Key highlights:

- Central banks purchased 45 tonnes of gold in November 2025, bringing total reserves to 297 tonnes.

- Gold prices reached over $5,500 per ounce due to rising institutional and central bank demand.

- Dollar’s purchasing power has fallen 52% since 1996, pushing governments and investors toward gold.

Economist Peter Schiff has warned that the era of the US dollar’s dominance is coming to an end. He predicts that central banks will increasingly shift to gold as their primary reserve asset, leading to a decline in the dollar against other currencies and a potential historic economic upheaval in the United States.

King dollar’s reign is coming to an end. Gold will take the throne as the primary central bank reserve asset. That means the U.S. dollar will crash against other fiat currencies, and America’s free ride on the global gravy train will end. Prepare for a historic economic collapse.

— Peter Schiff (@PeterSchiff) December 26, 2025

Central banks are actively increasing their gold holdings. According to the World Gold Council, net purchases in November 2025 amounted to 45 tonnes, bringing the total since early 2024 to 297 tonnes.

Emerging markets have been particularly active, with gold representing between 6% and significantly higher shares of their foreign exchange reserves.

Since 2022, central banks have been buying gold at twice the average volumes seen between 2015 and 2019. By 2024, their share of total gold demand grew to nearly 25%, highlighting a sustained trend amid geopolitical tensions and economic uncertainty.

Tether, a private company best known for issuing the USDT stablecoin, has also emerged as a major buyer of gold, accumulating 140 tons of the precious metal.

Gold prices reach new highs and 2026 outlook

Gold continued to hit record levels, reaching over $5,600 per ounce, reflecting growing interest from institutional investors and central banks. However, the market followed with a swift correction, with the price retreating back towards $5,250.

The World Gold Council forecasts that purchases in 2026 could reach 750-900 tonnes, depending on macroeconomic and political developments.

Experts attribute this demand to efforts by central banks to diversify reserves and reduce reliance on the US dollar, creating a more resilient global reserve system.

Weakening dollar and market shifts

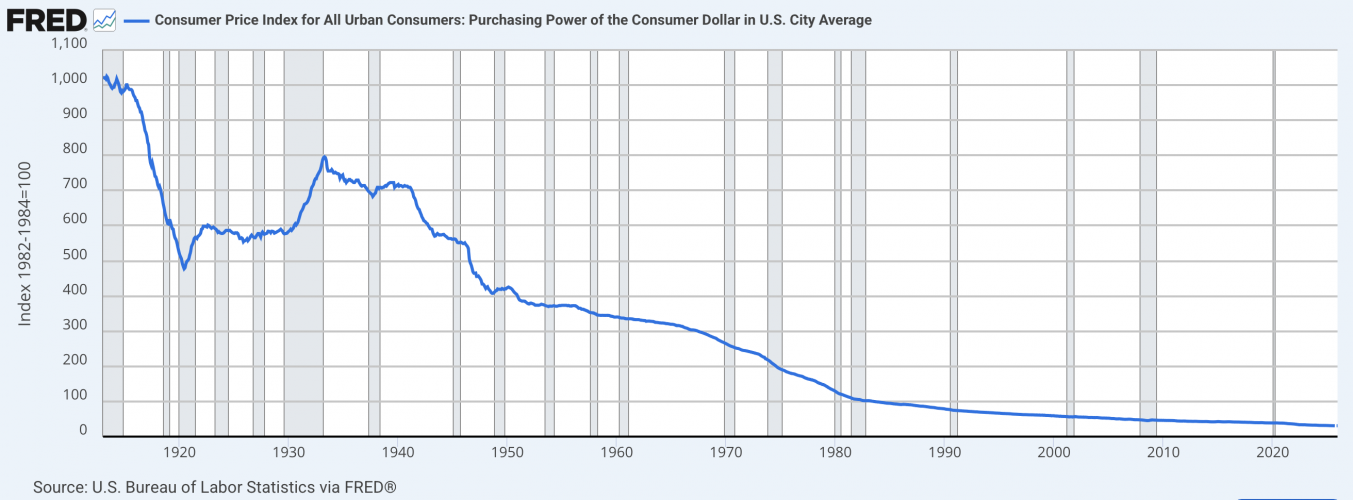

Data from the Federal Reserve Economic Data (FRED) show that the US dollar’s purchasing power has declined approximately 52% since 1996 and 83% since 1976, calculated using the consumer price index at an annual inflation rate of 2.7%.

The decline in the purchasing power of the dollar. Source: U.S. Bureau of Labor Statistics

China has continued to reduce its US Treasury holdings, dropping to $682.6 billion in November 2025 from $688.7 billion in October. This marks a decline of over 10% since the start of the year, reaching the lowest level since September 2008 and reflecting a strategic review of foreign exchange reserves amid trade tensions.

The gold market’s current dynamics indicate structural shifts in the global financial system. Central banks are reviewing reserve compositions, potentially affecting the balance of power between major currencies and precious metals.

Analysis of gold as a reserve asset

Historically, predictions of the “end of the dollar” have occurred repeatedly, from the 1970s post-Bretton Woods era to the 2008 financial crisis. Each time, the US dollar has proven resilient due to deep financial markets and its global reserve status.

Today, central banks’ gold holdings total around 36,000 tonnes, representing less than 20% of global foreign exchange reserves. While gold provides diversification, it is unlikely to replace the dollar in the short term.

Returning to a gold standard would pose logistical and technical challenges. Gold production has grown far slower than the global economy, and storing and transporting large reserves requires significant security and infrastructure investments.

Source:: Gold Price Prediction: Gold Peaks at Over $5,600 as Schiff Warns of Dollar's Demise