Key highlights:

Disclaimer: Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Dogecoin hasn’t had the most exciting month. The DOGE price has been sliding down, momentum cooled off, and enthusiasm faded across social platforms.

But now, something has shifted on the charts. After weeks of drifting lower, DOGE has landed right back at a price zone that previously triggered two major rallies this year, and traders are starting to pay attention again.

Right now, the Dogecoin price trades near $0.14682, and based on recent candles buyers may finally be showing up. That doesn’t guarantee a breakout, but it does explain why analysts are watching DOGE more seriously heading into December.

DOGE might be repeating a very familiar setup

Crypto analyst BitGuru recently pointed out a pattern that longtime DOGE followers know well. Earlier this year, Dogecoin went through two strong bullish cycles, climbing to $0.25580 in July and $0.26986 in October.

Both rallies started shortly after the DOGE price touched the exact same support zone it’s sitting on today. Markets often repeat behavior, especially with widely traded assets like Dogecoin.

In each previous run, DOGE formed a rounded base, slowly shifted momentum, and then surged upward. The price action forming now looks very similar.

$DOGE shows two strong bullish cycles reaching 0.25 and 0.26 before reversing into a steady downtrend…$DOGE has now returned to a key support zone around 0.14682 where it is attempting to stabilize. A rebound from this level could trigger a recovery toward the next resistance https://t.co/vbTXClpnb3 pic.twitter.com/xXoTNTp0SC

— BitGuru 🔶 (@bitgu_ru) November 24, 2025

Even though Dogecoin has spent the last month correcting, sellers haven’t been able to break support. Volume has thinned, volatility cooled, and the price movement tightened all classic signs of stabilization.

If this pattern repeats, the DOGE price may bounce toward resistance between $0.18845 and $0.20000, which has capped rallies twice this year.

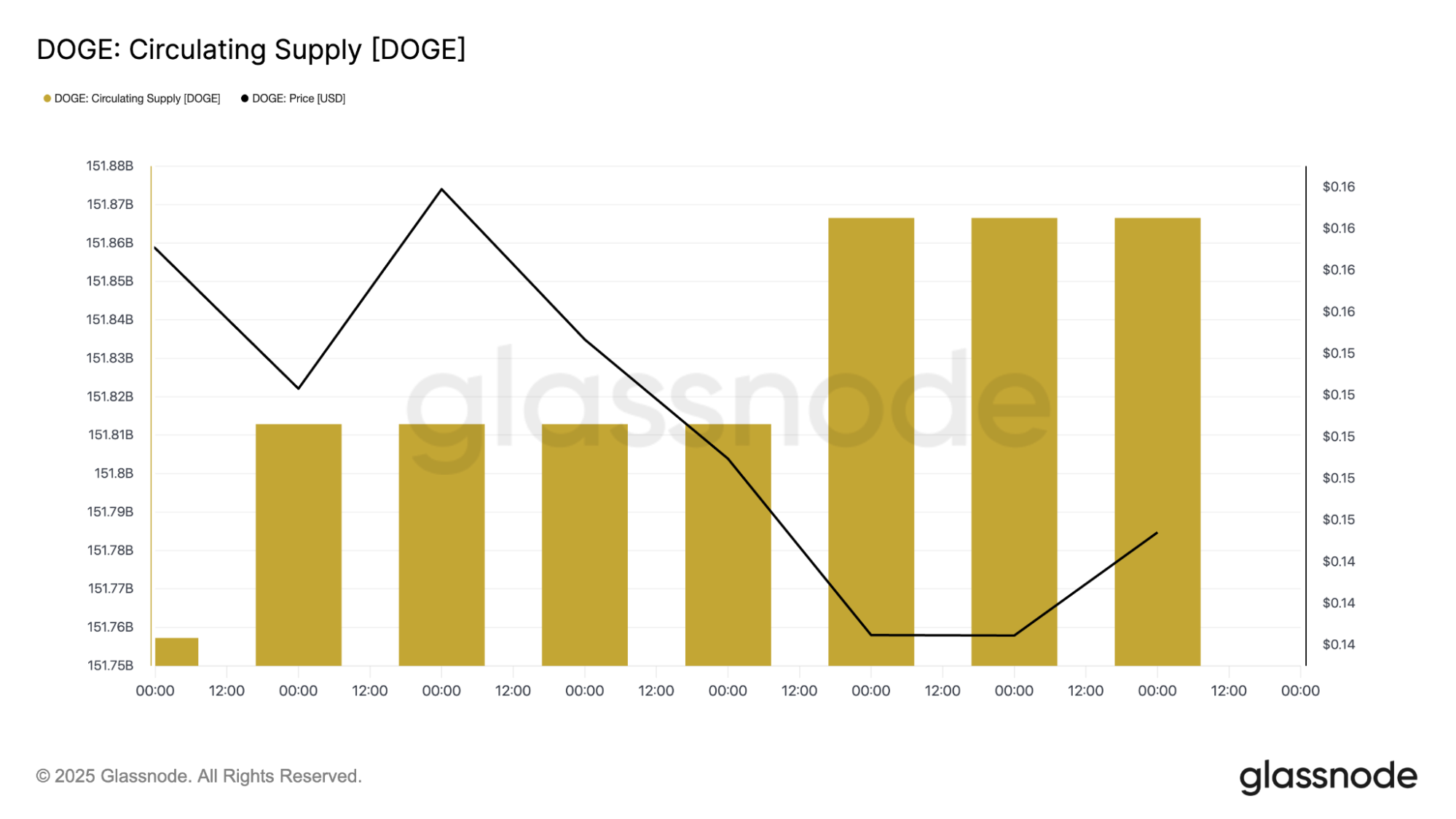

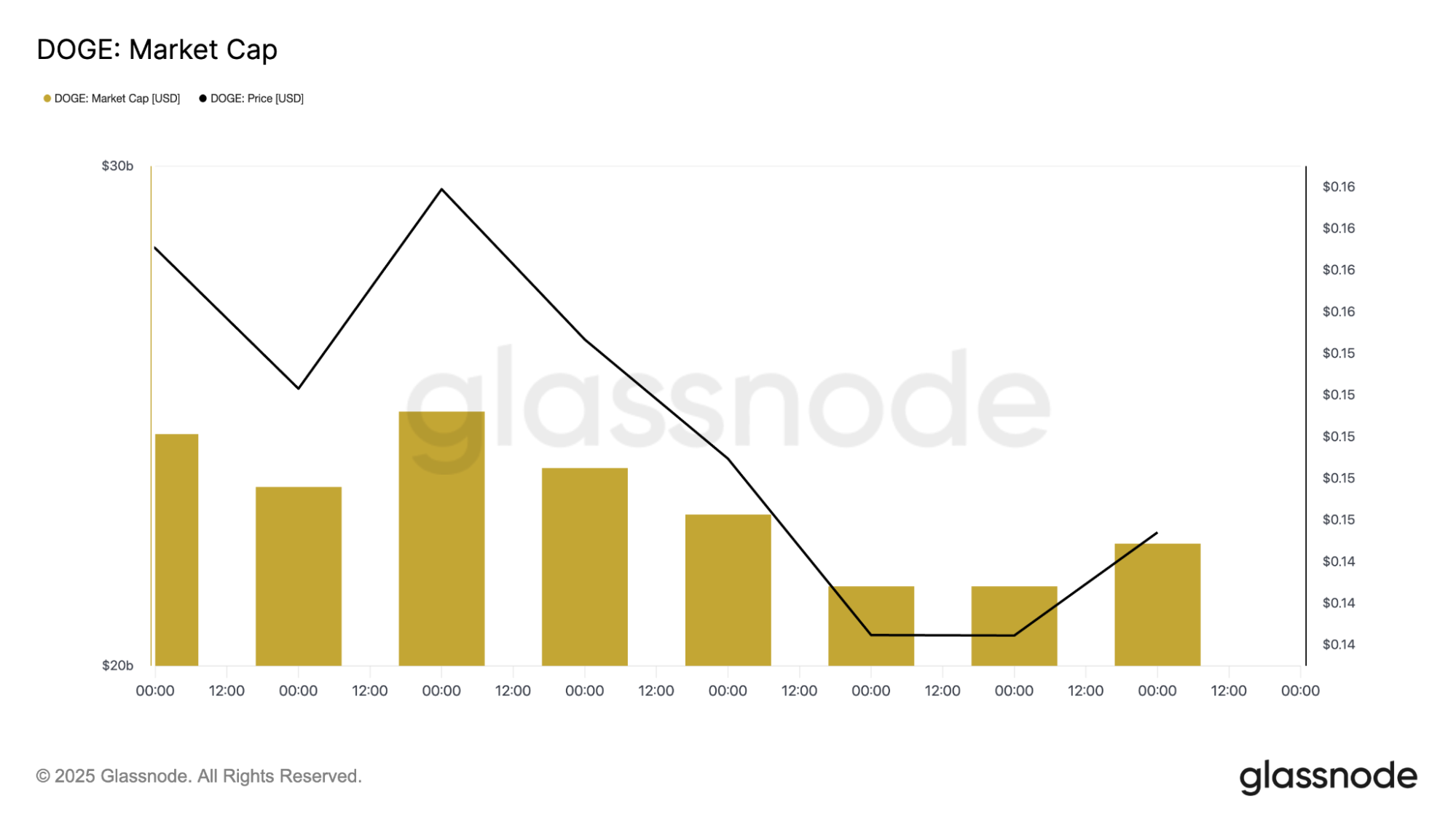

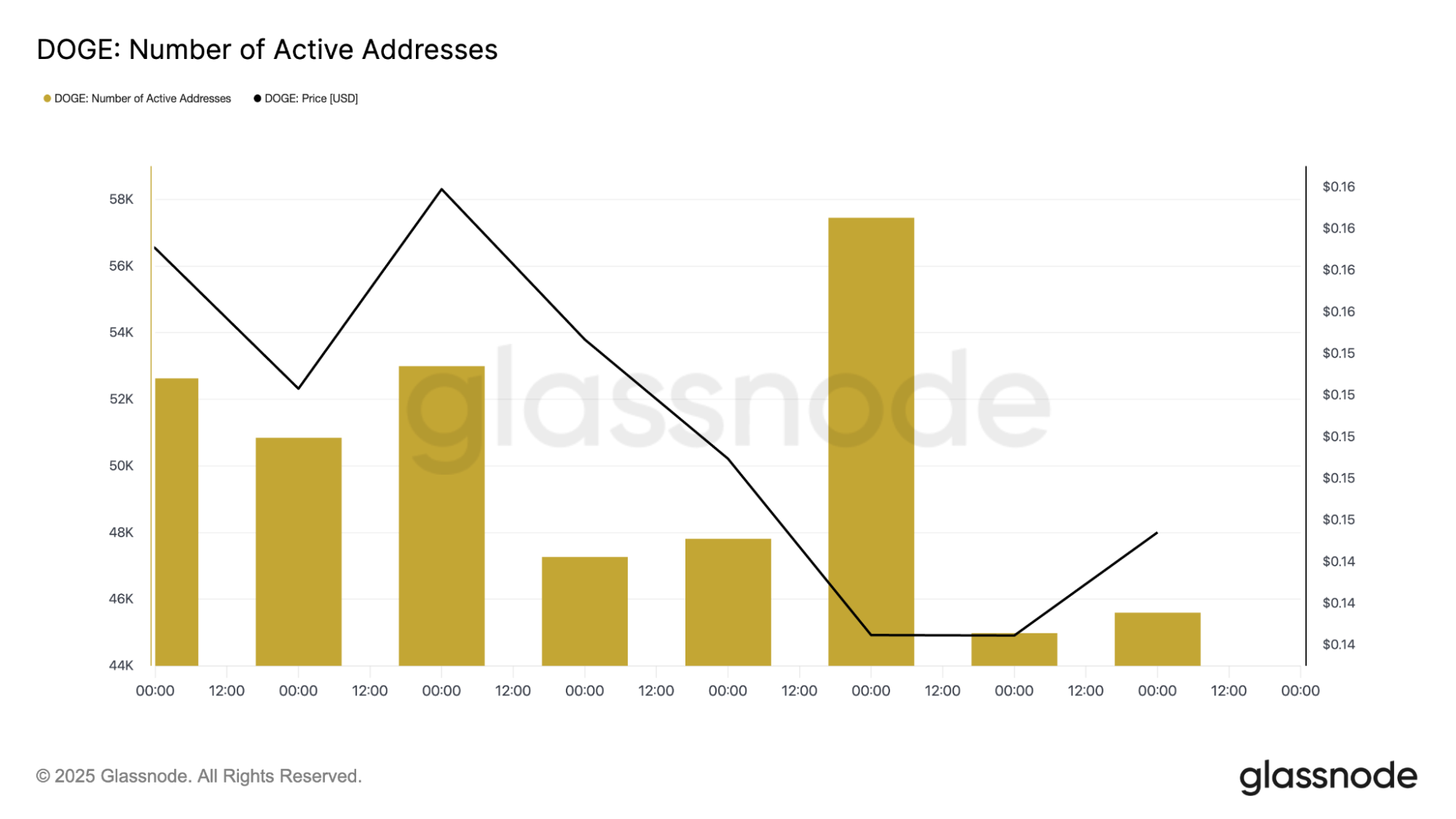

Dogecoin on-chain data remains stable

Technical analysis tells part of the story, but on-chain data from Glassnode helps confirm it, and Dogecoin’s metrics look surprisingly healthy. DOGE’s circulating supply remains steady, indicating no sudden inflation or aggressive selling.

The Dogecoin market cap has pulled back alongside the price, but it hasn’t collapsed. That means investors are still present.

Even better, active address counts remain consistent. Dogecoin continues attracting tens of thousands of daily users, which is rare for older meme-based assets.

This level of continuous activity makes DOGE one reason it historically bounces harder than expected after corrections. Dogecoin may not have the fastest tech or biggest DeFi ecosystem, but a community-driven liquidity continuously keeps it afloat.

Dogecoin holds support while traders watch the 200-day SMA

Support only matters if it continues holding under pressure and for DOGE, it has. On the daily chart, the area of demand within $0.14 – $0.146 has consistently absorbed sell orders, preventing its further sharp breakdown.

Each time the price of the DOGE has fallen beneath that area, buyers have stepped in and pushed it upwards. The picture becomes even clearer when zoomed out. On the daily timeframe, this same support area has triggered multiple reversals throughout the year.

As long as the DOGE price stays above $0.13, structure remains bullish, and the bottom thesis stays alive, leading to a more bullish Dogecoin price prediction. However, if the price fails there, a move toward $0.09 becomes more likely. For now, though, nothing indicates that a breakdown is imminent.

DOGE daily chart price analysis.

Dogecoin’s relationship with the 200-day simple moving average has been surprisingly consistent this year. When DOGE traded above it during the summer and early fall, bullish momentum followed and confidence returned fast.

But once the price slipped below it in late October, the correction got sharper and sellers completely took over. It was a reminder that this long-term trend line still carries real influence.

The 200-day SMA is currently sitting at around $0.20807, and a reclaim of this would send a strong message that buyers are back. It doesn’t need to happen immediately, but it would definitely shift sentiment.

Since moving averages lag behind price, Dogecoin could start moving higher before the SMA reacts. Still, until DOGE closes above that level again, the recovery remains a potential scenario rather than a confirmed trend shift.

DOGE RSI is showing fresh signs of life

Momentum readings are also starting to improve. With the RSI recently dipping toward oversold territory before turning upwards again, this may hint that selling pressure is finally losing steam.

Although not signaling massive bullish strength, it does show that bears might be running out of momentum and buyers are gradually returning. That alone changes the tone of the chart.

DOGE 4-hour chart price analysis

Meanwhile, the 4-hour RSI has already formed several bullish divergences, while the DOGE price keeps making lower lows, while momentum makes higher lows.

Historically, Dogecoin has often bounced shortly after similar setups, especially near meaningful support. If the RSI can push above its midpoint and stay there, a short-term rally could easily follow. It doesn’t guarantee a breakout, but it definitely makes one more realistic.

The road ahead for Dogecoin

The next move depends on two key price levels. First, DOGE must continue respecting support at $0.14682. If that floor holds, the bullish setup remains valid.

Second, the DOGE price needs to break through resistance around $0.15959. That zone has rejected Dogecoin multiple times in November.

If DOGE flips that level into support, traders may start eyeing $0.18845, and eventually the $0.20 mark. From there, momentum and volume will determine whether another $0.25 – $0.27 run similar to earlier this year is possible.

Much depends on Bitcoin as well. If the broader market stays steady, Dogecoin may finally have space to recover. But if volatility returns, support could be tested again.

Could DOGE be setting up for its next big move?

Dogecoin isn’t surging in price right now, but for the first time in weeks, its chart looks constructive again.

Support is holding, sellers are weakening, momentum indicators are improving, and on-chain activity remains healthy. For traders looking for early reversal signals, this zone makes sense to monitor.

Nothing in crypto is guaranteed, and DOGE has proven unpredictable plenty of times. But historically, when sentiment turns bearish and price sits quietly at support, that’s often when Dogecoin surprises everyone.

Right now, DOGE is flashing early bullish signals. The market just needs to decide whether to follow them.

Kraken: Best crypto exchange for security & reliability

- Buy, sell, and trade 400+ cryptocurrencies with industry-leading security

- Spot, Futures & Margin trading – leverage up to 5x for advanced traders

- Earn rewards with staking on top cryptocurrencies

- 24/7 customer support and high liquidity for fast trades

- Regulated in the US with strong compliance and security measures

- 13+ million users worldwide

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other advice. Nothing on this page is a recommendation or solicitation. Always seek independent professional advice before making investment decisions. Some links may earn us a commission at no extra cost to you.

Source:: Dogecoin Price Analysis: Is DOGE Preparing for Its Next Rally? Analyst Weighs In