Ethereum has been under immense selling pressure, losing 38.3% of its value in the last 30 days. The lowest price ETH has reached during this move to the downside was roughly $1,780, a price level that the coin last explored in May of 2025.

Ethereum is down 61% from its all-time high of $4,946, which the coin reached in August of 2025. Does this mean that current price levels are a good opportunity to accumulate ETH for those who have long-term conviction in the second-largest crypto asset on the market?

Current Ethereum price levels are attractive for accumulators

Popular crypto market analyst Merlijn The Trader says ETH is currently in “deep discount zones” and that he has started to buy the coin through a dollar-cost averaging (DCA) strategy. In a video shared on the X social media platform, Merlijn said:

“If you’re thinking “oh, I want to wait a little bit longer for more of a dip in Ethereum”, I would think that you should do some dollar-cost averaging. That’s my personal opinion.”

ETHEREUM IS STILL IN DEEP DISCOUNT ZONES.

Same levels we highlighted before.

Nothing changed.Trying to time the exact low is a trap.

DCA removes emotion.I’ve already started.

Do your own thing but don’t ignore the zone.Discounts don’t last forever. pic.twitter.com/F8Ix4Z0L7m

— Merlijn The Trader (@MerlijnTrader) February 10, 2026

In the video, Merlijn provided a long-term Ethereum price target between $10,000 and $20,000.

CW8900, an analyst on the CryptoQuant platform, highlighted that even though the price of Ethereum has dropped below the realized price of accumulation addresses, these whales are continuing to grow their ETH positions. The analyst wrote:

“The full-scale accumulation of $ETH by whales began in June 2025. The current price is below the price at which they began accumulating. Furthermore, their accumulation is proceeding even more aggressive. The current price will likely appear attractive to $ETH whales.”

Source: CW8900 via CryptoQuant

BitMine continues buying ETH while staking ratio hits new all-time highs

BitMine (BMNR), the largest Ethereum treasury company by far, has continued to aggressively accumulate ETH despite sitting on massive unrealized losses of roughly $8.3 billion. Last week, BitMine bought 40,613 ETH, bringing its holdings to 4,325,738 ETH (roughly 3.58% of the circulating supply).

BitMine and other digital asset treasury (DAT) companies have become major stakers of ETH, pushing the staking ratio to new all-time highs. Recently, the ETH staking ratio surpassed 30% for the first time in history.

ethereum staking ratio is at an all time high.

over 30% of eth is now staked.

while dats like BitMine and SharpLink accumulate with:

– balance sheet capital

– no debt

– long term conviction

– stake to earn modelbrutal market for crypto, but ethereum looks bright. pic.twitter.com/uVH59IWrAs

— Joseph Young (@iamjosephyoung) February 11, 2026

A higher ETH staking ratio means a larger share of the total supply is locked up to help secure the network instead of being kept liquid for short-term trading. When investors choose to stake, they are effectively committing their ETH for yield over time and accepting reduced liquidity, which shows confidence in Ethereum’s long-term value and stability.

According to data from ValidatorQueue, there are currently 4 million ETH in the entry queue for staking, while only 75,872 ETH are in the queue to get unstaked.

Polymarket users are bearish on ETH in the short-term

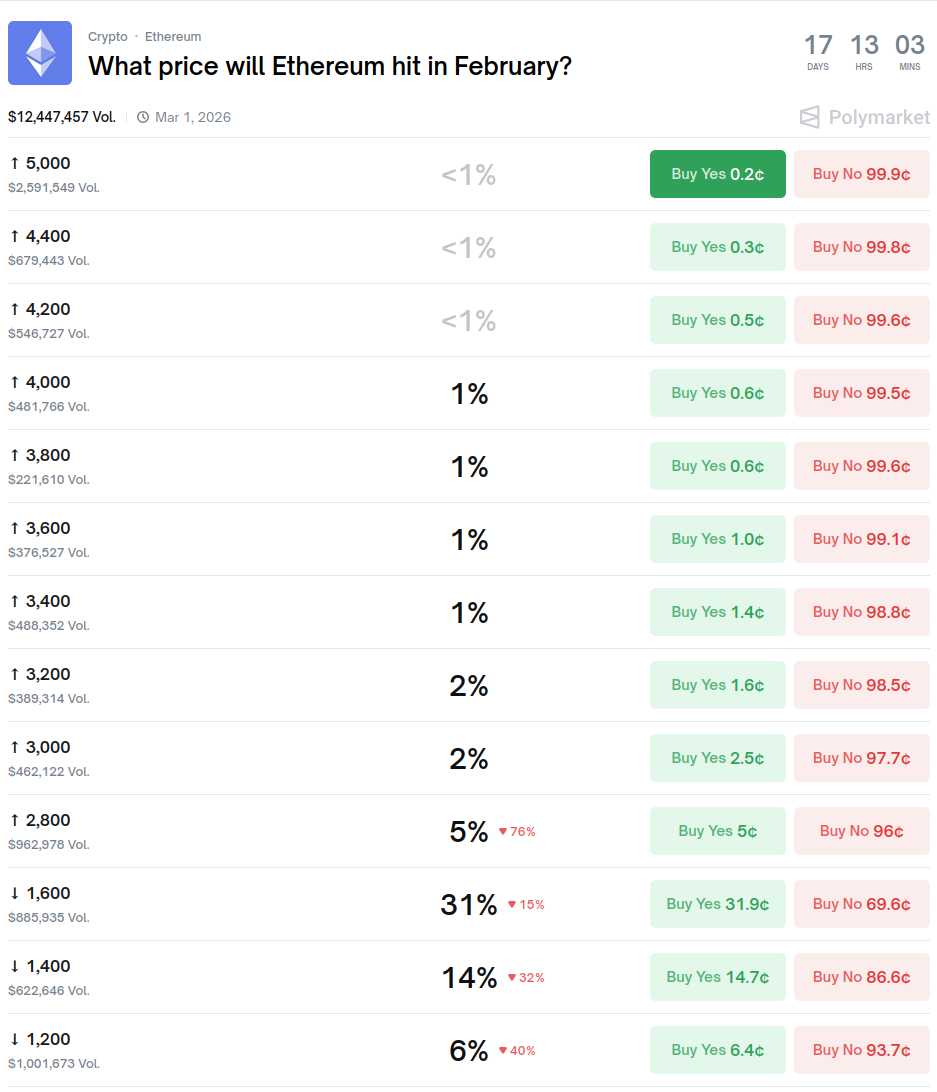

Users on the Polymarket prediction market are currently expecting Ethereum to hit significantly lower price levels in February. According to the bettors, Ethereum has a 31% chance of hitting $1,600 this month. The second most likely scenario is for Ethereum to hit $1,400, with a probability of 14%.

The odds of ETH reaching various price levels in February. Source: Polymarket

Meanwhile, the algorithmic Ethereum price prediction by CoinCodex is forecasting a moderate recovery, forecasting ETH to rise towards $2,350 by the end of February. This would represent a 21% increase compared to Ethereum’s current price.

Source:: Ethereum Price Prediction: Whales Keep Accumulating ETH Despite Fear in the Market