Key highlights:

- Sustained outflows from Bitcoin and Ethereum ETFs indicate that institutional investors are reducing exposure rather than making short-term adjustments.

- Negative ETF flows have persisted for weeks, reinforcing signs of weaker liquidity and declining institutional participation in crypto markets.

- Despite broader outflows, BlackRock’s flagship Bitcoin ETF continues to attract capital, highlighting a divergence within institutional demand.

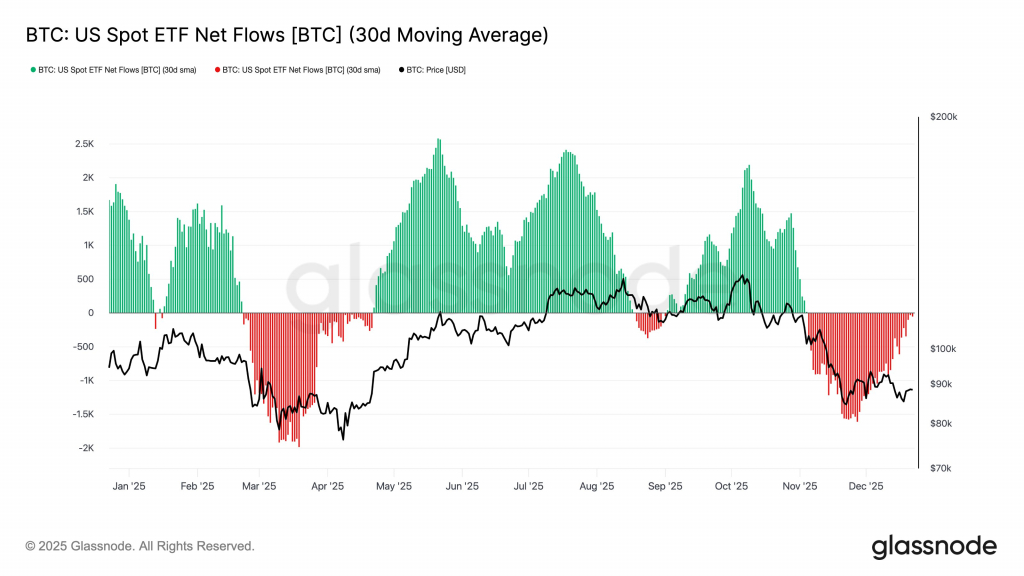

Institutional investors appear to be stepping back from cryptocurrencies, and recent data suggests the shift may be more than a temporary correction. Since early November, Bitcoin and Ethereum exchange-traded funds have recorded sustained capital outflows, signaling weakening enthusiasm among large market participants.

Analysts at Glassnode note that these persistent outflows reflect growing caution, as institutions reassess risk exposure amid broader market uncertainty.

Capital flows into Bitcoin ETFs. Source: Glassnode

ETF flows reveal a shift in institutional sentiment

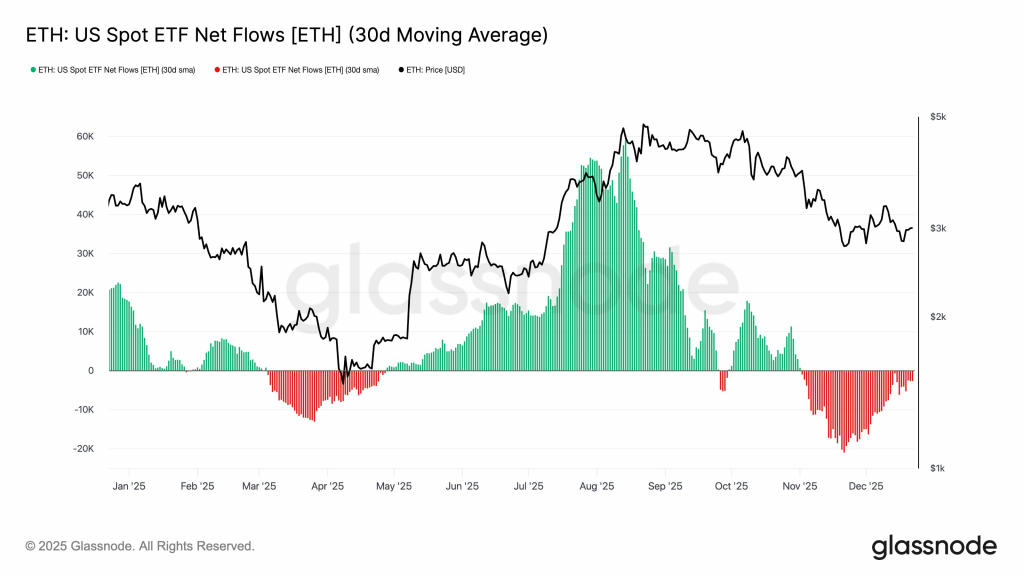

Data from Glassnode shows that the 30-day simple moving average of capital flows into U.S.-based Bitcoin and Ethereum spot ETFs has fallen into negative territory. While the figures themselves are technical, the implication is straightforward: institutional demand for digital assets has cooled.

Capital flows into Ethereum ETFs. Source: Glassnode

ETF flows often lag spot markets, and Bitcoin and Ethereum prices have been trending lower since mid-October. In this context, ETF outflows are reinforcing what price action has already suggested – participation from large investors is weakening.

Market analysts increasingly view crypto ETFs as a barometer of institutional sentiment. Earlier this year, strong inflows helped drive market momentum. Now, the same indicator is pointing to a more defensive stance.

Selling pressure builds despite a key exception

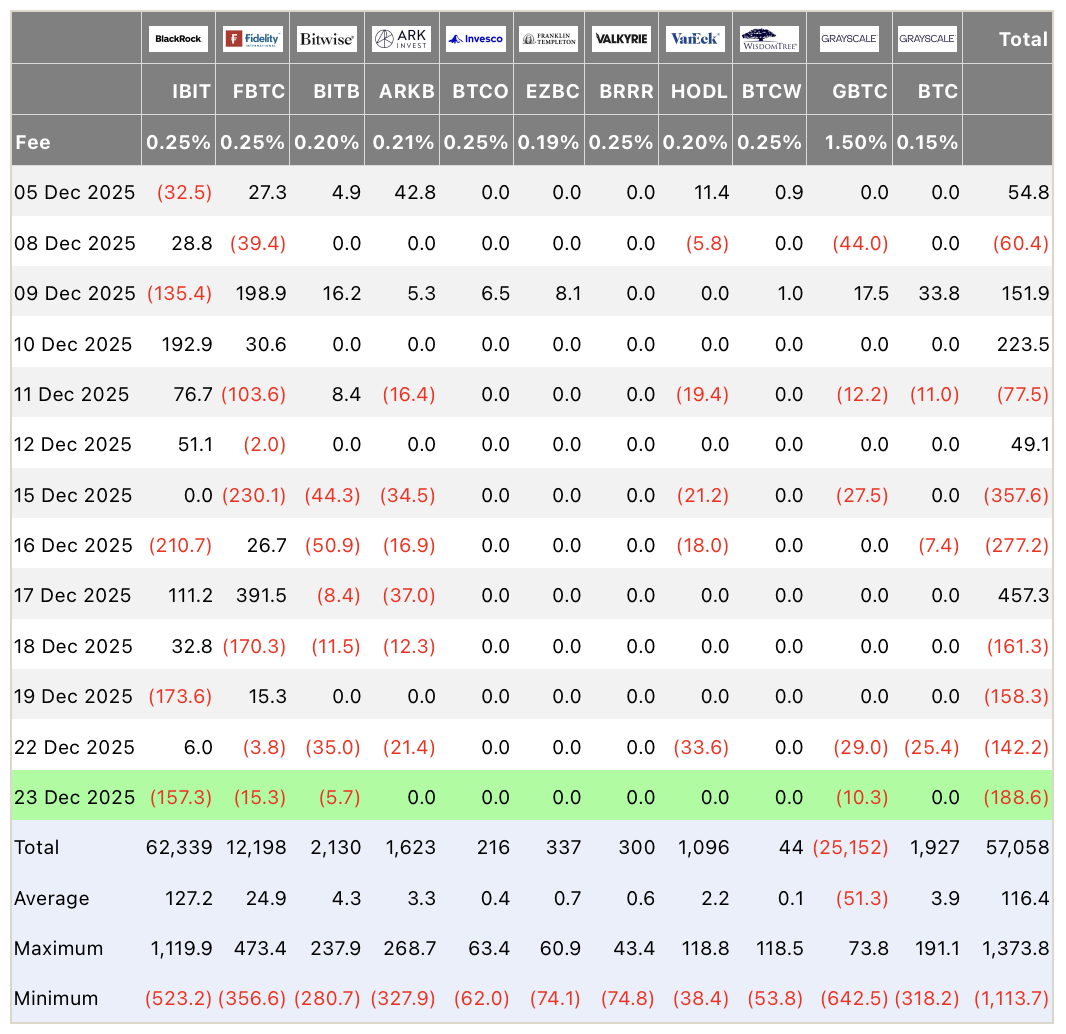

According to data from Farside Investors, Bitcoin ETFs have recorded net outflows for four consecutive trading days. However, not all funds are moving in the same direction.

Capital flows into US Bitcoin ETFs. Source: Farside Investors

BlackRock’s iShares Bitcoin Trust (IBIT) has continued to post modest inflows over the past week, standing out amid broader selling pressure.

BlackRock’s fund stands apart

Market commentary from The Kobeissi Letter highlights that crypto ETF selling pressure has returned, with roughly $952 million withdrawn from crypto funds last week. Investors have pulled capital in six of the past ten weeks, underscoring the persistence of the trend.

Despite recent outflows across the sector, BlackRock’s fund has accumulated approximately $62.5 billion since launch, more than all competing spot Bitcoin ETFs combined.

Eric Balchunas, an ETF analyst at Bloomberg, noted the paradox that IBIT remains the only ETF on Bloomberg’s 2025 Flow Leaderboard with a negative one-year return, yet still ranks highly in overall flows.

$IBIT is the only ETF on the 2025 Flow Leaderboard with a negative return for the year. CT’s knee-jerk reaction is to whine about the return but the real takeaway is that is was 6th place DESPITE the negative return (Boomers putting on a HODL clinic). Even took in more than $GLD… pic.twitter.com/68uq3HFRuO

— Eric Balchunas (@EricBalchunas) December 19, 2025

Balchunas also pointed out that the fund has attracted more capital than the SPDR Gold Shares ETF, despite gold posting significant gains over the same period. He described this resilience as a constructive long-term signal, even amid broader market weakness.

Interpreting the bigger picture

From a macro perspective, institutional outflows from crypto ETFs often coincide with periods of monetary policy uncertainty and portfolio rebalancing ahead of major economic or political events. Historical patterns suggest that large investors frequently reduce exposure to higher-risk assets as part of tactical reallocations rather than outright rejection of an asset class.

ETF structures can amplify these shifts. Even modest changes in sentiment may translate into large capital movements, magnifying perceived weakness in the market.

Rather than signaling a loss of faith in cryptocurrencies altogether, the current trend may reflect a temporary adjustment to tightening liquidity conditions. Whether institutional demand returns will likely depend on broader macro stability and clearer signals from global financial markets.

Source:: Glassnode Warns Crypto ETF Outflows Point to Institutional Exit