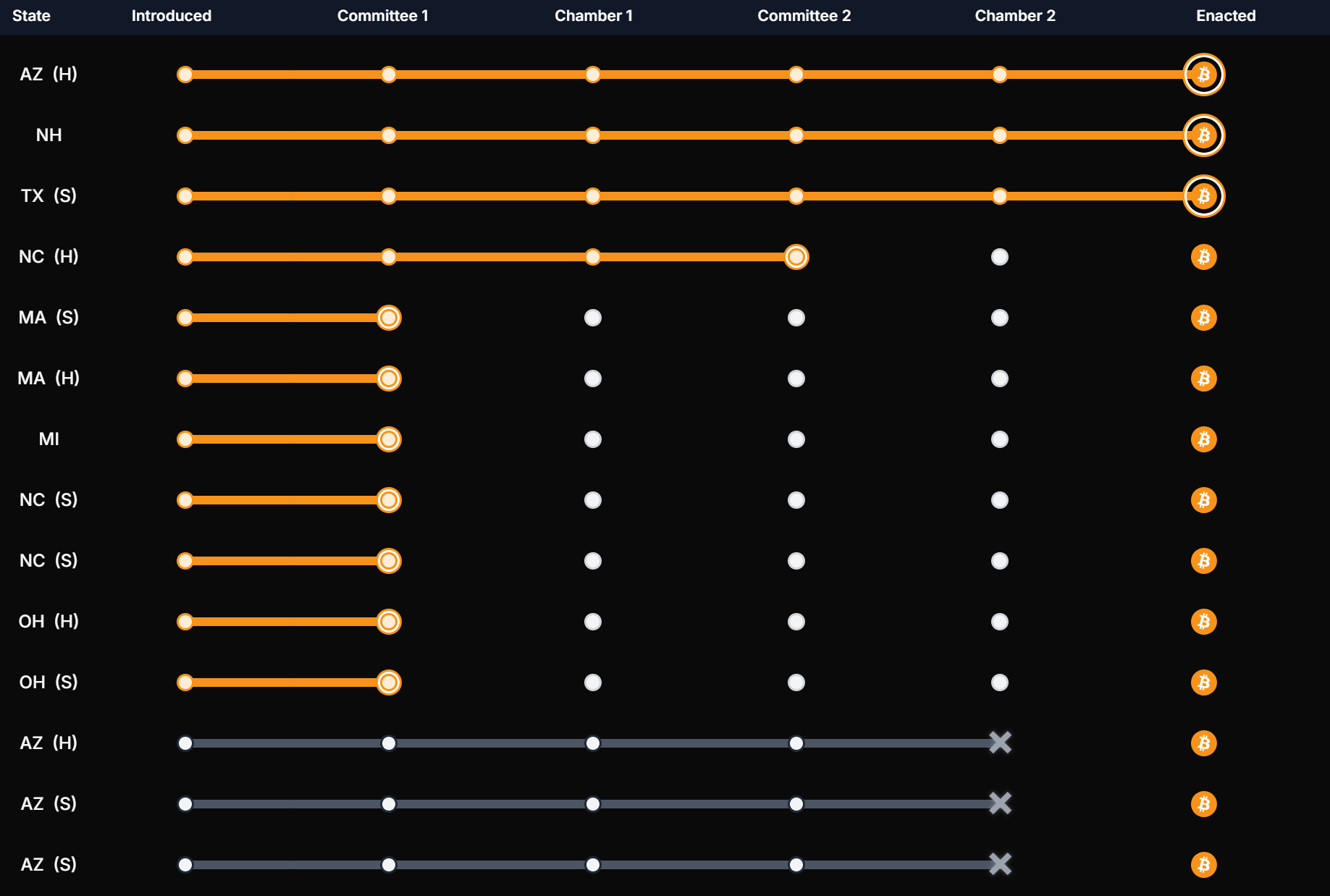

Three U.S. states have passed laws to create Bitcoin reserves, and 17 more are considering similar initiatives. New Hampshire, Arizona, and Texas have already allowed their treasuries to hold Bitcoin, while five other states have rejected such proposals.

According to Bitcoin Reserve Monitor, legislation is still being considered in Alabama, Florida, Georgia, Idaho, Illinois, Kansas, Kentucky, Maine, Maryland, Michigan, Missouri, New Mexico, North Carolina, Ohio, Oklahoma, Rhode Island, and West Virginia.

Bitcoin Reserves Acceptance Status by U.S. States. Source: Bitcoin Reserve Monitor

What exactly constitutes a “Bitcoin reserve” varies by state. Some initiatives seek to actively purchase Bitcoin on the open market, while others focus on allowing digital assets seized through enforcement actions or forfeitures to be retained.

Many proposals theoretically allow states to store other cryptocurrencies as well. In practice, strict market capitalization requirements mean that Bitcoin is usually the only digital asset that meets the criteria.

New Hampshire

New Hampshire became the first U.S. state to formally pass a Bitcoin reserve law in early May with the passage of HB 302. The law, signed by Governor Kelly Ayotte, allows the state to allocate up to 5% of state funds to precious metals and digital assets.

Source: X/KellyAyotte

However, digital assets must meet strict requirements of an average market capitalization of at least $500 billion over the previous calendar year, making Bitcoin the only viable option.

New Hampshire is once again First in the Nation! 🎉

Just signed a new law allowing our state to invest in cryptocurrency and precious metals. pic.twitter.com/ua9bawZKbM

— Governor Kelly Ayotte (@KellyAyotte) May 6, 2025

The decision sparked significant political debate, and the bill passed the House by just 13 votes. Still, Ayotte declared it a victory for the state’s innovation and fiscal prudence.

“New Hampshire is once again First in the Nation!” she wrote on social media after signing the bill.

Under the law, New Hampshire may hold these reserves directly through secure storage solutions, through a qualified custodian, or through regulated investment vehicles.

Arizona

Arizona’s attempts to adopt Bitcoin reserves have been marked by legislative controversy and repeated refusals.

In May 2025, Arizona passed HB 2749, which updated the state’s unclaimed property laws to allow crypto assets to be held in their original form rather than liquidated as was previously required. This paved the way for the state to retain seized or confiscated Bitcoin, effectively creating a form of reserve through enforcement action.

SB1025 ‘Crypto’ Bill was passed by the Senate, but later rejected by the governor. Source: azleg.gov

However, efforts to expand these measures have faced significant hurdles. Two additional bills, SB 1025 and HB 2324, were rejected by Gov. Katie Hobbs.

Source: azleg.gov

SB 1025, which would have allowed state treasurers and pension systems to allocate up to 10% of state funds to digital assets, was defeated in May.

The second bill, HB 2324, proposed creating a “Bitcoin and Digital Asset Reserve Fund” managed by the state treasurer and funded with cryptocurrency seized during criminal investigations.

Hobbs rejected the bill, arguing that it “disincentivizes local law enforcement from cooperating with the state on digital asset forfeiture matters by removing seized assets from local jurisdictions.”

Texas

Texas is perhaps the most active state in adopting Bitcoin reserve legislation.

In June 2025, Governor Greg Abbott signed Senate Bill 21 and House Bill 4488 into law, establishing the Texas Strategic Bitcoin Reserve with robust legal protections to ensure the reserve cannot be easily dismantled by future legislatures.

Texas law allows Bitcoin and potentially other digital assets to enter the reserve through purchases, forks, airdrops, or donations. However, only digital assets with a market capitalization of at least $500 billion over a 24-month period are eligible for inclusion, effectively limiting the reserve to Bitcoin only.

States That Rejected the Bitcoin Reserve

Several states attempted to follow similar initiatives but ultimately failed due to political resistance and financial concerns.

State Reserve Race. Source: Bitcoinlaws

In Montana, lawmakers were considering House Bill 429, which would allow the state to allocate up to $50 million to a combination of cryptocurrencies, stablecoins, and precious metals. The bill failed to gain enough support in the House and was killed before a full vote, joining previous failed attempts in North Dakota, Pennsylvania, and Wyoming.

South Dakota’s initiative also failed. State Representative Logan Manhart’s proposal would have allowed up to 10% of state funds to be allocated to Bitcoin investments. However, the House Commerce and Energy Committee voted to permanently defer the bill, effectively ending it.

In Utah, a broader blockchain-related bill passed in March, but lawmakers removed provisions that would have allowed the creation of a Bitcoin reserve.

Lawmakers in those states cited concerns about Bitcoin’s significant price swings, potential legal liability, and questions about the cryptocurrency’s long-term viability as a reserve asset.

Thus, there is growing interest in Bitcoin as a reserve asset at the state level, although opinions on the advisability of such an investment are divided. Further development of this trend will depend on the success of the initiatives already adopted and changes in the regulatory environment.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: From New Hampshire to Texas: How States Are Building Bitcoin Treasuries