Ethereum just experienced one of its sharpest pullbacks in recent months — tumbling 15% in a single day to touch $1,500, a level not seen since October 2023.

But despite the fear, panic, and whale liquidations, analysts and long-term indicators are flashing one thing loud and clear: Ethereum is in the buy zone.

Let’s break it down.

Why Ethereum Crashed

The Ethereum price crash was triggered by a combination of factors:

- Weak macro sentiment following Bitcoin’s decline

- A massive $106M ETH liquidation

- Collapsing network fees and reduced activity across the Ethereum ecosystem (CryptoQuant)

According to CryptoQuant, Ethereum is facing what they call a “hyperinflation hellscape”:

Falling fees + rising ETH issuance = short-term sell pressure

But despite the bearish headlines, many believe this panic is overdone — and even setting up the next big move.

Ethereum Enters “Buy Zone”

CoinCodex’s Ethereum Rainbow Chart now shows ETH entering the “Ethereum can be acquired for relatively cheap” zone.

Historically, this region has marked major accumulation phases — often right before parabolic runs. In other words: the green zone is where future profits are made.

What Top Analysts Are Saying

With Ethereum down 15% and sentiment in the gutter, top crypto analysts are starting to turn bullish. From long-term cycle models to technical breakdowns, their message is surprisingly aligned: this could be the bottom.

Here’s what the analysts are seeing right now.

MerlijnTrader: “We’re in the Green Zone”

MerlijnTrader believes Ethereum just entered a major bottom zone.

$ETH is back in the zone where generational wealth begins.

This green zone? A once-per-cycle gift.

Miss it now, regret it forever. pic.twitter.com/sFVxIcQG14

— Merlijn The Trader (@MerlijnTrader) April 6, 2025

His chart suggests we’re in the early stages of a new cycle — not the end of one.

Ted Pillows: “ETH Capitulation = Time to Buy”

Capitulation, he argues, is the final flush before revival. When fear peaks, opportunity rises.

$ETH capitulation is in play.

Maybe there’s one last 5%-10% dump left given the stock market weakness.

But after that, it’ll bounce.

There’s one simple reason behind it: FED pivot.

S&P 500 is already down 10% in just 2 days, and tomorrow could be another volatile day.

If… pic.twitter.com/xxhsnlMX8x

— Ted (@TedPillows) April 6, 2025

DD_Finance: Watching the $1,200–$3,000 Range

@dd_finance takes a tactical approach. This kind of deep retracement wick has played out in previous cycles — sharp flushes before rapid recoveries.

$ETH HTF

We are currently experiencing the deep retracement (wick) phenomenon that I mentioned in my previous analysis. I believe that the price will pull back to the blue box and then move towards the $1200 level. If we can establish a resistance above the blue box, my opinion… https://t.co/IAE5LPk1jI pic.twitter.com/YwVAHoK9Ye

— DD (@dd_finance) April 6, 2025

Whale Liquidated for $106 Million

One of the biggest triggers of the crash? A massive whale liquidation. According to Lookonchain, a position of 67,570 ETH — worth $106M — was forcibly liquidated.

Big liquidations like this tend to mark local bottoms, as excess leverage is wiped out and smart money steps in.

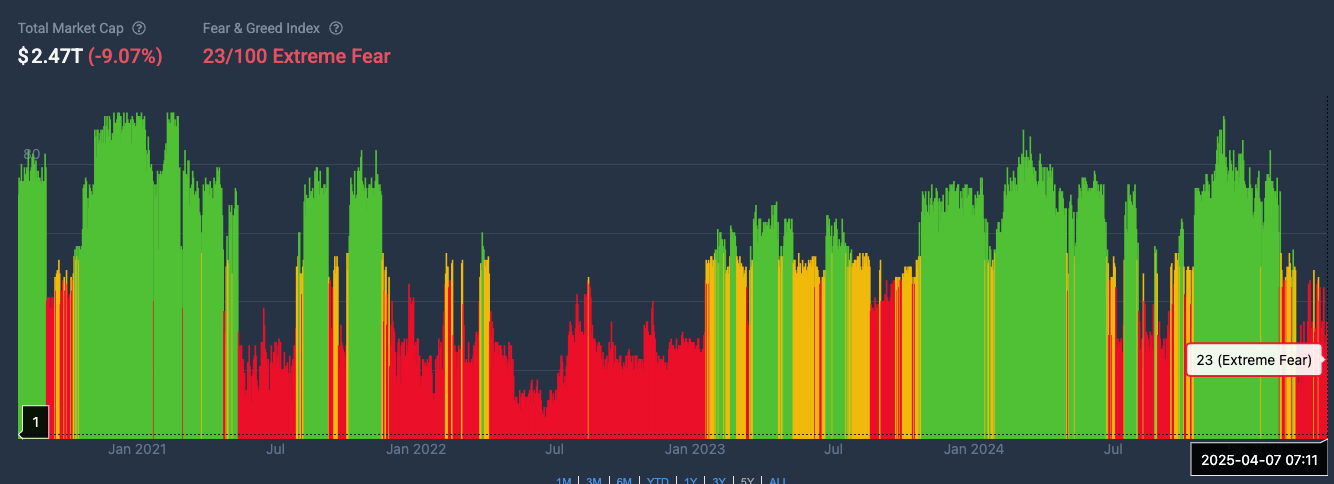

Fear & Greed Index: Extreme Fear

CoinCodex’s Fear & Greed Index has officially entered Extreme Fear.

Historically, that’s where long-term investors thrive. Warren Buffet once said:

Be fearful when others are greedy, and greedy when others are fearful.

If you’re waiting for everyone to be confident again… you’ll likely be too late.

CoinCodex Prediction: ETH to $5,000 by Nov 2025

Despite the drop, CoinCodex’s price prediction algorithm remains bullish:

- Price Target: $5,070 ETH by November 2025

This forecast is based on cycle trends, ETH supply, staking flows, and macro alignment with the Bitcoin halving cycle.

In short: this crash might be noise — the long-term signal remains strong.

Final Take: This May Be the Best Ethereum Entry in 2025

Let’s recap:

- Ethereum is down 15%

- Whale liquidations have cleared leverage

- Fear is at extreme levels

- Analysts are turning bullish

- Long-term models point to $3K–$5K targets

It might feel risky now — but the data, sentiment, and technicals suggest this is where smart money starts buying.

So, are you buying fear or waiting for the crowd to feel safe? Because history shows: The biggest wins come from buying when it hurts.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Source:: Ethereum Enters “Buy Zone” After 15% Crash — Is This the Bottom Before $5K?