Key highlights:

- ETH is holding its range low, with analysts eyeing a breakout toward the $2,700–$2,900 resistance zone.

- Ethereum’s daily transaction count surged to 1.75 million on June 25—its third-highest ever—suggesting renewed network engagement.

- Bit Digital is shifting away from Bitcoin mining to become a dedicated Ethereum staking and treasury company.

ETH price holds key level as bullish momentum builds

Ethereum is showing signs of resilience amid a volatile trading range, currently hovering around $2,400. Popular crypto analyst Michaël van de Poppe is bullish on the asset’s near-term prospects, stating in a recent X post that he expects “strong continuation from $ETH” as long as the asset maintains support at the range low. His technical chart suggests a potential move into the $2,700–$2,900 resistance zone.

I’m expecting strong continuation from $ETH to be happening in the coming days/weeks as we’re holding onto the range low. pic.twitter.com/UFELet8QBF

— Michaël van de Poppe (@CryptoMichNL) June 27, 2025

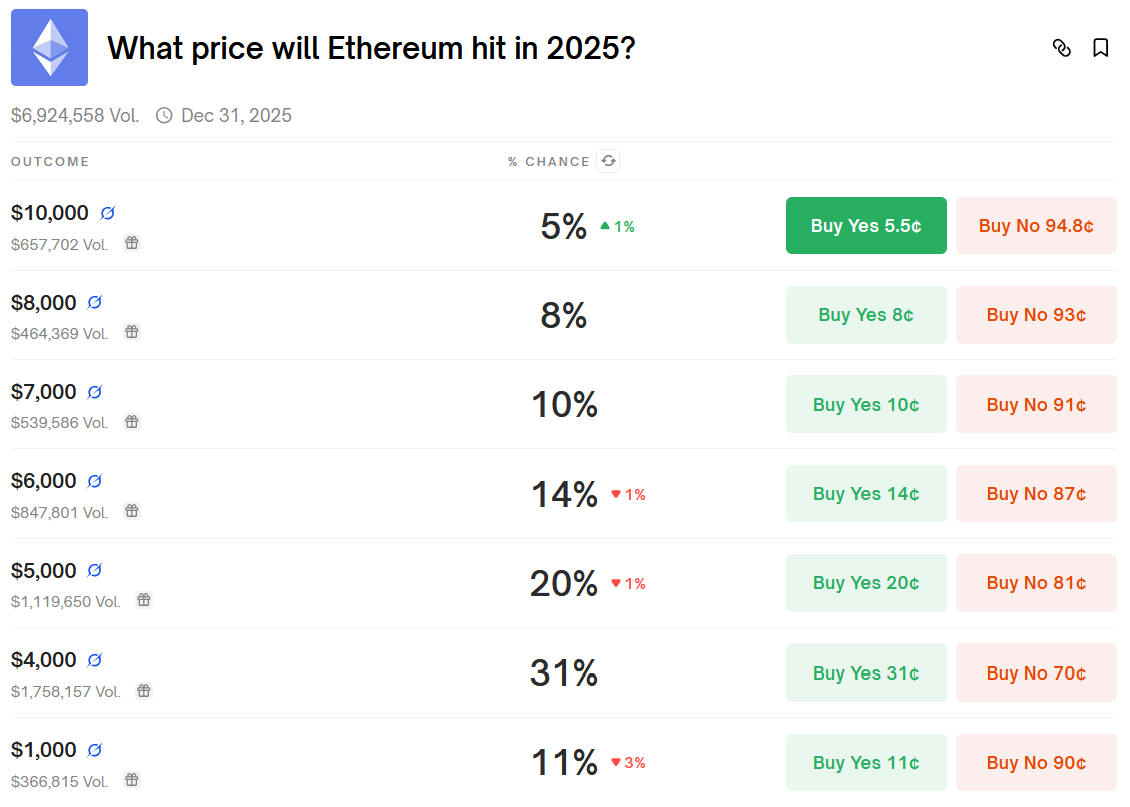

Despite ETH’s underperformance relative to Bitcoin over the past year, market sentiment appears to be turning. Prediction market Polymarket currently assigns a 31% chance that ETH will hit $4,000 by the end of 2025, with a 20% chance it reaches a new all-time high of $5,000.

On-chain activity signals strong network fundamentals

Ethereum’s network usage is on the rise even as its price lags. According to CryptoQuant analyst Carmelo Alemán, Ethereum recorded 1,750,940 confirmed transactions on June 25, the third-highest daily total in its history. The last time Ethereum saw similar activity was in January 2024, before a sustained downtrend in transaction volume.

Historic Activity on Ethereum

“On June 25, Ethereum recorded 1,750,940 confirmed transactions, marking the third-highest daily transaction count in the network’s history.” – By @oro_crypto pic.twitter.com/5tXYV8PIdz

— CryptoQuant.com (@cryptoquant_com) June 27, 2025

The surge in usage includes ETH transfers, smart contract executions, DeFi operations, and DApp interactions, indicating broad engagement across Ethereum’s ecosystem. Alemán noted that the spike could reflect a combination of increased DeFi activity, arbitrage trading, and infrastructure adjustments.

Layer 2 networks like Arbitrum and Optimism continue to absorb a growing share of activity, further supporting Ethereum’s structural role in the crypto space.

Bit Digital pivots to Ethereum staking amid changing market dynamics

Bit Digital, a company formerly focused on Bitcoin mining, has announced a full transition into Ethereum. The firm said it will divest from its Bitcoin operations and become a dedicated Ethereum staking and treasury company.

As of March 31, Bit Digital held 24,434.2 ETH (valued at $44.6 million) and 417.6 BTC ($34.5 million). The company plans to convert its remaining BTC holdings into ETH and reallocate proceeds from its Bitcoin mining business toward Ethereum.

The move underscores broader shifts in the crypto industry. With Bitcoin mining margins tightening post-halving and Ethereum’s staking yields offering more predictable returns, companies like Bit Digital are repositioning to capitalize on the Ethereum ecosystem’s growth.

Institutional flows into ETH remain strong

Ethereum-based ETFs have maintained a nine-week streak of net inflows, with $206 million added this week so far, according to data from Farside Investors. The momentum reflects growing institutional interest, even as ETH’s price consolidates below recent highs.

If flows remain positive through June 27, the streak will extend to 10 consecutive weeks, underscoring ETH’s appeal as a long-term investment vehicle.

eToro: Best platform for beginners and social trading

- Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

- Follow and copy top-performing traders with eToro’s unique social trading tools

- Earn passive income with staking on popular coins like ETH, ADA, and TRX

- Fully regulated in multiple jurisdictions with strong security protocols

- 0% commission on real stock trading and competitive spreads on crypto

- 30+ million registered users across 100+ countries

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Source:: Ethereum Poised for Breakout as On-Chain Activity Surges and Institutions Pivot Toward ETH