Key highlights:

- Galaxy Digital and long-dormant “whale” wallets are sending large amounts of Bitcoin to exchanges, sparking concerns of increased selling pressure.

- Long-term holders and miners are reducing positions as Bitcoin approaches psychological resistance, signaling a potential trend reversal in August.

- Despite mounting risks, analysts note Bitcoin’s market structure remains resilient, supported by strong liquidity and sophisticated trading activity.

Galaxy Digital is once again sending Bitcoin to crypto exchanges, and “sleeping whales”, which are major holders that have dormant for years, are awakening en masse. What is happening in the market, and why could August bring a correction?

The last week of July signaled warning signs for Bitcoin holders, as selling pressure intensified from multiple directions. Analysts now caution about the possibility of a trend reversal in August.

“Sleeping Whales” are awake and ready to sell

In mid-July, the crypto community was surprised by the awakening of a whale wallet holding 80,000 Bitcoin, which had remained inactive for 14 years. The sale of these Bitcoins through Galaxy Digital noticeably slowed Bitcoin’s growth at month-end.

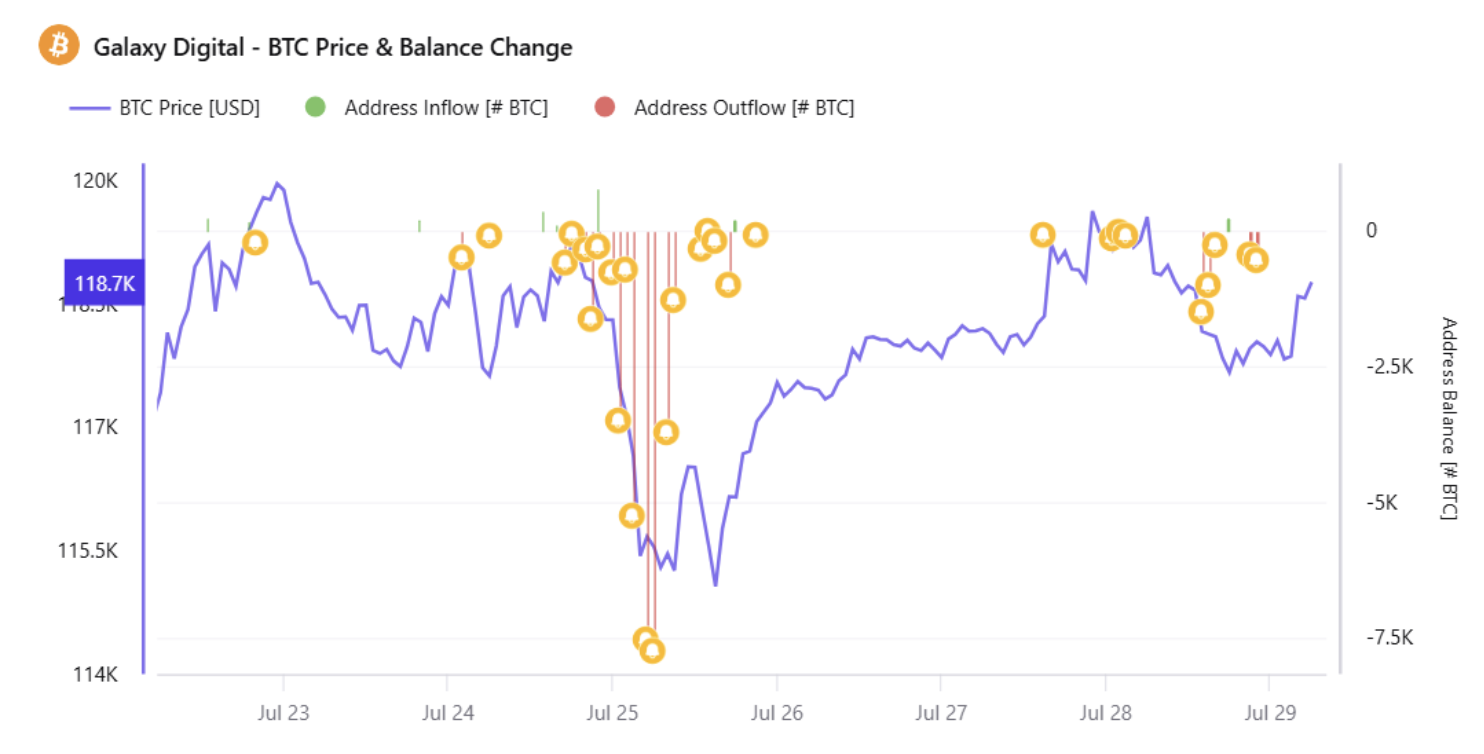

CryptoQuant data shows a direct link between large transfers from Galaxy Digital wallets and Bitcoin price corrections.

Bitcoin rate and transactions from Galaxy Digital wallet. Image source: CryptoQuant

On July 29, the analytics resource Lookonchain reported that Galaxy Digital moved another 3,782 Bitcoin (approximately $450 million) from its wallet, with the majority of funds sent to exchanges.

Is #GalaxyDigital helping clients sell $BTC again?

In the past 12 hours, GalaxyDigital has transferred out another 3,782 $BTC($447M), most of which went to exchanges.https://t.co/lD8tgkBx00https://t.co/u8s0VjLG5p pic.twitter.com/4wqf8DZx2y

— Lookonchain (@lookonchain) July 29, 2025

Adding to this, SpotOnChain recently discovered three other “sleeping whales,” likely tied to one owner, moved 10,606 Bitcoin ($1.26 billion) after 3 to 5 years of inactivity. The number of reactivated whales is growing, and each represents potential selling pressure.

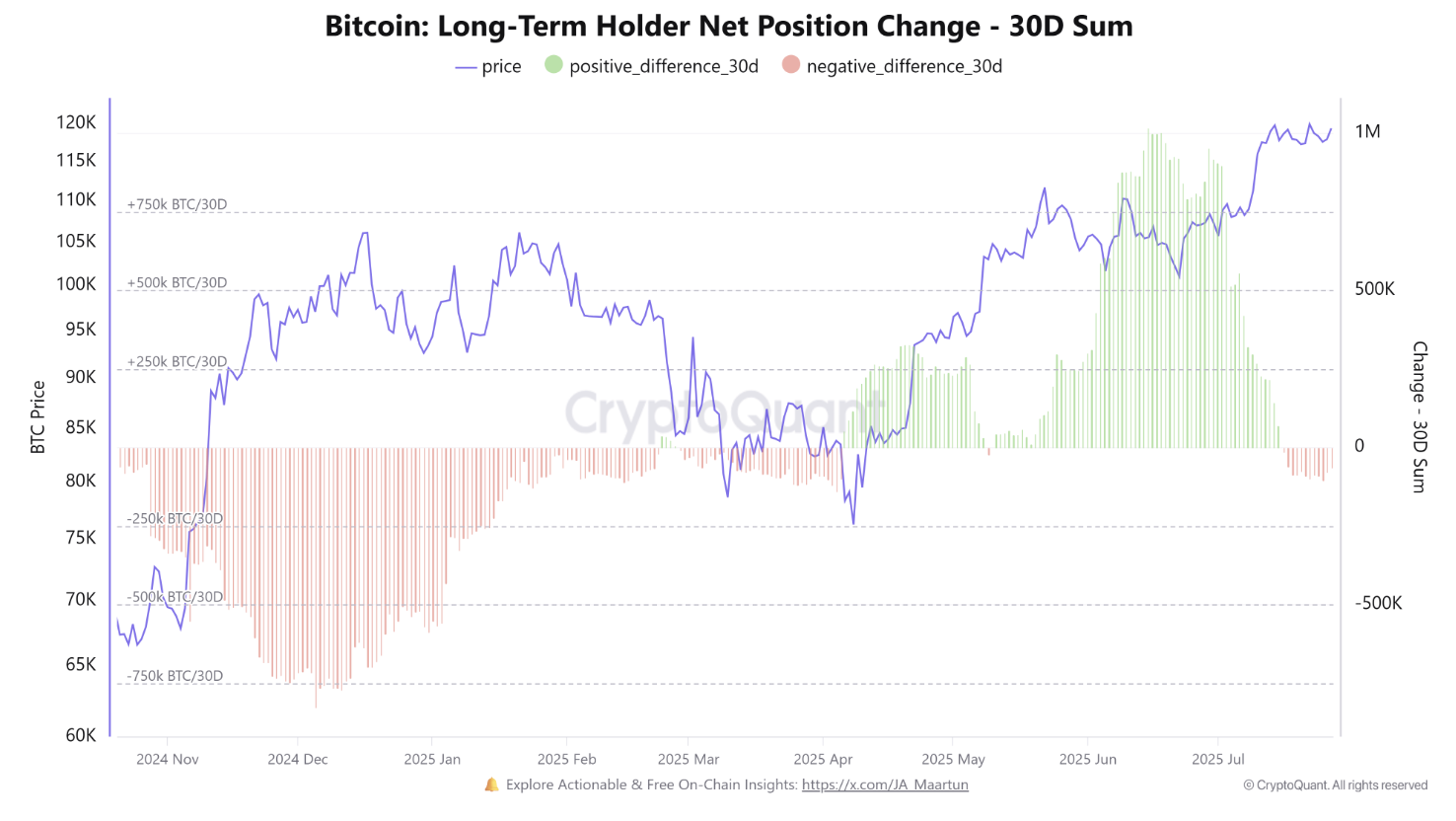

Long-term holders begin taking profits

Long-term holders (LTH)—considered the backbone of the Bitcoin market—have started to pull funds as Bitcoin neared $120,000 in late July, according to CryptoQuant data. This cautious behavior reflects investors locking in profits amid uncertainty.

The amount of bitcoin held by long-term holders. Image source: CryptoQuant

Analyst Burakkesmeci noted, “Long-term holders (LTHs) have started to turn net negative right at the $120K resistance — a historically important psychological level. This shift suggests that some investors who’ve held through previous cycles might be starting to realize profits.”

During Q1 2025, negative positioning by long-term holders contributed to Bitcoin’s drop below $75,000. If this selling trend continues, the risk of a strong correction in August increases significantly.

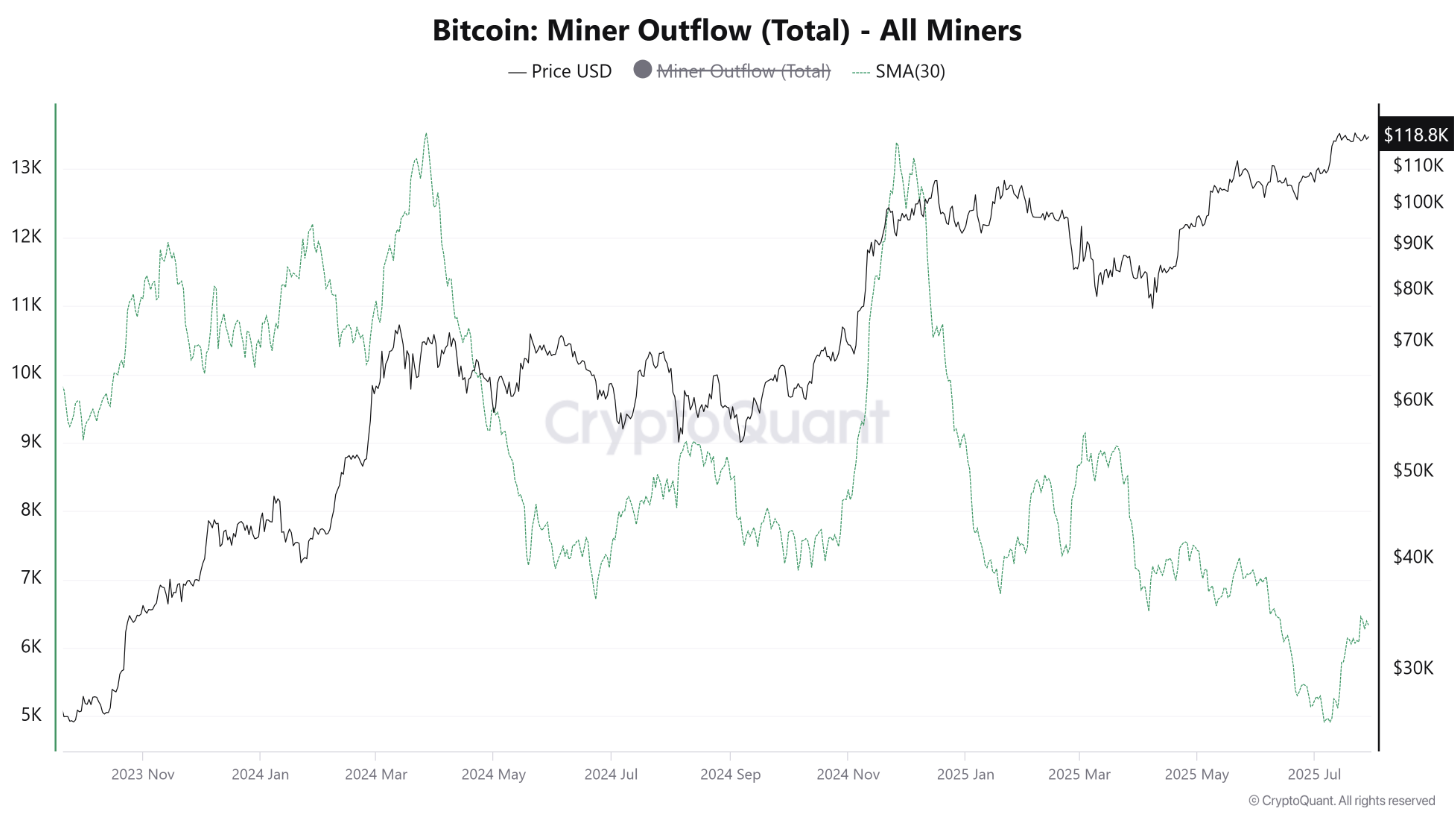

Miners increase sales

Outflows from miners’ wallets, a key signal of selling pressure, have risen again in July after a prior decline, per CryptoQuant data. Miners typically sell Bitcoin to cover operating expenses or lock in profits after price rises.

Bitcoin outflow from miner wallets. Image source: CryptoQuant

According to CryptoQuant, when affiliated miner wallets simultaneously send portions of their reserves, it can contribute to downward price pressure.

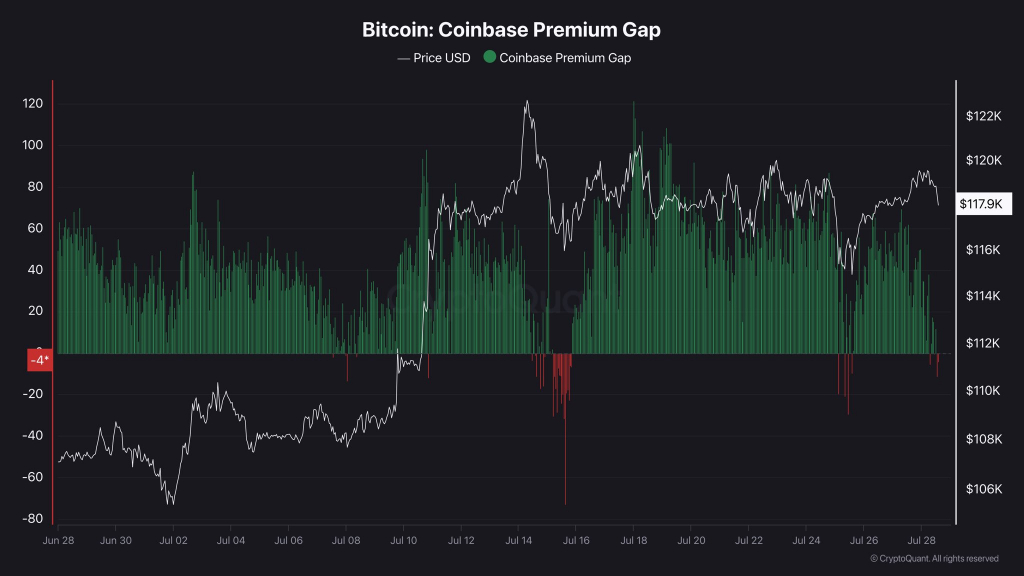

American investors show waning interest

The Coinbase Premium metric, which measures Bitcoin’s price difference between Coinbase and Binance, reflects U.S. investor demand. A negative premium indicates weaker demand or increased selling pressure in the American market.

While mostly positive throughout the year, Bitcoin Coinbase Premium Gap turned negative again. What does it mean? The demand in the US Market is weakening. Caution is necessary.”

Coinbase premium chart. Image source: IT Tech

Historically, a negative Coinbase Premium often signals a slowdown in upward momentum, though not always a trend reversal.

MVRV ratio nears peak levels

Some analysts are cautious heading into August following four consecutive months of Bitcoin gains. According to Coinglass, Q3 is historically the weakest quarter, with August frequently being the most challenging month.

Bitcoin quarterly returns.

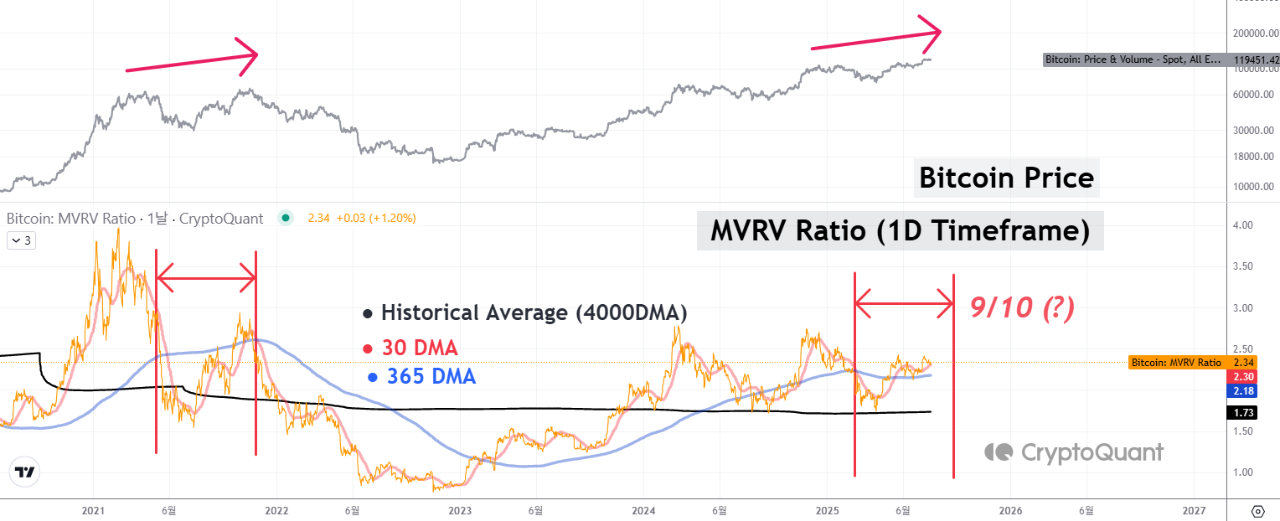

CryptoQuant’s analyst Yonsei highlighted that the MVRV (market value to realized value) ratio is approaching the cycle top threshold, potentially signaling a local market peak by late August.

In 2021, the MVRV formed a double top pattern that accurately predicted Bitcoin’s market peak. If history repeats, August could mark a turning point toward correction or consolidation.

Bitcoin Price and MVRV. Image source: CryptoQuant

“As we enter this zone, optimism and caution must coexist,” CryptoQuant analyst Yonsei concluded. “Let blockchain data guide your strategy—now is the time to tighten risk management and stay flexible.”

Market shows resilience despite selling pressure

Despite the looming risks, Kaiko’s recent report expresses confidence in Bitcoin’s ability to absorb the current selling pressure.

“Strong liquidity profile, matched with the market’s ability to handle large orders and growing demand from treasury companies, indicates the presence of sophisticated traders. These traders are more price agnostic, which should bode well for BTC’s price action heading into what can be a choppy month,” Kaiko stated.

While whales, long-term holders, and miners may spark volatility, the current market structure appears to provide a buffer against a major crash. August will reveal how resilient Bitcoin truly is amid rising selling pressure.

Source:: Four Factors That Could Crash the Bitcoin Price in August