The cryptocurrency market is currently in an uncertain position. The prices of top crypto assets like Bitcoin and Ethereum have seen a moderate decline in the last year, while prices of smaller altcoins have collapsed in the same time period.

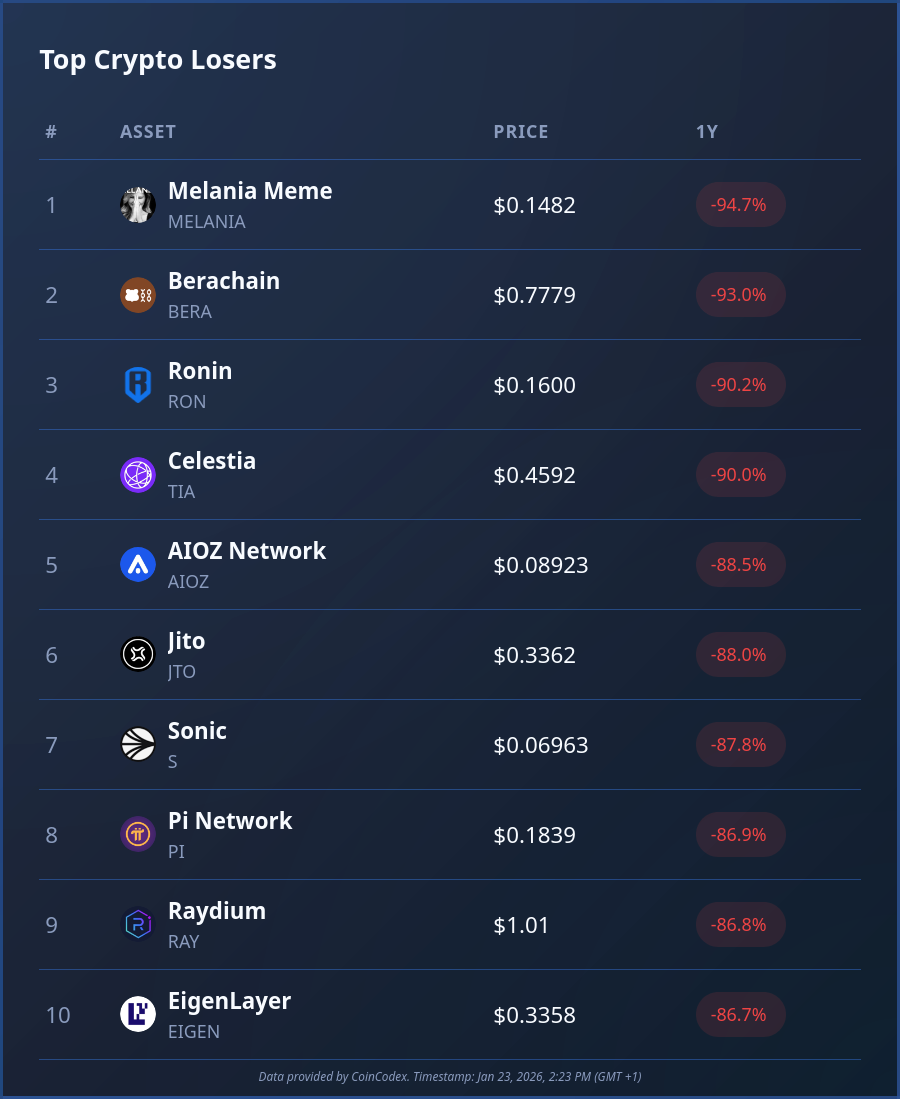

The performance of the top 200 crypto assets by market cap in the last year does not look pretty at all. 146 of them are down 30% or more, with 118 of them sustaining losses of over 50%. 35 of these coins have seen almost complete collapses, losing over 80% of their value in the last 365 days.

Meanwhile, traditional markets have been doing just fine. The S&P 500 is up 13% in the last year, while gold has seen an incredible 79% price increase over the same period.

So, is crypto on its way out or is the current situation a great opportunity to buy the dip? Let’s take a look at the main arguments for and against crypto to see whether crypto is a good investment in 2026.

Reasons for investing in crypto in 2026

- The regulatory landscape for crypto is looking more supportive than ever.

- Institutional investors are highly active in the crypto market through exchange-traded funds (ETFs) and digital asset treasuries (DATs).

- Many altcoins have crashed in value, which means there are opportunities to buy the dip.

Crypto-friendly regulations under the Trump administration

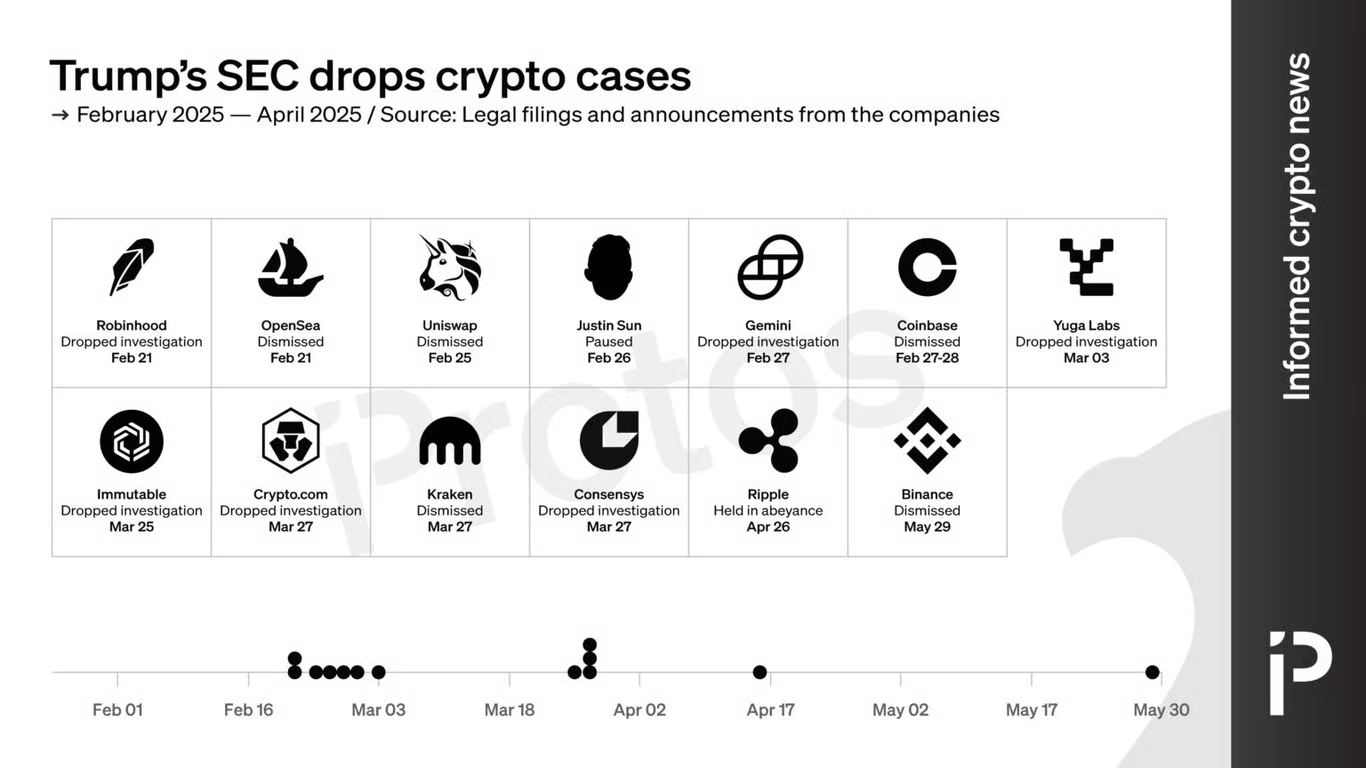

Due to its immense concentration of capital, the United States is the world’s most important market for cryptocurrency. Joe Biden’s administration was relatively hostile to crypto, with former SEC chairman Gary Gensler becoming a sort of bogeyman to the industry by pursuing legal action against major crypto players such as Ripple, Coinbase and Binance.

In response, the crypto industry stepped in to overwhelmingly support Donald Trump and Republican candidates during the 2024 election cycle.

The crypto industry collectively raised over $245 million for super PACs and individual candidates during the 2024 election cycle, which was more than what was raised by the oil and pharmaceutical industries. In addition, crypto firms also gave $18 million to Trump’s inauguration.

Under the Trump administration, U.S. regulators have completely changed their approach to crypto, adopting a much more hands-free approach. For example, the SEC has dropped practically all of its high-profile crypto cases.

Image source: Protos

Trump is also repaying the crypto industry’s support for his campaign with multiple moves, such as establishing the U.S. Strategic Bitcoin Reserve, backing the GENIUS Act stablecoin legislation, and attempting to create a new regulatory framework for cryptocurrencies with the upcoming CLARITY Act.

Trump has gone so far as to launch an official TRUMP meme coin and endorse the World Liberty Financial (WLFI) project. This means that the president of the United States now has real skin in the game when it comes to crypto, which would have been unthinkable just a few years ago.

At least in terms of regulations, we can therefore expect strong support for the crypto industry in the U.S. until the end of Trump’s term in early 2029, which bodes well for cryptocurrencies. Of course, the next administration might not be so friendly, which introduces some uncertainty over the long term.

ETFs and DATs are enabling institutional participation in the crypto market

The barriers preventing institutional investors from participating in the cryptocurrency market are practically all gone, as there are now several methods for getting exposure to crypto through traditional market infrastructure.

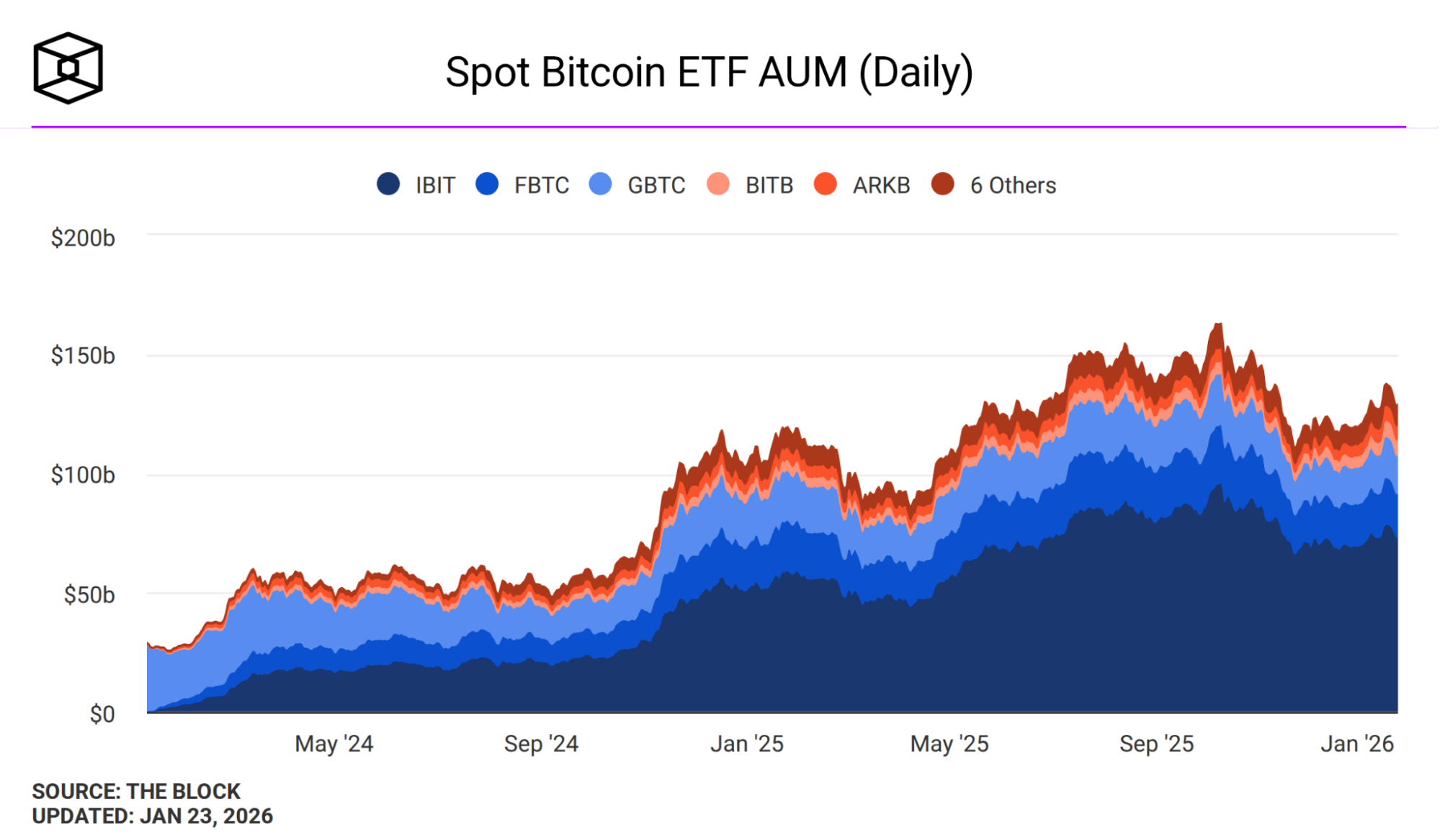

Spot Bitcoin ETFs have been a tremendous success, with the combined AUM of these investment products ballooning to around $130 billion. Ethereum ETFs have also seen considerable demand, as they currently have an AUM of $16 billion.

Image source: The Block

There are also a plethora of altcoin ETFs for investors that want exposure to crypto assets other than Bitcoin. Thanks to the crypto-friendly Trump administration, the process of approving crypto ETFs has become significantly faster, and there are now ETFs tied to XRP, Solana, Hedera, Sui, Litecoin, and even Dogecoin.

We have also seen a boom in digital asset treasuries (DATs), which are publicly-traded companies that invest in crypto assets. The most notable of these is Strategy (MSTR), which has accumulated over 700,000 BTC (worth over $63 billion) since starting to buy Bitcoin in 2021.

When it comes to Ethereum, BitMine (BMNR) has accumulated more than 4.2 million ETH, valued at nearly $13 billion.

In the last year, we have seen plenty of companies attempting to replicate Strategy’s playbook to varying degrees of success. While the demand for crypto assets originating from DATs is certainly beneficial for crypto, the long-term viability of these companies is still under question. This is especially true for companies that have no meaningful operations other than acquiring Bitcoin (or other cryptocurrencies).

Opportunities in the altcoin markets

Several notable crypto projects have seen massive declines from their all-time highs, which means now could be a good opportunity to buy for investors that believe in their long-term potential.

Here are some projects that could be a compelling opportunity right now, including the drawdown from their all-time highs:

- Ethereum (-41%)

- Solana (-57%)

- XRP (-51%)

- Chainlink (-77%)

- Hyperliquid (-63%)

- Bittensor (-69%)

Reasons against investing in crypto in 2026

- Some altcoins will never recover to their all-time high prices. What looks like buying the dip could actually be just catching a falling knife.

- Bitcoin is not behaving like a safe haven investment, and there will likely be plenty of uncertainty and geopolitical instability in 2026.

- Accumulation by DATs could be a double-edged sword if they are forced to start selling.

Some altcoins will never recover

While we just mentioned several crypto projects that could have potential for a strong bounceback in 2026, it’s important to keep in mind that some altcoins will never recover from their crash. With each crypto market cycle, some projects are simply left behind and never surpass their previous peak valuations.

For example, projects focusing on the GameFi, NFT and metaverse crypto sectors have a very tough road ahead of them.

The tokenomics of GameFi projects have proven to be unsustainable in practically every case, and the games they released have not been good enough to organically attract players.

Users have shown practically no interest in the metaverse, as these digital worlds remain barren despite major venture capital investments.

NFTs have shown some resilience, but it’s clear that the valuations we saw in 2021 and 2022 were completely overblown. The NFT markets are still in the process of finding a bottom, which could be much lower than holders of top NFT collections are hoping for.

While some of the projects in these sectors might be able to come back with intelligent pivots, these trends have lost all steam and there is currently no reason to expect a significant resurgence.

Bitcoin is not acting as a safe haven

The geopolitical situation in 2026 is increasingly unstable. The U.S. has captured Venezuelan president Nicolas Maduro, ignited tensions with Europe by insisting on taking over Greenland, and suggesting they may take further military action in Iran as the country’s regime struggles to deal with mass protests and unrest. Meanwhile, the war in Ukraine continues raging on, and Israel is still striking Gaza.

On top of that, the United States has enacted protectionist trade policies centered around tariffs since Trump took office in 2025, causing uncertainty in global markets.

As a result, there has been growing demand for safe haven assets, with precious metals benefiting the most. The gold price is up nearly 80% in the last year, while the Bitcoin price has dropped by 13% in the same time period. It’s clear that investors currently aren’t treating Bitcoin as a safe haven, despite the “digital gold” narrative which is popular among crypto enthusiasts.

On the other hand, Donald Trump is aggressively pressuring the U.S. Federal Reserve to cut interest rates further in 2026, which would bode well for risk assets, including cryptocurrencies.

DAT accumulation risks

Digital asset treasuries such as Strategy have become a powerful new source of demand for cryptocurrencies, helping to absorb supply, support prices, and signal long-term institutional conviction in the asset class. By treating crypto as a strategic reserve rather than a speculative trade, these entities can reduce circulating liquidity and reinforce the narrative of digital assets as a store of value.

However, this concentration of ownership also introduces systemic risk.

If a large treasury is forced to sell due to leverage, regulatory pressure, liquidity needs, or a loss of market confidence, the resulting supply shock could overwhelm market depth and trigger cascading liquidations. In that scenario, what once stabilized the market could instead amplify volatility, turning a key pillar of demand into a potential black swan event with outsized impact on prices and sentiment.

Top crypto trends and narratives in 2026

Now, let’s take a look at the most relevant crypto trends and narratives in 2026 so you can have a better understanding of this rapidly-shifting market. For each category, we will highlight a few standout projects that could be a good option if you’re looking to get exposure to that specific sub-sector of the crypto and blockchain industry.

- Stablecoins: Major layer 1s with smart contracts (primarily Ethereum and Solana)

- Real-world asset tokenization: Ethereum, Solana, Chainlink, XRP, Stellar, Ondo

- On-chain trading: Hyperliquid, Aster, Lighter

- AI x crypto: Bittensor, NEAR Protocol, Render

- Privacy coins: Monero, Zcash

Looking to invest in crypto? Here’s how to get started

If you’ve decided to invest in crypto, we provide a number of resources to get you up to speed with everything you need to know.

- Our crash course for investing in crypto will help you learn the most important elements of investing in crypto and will introduce you to key concepts like cryptocurrency wallets, exchanges, and the most common misconceptions beginners have about cryptocurrencies.

- If you’re looking for a more comprehensive overview, our ultimate guide to investing in crypto will guide you through the process of buying cryptocurrency and safely storing it using a cryptocurrency wallet.

- If you’re not sure which cryptocurrencies to choose, our list of the best cryptocurrencies to buy provides an overview of some of the best cryptocurrency projects to explore.

Please keep in mind that cryptocurrencies are a highly risky investment. Before making any investment, make sure to carefully consider your financial situation and conduct your own research using multiple sources. Never invest more than you are willing to lose.

The bottom line – Is cryptocurrency a good investment in 2026?

Overall, cryptocurrency in 2026 is at a crossroads between growing structural legitimacy and persistent market risk.

On one hand, the regulatory environment, especially in the United States, has become markedly much more supportive, institutional access has expanded through ETFs and digital asset treasuries, and deep price declines across many major crypto assets have created selective opportunities for investors with strong long-term conviction.

At the same time, the past year has showed just how unforgiving the market can be, particularly for weaker altcoins that may never reclaim prior highs, while Bitcoin’s underperformance relative to traditional safe havens challenges some of crypto’s core narratives in a period of global instability.

The rise of digital asset treasuries adds another layer of complexity, offering plenty of demand but also concentrating risk in ways that could heighten volatility under stress.

Taken together, cryptocurrency in 2026 is neither a clear bargain nor a dying asset class. It is a high-risk investment where outcomes will depend heavily on asset selection, time horizon, and an investor’s ability to tolerate uncertainty in an increasingly polarized global and macroeconomic environment.

Source:: Is Crypto a Good Investment in 2026?