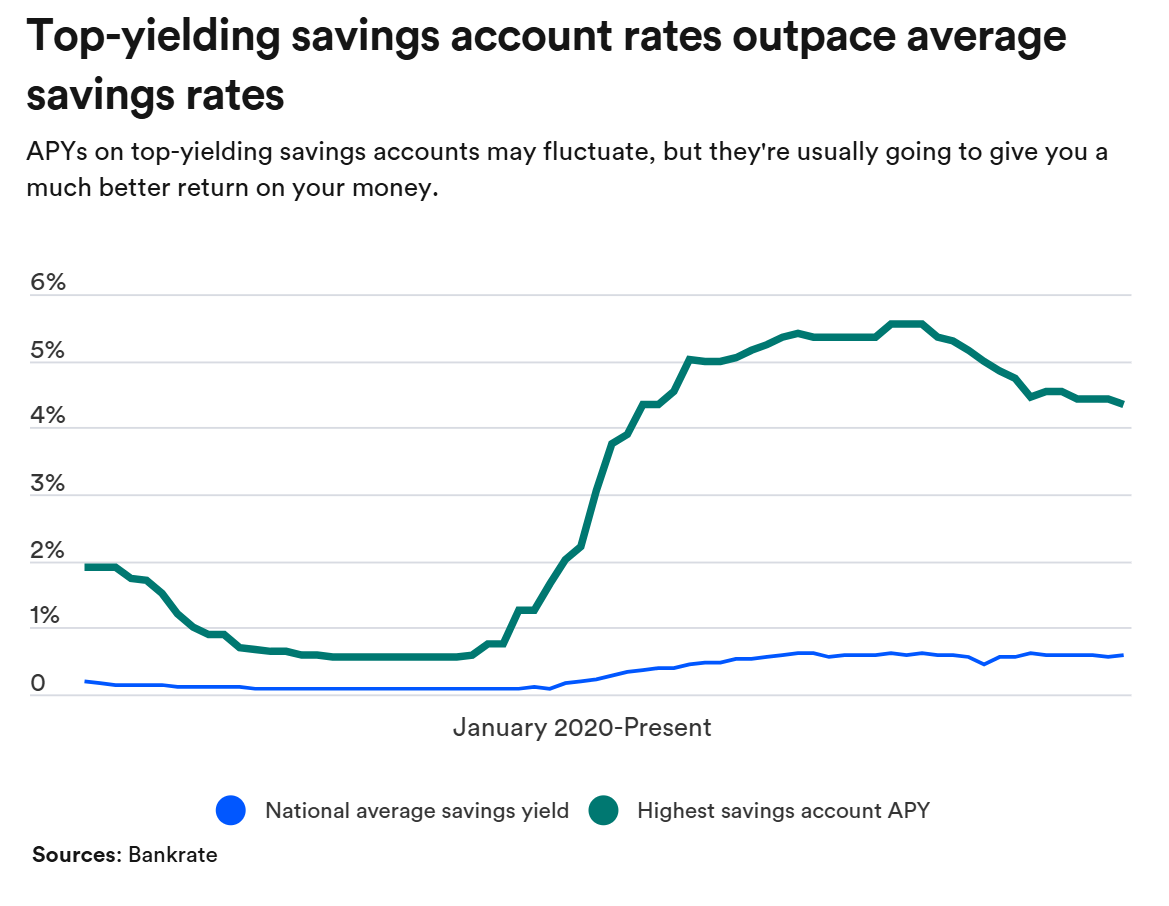

Data backs the rivalry: some stablecoins offer up to 5% annual yield, far above the average U.S. savings rate of 0.6%, according to Bankrate.

Source: Bankrate

The debate comes just months after the U.S. approved the GENIUS Act, the nation’s first major stablecoin framework. Some experts now argue stablecoins could be safer than bank deposits when backed by short-term Treasuries and top-tier custodians.

Meanwhile, similar tensions are emerging internationally. A Binance Australia study found that crypto users continue to face banking barriers, limiting market participation and slowing adoption.

As both sides dig in, the question is no longer whether stablecoins will reshape finance — but who will control that future.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: Kraken CEO Fires Back as Banks Push to Stop Stablecoin Yields