Key highlights:

- The HYPE price is finally moving again, pushing back into the mid-$30s as buyers step in and defend support on the short-term charts.

- The daily chart still holds the real test, and price hasn’t cleared the resistance levels that would confirm a bigger breakout.

- Traders aren’t ignoring the downside, with the low-$20s still sitting there as a possible retest zone.

Hyperliquid has been doing the thing crypto charts love to do: staying quiet for a while, then suddenly moving again.

For weeks, it felt like nothing was really happening. Price was stuck in a range, volume faded, and most people stopped paying attention. But honestly, that’s usually when things start getting interesting, because big moves don’t always begin with hype; sometimes they begin with boredom.

Why the HYPE price keeps getting linked to a $20 retest

Greeny Trades shared a tweet saying the HYPE price could still dip back toward ~$20 later this year. At first glance, that sounds pretty wild when the price is sitting in the mid-$30s. But once you actually look at the chart, it starts to make more sense why that level keeps coming up.

This isn’t people randomly calling for a collapse. It’s really just how markets behave after big moves. When something rallies hard out of a downtrend, price often goes back later and revisits the zones it launched from.

I’m still pretty confident we see $HYPE ~$20 again later in the year pic.twitter.com/wms2b74aNB

— Greeny (@greenytrades) February 4, 2026

On this chart, the HYPE price has managed to climb back above some important mid-range levels, but there’s still a pretty open pocket underneath. If support starts slipping, there isn’t a lot of structure until you get down into the low $20s.

That’s why levels around $24.17 and $20.11 stand out. They line up with prior reaction zones and deeper retracement areas, which makes them obvious downside targets if this breakout attempt doesn’t hold.

And with a token like this, moves don’t always happen slowly. The HYPE price tends to flush quickly when leverage unwinds and stops start getting hit.

Hyperliquid’s market cap isn’t falling apart – it’s moving up again

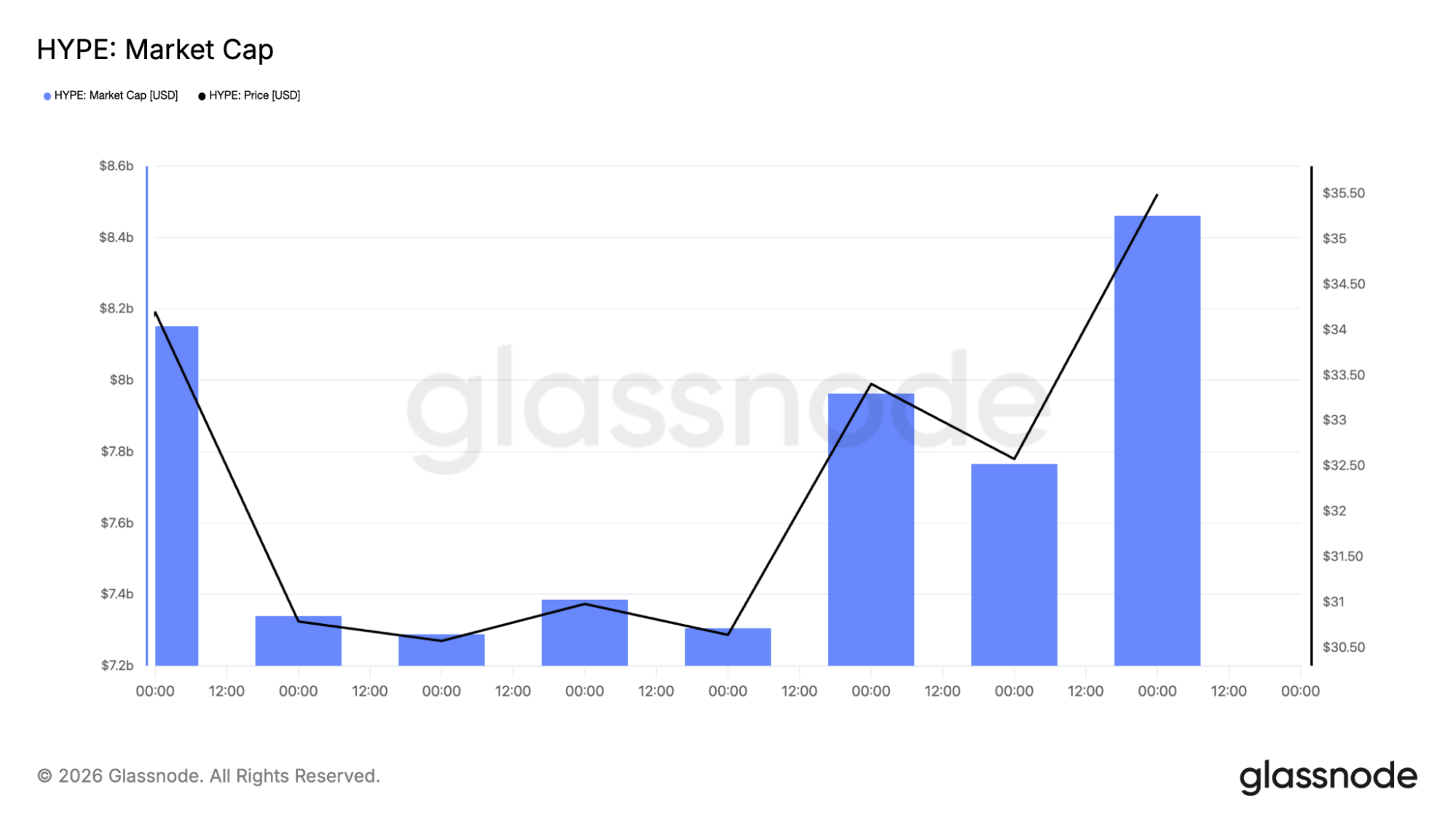

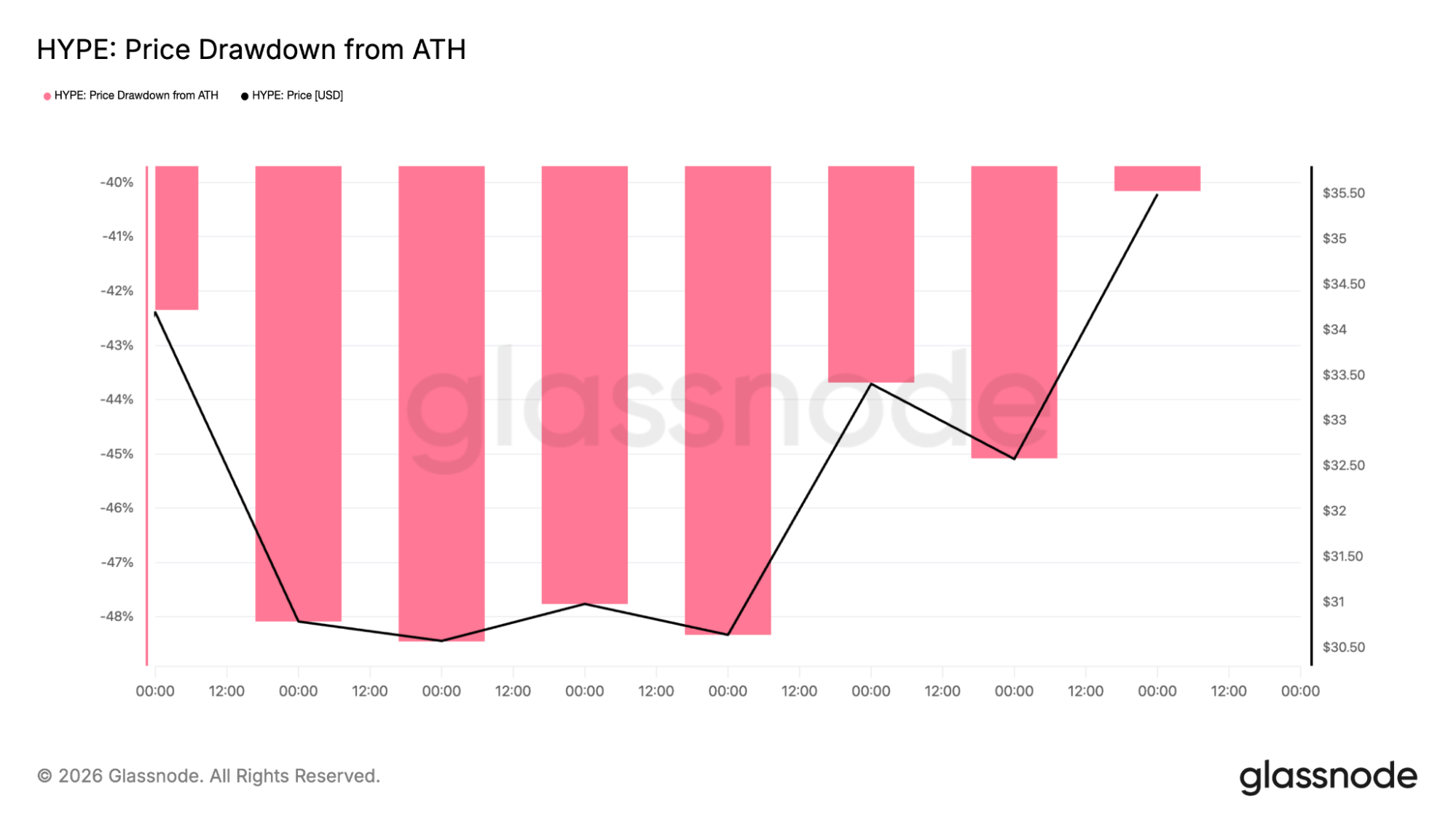

The Glassnode charts back up what the price action is showing. HYPE’s market cap dipped into the low-$7B range during the slower stretch, but it’s turned higher again and pushed back into the mid-$8B area as the HYPE price rebounded from the low-$30s.

That kind of recovery usually doesn’t happen without buyers stepping back in. That’s not what a market looks like when it’s collapsing. It looks more like capital is coming back in after a pullback, with sentiment starting to stabilize again.

The drawdown chart tells the same story. The HYPE price was sitting close to a -48% drawdown from its peak, but that’s improved closer to the -40% area with this rebound. That’s a meaningful change in tone, and it hints that the worst pressure may already be easing.

HYPE is bouncing short-term, but the daily chart is key

If you look at the 4-hour chart, it’s pretty obvious the HYPE price has finally gone from “dead quiet” to actually doing something again. After spending time sitting around the low-$20s, price started climbing, printing higher lows, and pushing up into the mid-$30s.

4-hour HYPE price chart analysis

Right now, the HYPE price is hovering around $34, and it’s doing it right around an area that’s been acting like a real short-term pivot. The $33 zone keeps getting defended every time price dips into it, which is usually a sign that buyers aren’t backing off yet.

But there’s still a problem overhead. The HYPE price is running straight into a resistance pocket between roughly $35.84 and $38.66. That’s where the market has been getting stuck. If price can’t break through cleanly, it’s the kind of spot where you often see another pullback back toward the trendline.

On the daily chart, this move feels a lot more important. The HYPE price isn’t just bouncing randomly; it actually reclaimed the low-$30s and is now pressing into an area where previous breakdowns happened.

Daily HYPE price chart analysis

The daily close is sitting near $34.19, and that’s above the 100-day moving average around $30.83. That matters because it tells you the bounce has some structure behind it. Price isn’t just wicking up, it’s holding above levels traders care about.

And above here, the next obvious magnet is sitting in the high-$30s. The $40.40 region stands out as the next major ceiling. If the HYPE price keeps pushing, that’s the level everyone ends up watching next.

What happens next from here

At this point, the HYPE price is basically stuck between rising support underneath and heavy resistance above. If it can keep holding above $33.00 and grind higher, the next big test is that $35.84 to $38.66 zone. A clean break there starts opening the door toward $40 again.

But if the HYPE price gets rejected and slips back under $33.00, then downside levels start coming back into play, first the high-$20s, and then that $24–$20 region that keeps showing up on the chart.

CoinCodex’s one-month HYPE price prediction places the price around $25.03, which fits with the idea that Hyperliquid may cool off and consolidate before any bigger move develops.

That’s where things stand. The HYPE price is strong enough to stay interesting, but it’s also sitting right at the kind of level where one rejection can flip the whole mood fast.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Hyperliquid Price Analysis: HYPE Bounces, but Traders Still Eye a Return to $20